If you are an income-focused investor, there are many big-yield strategies to choose from. However, not all of them may be right for you. In this report, we share updated data on a wide variety of big-yield opportunities, including over 100 big-yield REITs, CEFs, BDCs and more. Then we highlight four names from the list that are particularly interesting and worth considering. Specifically, we highlight three tempting big-yield opportunities that we are currently avoiding, followed by one very attractive big-yielder that we currently own.

Without further ado, let’s get into it…

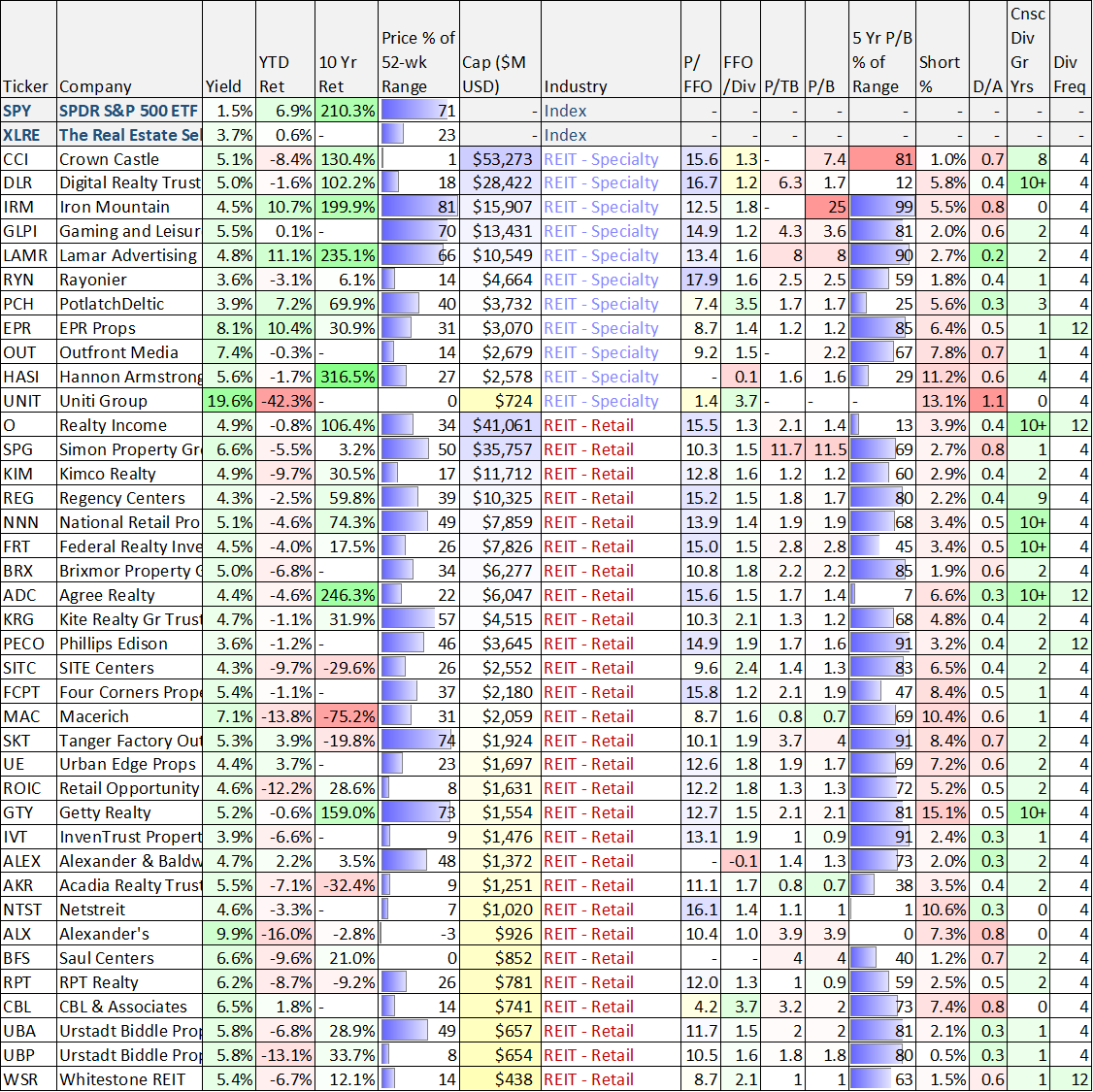

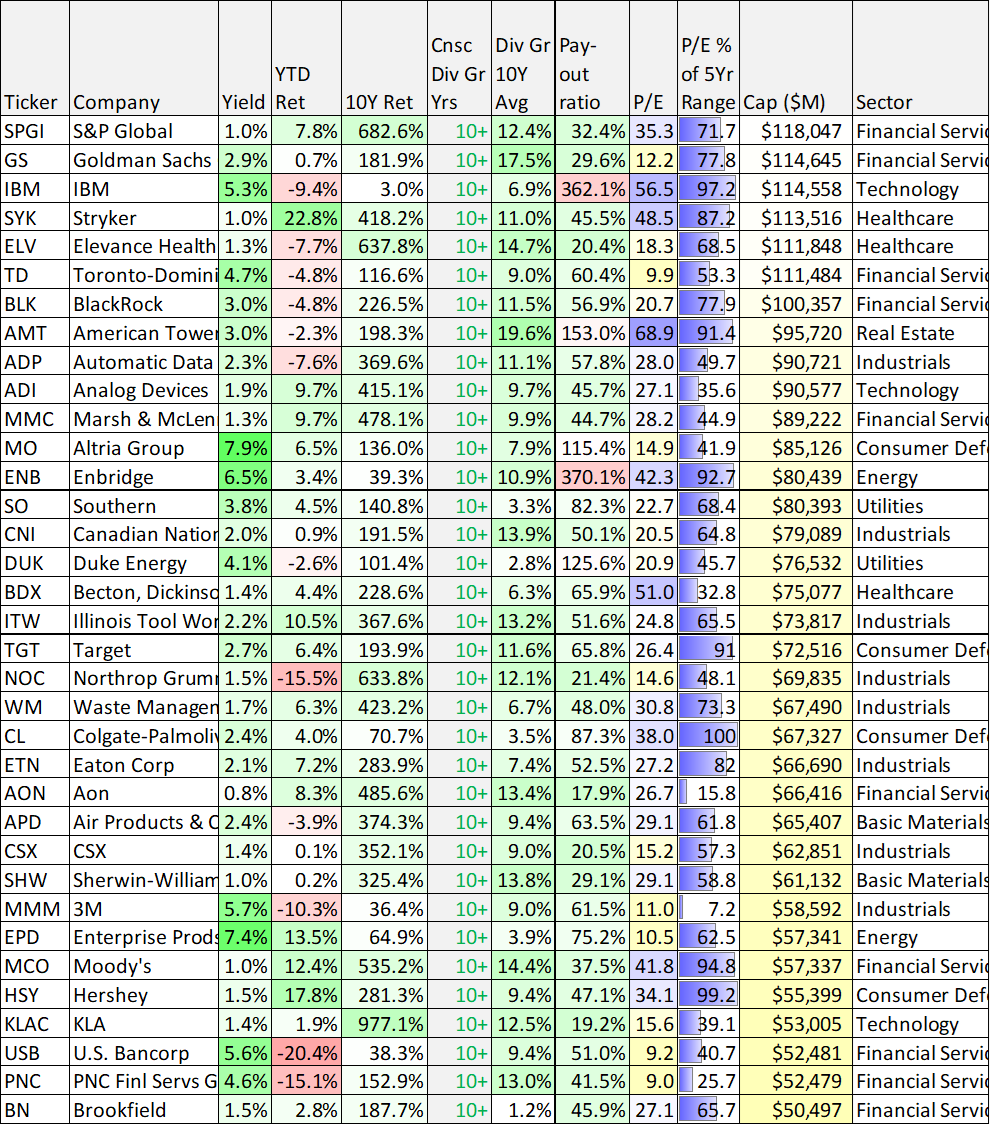

100+ Big-Yield Real Estate Investment Trusts (“REITs”):

With the exception of specialty REITs and Industrial REITs, all other REIT sub-industries have essentially been terrible over the last year (as you can see in the chart below).

Note: data as of Tues April 25th. Download this sheet here.

In particular, many commercial real estate properties have had their businesses wrecked by the shift to “work-from-home” and “shop-online” following the pandemic. This is a big part of the reason office REITs and retail REITs (in the table above) have performed so badly, while industrial REITs (generally not hurt by the pandemic, and in many cases actually helped by it) have performed so well.

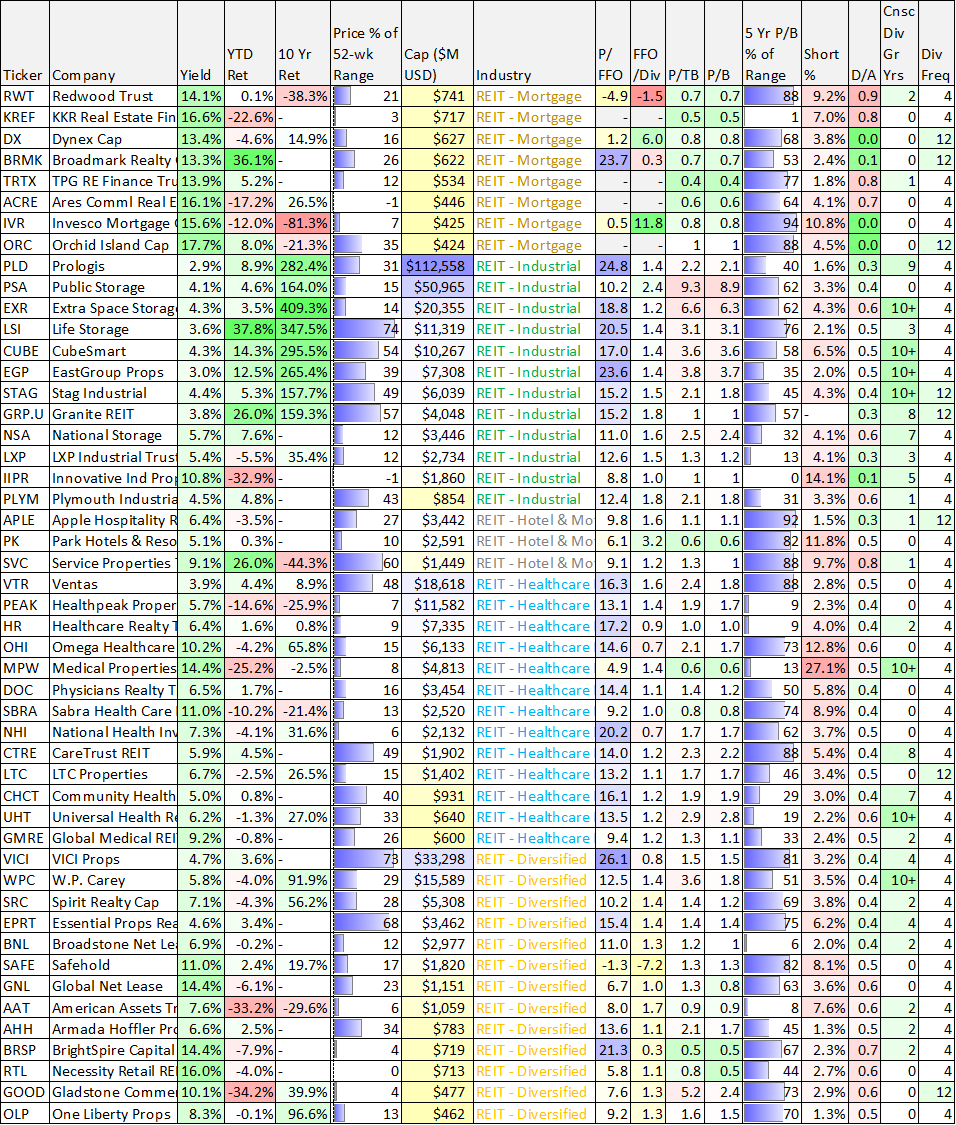

1. Ares Commercial Real Estate (ACRE), Yield: 16.1%

Ares Commercial Real Estate Corporation (a $446 million market cap mortgage REIT in the table above), originates and invests in commercial real estate (“CRE”) loans and related investments in the US. It provides a range of financing solutions for the owners, operators, and sponsors of CRE properties. And as you can see in more detail in the following graph, ACRE invests in some challenging market segments (not only because of the pandemic, but also because of the lending and borrowing challenges created by sharply rising interest rates).

And even though ACRE pays a large dividend and an additional supplemental dividend, there are growing risks to investors, and we are taking a hard pass on these shares (i.e. we recommend avoiding ACRE). We went into more detail on ACRE earlier this week (members can access that report here), but essentially this market is simply to ugly for our taste at this point in the cycle. There may be some distressed opportunities down the road, but we don’t believe we are there yet.

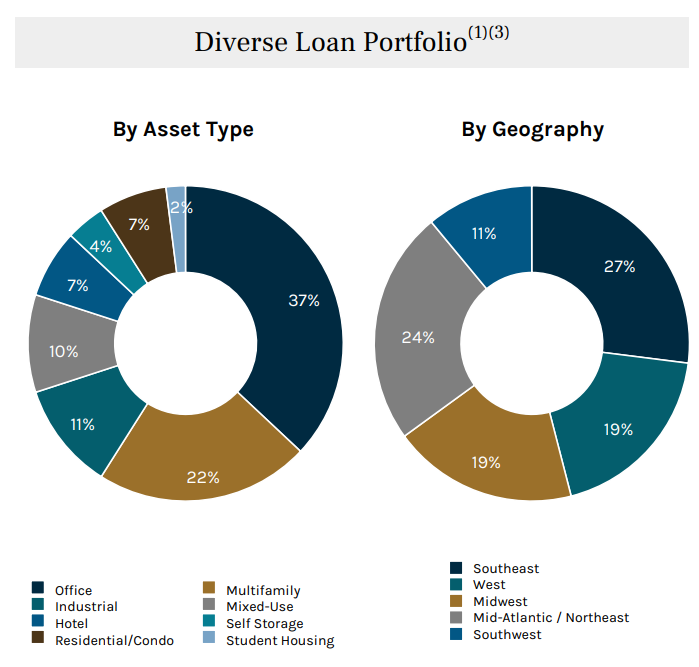

Dividend Growth Stocks

A lot of investors like investing in dividend growth stocks as a strategy because consecutive dividend growth years is an indication of financial health in the opinion of many investors. And if the share price of a dividend growth stock is down—that could be an indication of attractive contrarian value. For your consideration, here is a list of 75 top dividend-growth stocks (i.e. those that have increased their annual dividend for at least 10 consecutive years in a row). You likely recognize many names on the list.

2. US Bancorp (USB)

US Bancorp offers one of the highest dividend yields in the table above, and its shares are one of the worst performers so far this year. This combination has many contrarian investors curious if USB is an attractive investment right now. And our opinion is that it is very tempting, but we are avoiding the shares.

Specifically, a recent short-seller report highlighted that USB may soon be subjected to the same strict capital requirements of other large globally systemically important banks, in which case the company could face significant challenges ahead (including a dividend cut, a halt to share repurchases, and the need to raise capital that would dilute existing shareholders). We recently wrote USB up in detail here, and for now we are avoiding USB shares (despite its big dividend and recent share price declines). However, we do own several of the other names in the table above in our Blue Harbinger Income Equity Portfolio.

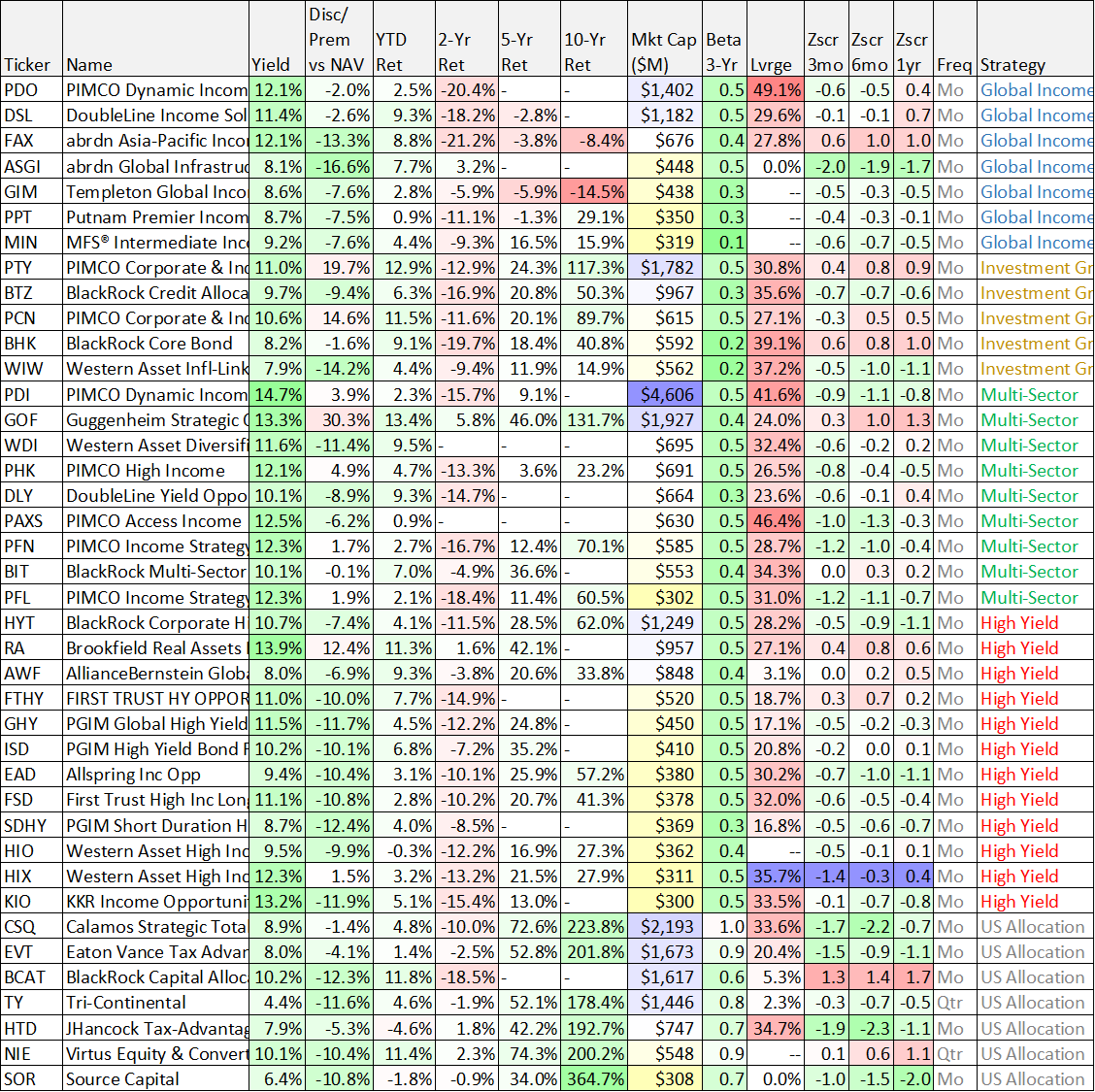

Closed-End Funds (“CEFs”):

Closed-end funds are often an income investor favorite because they can offer very big yields, often paid monthly (as you can see in the chart below). Additionally, CEFs come in many different strategies, ranging from stocks to bonds (and many others), and you can see over 80 popular examples below (the table is sorted by strategy and then market cap).

data as of Friday April 28th. source: CEF Connect, Stock Rover

One of the unique characteristics of CEFs is that they often trade at significant discounts and premiums (as compared to the net asset value of their underlying holdings) as you can see in the “Premium / Discount” column above. These premiums and discounts generally don’t occur for ETFs and other mutual funds (because of the mechanisms in place to prevent them), and they can create unique risks and opportunities.

3. Guggenheim Strategic Opportunities, Yield: 13.3%

One very popular CEF that currently trades at an unusually large premium to the net asset value of its underlying holdings is the Guggenheim Strategic Opportunities Fund (GOF). This fund has been very popular among income-focused investors, especially as the market has been volatile, because it employs a mix of stocks, bonds and options strategies, and it has delivered positive returns, big monthly income, and with a low market beta. However, the premium on this strategy has soared to over 30%, and this is unusually large as per the high z-scores in the table above (and very large as per the fund’s own historical standards). As tempting as GOF’s past performance may be, this is one big-yield CEF we are currently avoiding.

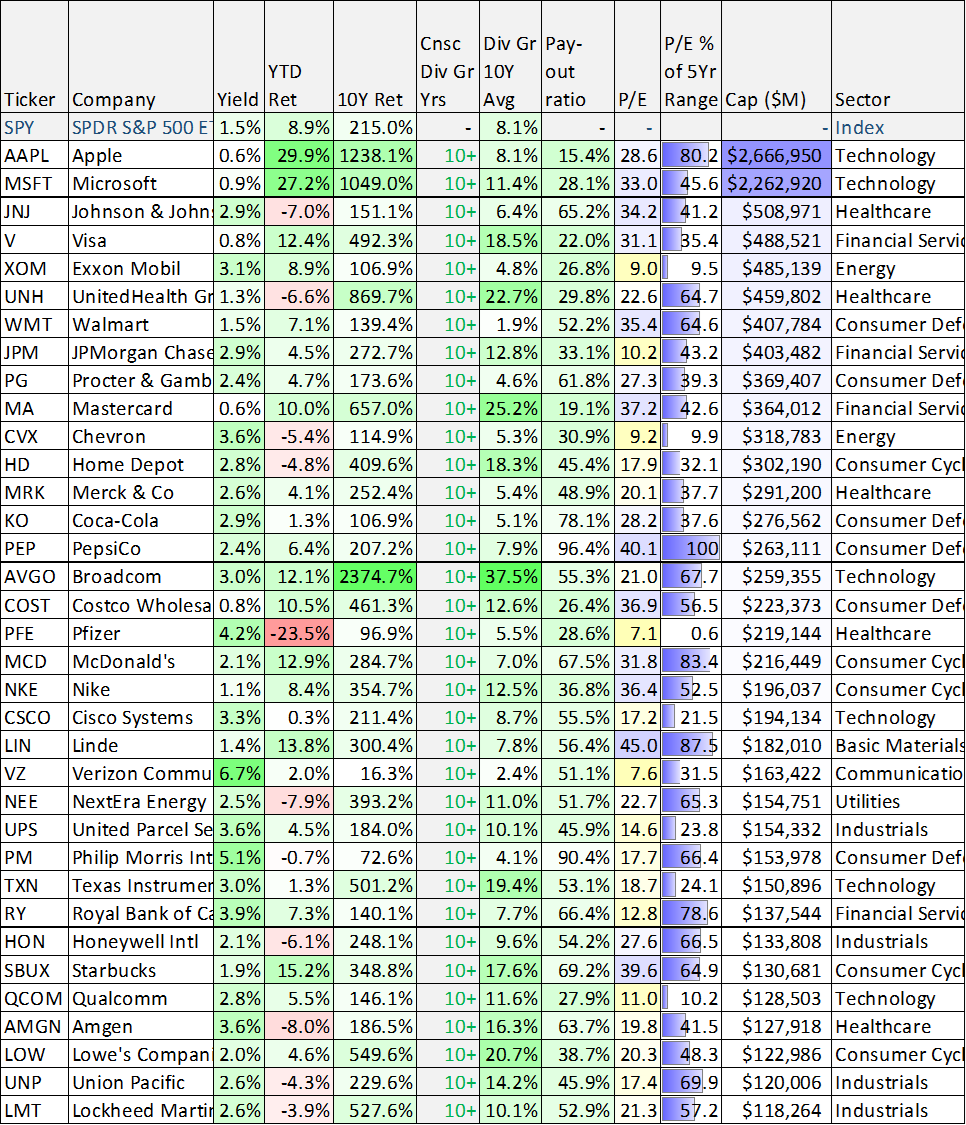

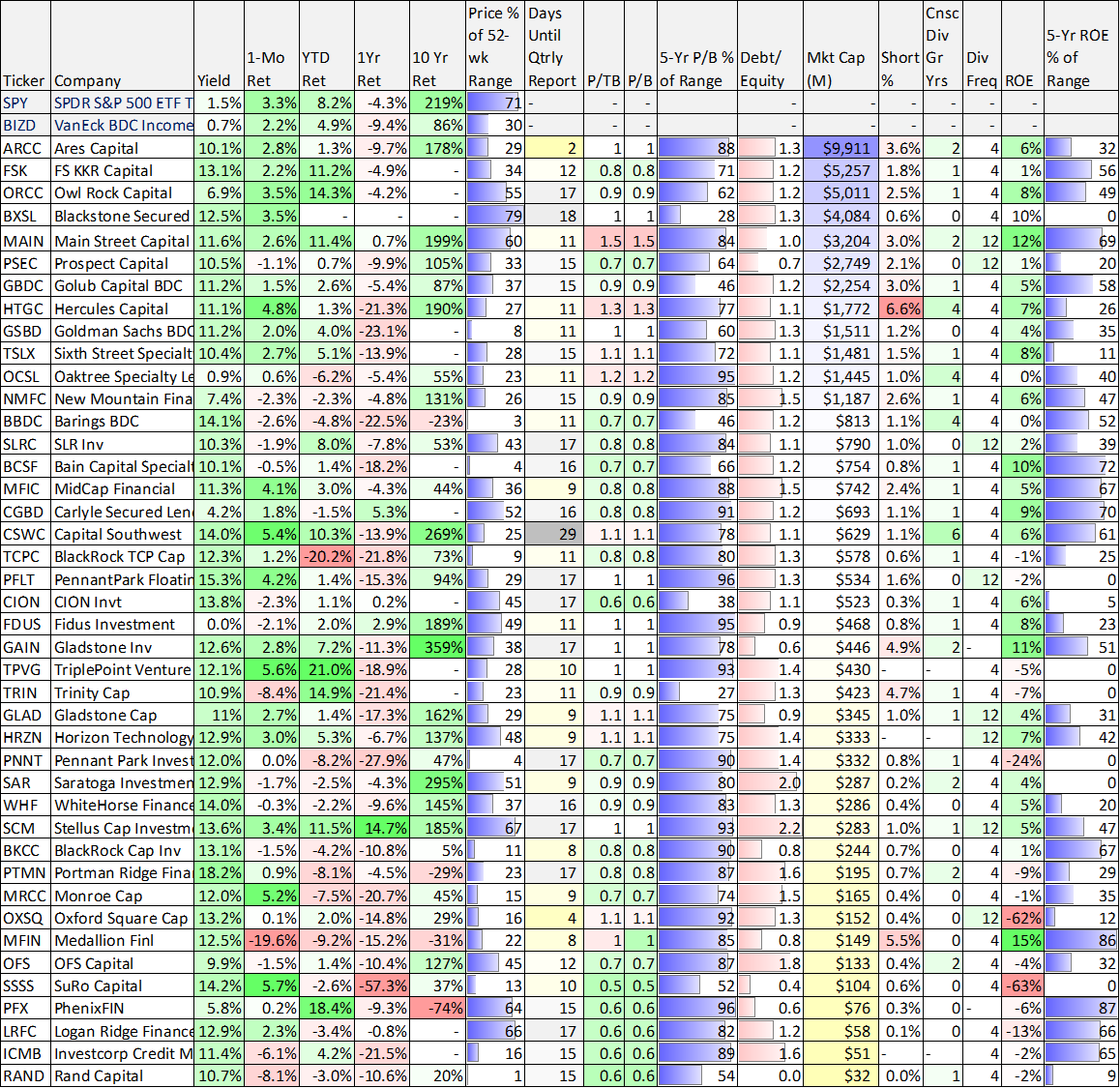

Business Development Companies (“BDCs”):

Business Development Companies provide financing to small (middle market) businesses. They utilize a wide variety of strategies, ranging from venture capital focused, to healthcare, debt to equity, and smaller to larger transactions, to name a few. You can see in the table below that they also offer high dividend yields (they can generally avoid corporate taxation by paying out most of their income as dividends), and their year-to-date performance has been mixed.

BDCs are considered to be more economically sensitive than some other segments of the market because they provide financing (mainly loans) to smaller (middle market) companies that are generally more risky by nature (i.e. when the economy slows, smaller and younger private companies are often the first to fail).

1. Ares Capital (ARCC), Yield: 10.1%

Ares capital is the largest publicly-traded BDC in the US (it’s at the top of our table above), and it is also one of the safest in terms of its well-diversified book of business. And considering the economy continues to head towards recession, we greatly prefer to be invested in the blue chip BDC industry leader, Ares Capital (i.e. we currently own shares of ARCC).

Ares announced earnings this past week, whereby they acknowledged market conditions were increasingly challenging, but that the company has ample financial wherewithal to survive the challenges (and even thrive). We’ve written up Ares Capital many times in the past (view examples here), and we have no intention of selling. Just don’t confuse Ares Capital (we like and own) with Ares Commercial Real Estate (we don’t like, and we’re avoiding). Ares Capital (ARCC) is a financially strong big-dividend blue-chip leader, and we own shares in our High Income NOW portfolio.

Top 10 Big-Yield Opportunities

If you appreciate the data and ideas in this report, consider accessing our income-focused Top Idea Portfolios: (1) The High Income NOW Portfolio, and (2) The Income Equity Portfolio. Each portfolio includes over 25 positions and is focused on a separate income strategy (i.e. high current income versus dividend growth, respectively). And readers are frequently very interested in the top 10 ideas in each strategy.

Current market conditions (volatility, inflation, higher interest rates) have created some select opportunities (including REITs, BDCs, CEFs, dividend growth stocks and more) that are particularly compelling, and we continue to share our top ideas and holdings with members.