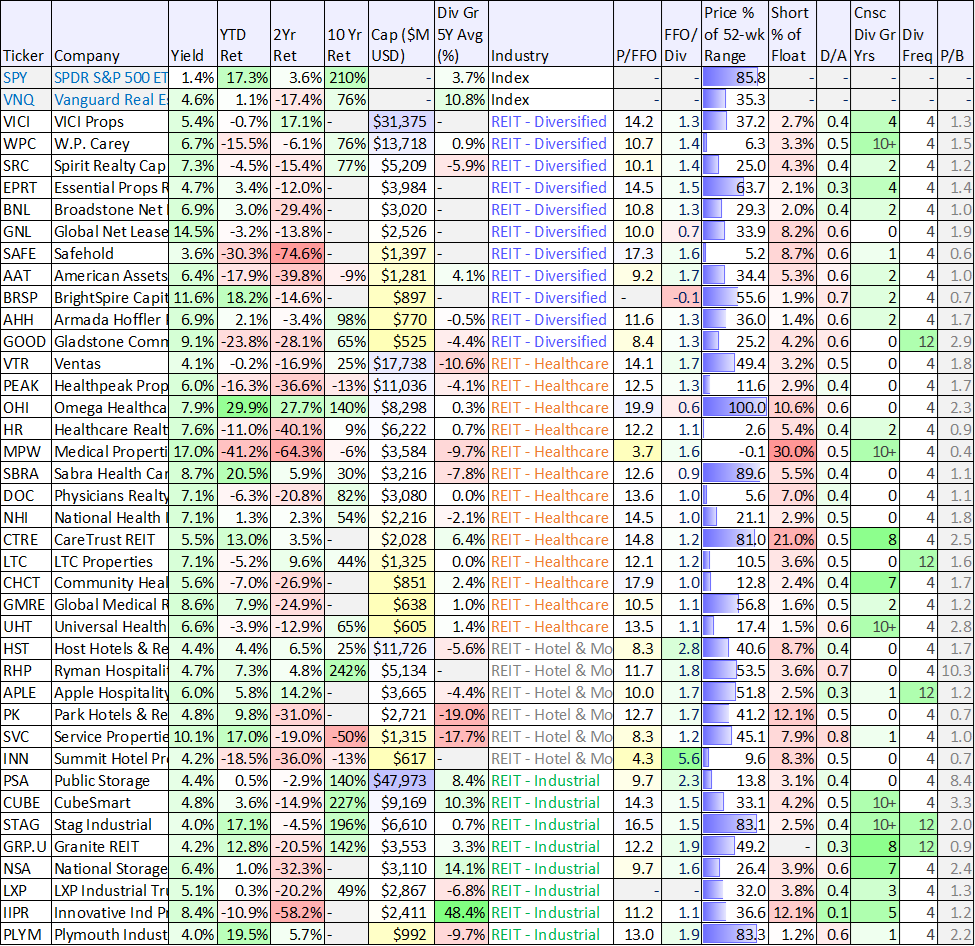

The following table includes data on over 100 big-yield REITs, sorted by REIT industries (and then market cap). And as you can see, recent performance has been mostly terrible with 2-year total returns very negative, and lots of REITs sitting near 52-week lows. The carnage has clearly been worse for some industries more than others, and short-interest remains high in certain areas (indicating lots of investors believe there is still more pain to come). In this quick note, we briefly review the REIT market by sub-industries and then highlight a very select few big-dividend REITs that appear attractive and worth considering for investment.

100+ Big-Dividend REITs:

For starters, let’s have a look at the data, including a variety of metrics you may find useful.

Many income-focused investors love REITs for the large dividend yields, but they are also attracted to the long track records of dividend growth (as you can see in the “Consecutive Dividend Growth Years” column and the 5-year average dividend growth column too.

Further still, price-to-FFO (funds from operations) is a basic REIT valuation metric, and these P/FFO numbers are generally very low compared to a few years ago. But of course a lot has changed.

Diversified REITs:

In this sub-industry, we do like W.P. Carey (WPC) as a contrarian play. Part of the reasons these shares are down is because of its exposure to “Office” properties (a group that is struggling, more on this later), but the office exposure is low, the dividend remains well covered, and the company has increased exposure to industrial real estate (a sub-industry we like).

Industrial REITs:

We continue to like this group even though it includes many of the best-performers in recent years. Some think the relatively strong performance by industrial REITs is a contrarian indication that the sector may be overheating. However, fundamentally speaking, we like the sector because it continues to be a critical piece of infrastructure for the growth economy. Specifically, Retail REITs are getting replaced by the internet, Office REITs are getting replaced by work from home, but industrial REITs remain a critical part of the macroeconomic infrastructure. We own Plymouth Industrial (PLYM).

Office REITs:

The group is ugly as work-from-home seems increasingly permanent for many in the post-pandemic economy. There may be some attractive contrarian opportunities in this group, but we own zero office REITs (no need to try to catch a falling knife at this point in our opinion).

Mortgage REITs

Mortgage REITs are a special breed in that they often own almost entirely real estate securities (e.g. mortgage-backed bonds) and because mortgage REITs tend to use a lot more borrowed money. Mortgage REITs are often valued (at a very basic level) based on price-to-book value, whereby anything below 1 is considered a discounted price (a lot more goes into valuing mortgage REITs than just that though).

We generally avoid this group (we own zero mortgage REITs right now), but because the sub-industry can be extremely volatile at times, we will occasionally purchase/own a mortgage REIT. However now seem not to be the time for that in our view.

Retail REITs:

We believe Realty Income (O) is a bargain in this environment because it has suffered the broad REIT market pressures (its price is down), but the business is much more stable as it owns many retail properties that are more difficult to get rid of. The valuation is attractive, the dividend is well covered, and shares of this monthly-dividend payer are on sale. Long Realty Income.

Bottom Line:

You may see select attractive REIT opportunities (we currently own a select few), but the group faces secular headwinds with work-from-home and online shopping (not to mention higher interest rates, which may be here for a very long time). You can view all of our current holdings (including REITs) here.