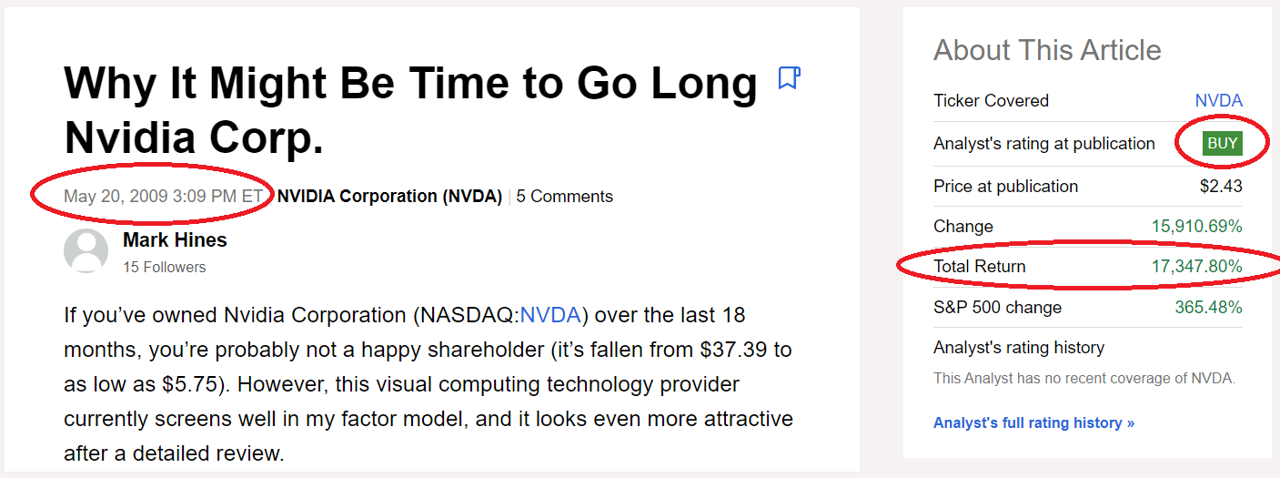

I wrote a positive report about Nvidia (NVDA) in 2009 (see image below), and since then the shares are up over 17,347%. I believe Nvidia shares can still go dramatically higher from here (driven by momentum and investor exuberance about artificial intelligence, in particular), but based on valuation, there are other (newer and smaller) high-growth stocks that are also worth considering (such as the 40 included in the detailed data table in this report). After reviewing Nvidia’s business and current valuation, we highlight a couple names from the list that are also particularly attractive, and then conclude with our strong opinion on investing.

Nvidia’s Epic Performance

Before it was a mega-cap stock, if you had purchased shares of Nvidia back in 2009 (when it was still a mid-cap), you would be up more than 17,347%. For example, here is a screen shot of my positive report on Nvidia from back in 2009.

The explosive growth has been driven by Nvidia’s innovative advances, as described in the next section.

Business Overview:

Nvidia is a technology company (semiconductors) known for its design and manufacture of graphics processing units (i.e. “GPUs”). Originally used mainly for video games, GPU usage has exploded into other areas as their processing power has proven significantly superior (to traditional “CPUs”) in many areas. According to the company’s website:

“NVIDIA pioneered accelerated computing to tackle challenges no one else can solve. Our work in AI and the metaverse is transforming the world's largest industries and profoundly impacting society.”

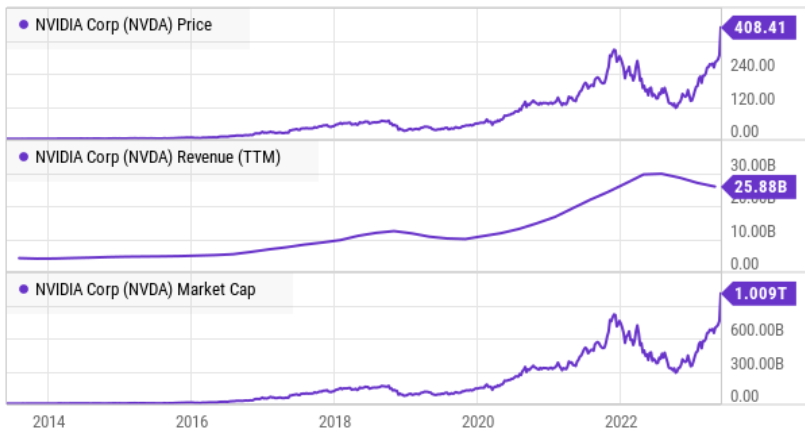

To give you an idea of how rapidly Nvidia has grown, here is a look at the company’s historical share price, revenues and total market capitalization.

The most recent steep gains in share price and market capitalization are due to the company’s most recent quarterly earnings release, whereby it provided forward revenue guidance dramatically higher than Wall Street expected, driven by a surge in artificial intelligence demand related to data centers.

Here is what CEO Jensen Huang had to say about it in the company’s latest press release:

“The computer industry is going through two simultaneous transitions — accelerated computing and generative AI.”

“A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.

“Our entire data center family of products — H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU — is in production. We are significantly increasing our supply to meet surging demand for them,” he said.

And here is a breakdown of Nvidia’s revenue by operating segment.

Artificial intelligence is the latest driving force behind the sharp uptick in Data Center revenue, and it is expected to keep accelerating.

Artificial Intelligence:

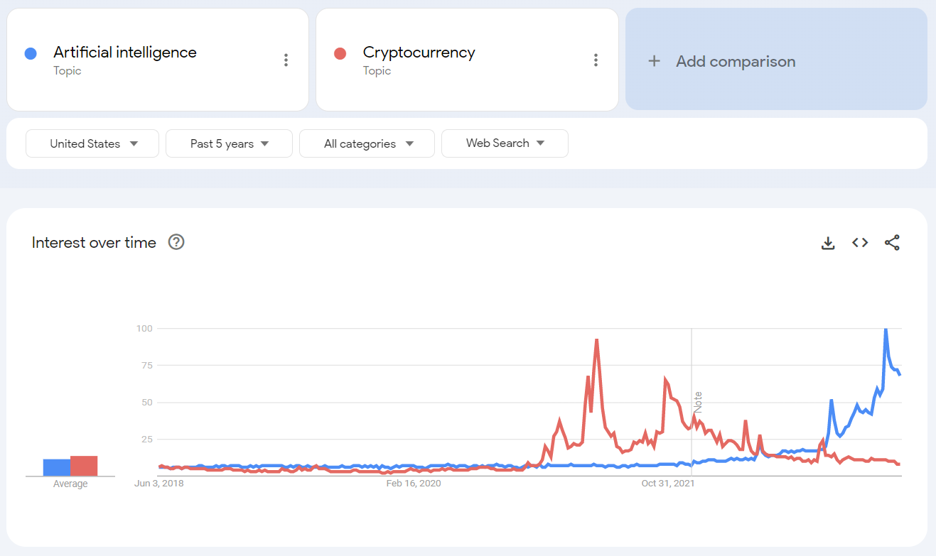

To give you an idea of how excited the world (particularly the US) is about Artificial Intelligence, here is a look at some recent Google Trends data.

As you can see, over the last 5 years, interest in artificial intelligence has grown rapidly (and now exceeds the popularity of cryptocurrency, including Bitcoin (BTC-USD), in recent years).

And this popularity has been driven by a combination of Nvidia’s recent blowout guidance numbers, the introduction of the widely popular ChatGPT and Nvidia’s own “talking up” of the topic (as per the specific mention of “AI,” now included on the company’s description of itself on its own webpage as described earlier), among others.

40 Top Growth Stocks, Compared:

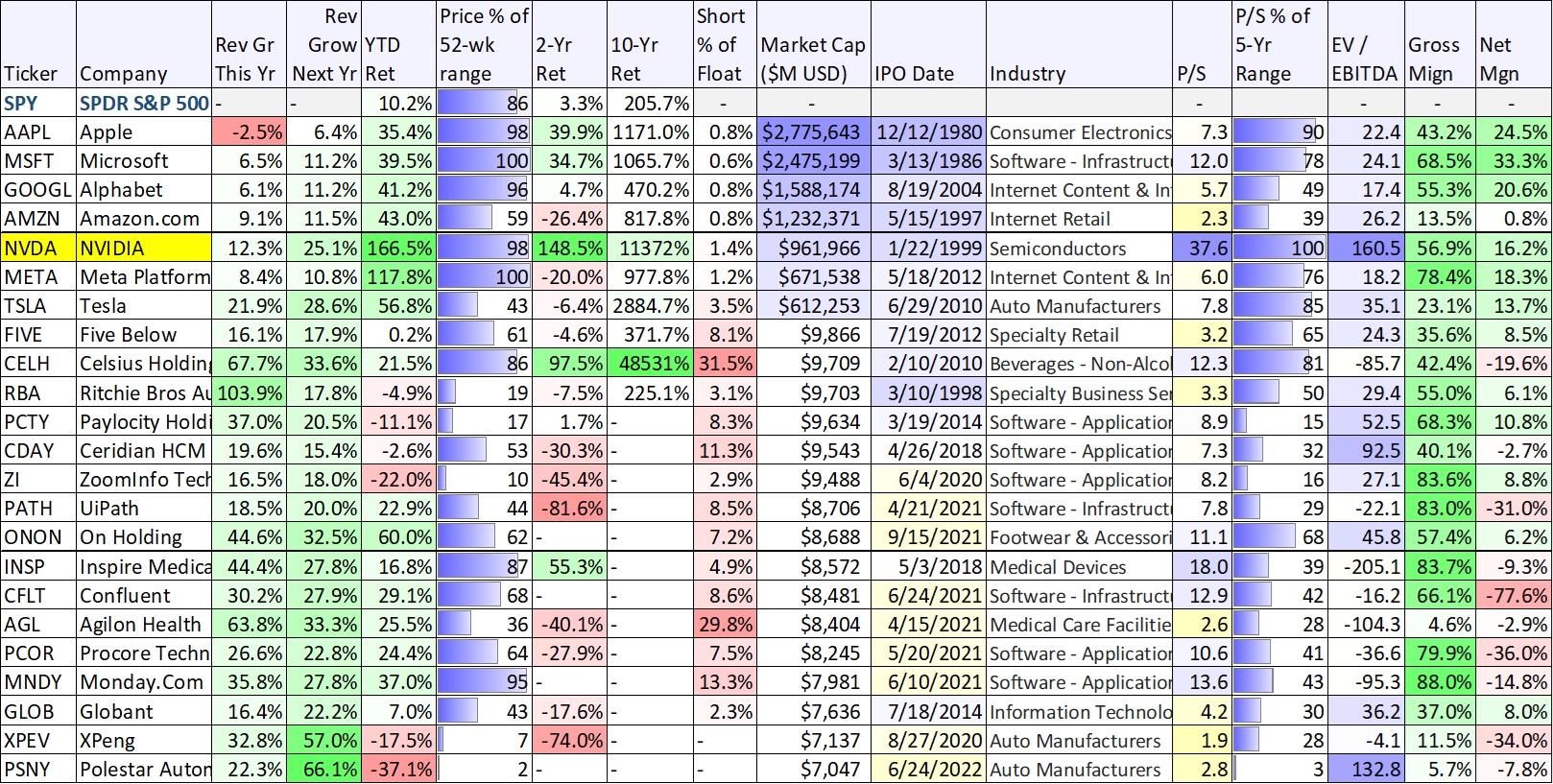

Before we get into more detail on Nvidia’s current valuation, here are some important financial data points on Nvidia as compared to other high growth companies. The table includes popular mega-cap stocks (including Nvidia) followed by 40+ high-growth mid-cap stocks (recall, Nvidia was only a mid-cap when we put out our original “BUY” report in 2009).

You likely recognize many names in the table. Metrics that you may find particularly interesting include revenue growth expectations (for this year and next), price (as a percent of the 52-week price range) and valuation multiples (including Price-to-Sales and EV-to-EBITDA). Nvidia certainly stands out for its top performance so far this year and its very rich valuation metrics.

Valuation:

Valuation multiples are one of the most basic ways to value a business (i.e. they can be a good starting point). For example, Nvidia currently trades at around 37.6 times sales (i.e. a P/S ratio of 37.6x in our table above). This means if there were no expenses, and if sales stay flat forever, it would take 37.6 years for a shareholder to get his money back from purchasing one share of Nvidia. And as you can see in the table, this is a very high P/S ratio as compared to all the other high growth businesses.

Of course, Nvidia sales are not expected to stay flat forever. Rather, they are expected to grow rapidly (based increasingly on the demand for AI-related products), at approximately a rate of 25% next year. So if we were to assume Nvidia grows at 25% for the next ten years (which is an extraordinarily high rate), then its P/S ratio (based on the current market price) falls to only 4.0x (much more reasonable as compared to other names in the table, and especially considering Nvidia is already very profitable).

But is it reasonable to assume Nvidia can continue to growth that fast for that long?

Total Addressable Market Opportunity.

In 2011, venture capitalist Marc Andreessen famously said “software is eating the world.” He was talking about company’s like Meta (META) and Twitter way back then, and so far he has been very right. And it appears he may be even more right in the years ahead.

For example, according to Jensen Huang’s quote (earlier in this article) there is already a trillion dollars of installed infrastructure for data centers globally (data centers are basically where data is stored for everything in “the cloud”). And all of that is expected convert in the coming years to accommodate new AI-driven solutions (and data), and also expand significantly beyond the current level too.

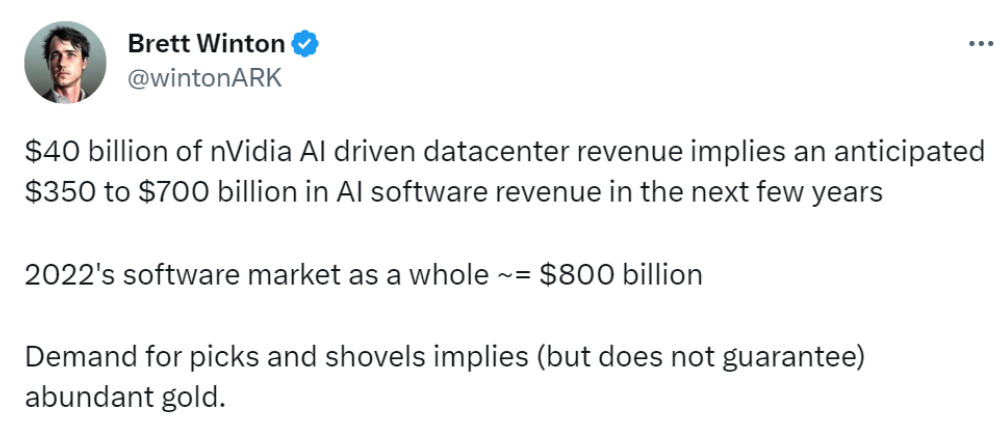

According to Brett Winton (of ARK Invest), the sharp uptick in demand for Nvidia products is akin to a sharp uptick in picks and shovels implying abundant gold.

His firm believes that AI will dramatically increase productivity (see graphic below), and thereby enable a $14 trillion dollar Total Addressable Market (“TAM”) opportunity by 2030. That is a lot of growth that could support a continuing high growth rate for Nvidia (the industry leader in advanced-technology semiconductors and innovation).

The market is very excited about Artificial Intelligence right now, and there could actually be ample long-term demand to meet (and even significantly exceed) current expectations.

Two More Top Growth Stocks Worth Considering

The opportunity for Nvidia is clearly very large, and we’ll have more to say about investing in Nvidia in the conclusion of this report, but let’s first briefly consider a couple other high growth names from the 40+ top growth stock table earlier in this report. In particular, let’s consider two “mid-cap” growth stocks because Nvidia was a mid-cap when we first wrote about it back in 2009 (as described earlier in this report).

SoFi Technologies (SOFI)

SoFi is an online financial services company and bank that targets younger high-income customers. It generates the majority of its revenues from loan origination, and it has recently faced heavy fear and price volatility. Specifically, a Supreme Court decision (regarding student loan forgiveness and forbearnance) is expected in the next few weeks, and it could significantly affect the business and the share price.

In addition to legal challenges, fear regarding recent bank failures has kept the price artificially low in our view (the shares trade at only 2.9 times sales) despite continuing rapid revenue growth.

Rising interest rates have been a significant driver of revenue growth recently as the shares head toward GAAP profitability this year. And if sentiment changes (like we believe it should) these shares can rise significantly in the short run, and over the long-term the upside is even bigger as the total addressable market opportunity is quite large. We wrote in detail about SoFi last week.

Paylocity (PCTY)

Paylocity provides cloud-based human capital management and payroll software solutions, and the shares are attractive. Growing revenues at 20-30% per year is especially impressive considering the company is very profitable (10% net margins), but still spending heavily on growth (the company’s research margin was recently 13.9%).

A few thing that make Paylocity special (aside from its high revenue growth and high profits) are its sticky customer base (once a company sets up its payroll processing, they are unlikely to switch). Paylocity’s original strategy (in an industry once-dominated by entrenched behemoth ADP) was to work with small businesses that were largely ignored by ADP (the industry leader that focuses on very large businesses). However, Paylocity did so with more flexible cloud-based solutions that are now greatly preferred in many instances, and the company continues to make progress with larger companies too (especially as its grows its offerings to the benefit of its “land and expand strategy”).

The shares have sold off this year (as the economy has hit a soft spot, particularly with many client companies in the technology sector laying off employees) thereby making for a more attractive entry point. Especially considering Paylocity has exceeded earnings expectations and raised guidance during both 2023 quarterly earnings releases so far. And here are a few interesting things Paylocity CEO Steve Beauchamp had to say in the company’s most recent release:

"Our overall momentum continued in the [most recent] quarter, with… recurring & other revenue growth of 28% and total revenue growth of 38%, as our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace. We continued to build upon our unique value proposition with the recent release of AI Assist, the HCM industry’s first integration of generative AI. Leveraging an integration with Open AI – the developer of ChatGPT – AI Assist is designed to help our clients more easily and effectively communicate and engage with their employees. Additionally, our commitment to product development continues to be recognized, with Paylocity recently placing #1 overall in G2’s Best HR Products list and ranking inside of G2’s Top 25 Global Software companies. Similarly, the strong culture at Paylocity was recognized externally as we received Forbes’s 2023 Best Employers for Diversity award for the second consecutive year.”

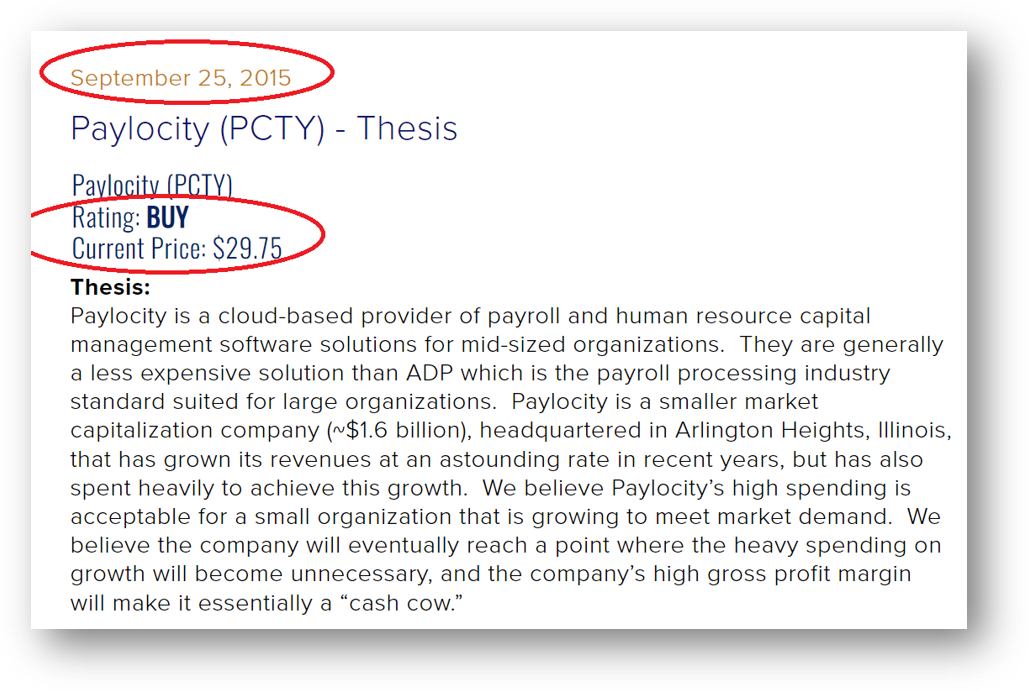

We have owned shares since 2015 when they were trading below $30 (they currently trade at over $170), but the shares continue to have significantly more upside ahead (they trade at only 8.9 times sales and are well below their 52-week high). You can view our original Paylocity thesis below (see screen shot) and our previous Paylocity reports here.

The Bottom Line:

Nvidia is a great business. And the shares have dramatically more long-term price appreciation potential ahead. Some investors argue that because it is already a mega-cap stock (and because the current valuation metrics are so high), investors should consider investing elsewhere. If you are inclined to consider additional opportunities, SoFi and Paylocity are mid-cap stocks (like Nvidia was when we first wrote about it back in 2009), and they both have significant long-term price appreciation potential ahead (plus they arguably trade at significantly more compelling valuation multiples).