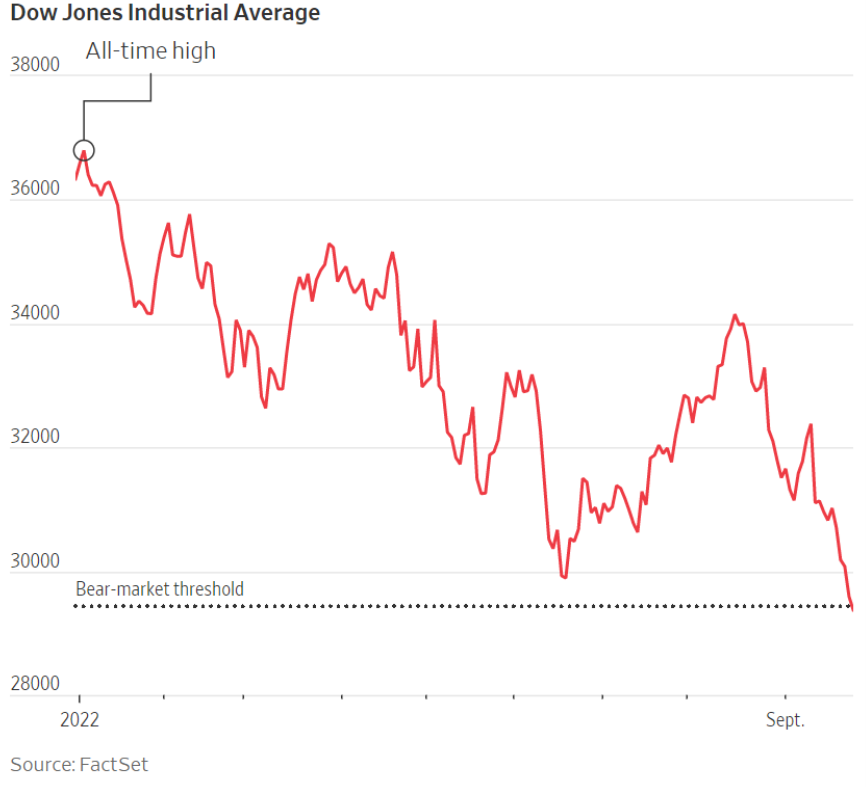

With the blue chip Dow Jones Industrials Average now down 20% from its recent highs, it’s officially in bear market territory by that popular definition.

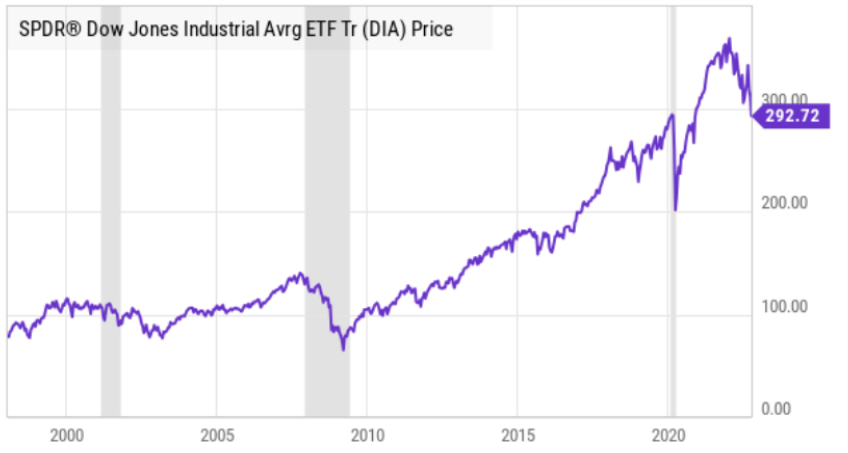

And if you have missed out on this year’s market declines because you have been sitting in cash—you are either very lucky (market timing in a crap shoot) or you are probably in horrible shape because you’ve been out of the market for too long and you’ve missed out on the market’s truly incredible gains over the last decade.

As Peter Lynch reminds us, “more people have lost money waiting for corrections and anticipating corrections than in the actual corrections."

Pre-market futures are pointing to a strong open today, but we’ll undoubtedly hear a chorus of “dead cat bounce” cries from the fearmongering media. What’s true, however, is that if you are a disciplined long-term investor, your investment account balance has likely experienced extraordinary strong gains over the last decade (see our earlier chart—the grey regions are recessions—also known as incredible buying opportunities!), and if you stay focused on your long-term goals—you’ll likely experience incredible strong gains in the decade ahead.

Be smart. Don’t try to time the market. This too shall pass, and the market will eventually trade MUCH higher than it is now.