Among S&P 100 stocks (see table below), US Bancorp (USB) has one of the biggest dividend yields, but some of the worst year-to-date performance. Like most banks, USB shares sold off hard when the recent Silicon Valley Bank failure was announced, but unlike most banks—shares of USB have NOT subsequently rebounded. In this quick note, we review USB’s recent earnings announcement and the recent USB short-seller report (from HoldCo Asset Management). We conclude with our opinion on whether it’s time to buy US Bank or if it’s time to sell.

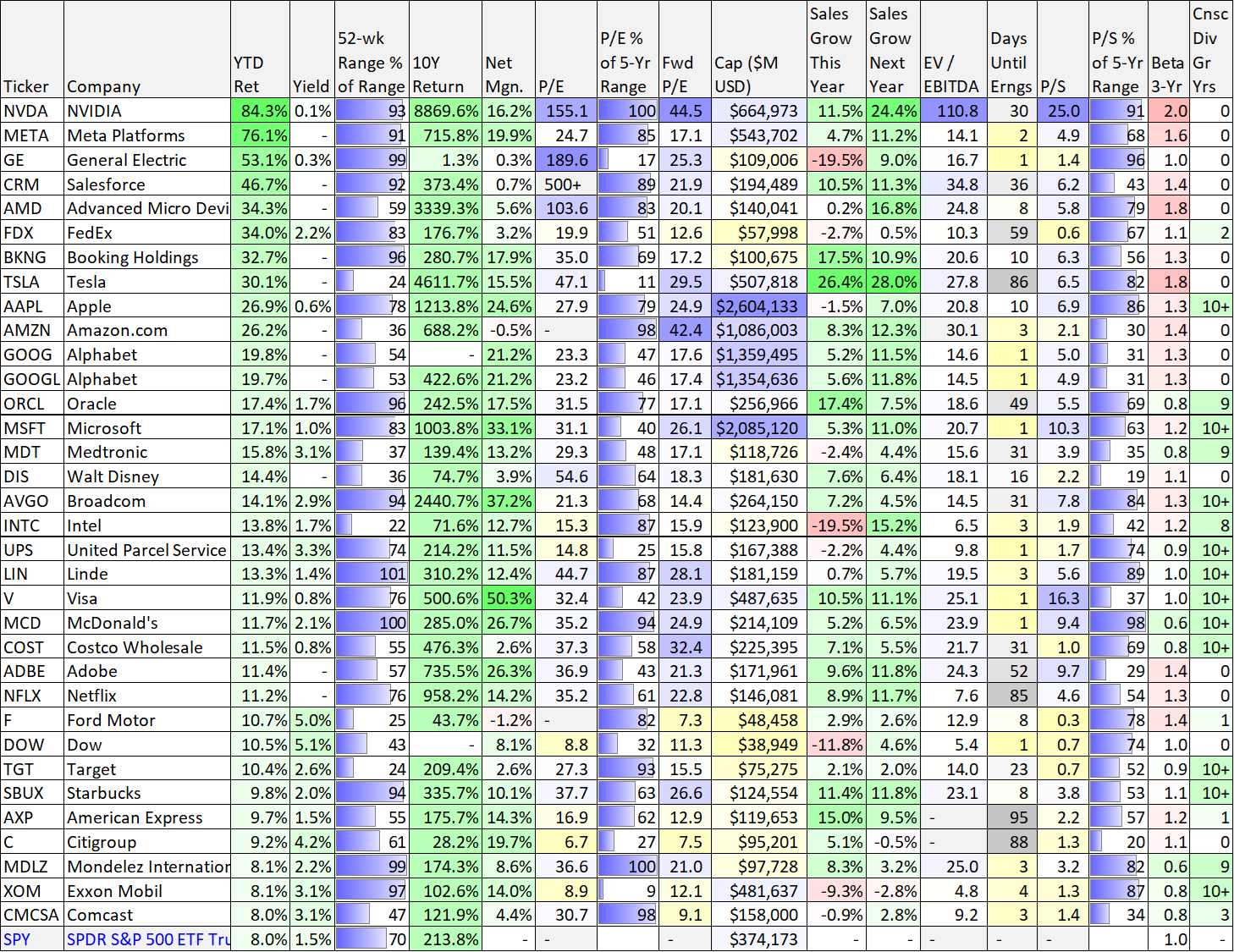

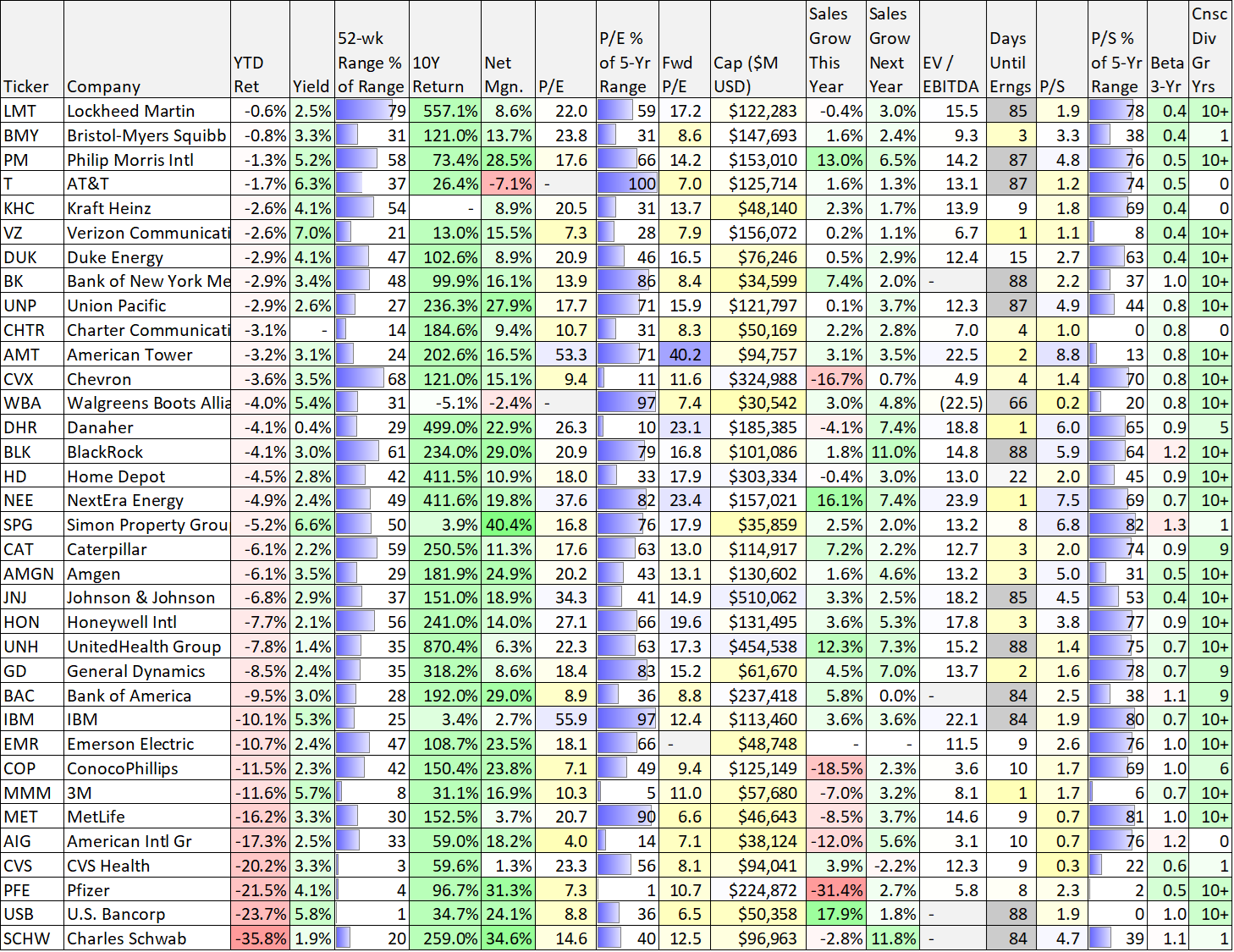

S&P 100 Stocks:

Before getting into USB, here is a look at the best and worst performing stocks (so far this year) in the S&P 100 index (the index is basically the 100 largest publicly-traded companies in the US). And as you can see, USB (near the bottom of the table) is the second worst performer and offers one of the highest current dividend yields (note: the table is sorted by year-to-date total returns).

data as of midday Monday, April 24th.

USB’s Recent Earnings Announcement:

U.S. Bancorp recently announced seemingly healthy quarterly earnings whereby non-GAAP EPS was $1.16 (beating expectations by $0.04) and revenue was $7.18B (beating expectations by by $50M). And, when you include charges for the bank’s recent acquisition of Union Bank, EPS was $1.04. USB also announced that its important CET1 capital ratio (Common Equity Tier 1) rose to 8.5% at March 31, 2023, compared with 8.4% at December 31, 2022 (another positive sign).

For some perspective, Morningstar strategist, Eric Compton, assigns USB Morningstar’s highest ratings (he ranks USB a five-star wide-moat opportunity with “exemplary” capital allocation and says the shares have 43% upside (his fair value is $58.00 while the current price is around $32.79). Eric explains in an Apil 19th note:

“U.S. Bancorp is the largest non-GSIB in the U.S. and has been one of the most profitable regional banks we cover. Few domestic competitors can match its operating efficiency and returns on equity over the past 15 years.”

GSIB stands for Globally Systematically Important Bank (a designation that was create following the Great Financial Crisis of 2008-2009, and thereby subjecting GSIB bank to more stringent testing and balance sheet capital requirements.

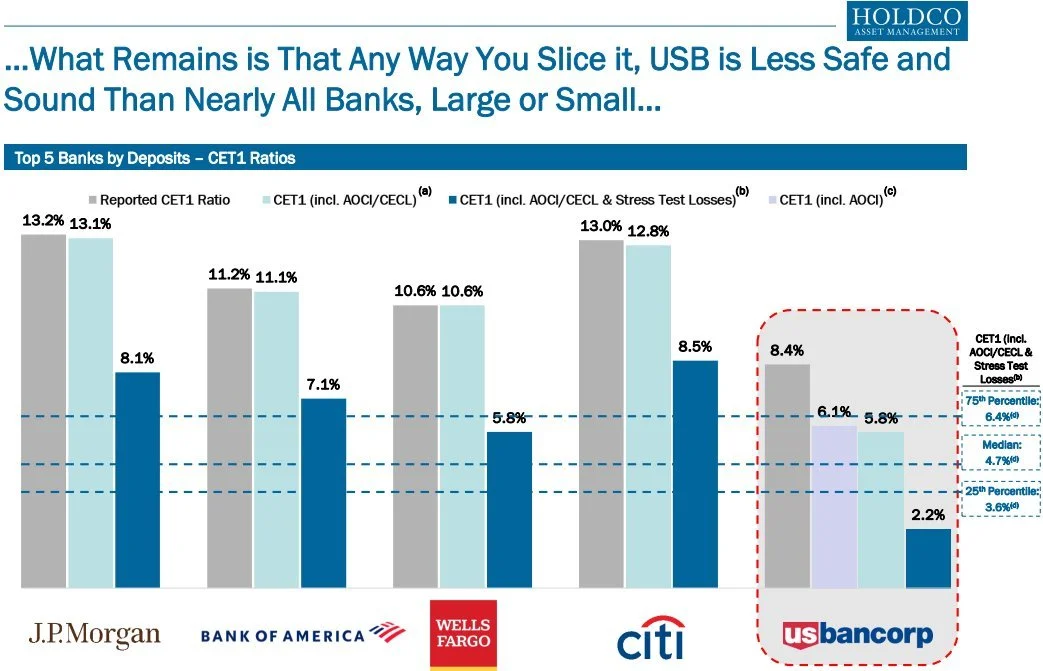

HoldCo Short Seller Report:

However, contrary to the seemingly healthy results (described above) and the positive outlook by Morningstar (also see above), a recent short-seller report was released basically describing USB as a terrible investment. Here is a link to the report. (from HoldCo Asset Management).

To summarize the short-seller report, HoldCo basically argues that because of the recent Silicon Valley Bank failure, and because of USB’s growing size, the government regulators will soon designate USB as "too big too fail,” and thereby subject it to the more stringent GSIB capital requirements (as described above), and this will be very bad news for USB because it could require more assets to be “marked to market” (and this would essentially show USB’s balance sheet is very weak and they’d be required to raise massive new assets to shore up the balance sheet and that would be at the dramatic expense of current shareholders.

To add a little more perspective to the HoldCo short-seller report, it’s worth mentioning they are shorting USB while they are long shares of Wells Fargo (WFC) in what appears to be a market-neutral bet that Wells Fargo will outperform USB whereby HoldCo makes money whether the market goes up or down, just as long as WFC performs better than USB.

However, compounding the market’s negative reaction to the HoldCo report, Moody’s just downgraded USB’s credit rating, explaining:

Moody's said the rating action reflects a deterioration in the operating environment and funding conditions for US banks. In response to this, Moody's has lowered the macro profile of the US banking system to 'Strong +' from 'Very Strong –'. The change in funding conditions reflects rising asset liability management challenges at US banks. Specifically, the banking system faces rising funding and profitability pressures related to the significant and rapid tightening in monetary policy, which has led to a reduction in US banking system deposits and higher funding costs. Higher interest rates have also reduced the value of US banks' fixed rate securities and loans which increases their liquidity and capital risks.

Our Bottom Line:

US Bancorp is increasingly tempting here, considering the price is down, the yield is up, and market sentiment is very negative (it can be lucrative to take a contrarian position when market fear is high). We’ve not yet pulled the trigger on USB (we do NOT currently own shares), but the share are high on our watchlist and we may initiate a new position soon.