Stocks posted strong gains this past week, and are set to rise further (over the long-term) despite a wall of worry. The gains come on strong quarterly earnings results (from Artificial Intelligence stocks, in particular) and a resolution on the debt ceiling. There are so many great investment opportunities right now for patient and disciplined investors (both growth and income opportunities).

Strong Post-Earnings Performance and Updates

Nvidia (NVDA)

Nvidia (a Blue Harbinger Disciplined Growth Portfolio holding) is still grabbing headlines following its dramatic increase to forward guidance driven by artificial intelligence. The company said it expects a dramatic uptick in business (far above previous Wall Street expectations) due to demand for the company’s data center products. Specifically, companies are expecting dramatic growth in “AI,” and they’re already spending on data center infrastructure to store all the new data in “the cloud.” We recently wrote up Nvidia here.

Pure Storage (PSTG)

Pure Storage (a Blue Harbinger Disciplined Growth Portfolio holding) gained 20% this week on strong earnings driven by an uptick in artificial intelligence driven demand. Pure Storage provides high-capacity storage for data centers using software & hardware technologies that are extremely well rated by customers. You can read our previous report on the company here.

Sofi Technologies (SOFI)

Online financial service company (and bank) SoFi Technologies posted very strong gains this week following clarification on Federal Student Loan Forbearance. The company has been disadvantaged (because their private loans don’t qualify for pandemic-related government handouts). However, the recent debt ceiling bill includes provisions to end student loan forbearance in 60 days. This lift a wall of uncertainty, and the shares were up big. We do own shares of SoFi in our Disciplined Growth Portfolio, but it is very volatile, and you can read our latest report here.

Cohen & Steers Infrastructure (UTF), Yield: 8.7%

Switching gears to income-investments, the Cohen & Steers Infrastructure Fund offers a big yield (paid monthly) an currently trades at an attractively discounted price. We don’t yet own shares, but we recently wrote about this compelling closed-end fund (“CEF”) here.

Veeva Systems (VEEV)

Veeva is a stock we own in our Disciplined Growth portfolio and it gained over 20% in the last week following strong earnings. Veeva is the leading provider of cloud solutions for the global life sciences industry. The company announced earnings this past week, and according to CFO Brent Bowman

"We started the year strong and delivered financial results that exceeded our guidance on all metrics… We see momentum in multiple product categories, which positions us well to deliver durable and profitable growth through 2025 and beyond."

We have previously written in detail about the attractiveness of Veeva here.

The Debt Ceiling and Treasury Bill Yields:

It feels a little bit like watching old TV reruns, but after weeks of quibbling, the US government passed a bill to raise the debt ceiling and avoid government default. The market appears to like this, and it has provided a boost to stocks so far.

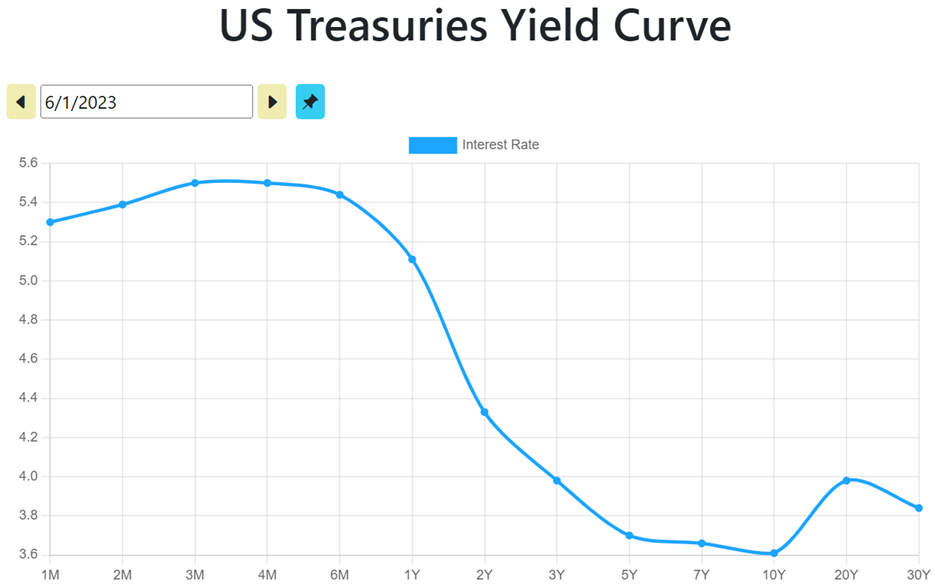

Interesting, short-term treasury yields remains at elevated levels (see yield curve below).

Generally speaking, an inverted yield curve is a signal of looming recession, and that is exactly what many experts predict. However, part of the issue is the current highly inflation rate (caused by pandemic stimulus) and the fed’s aggressive rate hikes to combat inflation. We’re left in an unusual spot with short-term treasury yields significantly higher than long-term yields.

If you are an income-focused investor the 5.5% yield (annualized rate) on 3-month and 4-month treasuries is compelling (especially now that the debt ceiling appears to be resolved). And thank goodness, because if the government defaulted on treasuries it would wreak absolute havoc on the global financial system (so many large organizations use treasuries as collateral to borrow money, and a default would set off a chain reaction of big problems).

Top Rated Opportunities Going Forward

As a reminder, you can view our current holdings (and view our top rated investment opportunities in the portfolio tracker sheets here. We also recently shares two new top idea reports here:

We believe the market continues to offer select attractive opportunities, such as those provided above, as well as risks.

Market Risks:

There are still a lot of risks in the market right now. For example, there is no guarantee that fed interest rate hikes have ended (the fed’s next interest rate decision is expected on June 14th). And if the fed keeps hiking aggressively that could be bad news for many young high-revenue-growth stocks that are not yet profitable. However, risks creates opportunity, and if the fed is done raising rates (and may even now lower rates to boost the economy) high-growth stocks could still rise significantly more in the near term.

We also continue to see risks in the real estate market. In particular, office properties will remain challenged, as covid permanently changed how (and where) people work (many people are still never going back to those big office buildings again—at least not on a regular basis). However, we do still like industrial real estate because it will grow.

Also noteworthy, the market is posting strong gains so far this year, and that can feel good. But there is no guarantee that things won’t turn south in the short run. Now is a good time to make sure you are positioned appropriately for your own personal long-term goals.

The Bottom Line

Despite short-term and mid-term market volatility, and despite a never ending litany of naysayers and media hit jobs—disciplined, goal-focused, long-term investing continues to be a winning strategy. Invest only in things that are consistent with your goals. Be smart.