Like a lot of stocks that started trading publicly during the pandemic bubble, there has been a lot of skepticism associated with Palantir. For example, naysayers decried that it wasn’t profitable (now it is), the company could never successfully expand from government to commercial (now it has), stock-based compensation was too high (now it’s not) and the whole big-data theme was dramatically overblown (however, machine learning and artificial intelligence are now big revenue growth drivers). In this report, we review the business, the financials, current valuation and risks. We conclude with our strong opinion on investing in Palantir.

Key Takeaways:

Despite naysayers, Palantir is driving platform stickiness through expanding capabilities and AI/ML integrations.

Leveraging large, fast-growing big-data analytics, AI markets.

Expanding customer base amidst low to moderate concentration risk.

Declining stock-based compensation expenses helps drive newly achieved GAAP profitability.

Strong balance sheet with healthy improvement in cash flows.

Promising future with abundant opportunities for additional growth.

A PDF version of this report is available here.

Palantir: Business Overview

Palantir offers a software platform that employs advanced data analytics and AI/ML algorithms (artificial intelligence / machine learning), enabling organizations to efficiently analyze both structured and unstructured data. It was founded in 2003 and began trading publicly during the early onset of the pandemic bubble in 2020.

Palantir generates revenue by offering subscription-based access to its software, which is hosted within its dedicated environment called "Palantir Cloud." It also offers software subscriptions and ongoing operating and maintenance services for customers who prefer to host the software within their own environments, referred to as "On-Premises Software".

The company is known for its three main software platforms, including Gotham (used by counter-terrorism analysts in the US government and fraud investigators at various federal agencies), Apollo (an operating system that allows continuous deployment across operating environments in the cloud, and it is one of only a small handful of Software-as-a-Service (“SaaS”) platforms authorized for mission critical systems at the US department of defense) and Foundry (an operations platform used by corporate clients to allow diverse teams to work together regarding big data analytics).

And more recently, Palantir has introduced its Artificial Intelligence Platform (“AIP”) which integrates existing software platforms with Large Language Models (LLMs) and robust AI tools, enabling real-time interaction and data-driven decision making through a secure AI chatbot in a secure environment (see chart below, more on this later).

Source: Investor Presentation

Impressive Government and Corporate Growth

Initially known for its impressive (and hard to acquire) government contracts, one of the big complaints against Palantir in recent years has been that its efforts to expand heavily into commercial (non-government) clients would be challenging. Specifically, naysayers proclaimed that commercial business was totally different than government business, and that Palantir’s aspirations for commercial expansion were absurdly optimistic.

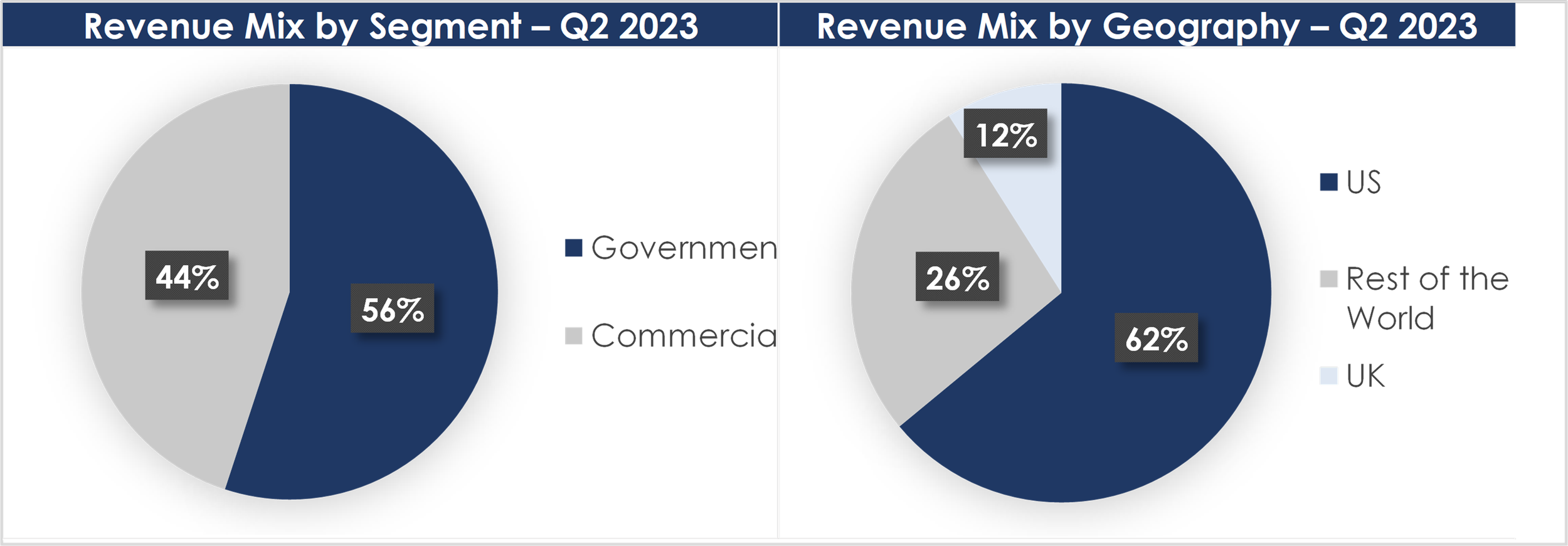

However, the naysayers have been wrong, and Palantir’s impressive growth with commercial (and government) clients has been impressive. Specifically, commercial revenues now account for nearly half of the company’s total revenues. More specifically, Palantir now operates through two segments, Government and Commercial, which accounted for 57% and 43%, respectively, of the company's total revenues in Q2 2023. And in terms of geographical distribution, the majority of its revenue (64%) is generated from the US, followed by the rest of the world (27%) and the UK (9%), as shown in the chart below.

Source: Company’s 10-Q

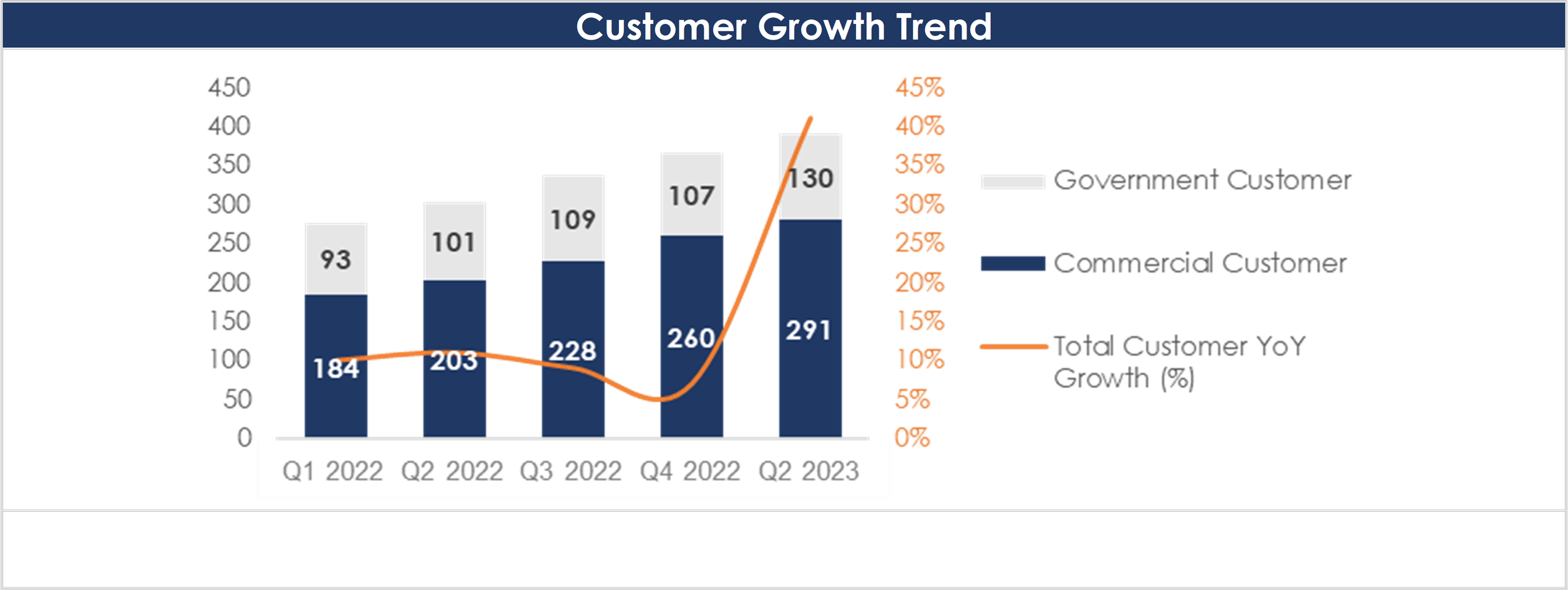

In particular, in the most recent quarter (Q2 2023) Palantir added 117 new customers compared to the previous year, bringing the total count to 421. This represents a 38% YoY increase from 304 customers in Q2 2022. And the main driver of this growth has been a solid expansion in commercial customers, as you can see in the chart below.

Source: Company’s filings

Further, and importantly, Palantir has maintained a net dollar-based retention rate of over 100% signifying superior customer satisfaction. In fact, the company's top three customers have consistently contributed 20% of revenue and have maintained an average seven-year business relationship, showcasing loyalty and ongoing partnerships. Additionally, the average revenue per top twenty customers on a TTM basis has also been consistently rising, reflecting the sticky nature of the company’s platform.

Source: Company Filings, Investor Presentation

Also worth noting, Palantir’s focus has historically been on high-end solutions for large organizations. While this strategy has been successful, it has also prevented Palantir from landing more customers (as the solutions are too expensive for many organizations). According to a recent research note from Morningstar analyst, Malik Ahmed Khan, the company is now attempting to counteract this trend by shifting to a “modular sales strategy with customers now able to purchase specific modules instead of onboarding an expensive platform at the onset. This modular sales motion is coupled with a usage-based pricing model which allows Palantir to land customers with low annual spend and ramp their expenditure on its platform up over time by either increasing usage or selling the customers additional modules.”

Source: Morningstar

Big-Data Megatrend: Machine Learning and AI

Perhaps the biggest complaint against Palantir since it started trading publicly in 2020 is that the whole “Big Data” theme was massively overhyped. However, with the acceleration on AI / ML, Palantir is delivering on this opportunity. As per CEO Alex Karp’s most recent shareholder letter on August 7th:

“The scale of the opportunity in front of us has never been more significant.

We announced the release of our Artificial Intelligence Platform (AIP), which allows large language models to operate within the confines of the enterprise and on privately held data, less than three months ago.

The platform already has users across more than one hundred organizations, including some of the largest enterprises in the world from the healthcare, finance, automotive, and energy sectors…

…We have built the integration platform that they require, and the traction we are seeing, only months after its release, has been transformative for our company.”

This strongly positive message from Karp coincided with Palantir delivering on Q2 earnings estimates and raising full-year guidance.

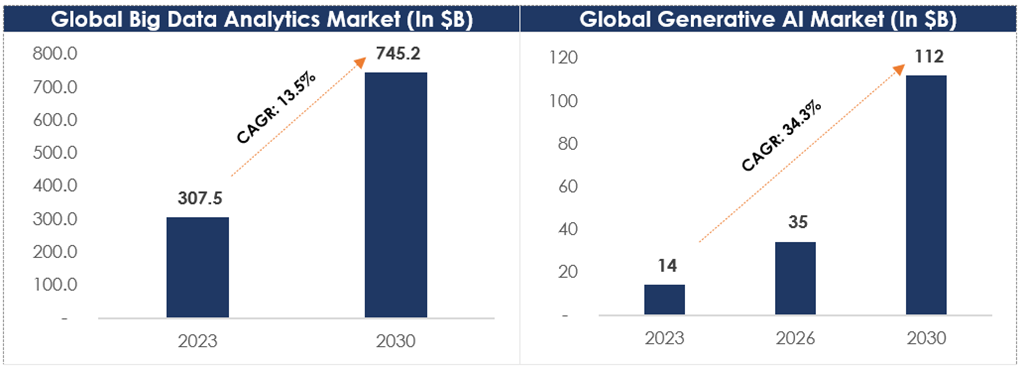

And for some perspective, the recent launch of Palantir's generative AI platform, AIP, has significantly expanded its Total Addressable Market (TAM). The global Generative AI market is estimated to be worth $14B in 2023 and is expected to grow at a CAGR of 34.3% to exceed $110B by 2030. Considering the big data analytics and generative AI market, Palantir's TAM exceeds $300B. With annual revenue of roughly $2B, the company has ample room for substantial growth.

Further, the global big data analytics market is projected to reach $745B by 2030, growing at a CAGR of 13.5% from 2023 to 2030, driven by the increased data volume due to the rise of IoT (the “Internet of Things”). Industries such as banking, healthcare, retail, agriculture, and telecom/media are generating massive amounts of data through digital solutions. Data discovery and visualization are expected to dominate the market as the need for better data interpretation grows.

Strengthening Profitability, Potential S&P 500 Inclusion

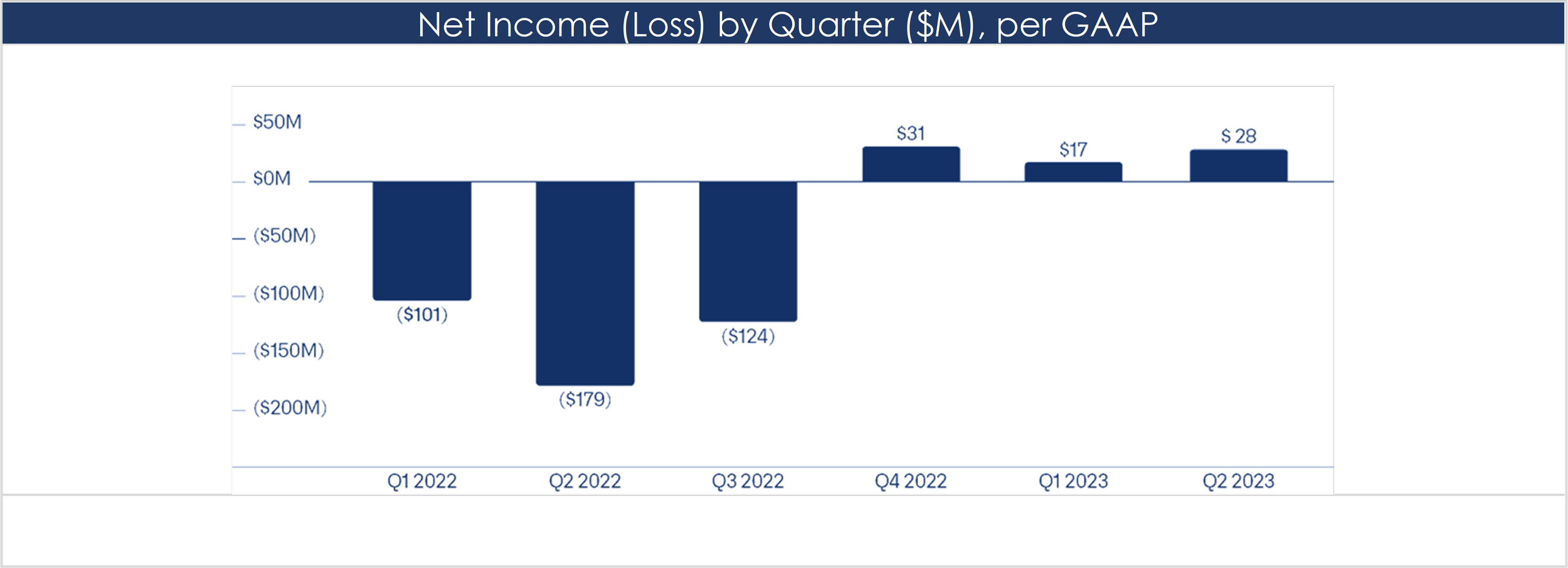

Another common complaint about Palantir since it started trading publicly in 2020 has been its lack of profits. Naysayers frequently complained that Palantir was just another overhyped pandemic darling. However, that has changed. Specifically, Palantir just achieved its third consecutive quarter of GAAP net income profitability. Most recently, Q2 GAAP EPS was $0.01 (up $0.10 year-over-year).

source: Q2 Shareholder Letter

Also important to note, Palantir may become eligible for inclusion in the S&P 500 later this year. As per Alex Karp’s Q2 letter:

“We expect to remain profitable on both a quarterly and annual basis this year. As a result, we anticipate that we will become eligible for inclusion in the S&P 500 after we report our financial results for Q3 2023 in early November. At that point, we will have been profitable on a cumulative basis over the preceding four quarters.”

Inclusion in the S&P 500 could potentially have a positive impact on the shares.

Strong Balance Sheet, Improved Cash Flow

Another important characteristic, Palantir is in a strengthened financial position, thanks to its healthy balance sheet and improved cash flow metrics. For example, the company ended Q2 2023 with $3.1B in cash, cash equivalents, and marketable securities and has no major debt on its balance sheet, which lends financial stability and indicates that the company has sufficient liquidity to meet its short-term obligations and pursue growth opportunities. This would further help Palantir to take up product portfolio expansion, particularly in a growing AI market, and enhance its competitiveness.

source: Q2 Shareholder Letter

Also, in Q2 2023, Cash Flow from Operations (CFO) was $90M compared to $62.4M in Q2 2022. This growth can be attributed to the favorable timing of customer payments and vendor payments. Also, adjusted Free Cash Flow (FCF) grew to $96M in Q2 2023 (18% margin), led by lower capital expenditure ($3.9B in Q2 2023 vs $5.5B in Q2 2022) and the achievement of profitability in Q2 2023 compared to a net loss in Q2 2022.

Per Alex Karp in the Q2 letter, “with strength comes freedom,” as the improved balance sheet and cash flows give the company more flexibility and opportunity going forward, especially in the increasingly challenging macroeconomic environment, such as increasing interest rates.

Declining Stock Based Compensation Signaling Positive Shift

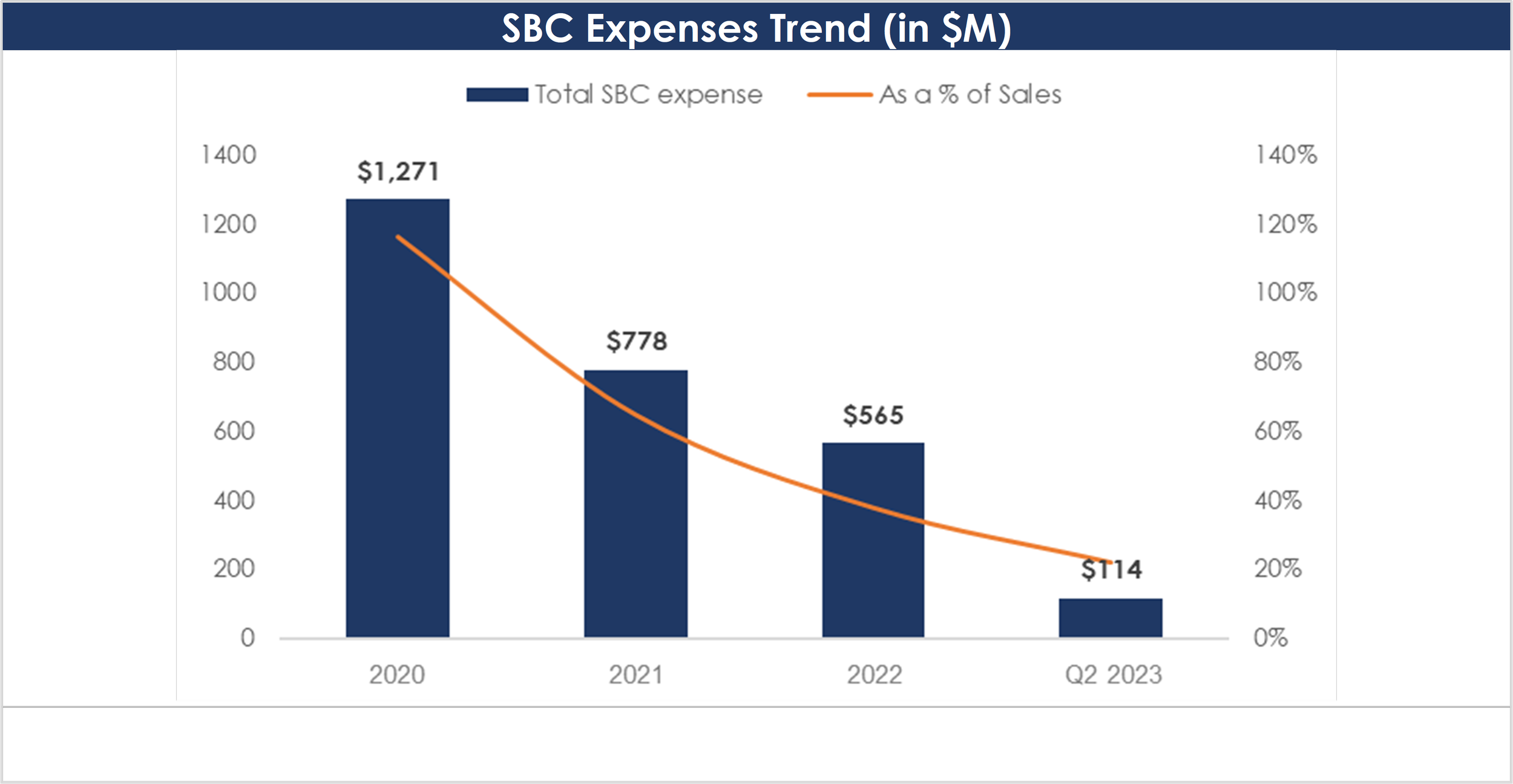

Since it started trading publicly in 2020, investors have decried Palantir’s significant stock based compensation (“SBC”) as a sign the company had more concern for insiders than ordinary investors. However, in a positive signal, the amount of SBC has continued to decline. Furthermore, SBC relative to sales has fallen from 116% in 2020 to 22% in Q2 2023. And in absolute terms, SBC has declined from $1.3B in 2020 to $114M in Q2 2023. And important to note, the decline in SBC has contributed meaningfully to Palantir’s success in achieving GAAP profitability in recent quarters.

Source: Company Filings

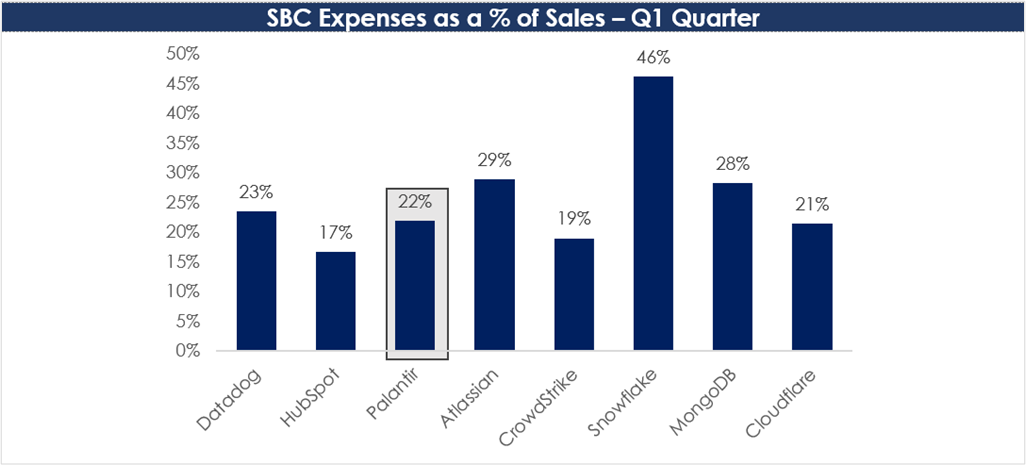

Also worth noting, even though it is a non-cash item, Palantir’s SBC (as a percent of sales) is now on par with other high-growth technology companies, as you can see in the following chart.

Source: Company Filings

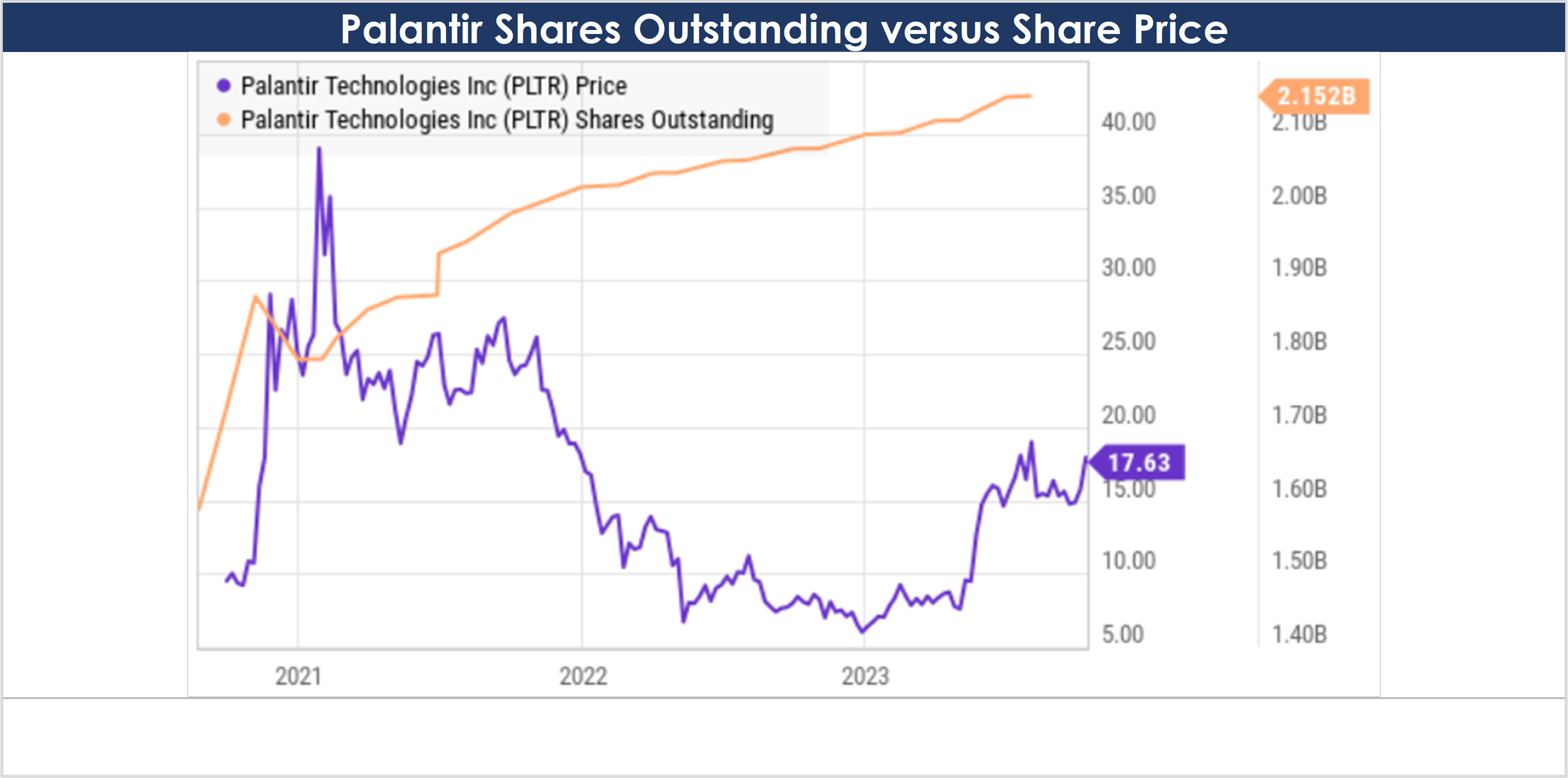

Another investor concern has been shareholder dilution (see chart below). However, in our view, Palantir was wise to offer shares publicly when prices were higher in 2020-2021 because that has contributed to its stronger cash position now (as described earlier).

Source: YCharts

Also an important signal going forward, Palantir’s board of directors has recently approved a common stock repurchase program, the first in its history as a public company. The program is authorized to repurchase up to $1 billion of the company's Class A common stock (more on Palantir share classes later).

Valuation

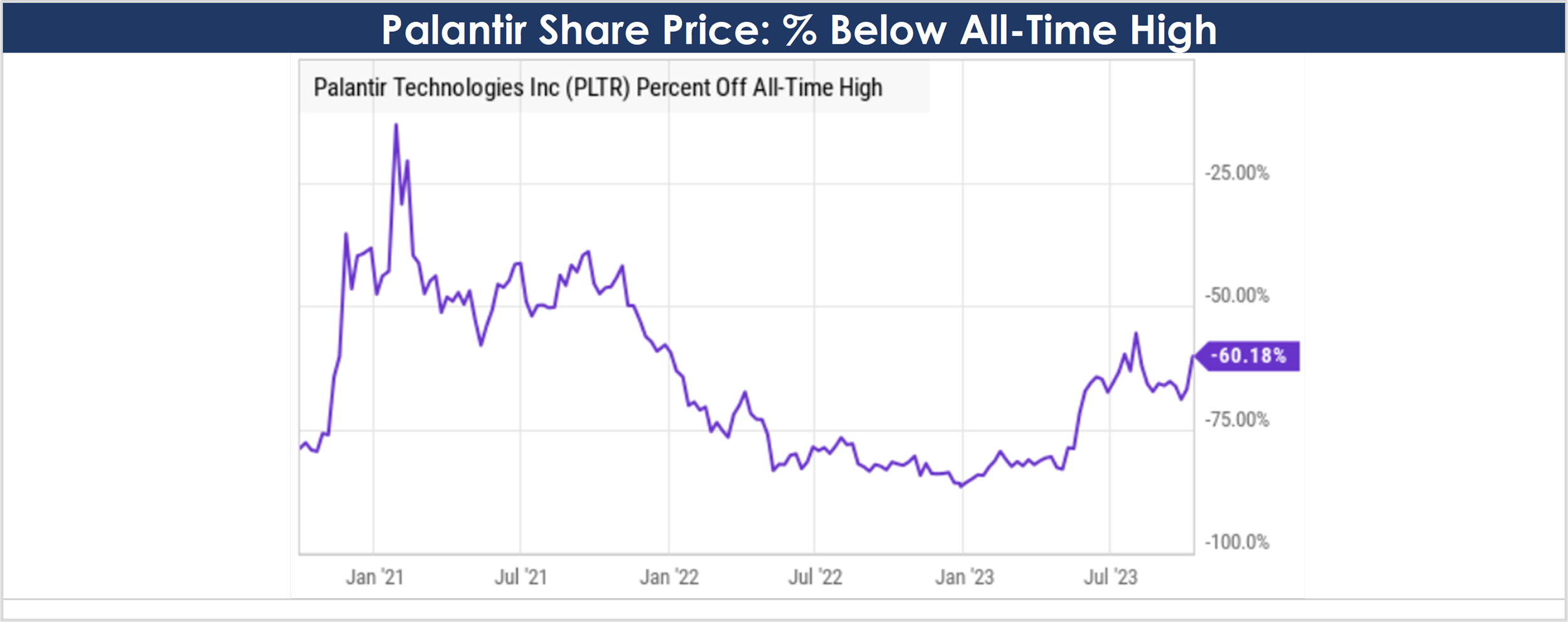

Palantir shares have recently experienced an impressive rally, climbing nearly 170% year-to-date. This strong performance can be attributed to the introduction of new product platforms and a heightened focus on AI offerings. Yet despite this positive momentum, the shares still trade more than 60% below the 2021 peak.

Source: YCharts

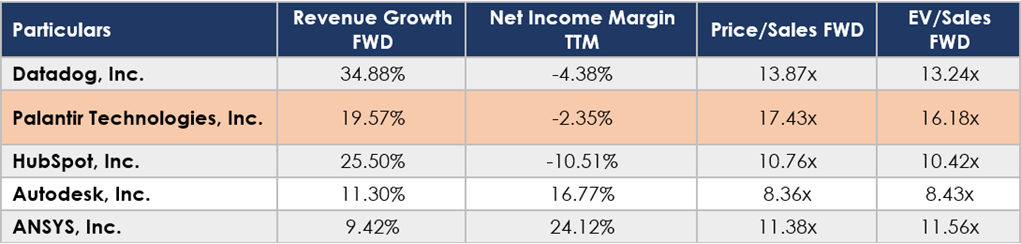

In terms of valuation, Palantir currently trades at a price-to-sales multiple of 17.4x on a forward basis. This places the company at a slight premium compared to peers. However, this premium can be justified due to several factors. Firstly, Palantir has consistently secured new customers and expanded its offerings among existing customers, indicating its ability to maintain its revenue momentum. Additionally, the company has recently entered the large and rapidly expanding AI market, which presents significant untapped opportunities for expansion.

Source: Seeking Alpha

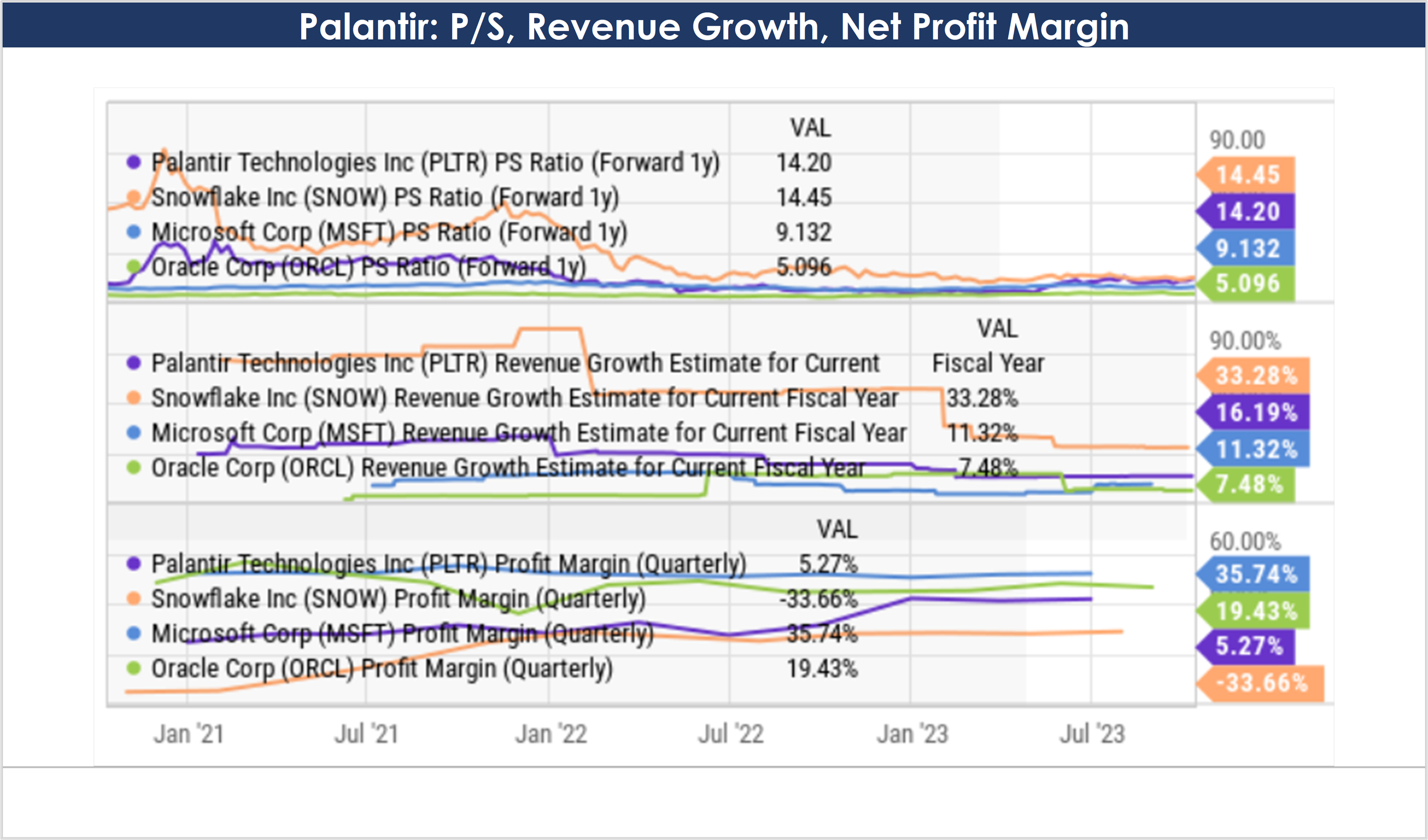

For more perspective, here is a historical look at Palantir metrics (P/S, revenue growth and net profit margin) versus peers.

Source: YCharts

Again, Palantir trades at a slight premium, but its uniqueness and attractvely concentrated opportunities warrant the valuation (which by the way is now dramatically lower than during the heights of the pandemic).

Risks

Intense Competition: Palantir operates in a highly competitive market for data analytics and software solutions, competing with industry leaders such as Snowflake, IBM, Salesforce, Microsoft, Tableau, and Oracle. Despite fierce competition, Palantir has been recognized as a leader in AI/ML platforms by Forrester Research in its Q3 2022 report (see graphic below). This represents Palantir's strengths and its ability to provide effective solutions that meet customer needs in a highly competitive environment.

Source: Investor Presentation

Challenging Macroeconomics: As interest rates have increased rates rapidly, this puts increased pressure on economic growth, thereby making it harder for companies to grow. However, as mentioned, Palantir is in a stronger financial position than many peers (based on cash flows, balance sheet and profitability) and it is well positioned to support growth related to big data and AI secular trends.

Voting Rights: Worth mentioning, Palantir has Class A, Class B, and Class F common stock, and they have different voting rights. Specifically, according to Palantir’s most recent quarterly report, “Class A and Class B common stock have voting rights of 1 and 10 votes per share, respectively.” However, “All shares of Class F common stock are held in a voting trust established by Stephen Cohen, Alexander Karp, and Peter Thiel (the “Founders”). The Class F common stock generally gives the Founders the ability to control up to 49.999999% of the total voting power of the Company's capital stock, so long as the Founders and certain of their affiliates collectively meet a minimum ownership threshold, which was 100.0 million of the Company's equity securities as of June 30, 2023.” This basically means that the owners control the company, and they may act in their own best interests instead of the best interests of the shareholders.

Concentration Risk: As with many high-growth technology companies, Palantir is also faced with low to moderate concentration risk. Specifically, one of the company’s government customers accounted for 10% of the total revenue in Q1 2023, which poses a notable risk considering the sensitivity of the data handled by the company's platform. As such, issues with a single government customer such as a data breach could create a contagion effect and can potentially impact the entire government customer base, resulting in significant revenue downside. On a positive note, having a significant revenue contribution from government entities can also help ensure stability in cash flows and provide opportunities to secure larger contracts. Additionally, it helps the company sustain growth, even during market downturns.

Conclusion

Palantir’s strong platform capabilities, expanding customer base, and AI-based platform position it for long-term growth in the thriving big data analysis and generative AI market. The company's solid balance sheet, improving cash flow generation, and zero debt contribute further to its financial stability. Additionally, Palantir's growing commercial customer base and comprehensive capabilities will overtime make the platform more attractive. Despite recent share price gains, we view Palantir as an attractive opportunity for patient, long-term investors, who are looking to capitalize on the secular AI tailwind.

We are currently long shares of Palantir in our Disciplined Growth Portfolio.