Rarely has there been a market where both stocks and bonds have fallen so hard at the same time. And if you’ve tried to hide in cash, well inflation is crushing you too. From an investor standpoint, there is blood in the streets, and things can still get much worse, especially considering the precipitous technical level of the S&P 500, the rising S&P 500 Fear Index, the dangerous S&P 500 style reversion trend and the Fed’s extreme focus on battling inflation. In this report, we share our take on the current unsettling position of the S&P 500, three big risks to be aware of, and three dividend-growth stocks worth considering. We conclude with an important takeaway and our strong opinion on investing in this market.

S&P 500: Blood In The Streets

The S&P 500 has been absolutely terrible this year, and things can still get much worse.

Precipitous Technical Levels: The S&P 500 just retested the June lows (see chart below). And although we got a strong bounce, some technicians argue we broke through the previous support level thereby signaling the potential for a lot more trouble ahead (as the down trend of lower lows remains intact).

And there is certainly no short supply of reasons why this market can still go much lower. For example, the Fed is intensely focused on fighting inflation with complete disregard for the bear market created by rising rates and the potential for a deep recession. As further examples, rising rates will devastate mortgage seekers’ buying power, and if you’ve visited a grocery store lately you appreciate the disturbing price increases as CPI remains stubbornly high.

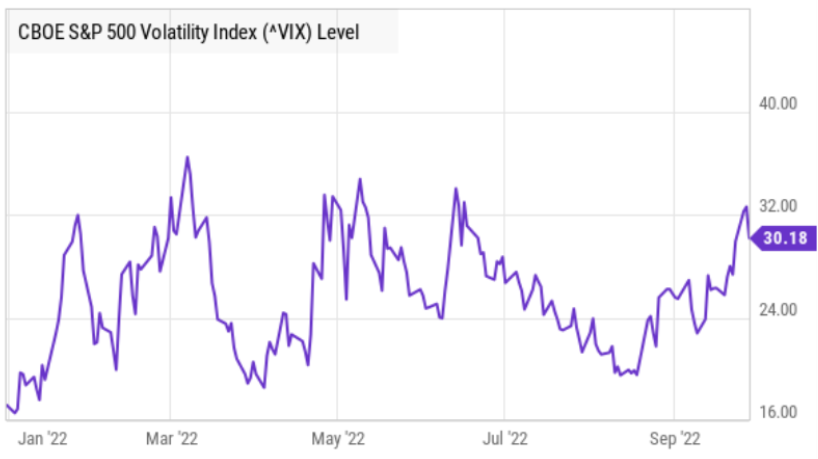

The S&P 500 Fear Index: Expected market volatility is on the rise, as measured by the VIX (also known as the market fear index). Specifically, the VIX is the Chicago Board Options Exchange's (“CBOE”) Volatility Index, a measure of the stock market's expected volatility over the next 30 days based on S&P 500 index options. And as you can see below, fear remains elevated as the VIX is above 30.

Investors tend to psychologically react much stronger to market declines than market gains, and with markets down this year, combined with an elevated Fear Index, selling pressure can intensify quickly.

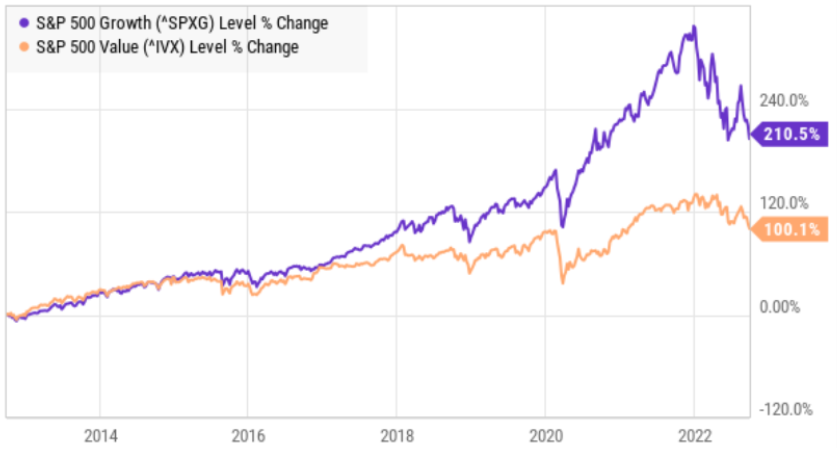

Style Reversion (Growth Versus Value): One area of the market where selling pressure has been intense is growth stocks, as measured by the S&P 500 Growth Index (SPXG). Specifically, growth stocks were helped after the pandemic by extraordinarily low interest rates, and now that trend has been unwinding hard as rates rise.

Further, growth may still have a lot of room to underperform versus value stocks (IVX) considering the longer term chart above and the fact that the Fed really has no regard for stock performance (it’s not part of their dual mandate) and is so intensely focused on fighting inflation by hiking interest rates. As a reminder, the S&P 500 is already in bear market territory (it’s down over 20% this year).

3 Big Risks:

And considering all of the intensifying market factors (e.g. high inflation, climbing interest rates, falling stocks, rising fear) there are three big risks that investors may want to keep on their radar.

The Fed May Overshoot: When the Fed sets its monetary policies (such as interest rates), they are relying on backward looking data (such as last month’s CPI and last month’s employment numbers), and the policies they implement have a lagged effect on the economy (for example, it can take over one year for an interest rate hike to flow through and impact the actual economy). And considering the high inflation they are fighting may be transitory (meaning it’s a short-term phenomenon resulting from pandemic stimulus and it may just revert to lower levels on its own) there is a real risk that the Fed is overshooting with its interest rate hikes. Specifically, the Fed may already have raised rates way too high, and this may be driving us into a painful recession and devastating stock prices unnecessarily. Afterall, it’s not hard to argue the Fed overshot by keeping rates too low for too long which is how we got into this inflation problem in the first place.

The Fed May Undershoot: On the other hand, a strong argument can be made that the Fed is not doing enough to fight inflation. For example, the Fed should have started increasing rates much sooner, and now they have a lot of ground to make up in the fight against inflation. If you don’t know, the big problem with inflation is that it can lead to a decline in aggregate demand, leading to lower prices, and ultimately turn into deflation. Deflation may not sound bad, but it is actually really bad because it can lead to high unemployment, and it can turn a bad situation (recession) into a worse situation (depression).

You May Be Paralyzed By Fear: Another big risk of high volatility and steep S&P 500 declines is that you may be paralyzed by fear. Specifically, you may be so frightened by the market declines and the media fearmongering that you don’t want to invest at all (you’d rather hide your money under your mattress). The problem with this is that you will miss out on the eventual market rebound. The market has faced many steep declines in the past, and those declines have always resulted in great long-term buying opportunities. You’re never going to be able to perfectly time the market bottom, and you shouldn’t even try. Fear is one of the main reasons the average investor (orange bar below) performs so badly as compared to the S&P 500 (green bar) over time.

This too shall pass. As 19th century British financier, Nathan Rothschild, is purported to have said: “the time to buy is when there's blood in the streets.”

3 Dividend-Growth Stocks Worth Considering

With that backdrop in mind, we share three dividend-growth stocks that are worth considering. The thought is threefold. First, from a contrarian standpoint, stocks are down, and that can be a good time to buy (all three stocks are down significantly this year). Second, these stocks are “value stocks” (even though it may not seems that way at first) that can perform particularly well in a higher interest rate environment. And third, these stocks all offer steady growing dividend payments (that can help you cope psychologically with a volatile market because the steady rising income can be comforting and help prevent you from making psychological errors that will hurt you in the long term—remember the average investor “orange bar” from earlier).

Apple (AAPL): A lot investors think of Apple as a growth stock, but we view it as an attractive value stock considering it trades at such low valuation multiples relative to its powerful earnings, cash flow generation and growth. Not to mention it has now raised its dividend payment for the last nine years in a row. Specifically, growing revenues at a double-digit rate, with a 25% net profit margin, and trading below 25 times forward earnings (especially after the recent reports of Apple ditching iPhone production boosts), Apple is very attractive as a contrarian dividend-growth investment.

Realty Income (O): Known as the monthly dividend company, Realty Income has recently become very attractive as the shares have sold off hard and the dividend yield has mathematically rise to roughly 5.0%. Specifically, Realty Income remains attractive for a variety of reasons, including its very strong financial position, its prudent acquisition-focused business strategy, its incredible dividend-growth and safety (it’s raised its dividend for 25 years straight) and its attractive current valuation. Not to mention, the outlook for its real estate business remains attractive because of the prime location properties that are largely not vulnerable to the online shopping trend that other types or REITs face (for example shopping malls). And despite the risk factors (such as rising rates and conservative rent escalators), we continue to believe Realty Income presents a very attractive investment opportunity (trading at just over 15 times forward AFFO) for steady income-growth (and price appreciation) investors.

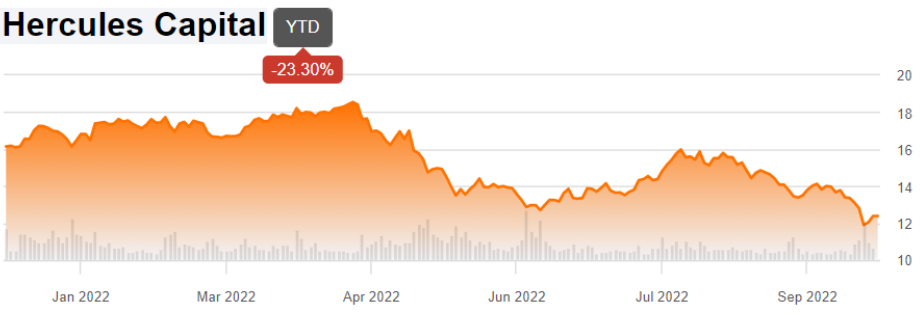

Hercules Capital (HTGC): Hercules is an internally-managed business development company that offers a double-digit yield and has now increased its dividend for 3 years in a row (a rarity in the BDC space). Focused on providing financing for high-growth ventures, Hercules can get income investors access to market sectors they don’t normally invest in (prudent diversification can be a very good thing). Further, growth and venture have sold off this year (including Hercules) thereby making for a lower entry point to purchase shares. Further still, if rates keep rising—Hercules is in good shape (double good if the market recovers) because of its high exposure to floating rate investments and low fixed rate debt. Further, the valuation (price-to-book) has even come down (currently only a small premium to NAV). Overall, we like the business, and if you are a long-term income-focused investor, we believe Hercules is absolutely worth considering for a spot in your prudently-diversified portfolio. You can read our full report on Hercules here.

The Bottom Line:

The S&P 500 has been absolutely ugly this year. And things can still get much worse considering the precipitous technical level of the market, the rising fear index and the ongoing style reversion from growth to value. What’s more, there is a real risk of a major Fed policy error, not to mention the risk of individual investors being paralyzed by fear.

However, from a contrarian standpoint (i.e. blood in the streets) we recently selected Apple, Realty Income and Hercules Capital as three favorites from our new report “50 top dividend-growth stocks down big” because of their attractive lower prices (and attractive valuations), compelling value tilts (which can continue to perform well as rates rise) and growing dividends (which can be comforting and help prevent you from making fear-driven psychological errors).

There are lots of reasons to be afraid, and you will never bottom tick the market exactly. But to be an extremely successful long-term investor, you don’t need to. As with every other major market decline throughout history, the S&P 500 has recovered dramatically. It will this time too.