It takes a special mindset (and a certain financial fortitude) to be a long-term growth investor. But if you can persevere through years of lumpy financial results, whipsawing volatility and the constant drumbeat of naysayers, you could end up getting in early on the next mega-cap growth stock (and enjoying all the powerful long-term gains that go along with it). In this report, we rank our top 10 “non-mega-cap” growth stocks, starting with #10 and counting down to our top ideas.

What is a Mega-Cap Stock?

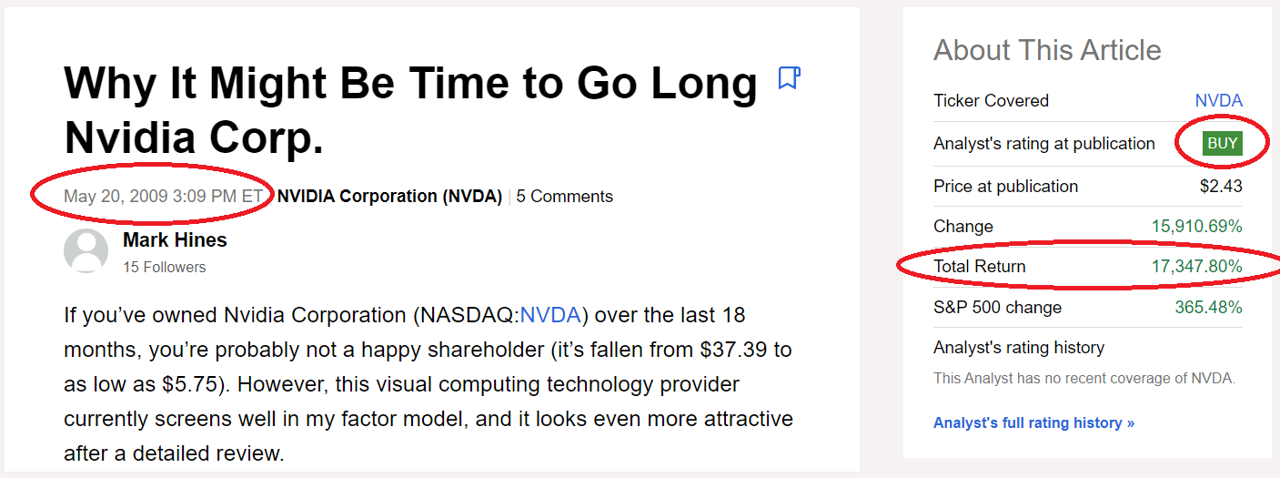

There are a variety of definitions of “mega-cap stock,” such as companies with market capitalization over $200 billion, or companies with market caps in the top 50th percentile of the S&P 500, but in a nutshell—mega caps are really big companies (think Apple, Microsoft, Meta, Google and Nvidia). Furthermore, mega caps all started out as significantly smaller businesses. And if you had invested early, then you would have enjoyed significant long-term gains. For example, if you would have invested in Nvidia back in 2009 (when it was still just a mid-cap stock), you’d be up over 17,347%!

And while many mega-cap stocks can still go much higher (and likely will), its much more challenging for very large companies to continue growing at such a rapid rate (because they’re already so big). Therefore, we exclude mega caps from our rankings in this report (although we do include a few in our table below).

Recent “High-Growth” IPOs

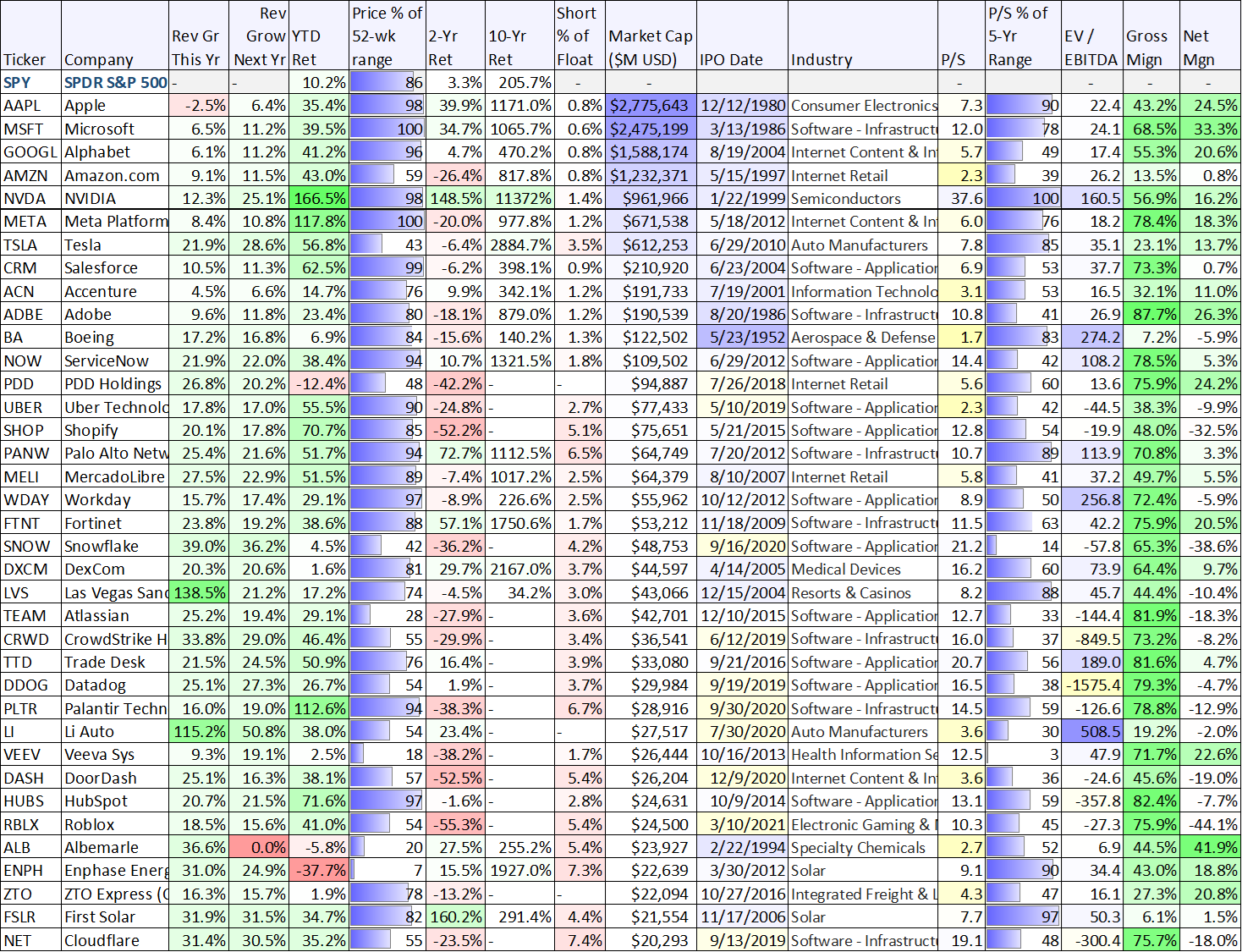

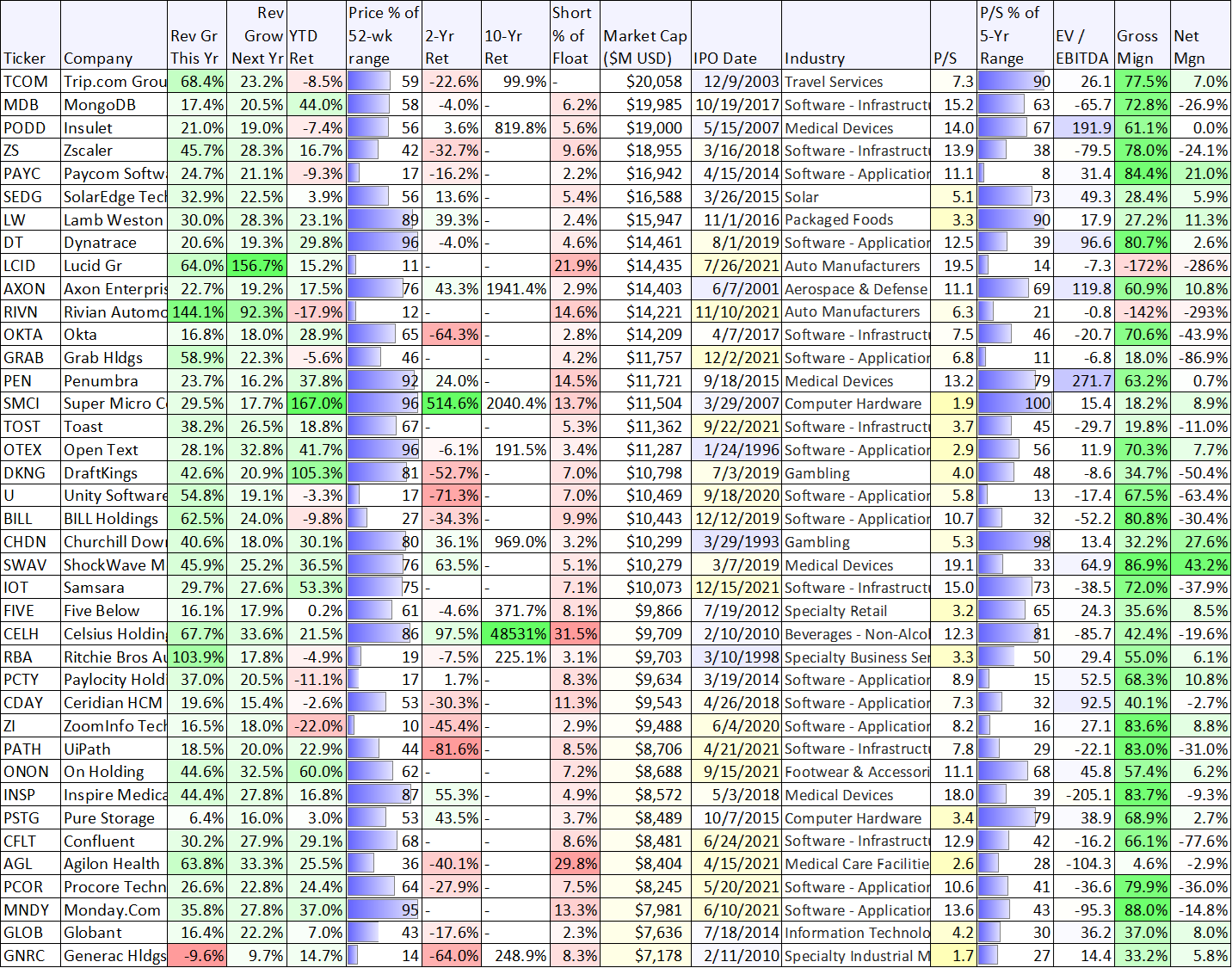

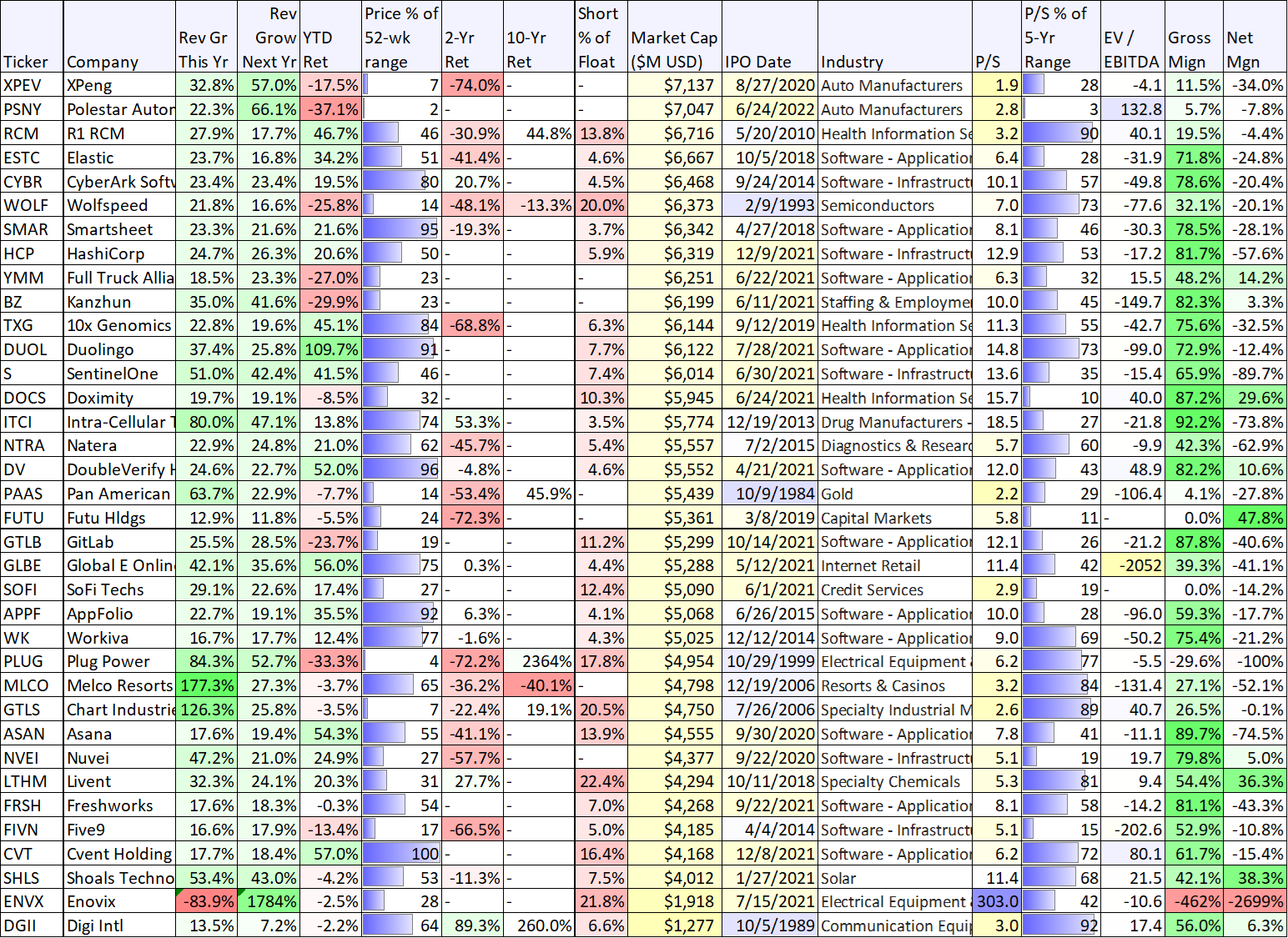

Before we get into our top 10 rankings and countdown, it’s worth considering the recent batch of newly-public high-growth companies (IPOs within the last few years) as you can see in the following table (see “IPO Date” column).

(access a downloadable spreadsheet version of this chart here).

Not surprisingly, a lot of growth stocks went public in 2019-2021 when market valuations were very strong (and they could raise a lot of capital by selling shares at a very healthy price). However, as you can see, a lot of these recent IPOs have performed very poorly over the last two years as valuations have come down significantly (see 2-year return column). You likely recognize at least a few of the popular names in the table.

So with that backdrop in mind, and before we get into our official top 10 ranking, let’s start with an honorable mention from the above table.

*Honorable Mention: Celsius Holdings (CELH)

Celsius (it has a $9.7B market cap in our table, sorted by market cap) is basically an energy drink company (offering a variety of flavors with proprietary clinically-proven formulas), and its revenues have been growing at an absolutely incredible pace. The driving force behind its recent rapid revenue growth is its relatively new (within the last year) distribution deal with Pepsi. According to CEO John Fieldly in the company’s latest earnings press release):

“During the first quarter of 2023, Celsius delivered an all-time quarterly record revenue of $260 million in sales and over $34 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further transition into PepsiCo’s best in class distribution system.”

Distribution is a huge deal, and if you’ve been in a US grocery or convenience store lately, you’ve probably come across a Celsius display, such as the ones below.

Celsius has plans to keep growing. Its corporate mission is:

To become the global leader of a branded portfolio which is proprietary, clinically-proven or patented in its category, and offers significant health benefits).

And as compared to competitor Monster Beverage (distributed by Coca-Cola), Celsius continues to have significant room for growth in terms of revenue and market cap.

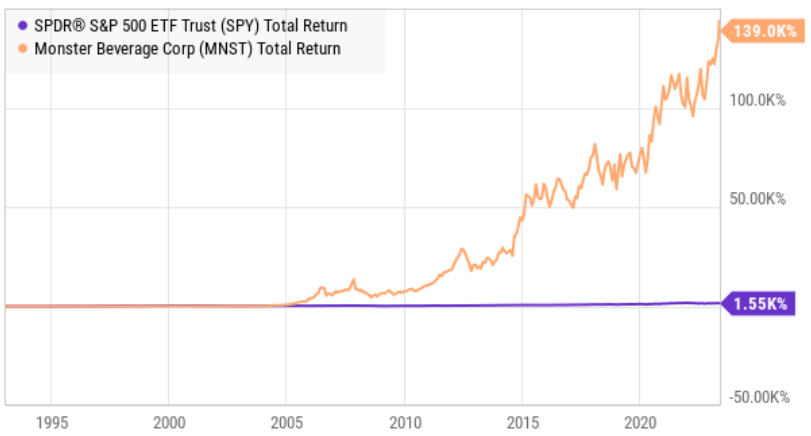

And if Monster’s historical price returns trajectory (following its Coke deal) is any guide (see below), Celsius is still just getting started.

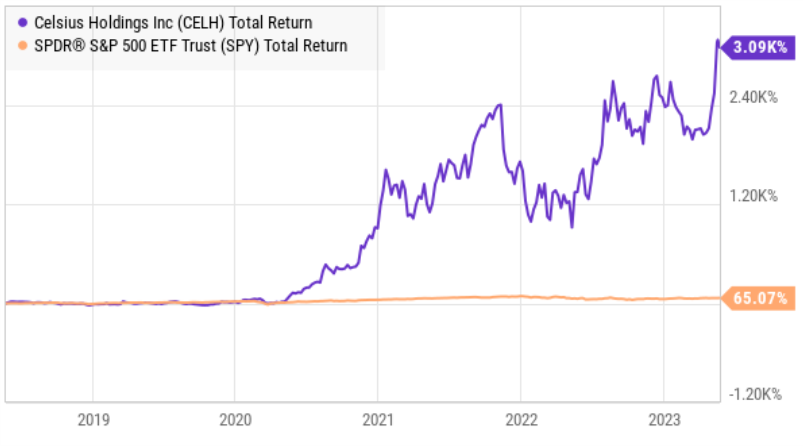

For reference, here is a look at Celsius’ recent price returns (below). The shares started to take off during the pandemic as lockdowns forced sales outside of mainly fitness clubs and into the mainstream (and now the Pepsi deal is taking the sales to new levels).

We’ve owned the shares since they traded in the $60’s (the current price is above $130), and we’d have ranked it higher on this list if it weren’t for the recent steep share price surge (the market cap is now 12.7x TTM sales—a lot for a “consumer staples” stock) and the very high short interest (recently over 30%). We continue to own shares, and we’ll consider adding more on any steep share price pullback (because Celsius appears to still have a lot more upside ahead). If you are curious, you can access our initial 2021 Celsius report (to see how we were thinking about it during the pandemic and before the Pepsi deal) using the following link.

Now let’s get into the actual top 10…

10. Datadog (DDOG)

Datadog is a very high growth “observability and security” platform for cloud applications. Its highly-regarded solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience.

The company is an industry leader and will continue to benefit from the ongoing digital revolution and migration to the cloud (a secular trend that is still just getting started, and now reaccelerating following the post pandemic slowdown).

As members know, we purchased shares of Datadog in March (in the $60’s), and it is increasingly attractive following its latest earnings release, whereby it beat revenue and earnings estimates and also raised forward guidance. Growing revenues at a very impressive rate (and with gross margins near 80%, and an impressive land-and-expand track record), yet still trading at only 14.7 times forward sales, Datadog continues to present a highly attractive long-term buying opportunity. You can access our previous Datadog report using the link below.

9. SoFi Technologies (SOFI)

SoFi is an online financial services company and bank that targets younger high-income customers. It generates the majority of its revenues from loan origination, and it has recently faced heavy fear and selling pressure. Specifically, a Supreme Court decision (regarding student loan forgiveness and forbearnace) is expected in the next few weeks, and it could significantly affect the business and the share price.

In addition to legal challenges, fear regarding recent bank failures has kept the price artificially low in our view (the shares trade at only 2.9 times sales) despite continuing rapid revenue growth.

Rising interest rates have been a significant driver of revenue growth recently as the shares head toward GAAP profitability this year. And if sentiment changes (like we believe it should) these shares can rise significantly in the short run, and over the long-term the upside is even bigger as the total addressable market opportunity is quite large. You can access our recent SoFi report here.

8. Albemarle (ALB)

As lithium demand grows (and supply remains limited), Albemarle is increasingly attractive. The shares are down 36% from their 52-week high, but the business continues to strengthen (i.e. revenues are growing very rapidly, the market opportunity is huge and profit margins remain strong). In the following note, we consider the company’s latest strategic effort, its valuation and our opinion on investing (i.e. we own shares).

7. Digi International (DGII)

Digi International is a small cap company (based in Minnesota) that enables machines to communicate with each other. And it is well positioned to benefit from vast and expanding new opportunities related to the Industrial Internet of Things (“IIoT”). It is currently being valued unjustifiably low (in our opinion) because supply chain issues are being misunderstood (and they will clear up) and because it’s being valued like a traditional hardware company without proper recognition for its growing subscription revenue model (which warrants a higher multiple). In the following report, we review the business, the expanding market opportunity, valuation and risks, and then conclude with our opinion on investing.

6. Paylocity (PCTY)

Paylocity provides cloud-based human capital management and payroll software solutions, and the shares are attractive. Growing revenues at 20-30% per year is especially impressive considering the company is very profitable (10% net margins), but still spending heavily on growth (the company’s research margin was recently 13.9%).

A few thing that make Paylocity special (aside from its high revenue growth and high profits) are its sticky customer base (once a company sets up its payroll processing, they are unlikely to switch). Paylocity’s original strategy (in an industry once-dominated by entrenched behemoth ADP) was to work with small businesses that were largely ignored by ADP (the industry leader that focuses on very large businesses). However, Paylocity did so with more flexible cloud-based solutions that are now greatly preferred in many instances, and the company continues to make progress with larger companies too (especially as its grows its offerings to the benefit of its “land and expand strategy”).

The shares have sold off this year (as the economy has hit a soft spot, particularly with many client companies in the technology sector laying off employees) thereby making for a more attractive entry point. Especially considering Paylocity has exceeded earnings expectations and raised guidance during both 2023 quarterly earnings releases so far. And here are a few interesting things Paylocity CEO Steve Beauchamp had to say in the company’s most recent release:

"Our overall momentum continued in the [most recent] quarter, with… recurring & other revenue growth of 28% and total revenue growth of 38%, as our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace. We continued to build upon our unique value proposition with the recent release of AI Assist, the HCM industry’s first integration of generative AI. Leveraging an integration with Open AI – the developer of ChatGPT – AI Assist is designed to help our clients more easily and effectively communicate and engage with their employees. Additionally, our commitment to product development continues to be recognized, with Paylocity recently placing #1 overall in G2’s Best HR Products list and ranking inside of G2’s Top 25 Global Software companies. Similarly, the strong culture at Paylocity was recognized externally as we received Forbes’s 2023 Best Employers for Diversity award for the second consecutive year.”

We have owned shares since 2015 when they were trading below $30 (they currently trade at over $170), but the shares continue to have significantly more upside ahead (they trade at only 8.9 times sales and are well below their 52-week high). You can access our previous Paylocity reports here:

5. Enovix (ENVX)

This is our most speculative idea on the list, and potentially the most lucrative (if things continue to progress for the company). Enovix a manufacturer of advanced lithium-ion batteries. And this “early-stage public company” is well-positioned to benefit from growing demand, including mobile, Internet of Things (IoT) and electric vehicles. Key differentiators include its energy density advantage (achieved through design and architecture choices) and silicon anode technology. It also addresses key safety concerns. In the following report, we analyze the business model, market opportunity, financials, valuation and risks. We conclude with our strong opinion on investing.

4. Shoals Technologies (SHLS)

Shoals is an industrial sector business that continues to grow rapidly as it benefits from the solar energy secular trend. Specifically, it provides electrical balance of system solutions (for solar, battery energy and EV charging applications) to mainly engineering and construction firms. And its valuation is increasingly attractive, especially considering the competitive advantages of this highly profitable $3B+ market cap company. In the following report, we review all the details, and then conclude with our opinion on investing in this rapidly growing business.

3. Veeva Systems (VEEV)

Given the challenging macroeconomic backdrop (high inflation, recession looming), if you had to list the top characteristics you’d like to see in a stock market investment right now, it might include things like: high profit margins, no debt, tons of cash and a sticky client base that is economically non-cyclical. The healthcare stock we review in this report has all of those things, plus a very high revenue growth rate, a large total addressable market opportunity, a wide economic moat and basically no competition. Plus the shares are near the lower end of their 52-week range, thereby creating a more attractive entry point. This is an attractive long-term growth stock, and you can read our previous report here:

2. ServiceNow (NOW)

The problem that the ServiceNow platform solves is that most organizations have a lot of outdated manual workflow processes (ranging from finance, to IT, to sales and marketing) that are segregated, inefficient, and make work miserable for employees. ServiceNow helps digitize and unify these workflows to capture valuable data and make life better for employees.

And ServiceNow is a highly-profitable Software-as-a-Service (SaaS) company that is growing rapidly, has an extremely high customer retention rate and a massive long-term total addressable market opportunity (so it can keep growing rapidly) as it continues to benefit from the ongoing cloud migration (and digitization) mega trend.

The shares are still significantly below their pandemic highs, despite revenues and profits being now significantly higher than they were then. Trading at 13.5 times sales may seem expensive, but it is not considering revenue is growing at over 20% year and ServiceNow still has a very long (and profitable) runway for growth. The company just recently announced its first ever share buyback program (to help offset share-based compensation). You can access our previous notes and reports on ServiceNow using the following button.

1. Enphase (ENPH)

Enphase is a leading manufacturer of semiconductor-based microinverters, as well as batteries, EV chargers, and other storage solutions. The company is well positioned given the strong investment activity in the clean energy space globally as well as its innovative microinverter technology. Enphase is actively diversifying its product offerings and expanding into new markets, while also focusing on continuous technological advancements to maintain a strong presence in the industry. In the following report, we analyze the company’s business model, its market opportunity, financials, valuations, risks, and finally, conclude with our opinion on why it currently presents such an attractive investment opportunity.

The Bottom Line:

If you have what it takes (and if it is consistent with your goals) the market continues to present a variety of very attractive long-term growth opportunities, such as the ones described in this article. Just know that short- and mid-term price volatility can be the price you pay for powerful long-term price returns and compounding. We currently own all 10 of the stocks described above (within our more broadly-diversified 30+ stock, Disciplined Growth Portfolio). And we believe that disciplined goal-focused long-term investing will continue to be a winning strategy.