Members Mailbag: We received an inquiry from a member this week about ACRE (expected to announce earnings on Tues May 2nd). We believe that some investors view this particular mortgage REIT (ACRE) as an attractive contrarian opportunity, considering the shares are down big (-40% over the last year), the yield has mathematically grown to a tempting 16.1%, and it has a well known brand name attached to it (Ares). However, the commercial real estate market is terrible. We share comparative data points on over 100 big-dividend REITs (sorted by sub-industry), dig into some important details on ACRE, and then conclude with our opinion on investing.

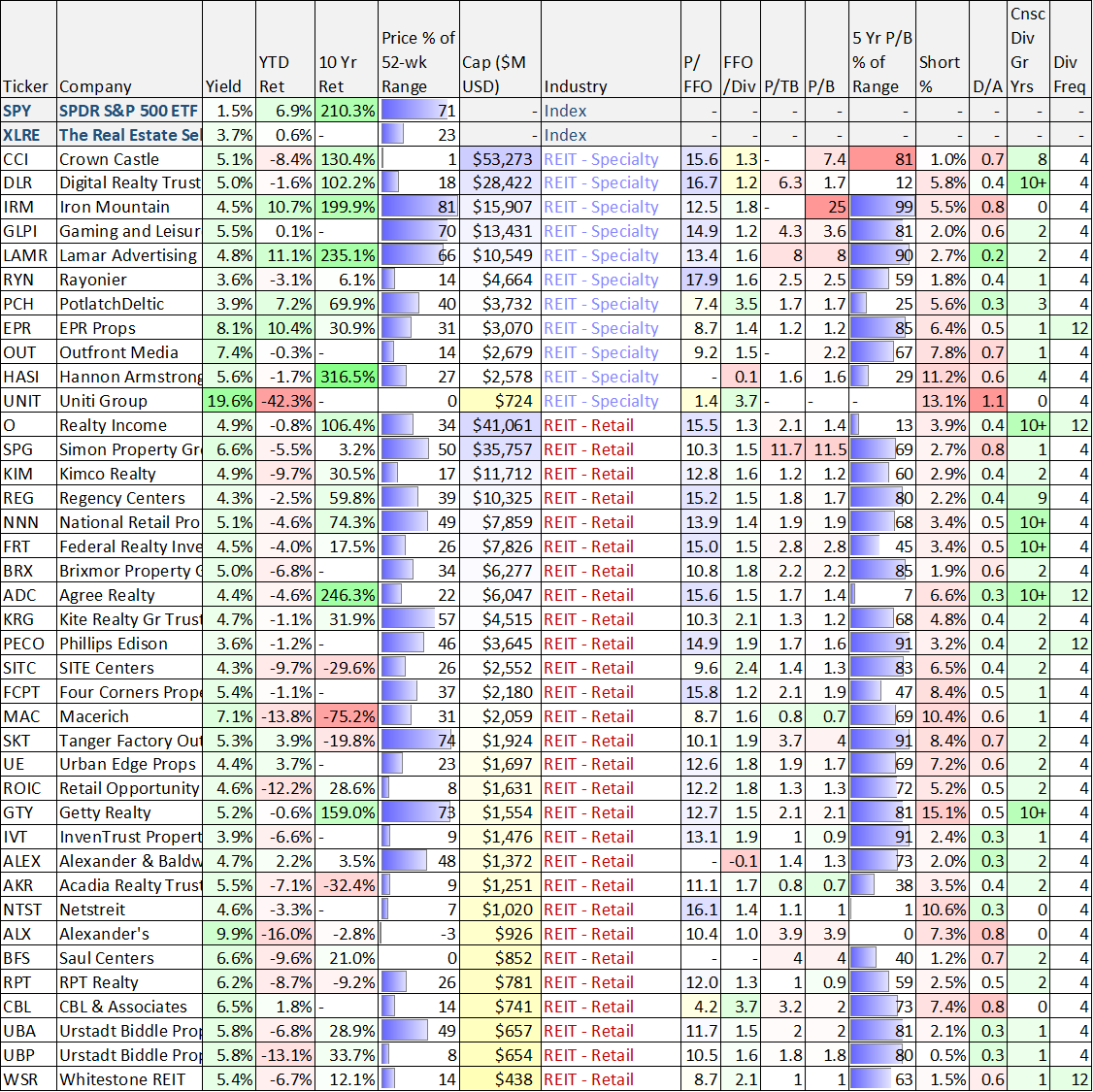

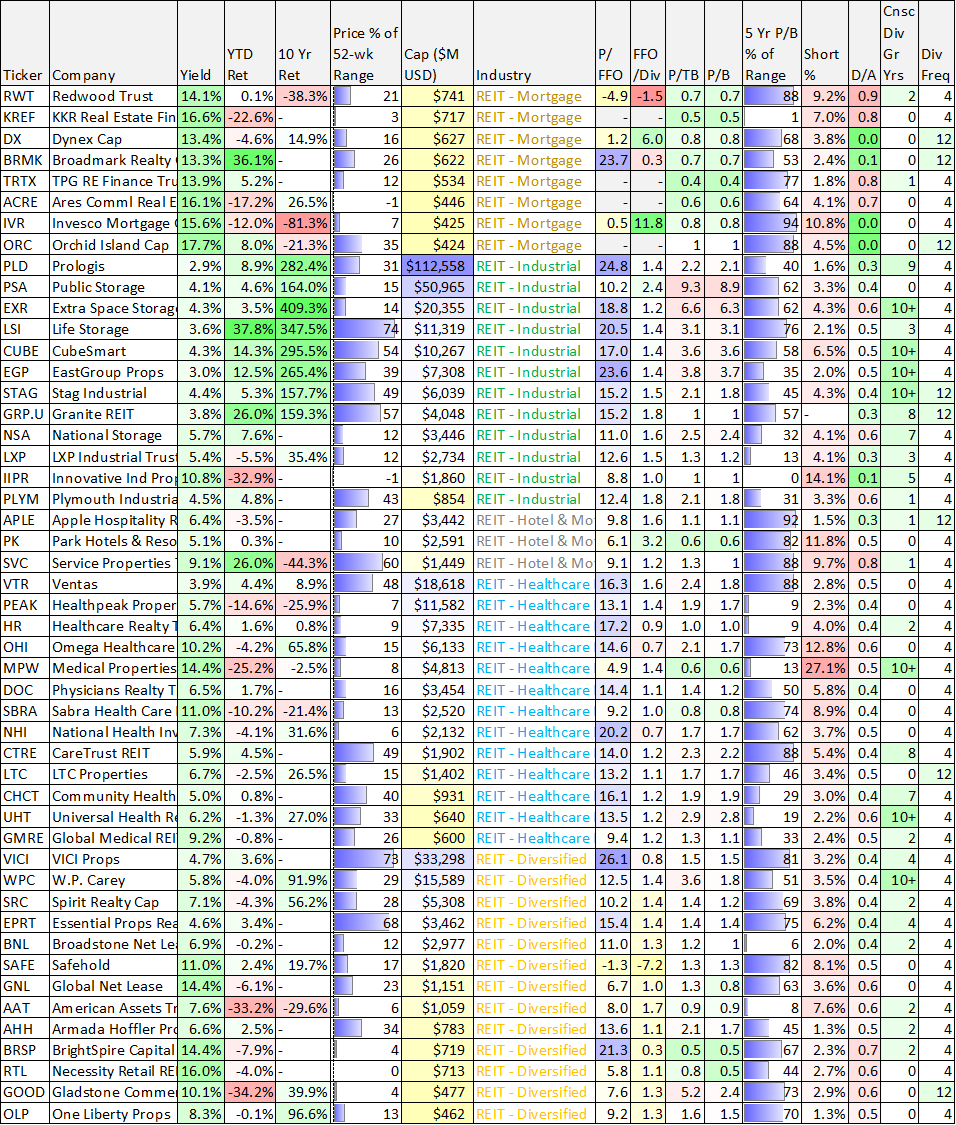

100 Big Yield REITs:

With the exception of specialty REITs and Industrial REITs, all other REIT sub-industries have basically been terrible over the last year (as you can see in the chart below).

data as of Tues April 25th. Download this sheet here.

Many commercial real estate properties have had their businesses wrecked by the shift to “work-from-home” and “shop-online” following the pandemic. This is a big part of the reason office REITs and retail REITs (in the table above) have performed so badly, while industrial REITs (generally not hurt by the pandemic, and in many cases actually helped by it) have performed so well.

Ares Commercial Real Estate (ACRE)

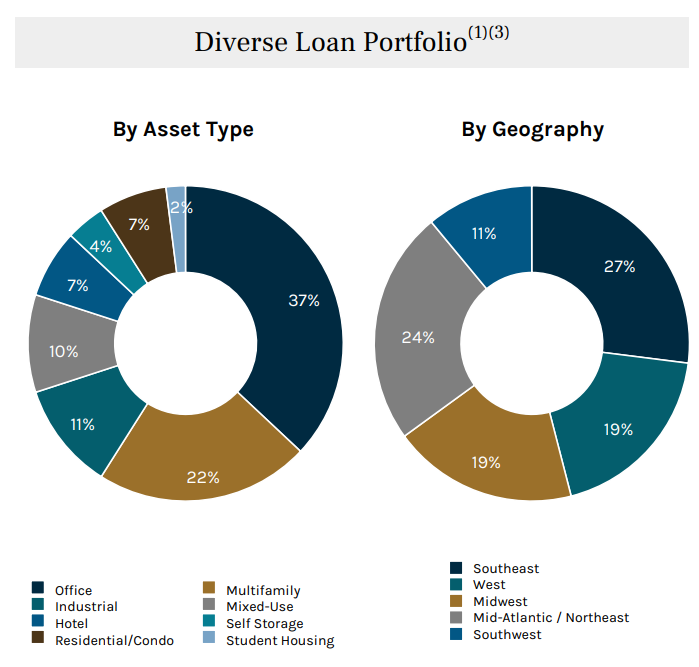

Ares Commercial Real Estate Corporation, a specialty finance company, originates and invests in commercial real estate (CRE) loans and related investments in the United States. It provides a range of financing solutions for the owners, operators, and sponsors of CRE properties. And as you can see in the following chart (and based on its name), this mortgage REIT invests in commercial real estate—a very challenging market lately (not only because of the pandemic, but also because of the lending and borrowing challenges created by sharply rising interest rates).

And even though ACRE pays a large dividend and an additional supplemental dividend, there are growing risks to investors. For starters, the dividend is only covered 1.1x by distributable cash flow. And secondly, market conditions are bad and getting worse. For example, see growing vacancy rates below.

Further still, the company is preparing for more challenging market conditions ahead, as described by CEO Bryan Donohoe in the previous earnings all (ACRE is expected to announce its next quarterly earnings on Tuesday May 2nd before the market opens).

While our strong distributable earnings benefited from the tailwind of higher interest rates, the same higher interest rates have also led to some headwinds for the overall commercial real estate market. Specifically, we're seeing many property owners take a pause on executing business plans as they adjust to these historic increases in market interest rates.

At the same time, certain markets are experiencing weaker leasing and occupancy trends. As has been well publicized office market in particular is facing challenges from shifting demand in a post-pandemic economy. Although, we believe our senior loan oriented portfolio has been carefully constructed, we aren't immune to the effects that these market headwinds present. As you'll hear from Tae-Sik, these industry-wide movements have resulted in higher credit reserves, a greater number of loans in default are on non-accrual status and elevated risk ratings. We are very focused on maximizing the outcomes for these situations and we believe we are well equipped to handle them.

Basically, ACRE is in bad shape and things can still get much worse (for example, vacancy rates can still go higher, as shown in our pervious vacancy chart).

Our Bottom Line:

Don’t get fooled by the well known “Ares” brand name (we like BDC Ares Capital (ARCC), but not this commercial mortgage REIT, (ACRE)). We do NOT believe the commercial real estate market will be returning to pre-pandemic conditions anytime soon, especially as vacancy rates and defaults are both likely to go higher. For some contrarians, they see the recent mortgage REIT declines as an opportunity. However, we are staying away from mortgage REITs at this time and from commercial mortgage REITs in particular (such as Ares Commercial Real Estate (ACRE)).