As the market selloff intensifies, one strategy that helps many investors cope is dividend-growth investing. By owning stocks that pay steady growing dividends, it becomes psychologically easier for some investors to avoid the panicked selling that ends up hurting them so badly in the long term. Afterall, long-term compound growth is where the real money is made when it comes to investing. Nonetheless, steady growing dividends can help investors cope with high volatility (like right now), so we have included 10 top dividend-growth ideas below. They all pay growing dividends and trade at attractively discounted prices if you are a disciplined long-term investor.

“More people have lost money waiting for corrections and anticipating corrections than in the actual corrections." -Peter Lynch

“The big money is not in the buying or the selling, but in the waiting.” -Charlie Munger

50 Dividend-Growth Stocks, Down Big

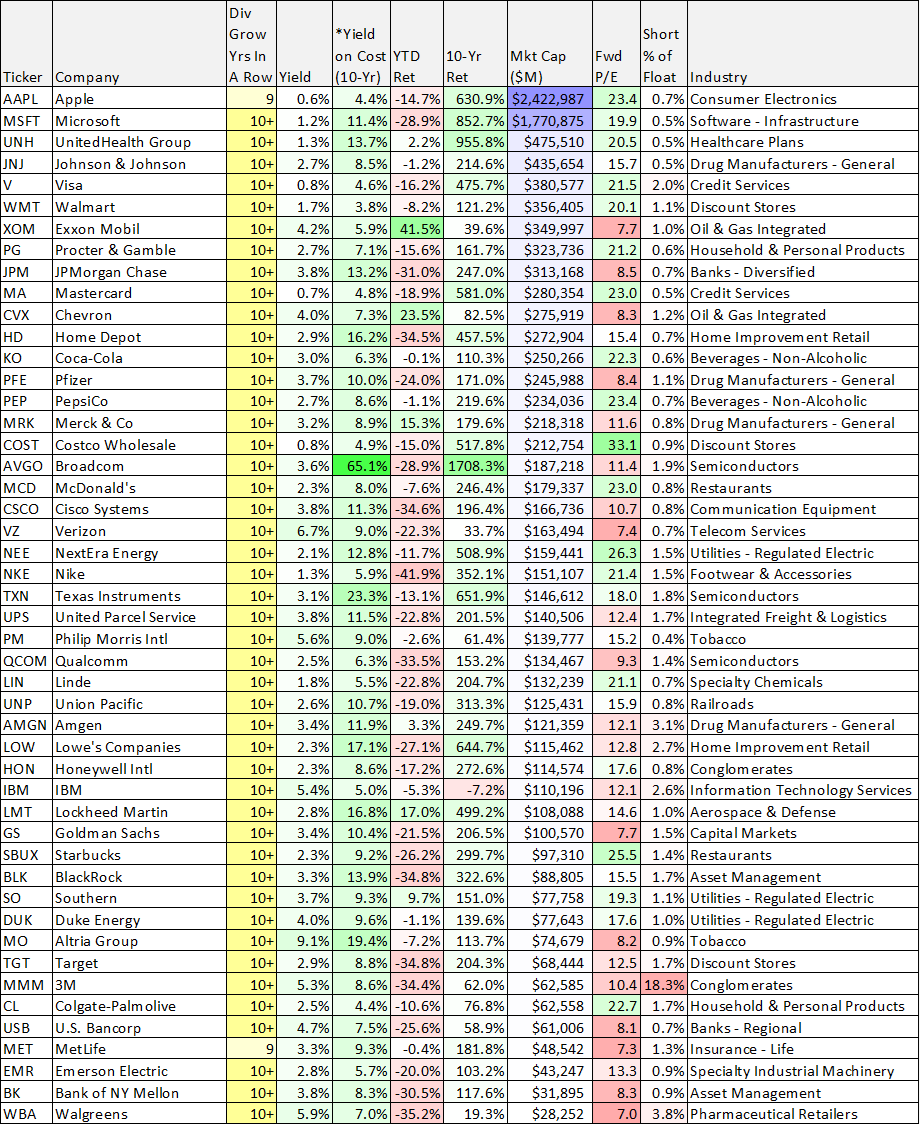

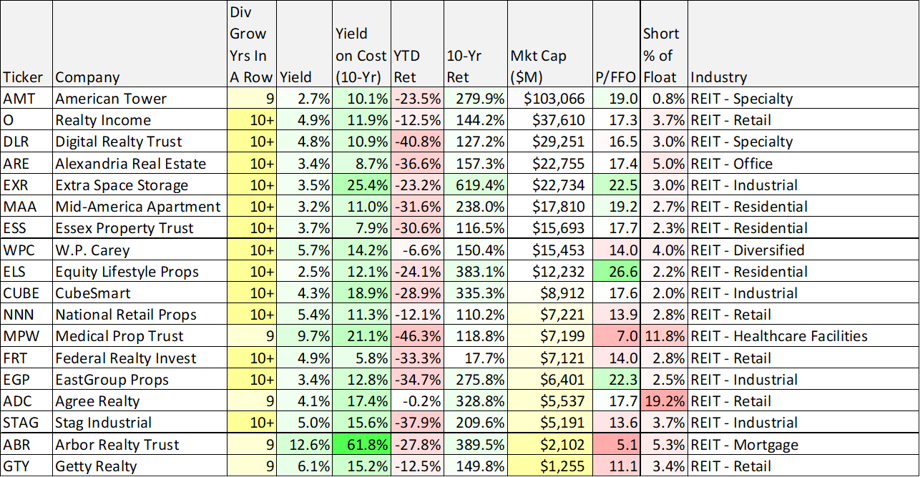

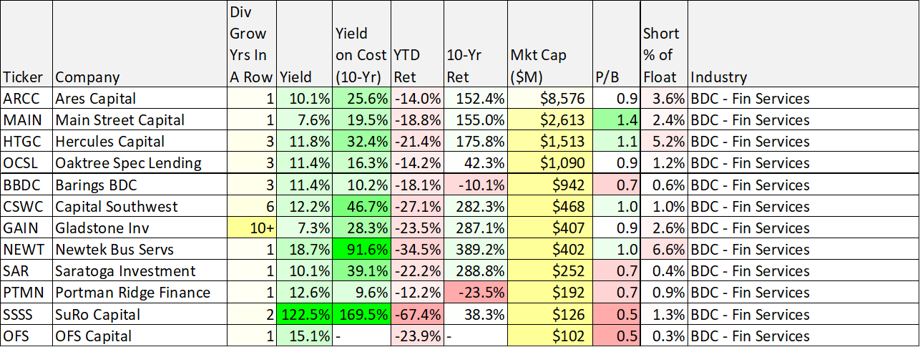

Before getting into our top 10 countdown, let’s start with some data. The following three tables include top dividend-growth stocks, separated into blue chip stocks, REITs and BDCs. And as you can see, they all have a history of growing their dividend payments to investors each year.

Blue Chip Stocks: Let’s start with the blue chips stocks. These stocks were selected from the S&P 100 for having powerful dividend growth histories (at least 9 consecutive years of dividend growth). You can also see they have some impressive 10-year total returns (even though they are mostly down a lot this year). The 10-year “yield on cost” metric is also compelling (it’s calculated as the forward annual dividend payment per share divided by the share price 10 years ago, and it’s a metric that long-term investors may want to consider). The table is sorted by market cap.

Real Estate Investment Trusts: REITs are also fertile ground for dividend growth opportunities. As you can see in this next table, the current dividend yields on REITs tend to be a little higher than the blue chips in our previous table, but the yields on cost are more similar. However, many of these REITs are down more this year, thereby creating some attractive long-term opportunities for income-focused investors (particularly those that like growing income). The short interest column is also interesting to consider.

Business Development Companies: BDCs generally offer much bigger current dividend yields, and they can offer some very impressive 10-year “yield on cost” too. However, there aren’t too many BDCs that have been able to consistently raise their dividend payment each year, and the 10-year total return column is also worth considering.

So with that backdrop in mind, let’s get into the 10 top ideas. The list includes a variety of attractive blue chips stocks, three very compelling REITs and one big-dividend BDC that is particularly attractive now. Let’s get into it.

10. Intel (INTC), Yield: 5.2%

Intel is the leader in PC and server chips. And even though it has failed to match the growth rates of high-flyers like Nvidia and AMD in recent years, it still delivers very high margins and very health profits. Further, it will be helped by the recent Chips for America Act. It has paid a dividend for 28 years straight and it has increased its dividend for the last 7 years in a row. And considering this years steep share price selloff, the shares are currently downright attractive from a contrarian value investing standpoint. You can read our previous full report on Intel here (don’t be misled by the title).

9. Verizon (VZ), Yield: 6.5%

Verizon’s share price sits near its 52-week low, and its dividend yield (currently 6.5%) sits near a decade-long high. What’s more, its valuation is compelling if you can get comfortable with the near-term price risks. Overall, we view Verizon as an extremely attractive investment opportunity if you are an income-focused investor. We believe the shares will recover (following the recent strong declines) as the market acclimates to the new interest rate environment and as the valuation multiple adjusts back closer to less panicked levels. You can read more about Verizon is our recent detailed report here.

8. Apple (AAPL), Yield: 0.6%

A lot investors think of Apple as a growth stock, but we view it as an attractive value stock considering it trades at such low valuation multiples relative to its powerful earnings, cash flow generation and growth. Not to mention it has now raised its dividend payment for the last nine years in a row. Specifically, growing revenues at a double digit rate, with a 25% net profit margin, and trading below 25 times forward earnings, Apple is a Buy.

7. Realty Income (O), Yield: 4.8%

Realty Income (known as the monthly dividend company) has recently become very attractive as the shares have sold off hard and the dividend yield has mathematically rises. Specifically, Realty Income remains attractive for a variety of reasons, including its very strong financial position, its prudent acquisition-focused business strategy, its incredible dividend-growth (and safety) and its attractive current valuation. Not to mention, the outlook for its real estate business remains attractive because of the prime location properties that are largely not vulnerable to the online shopping trend that other types or REITs face (for example shopping malls). And despite the risk factors (such as rising rates and conservative rent escalators), we continue to believe Realty Income presents a very attractive investment opportunity for steady income-growth (and price appreciation) investors. You can read our previous full report on Realty Income here.

6. Hercules (HTGC), Yield: 10.7%

Somewhat of an odd ball on our list, Hercules is an internally-managed business development company that offers a double-digit yield and has now increased its dividend for 3 years in a row (a rarity in the BDC space).

Focused on providing financing for high-growth ventures, Hercules can get income investors access to market sectors they don’t normally invest in (prudent diversification can be a very good thing). Further, growth and venture have sold off this year (including Hercules) thereby making for a lower entry point to purchase shares. Further still, if rates keep rising—Hercules is in good shape (double good if the market recovers) because of its high exposure to floating rate investments and low fixed rate debt. Further, the valuation (price-to-book) has even come down (currently only a small premium to NAV).

Overall, we like the business, and if you are a long-term income-focused investor, we believe Hercules is absolutely worth considering for a spot in your prudently-diversified portfolio. You can read our full report on Hercules here.

5b. 3M (MMM), Yield: 5.2%

Dogs of the Dow is a strategy whereby each year an investor purchases the 10 Dow Jones stocks with the highest dividend yields. The theory is that the high yield is an indication from the company that the shares are trading too low in the market based on the earnings and cash flow generation power of the company. 3M is a Dog of the Dow for 2022, and the recent share price decline makes for an increasingly attractive opportunity to pick up shares of a big-dividend blue-chip company that has grown its dividend for 64 years in a row (and paid a dividend for over 100). The recent high short interest is concerning to some (as the company faces risks from “forever chemical” lawsuits). However, if you are looking for a compelling contrarian opportunity with steady dividend growth, 3M is absolutely worth considering.

5a. Digital Realty, Yield: 4.8%

Digital Realty is a data center REIT, and it will continue to benefit from the massive secular trends of cloud migration and digitization. In particular, Digital Realty has recently been shifting more towards connection and co-location services, thereby giving it increasing access to attractive cloud-services growth. It also has an advantage over competitors that are more narrowly-focused geographically. Demand for data centers will continue to growth as the digital revolution and massive cloud migration will continue for many years. The shares have sold off particularly hard this year as anything related to “technology and growth” has been punished as the fed raises rates, thereby making the price and valuation increasingly hard to ignore. Also, Digital Realty also offers some compelling preferred shares as we wrote about one month ago (when the common shares were trading 19% higher than they are now).

4. JP Morgan (JPM), Yield: 3.6%

Banks make more money as interest rates rise because their net interest margins grow. JP Morgan is one of the best run banks in the world. It is extremely profitable, and will weather the current financial storm far better than most. What’s more, with interest rates higher, JP Morgan is increasingly well positioned for more gains in the years ahead. If you are looking for a healthy dividend-growth stock, JP Morgan has one of the safest dividends around, and it has increased its for the last seven years in a row. With a net profit margin of over 30% and a forward P/E under 10, JP Morgan is a steal for long-term dividend-growth investors.

3. Honeywell (HON), Yield: 2.3%

Based in Charlotte, NC, Honeywell is a diversified industrials company that offers a wide range of products. It’s also an example of an attractive value stock that could benefit dramatically if the growth-versus-value factor continues to unwind (i.e. if growth’s multi-cycle outperformance versus value continues to reverse—especially as the Fed raises rates significantly). Further, Honeywell’s business remains extremely healthy from a cash flow standpoint as it continues to weather the macroeconomic environment better than many. In the long-term, Honeywell has attractive earnings growth potential and room for additional price appreciation from multiple expansion. Honeywell offers an extremely safe dividend that has been increased for the last 11 years in a row. You can read our full report on Honeywell here.

2. Stag Industrial (STAG), Yield: 4.9%

If you are an income-focused investor, you probably like investing in REITs for their often big, steady, dividend payments. However, you may have noticed that following years of strong outperformance, the industrial REIT sector (including monthly-dividend payor, STAG Industrial (STAG)) has recently sold off hard. In ou view this sub-sector selloff, combined with the overall market selloff, makes for a very attractive long-term dividend growth buying opportunity. Stag has paid a dividend for over 10 years straight and trades at a price to forward FFO of only around 13.5x. All thing considered, Stag currently presents a very attractive buying opportunity. You can read our pervious full report here.

1. Microsoft (MSFT), Yield: 1.4%

As a long-term investor, I believe in owning a prudently-diversified portfolio of many stocks. However, if I could own just one stock, I’d want it to be a leader in the important categories of revenue growth, dividend income and financial strength (including profitability, a strong balance sheet and an attractive valuation). And I’d also want to buy it at an attractive price.

People often think of Microsoft as only a pure growth stock, but it has increased its dividend for 17 years straight, and it currently trades at a very attractive entry point price for long-term investors. You can read our previous report on Microsoft here.

The Bottom Line

Even though share prices can fluctuate widely in the short-term, stocks represent ownership in businesses, and businesses are long-term investments. The recent volatility has made for increasingly attractive entry prices for long-term investors. And if the short-term price volatility stresses you out too much, stocks with steady growing dividends (such as the ones in this report) can help calm your nerves. We currently own most of the stock ideas in this report in our Income Equity Portfolio. In particular, we currently own four REITs, three BDCs and a variety of very attractive blue chip stocks. You can view all of our current holdings here.