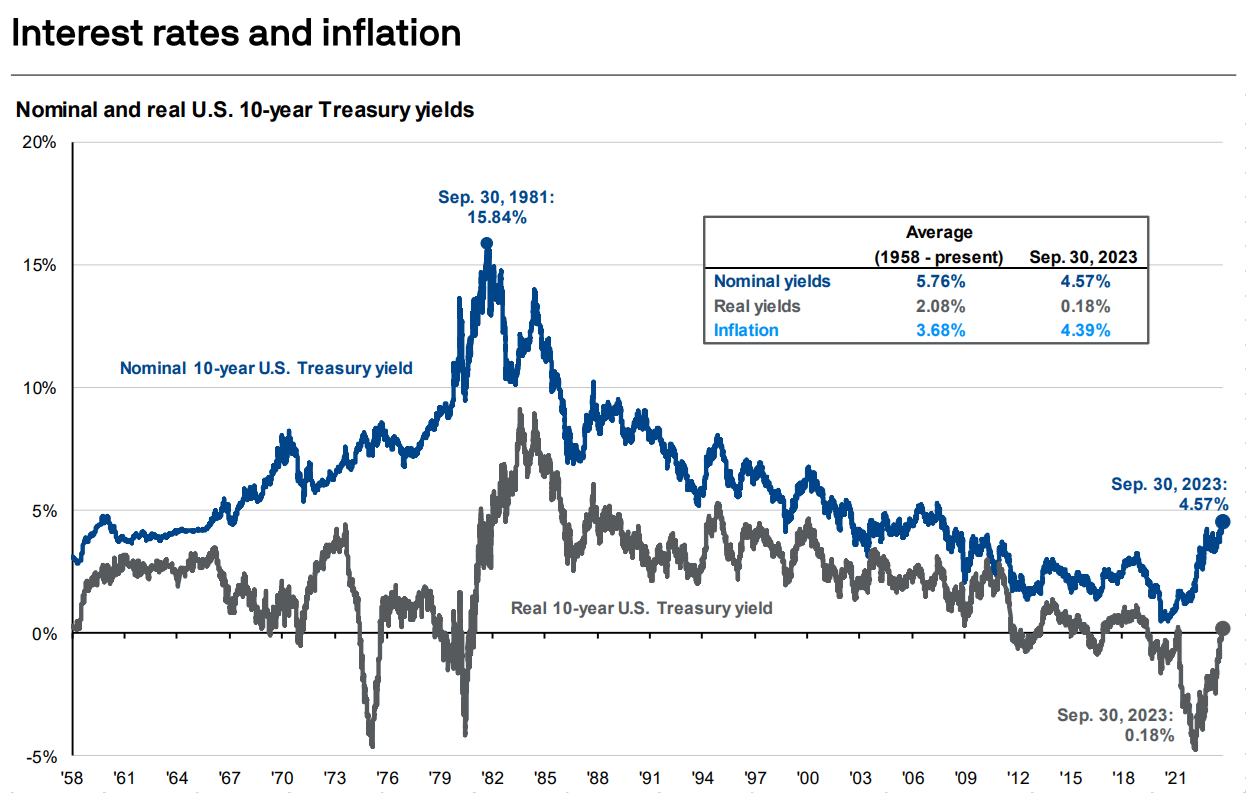

With real interest rates finally turning positive (inflation has slowed) and fed rate hikes arguably over, there could be incentive for investors to move out of equities (i.e. putting selling pressure on stocks) and into fixed income. One area that may benefit significantly is bond Closed-End Funds. In particular, many bond CEFs currently trade at unusually low market prices as compared to their net asset values (as evidenced by the many very negative z-scores across the space, as we show in this report).

If you don’t know, one unique aspect of closed-end funds is that they can trade at wide premiums and discounts relative to the net asset value of their holdings because (unlike ordinary mutual funds and exchange-traded funds) there is no immediate mechanism in place to resolve the CEF price-versus-NAV discrepancies (i.e. they trade based on supply and demand, not necessarily NAV).

As such, we could be about to see one “heckuva” rally in bond CEFs in the coming months and quarters as z-scores revert from very negative back closer to zero (and in some case the pendulum will swing very positive, thereby creating more upside). And with rate hikes over (remember, rate hike push bond prices lower), bond CEFs could be inline for a double benefit (i.e. z-scores move toward the positive and bond prices stop falling).

PIMCO Bond CEFs in particular have historically traded at large premiums to NAV because they are often revered as the premium player in the bond CEF space. As such, we like PIMCO Bond CEFs in particular, including tickers PAXS (13.6% yield, paid monthly) and PDO (13.7% yield, paid monthly). Both PAXS and PDO currently trade at price discounts to NAV, usual for PIMCO bond funds.

You can view all of our current bond CEF holdings (including PDO and PAXS) in our High Income NOW portfolio here.