The tech-heavy Nasdaq just closed at a new all-time high. And while this is encouraging to some investors, and discouraging to others, the best bet for long-term investors is to simply own geat businesses (and ignore everything else—it’s just noise). In this report, we countdown our top 10 growth stocks, starting with a few honorable mentions. If you are into day trading, options and crypto—ignore this report—it’s not for you. If you like massive long-term compound growth, continue reading for our top ideas.

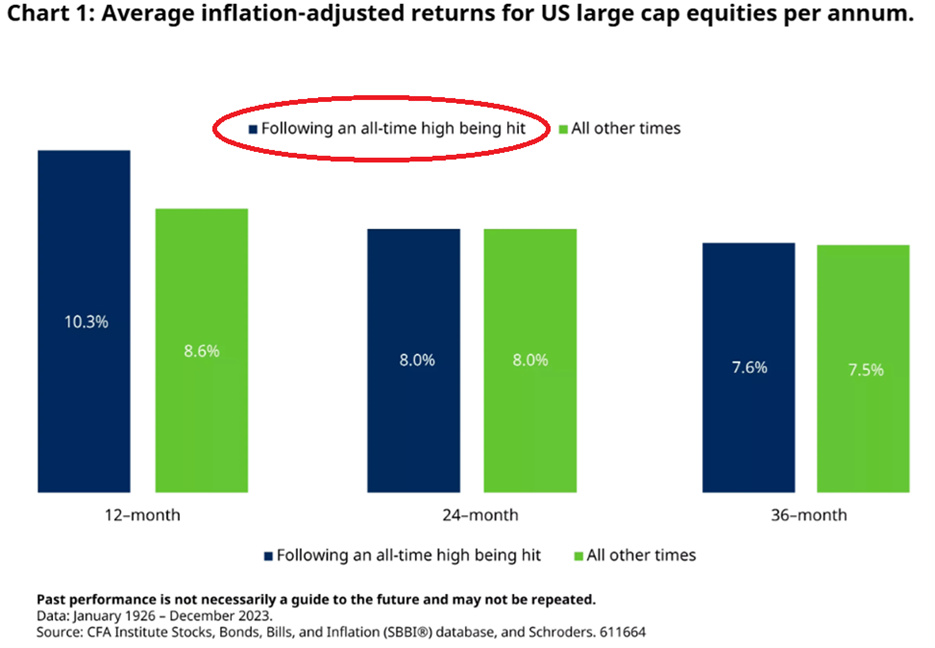

Buying at All-Time Highs

The internet seems full of market statisticians telling powerful stories that depend entirely on whatever time period or data set they choose (to get the data points to support their theme). For example, here is a chart that suggesting it’s a good idea to buy when the market is at all-time highs.

And here is a chart suggesting it’s better to NOT buy at all-time highs.

But while the internet meme stock experts try to “one up” each other with meaningless backward looking statistics, real investors know the incredible power of long-term compound growth (that can be achieved through buying and holding great business for the long-term).

In the following sections of this report, we highlight our top growth stock ideas (supported by powerful megatrends, disruptive ideas and attrative valuations).

Honorable Mentions:

Before getting into the official top 10 countdown, let’s first consider a few impressive honorable mentions.

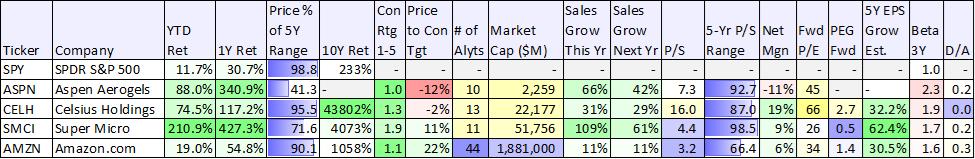

*Aspen Aerogels (ASPN)

This "energy industrials" (materials) business serves oil producers and refiners, but has a powerful recent tie in to electric vehicles with its thermal barriers for battery packs. It has an impressive recent track record of winning deals with major car dealers. We had Aspen ranked at #5 in our previous “top 10 growth stocks” report, but the shares have subsequently spiked over 75% in the last month. We’re still including it as an honorable mention because it continues to have attractive upside (and we continue to own shares). And you can read our previous report on Aspen here.

*Celsius Holdings (CELH)

This fitness drink company continues grow (and take share from industry leaders Monster and Red Bull) following its distribution deal w/ Pepsi. Now expanding internationally (and continuing to benefit from the growing energy drink market in the US and abroad), Celsius remains highly attractive (we own shares). High growth plus huge operating leverage gives Celsius continuing strength and upside (we are long Celsius in our Disciplined Growth Portfolio).

Data as of Fri 5/24/24, source: StockRover

*Super Micro Computer (SMCI)

No top growth stock list would be complete without including Super Micro Computer. The company produces hardware/servers that house GPUs used for computing, especially AI data center growth. In fact, SMCI continues to be a huge AI beneficiary, thanks in large part to its strong direct relationship with Nvidia (i.e. the leading AI GPU chip maker on the planet). We are long SMCI and you can read our previous reports on the company here.

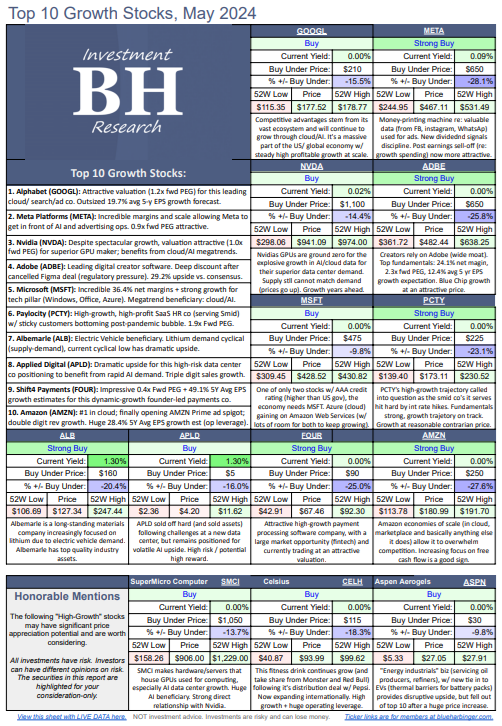

Top 10 Growth Stocks

So with that backdrop in mind, let’s get into our official countdown, starting with #10 and finishing with our top ideas.

10. Amazon (AMZN)

Amazon’s economies of scale (in cloud, marketplace and basically anything else it does) allow it to overwhelm competition, and its increasing focus on free cash flow is a good sign. Specifically, Amazon (AWS) is the #1 cloud services provider (ahead of Microsoft and Google), it has finally opened the AMZN Prime ad spigot (a good thing), and it has double digit revenue growth. Further still, Amazon has a huge 28.4% 5-year aveage EPS growth estimate, which makes these shares very attractive. We are long Amazon, and you can read our recent report on the company here.

9. Shift4 Payments (FOUR)

We recently added shares of this attractive high-growth payment processing software company (to our Disciplined Growth Portfolio). FOUR has a large market opportunity (in fintech) and is currently trading at an attractive valuation. Further it has an impressive 0.4x forward PEG ratio, a 49.1% 5-year average EPS growth estimate (impressive) and it is founder-led (a good thing). You can read our previous report on FOUR here.

8. Applied Digital (APLD)

Applied Digital is the riskiest and most speculative name on our list (so keep that in mind before you even consider buying shares). But it also has some of the most explosive upside growth potential courtesy of its focus on meeting data center demand, particularly for artificial intelligence demand. APLD sold off hard (and sold assets) following challenges at a new data center earlier this year, but remains positioned for volatile AI upside. We do have a small position in APLD, and you can read our previous report here.

7. Albemarle (ALB)

Most people like to say they are contrarians (i.e. they like to buy low), but now that Albemarle’s shares have sold off hard, many are afraid to buy. Albemarle is a long-standing materials company increasingly focused on lithium due to electric vehicle demand, and it owns top quality lithium assets. The selloff has been due to supply/demand dynamics (it seems we’re much closer to the bottom of the lithium price cycle than the top), and these shares have the potential to move dramatically higher in the years ahead. We are long Albemarle, and you can view our previous report on the company here.

6. Paylocity (PCTY)

Sticking with the contrarian theme, Paylocity is another attractive growth business (in a very different industry) that is currently trading at a low price relative to fundamental valuation (high margins and 1.9x fwd PEG), and the shares have a lot of upside price appreciation potential ahead. Paylocity is basically a Software-as-a-Service (SaaS) company (high margin, high renewal rate business) operating in the Human Resources and Payroll Processing industry. It serves mid and small-size businesses, which experienced explosive growth during the pandemic, but has since sold off hard as the market readjusted to the new post-pandemic normal. We’ve owned this one since 2015 (we’re up big), and we believe there is still a ton more long-term upside ahead. You can read our previous reports on the company here.

5. Microsoft (MSFT)

Simply put, Microsoft is an amazing business. Thanks to Microsoft Windows, Microsoft Office and Microsoft Azure (cloud), the company has an extremely high net margin of 36.4% (wide moat) and it continues to spend heavily on innovation and growth opportunities (a good thing). And despite recent price gains, Microsoft still trades at a reasonable 2.2x forward PEG multiple and 32x forward PE ratio. One of only two publicly-traded stocks with an "AAA" credit rating (not even the US government is rated this high), Microsoft will likely be trading much higher in the years and decades ahead. Long Microsoft.

4. Adobe (ADBE)

This digital creative software company has a wide moat (creators rely on it) and presents an attractive opportunity to purchase high growth at a relatively low price. In particular, the shares trade at a relatively deep discount after its cancelled Figma deal (regulatory pressure) earlier this year, but the business remains on a powerful growth trajectory. With a 24.1% net magin, 2.3x forward PEG ratio and a 12.4% average 5-year EPS growth expectation, this blue chip growth company is attractive. Wall Street analysts give it 29.2% upside versus their consensus estimate. We own a meaningful position size of Adobe shares in our Disciplined Growth Portfolio.

3. Nvidia (NVDA)

Nvidia’s growth is nothing short of spectacular, and we would have rated this company higher (we have a large postion) following its latest stellar earnings announcement (growth is out of this world). However, chip stocks are highly cyclical, and it seems a lot of its biggest customers may have just completed a significant portion of their GPU spending for this cycle (such as Meta, which just experienced a sell off after purchasing so many Nvidia GPUs). Incredibly, Nvidia still only trades at a 1.0x forward PEG ratio, and has truly incredible long-term growth (years and decades) thanks to its leading postion as a beneficiary of the digital revolution and AI megatrends. Nvidia may experience near-term volatility, but long-term these shares are still going much higher.

2. Meta Platforms (META)

Whereas Nvidia shares have been on fire (to the upside), Meta Platforms shares sold off a bit following its latest earnings announcement because analysts were concerned CEO Mark Zuckerberg just spent so much on Nvidia chips. Going forward, Nividia may not get as many new orders from Meta (in the near-term), but Meta will benefit from the massive amount of GPUs they just purchased. And to be clear, despite Meta’s unfriendly share structure (founder/CEO Mark Zuckerberg controls the voting rights), Meta continues to print money. It has extremely high net margins (32%), high growth and a low (attractive) 0.8x PEG ratio. Meta is focused on growth (particularly spending on data centers) and this is a good thing. Also a good thing, WhatsApp is now over $1B annual revenue run rate (from click-through ads and paid messaging) and it has continuing huge growth potential. Meta shares can be volatile, but the ongoing long-term growth potential makes this a powerful long-term investment opportunity.

1. Alphabet (GOOGL)

Alphabet (Google) is one of the most dominant companies on the planet, and it curently trades at an attractive price relative to its net profit margins and ongoing high-growth trajectory (Wall Street analysts rate the shares very highly). The company's vast ecosystem across Google and YouTube (not to mention it's the 3rd biggest cloud services company) basically gives Google an impenetrable moat to fend off competition (and to keep growing). Trading at only a 1.2x PEG ratio, and with strong earnings growth expected, Alphabet is an extremely attractive stock to own now and over the long term as it continues to benefit from digitization, the great cloud migration and AI megarends. Long Alphabet. You can read our previous report on the company here.

Data as of Fri 5/24/24, source: StockRover

The Bottom Line

The market has been strong this year. And it was strong last year. This makes a lot of investors nervous and afraid to buy. But if you are a long-term investor (which is proven to be one of the most powerful wealth building strategies in the history of the world) it’s always a great time to buy and hold great businesses, such as the ones listed in this report. And you can view all of the holdings (and position sizes) in our entire Blue Harbinger Disciplined Growth portfolio here.