The Trade Desk (TTD) reported strong results (particularly strong revenue growth) in its latest quarterly release on Tuesday. But despite the latest gains, the shares will likely crash again soon. In particular, high-growth stocks (like The Trade Desk) have rebounded hard since mid-June, but are still down dramatically year-to-date, and Wednesday’s newly released inflation numbers will likely embolden the fed in its fight against inflation (which is particularly bad news for high-growth stocks). In this report, we review the ugly top-down environment for five top growth stocks (including The Trade Desk) that will likely crash again soon, then dig into the details on The Trade Desk in particular (including its business, the latest earnings release, its current valuation and the big risk factors) and then finally conclude with our strong opinion about investing in The Trade Desk and top growth stocks in general.

High-Growth Stocks: Ugly Top-Down Environment

In case you haven’t noticed, the performance of high-growth stocks has been particularly ugly this year. And there are a couple main reasons. First, the easy monetary and fiscal policies designed to prop up the economy after covid hit actually created a bubble for high-growth stocks in particular. More specifically, high-growth stocks are valued much more based on their future earnings (because their current earnings are often weak or even negative), and the fed’s near-zero pandemic interest rate policy made those future earnings worth more because you discounted them back to their present value at a lower interest rate (not to mention that it was a lot easier to raise money to fund future growth).

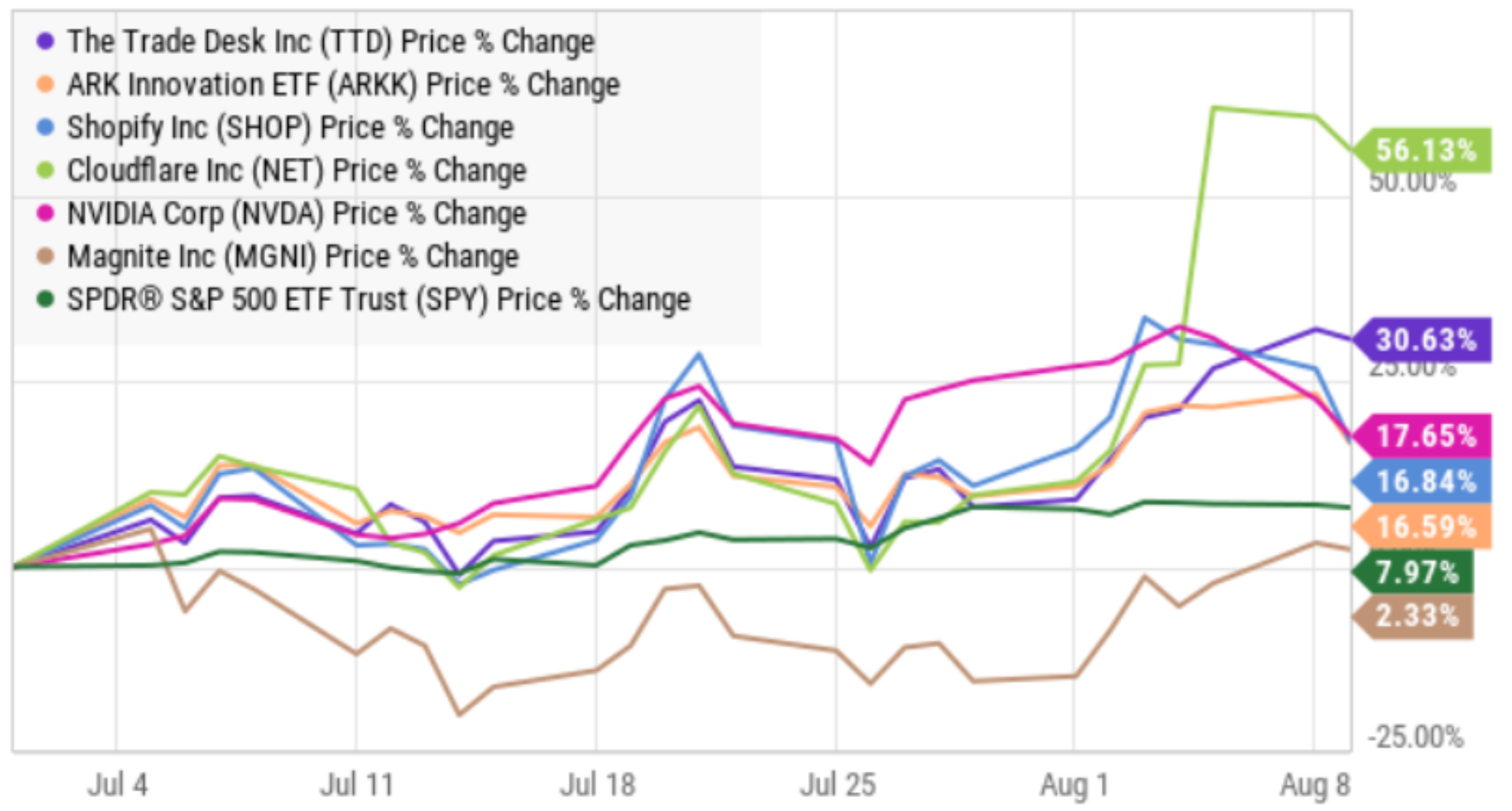

However, the fed has essentially popped that growth stock bubble this year as they’ve now embarked on a dramatically increasing interest rate trajectory to battle the sky-high inflation they created with the easy money policies after the pandemic first hit. This year has been really ugly for high growth stocks, such as The Trade Desk, the now infamous ARK Innovation ETF (ARKK) and others.

However, as you can also see in the next chart is that these same stocks that are down so much this year, have actually been posting strong gains in recent weeks in what many investors believe is a dead cat bounce.

And the reason they believe it is a dead cat bounce (i.e. the downward price trajectory will resume) is because the economy is in recession territory (it’s ugly) and because the latest inflation numbers reported Wednesday morning by the Bureau of Labor Statistics will likely embolden the fed to raise interest rates even more (to keep battling inflation) which will be particularly bad for high-growth stocks in particular. Not to mention, the market (SP500) is meeting strong resistance at the 4,160 level—the same level it could not break through earlier this year.

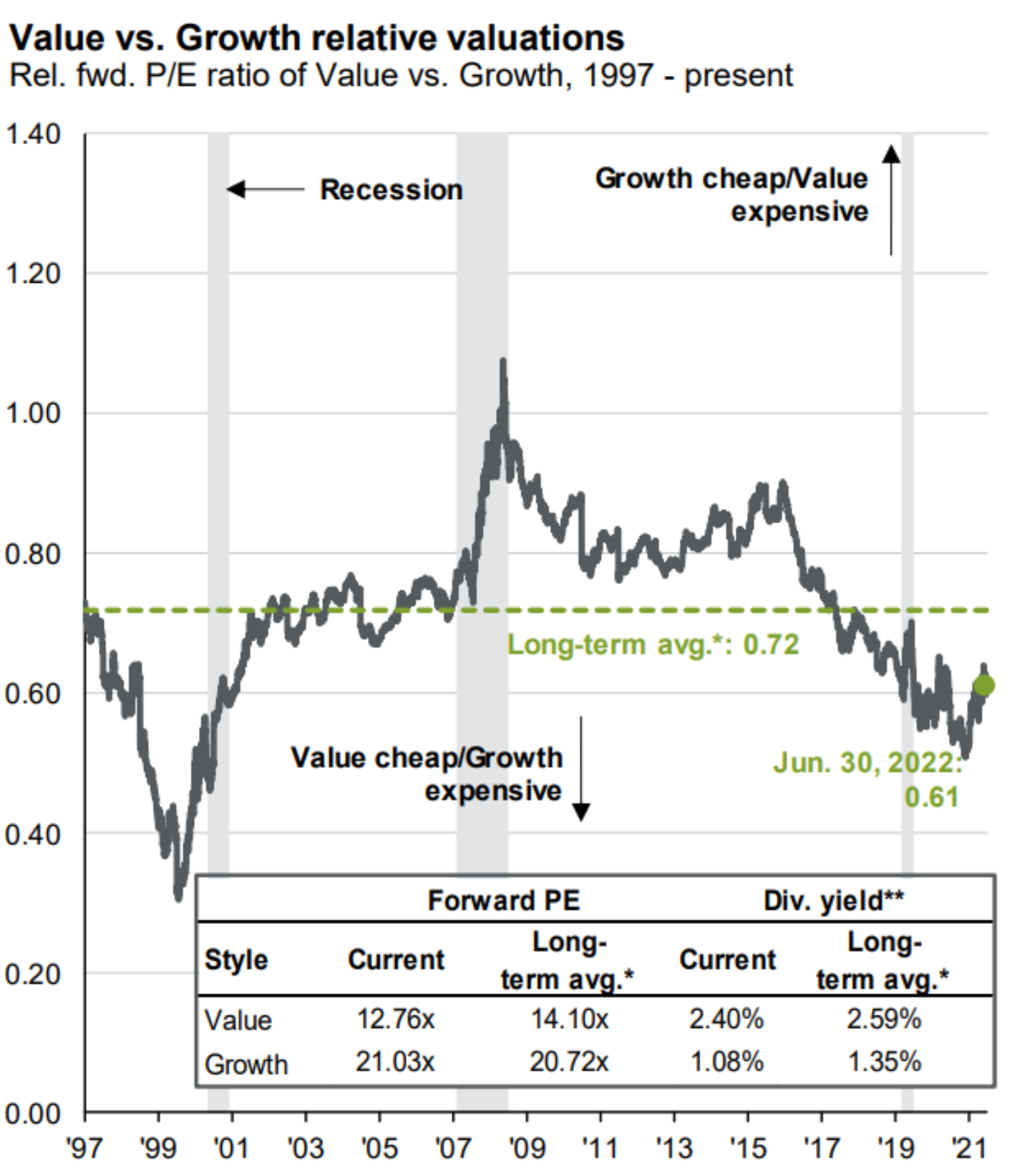

Furthermore, growth stocks are still overvalued by historical standards as you can see in the following growth versus value graphic (as of 7/31/22) below (many investors believe this is another indication that there is still more pain to come for growth stocks).

For example, we review one high-growth stock in particular (The Trade Desk) in the next section, and despite its strong gains following Tuesday’s earnings release, it too likely has a lot more pain to come in the relatively near future.

The Trade Desk: Overview:

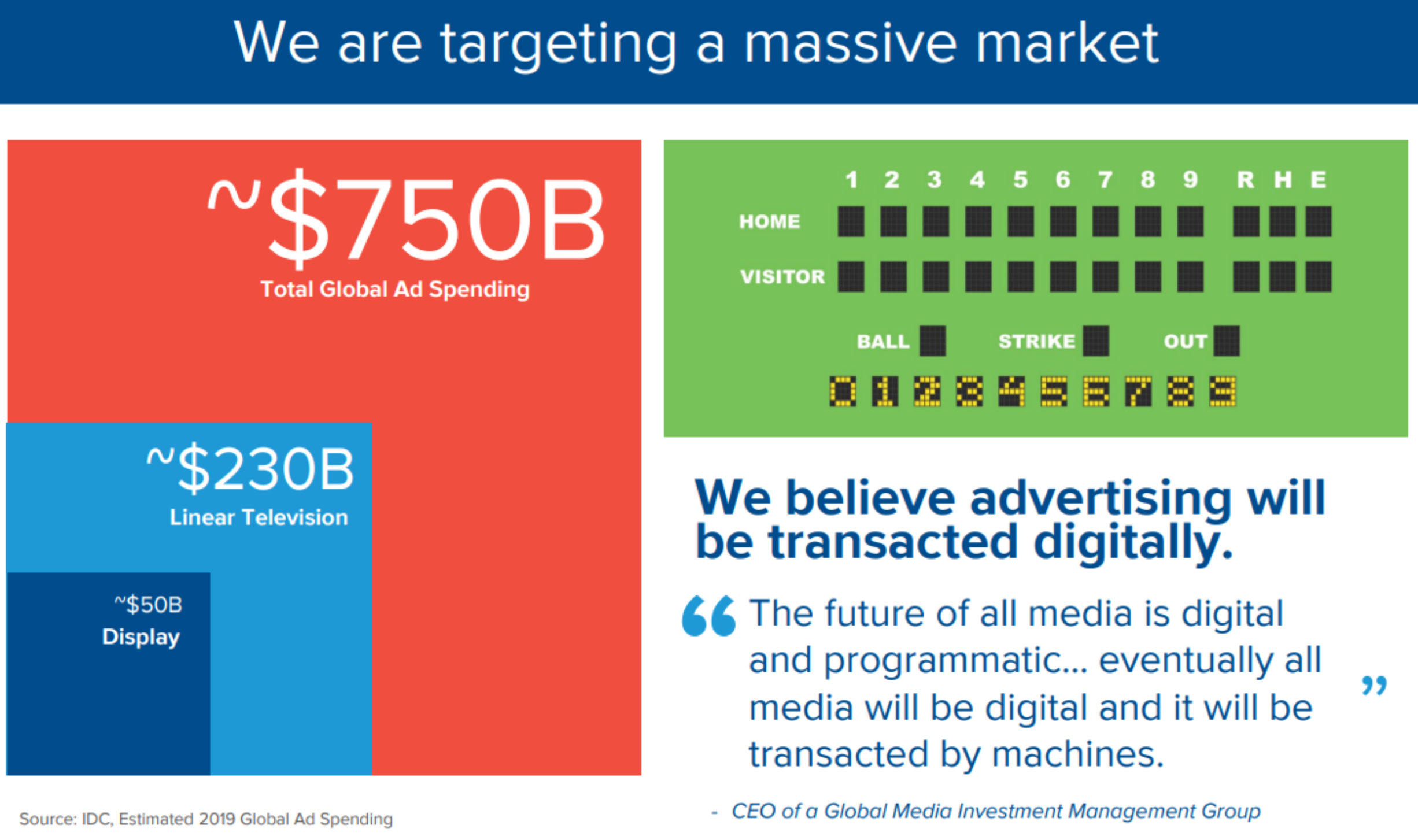

If you don’t know, The Trade Desk basically provides a platform for ad buyers (mostly ad agencies, brands or other technology companies). More specifically, the company provides a self-service platform to agencies who deliberately pick from over 500 billion digital ad opportunities a day. And by digital ad opportunities, we are talking about highly effective targeted ads across basically all digital channels, including connected TV, mobile, video, audio, display, social, and native.

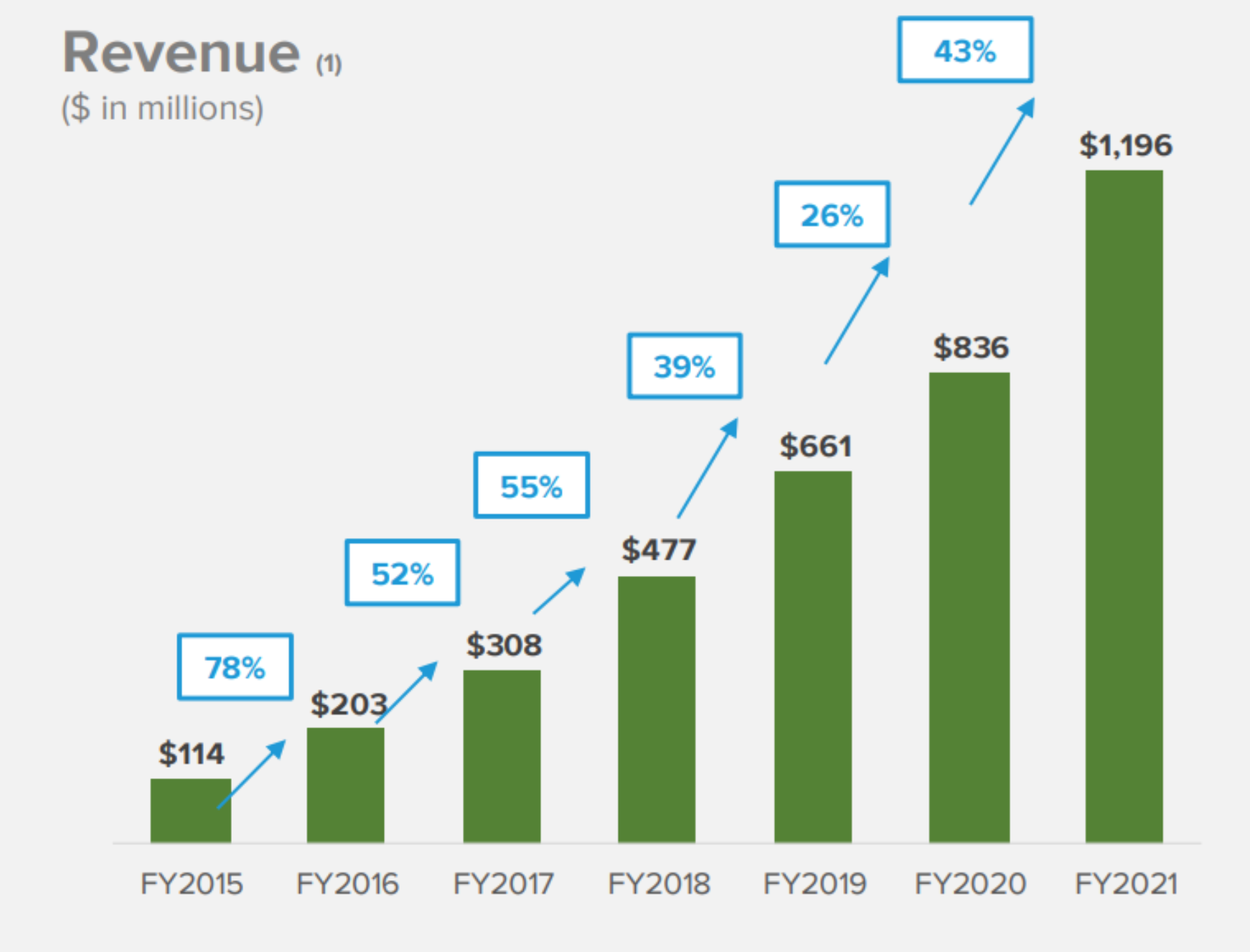

And in very simple terms, the three things that are special about The Trade Desk are that it is the clear leader in omni-channel advertising, its revenues are growing extremely rapidly and there is a very large total addressable market (“TAM”) so they can continue to grow rapidly for a long time. These three things are basically the holy grail to many growth investors.

And furthermore, the company’s latest earnings release was very good!

The Latest Earnings Release

The Trade Desk reported quarterly earnings on Tuesday, and the company topped revenue expectations (revenues grew 35% to $377 million) and provided a revenue outlook that exceeded street expectations ($385 million versus a consensus of $382.3 million). However, operating expenses jumped 72% to $375.2 million (including a 177% increase in stock-based compensation), and providing for income taxes, the company swung to a net loss of $19.1 million (versus a year-ago gain of $47.7 million). According to CEO Jeff Green:

"More of the world’s leading brands are signing major new or expanded long-term agreements with The Trade Desk, which speaks to the innovation and value that our platform provides compared to the limitations of walled gardens… This trend also gives us confidence that we will continue to gain market share in any market environment."

While it is great that The Trade Desk continues to grow revenue rapidly, the negative profits (i.e. a loss) is particularly worrisome to some investors in our current rising interest rate environment whereby growth stocks continue to fall out of favor with many investors.

Growth Opportunities

In its latest investor presentation, The Trade Desk lays out several significant opportunities for growth, including the convergence of connected TV and the Internet (which founder-CEO Jeff Green happily says “CTV is evolving faster than anyone predicted”), growth outside of North America, and “shopper marketing” (for example, this is part of a Walmart (WMT) initiative to expand its media business by enabling brands to power ad campaigns with shopper audiences, as well as measure the impact of in-store and online sales). If one thing has been consistent for The Trade Desk over the years, it is its high revenue growth rate—something that can continue considering its growth opportunities and large TAM going forward.

Current Valuation

Considering The Trade Desk remains focused on revenue growth (and not profits, as evidenced by the negative profit this quarter), valuing the company based on EV/EBITDA or even simply price-to-sales has some prudence. Specifically, the price rose to $64.40 in afterhours and the forward revenue guidance is $385 million ($1.54 billion annualized, or approximately $3.17 per share), therefore the company trades at around 20.3 times sales.

The Trade Desk’s valuation metrics have come down significantly since the height of the pandemic bubble, but remain elevated in the minds of many investors. Just bear in mind that this company is the clear industry leader with a very high growth trajectory and a very large total addressable market. In the long-term, The Trade Desk’s current share price may be too low, but in the short-term there is a lot of volatility and the top-down environment remains very challenging.

Risk Factors

It is important to recognize that The Trade Desk does face a variety of risks going forward. For example, the current recessionary macroeconomic environment is a headwind that could grow. And rising interest rates could put further pressure on the valuation. Furthermore, the company makes a lot of bold statements in its investor presentation that may not actually come true, such as:

“The future of all media is digital and programmatic… eventually all media will be digital and it will be transacted by machines.”

Another risk is simply the “creepiness factor.” For example, The Trade Desk uses all kinds of information about media consumers to target them with specific information and advertisements. Speaking from experience, it’s a little creepy when your devices start targeting you with specific information that you’d simply rather they were not able to do.

Furthermore, market opportunities can and do change. And further still, The Trade Desk had a significant increase in stock-based compensation and the company’s profit just swung to negative.

5 Top-Growth Stocks: To Crash Again Soon

The Trade Desk (and many other top-growth stocks) will eventually crash again, and perhaps sooner than later considering the current challenging market environment (as described earlier). For a little perspective, consider this quote from famous long-term investor, Charlie Munger, during the great financial crisis:

“If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve.”

On one hand, it’s like goodness gracious Charlie, a lot of investors truly cannot stomach a 50% decline in their investment (not everyone is as rich as you), and that is totally fine. For example, if you are retired and living off your nest egg, a 50% decline might put you into an early grave from a heart attack or perhaps even starvation if you run out of grocery money.

But on the other hand, big declines are a part of long-term investing, particularly if you are going to invest in volatile high-growth stocks. As Charlie’s partner Warren Buffett once said:

“Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.”

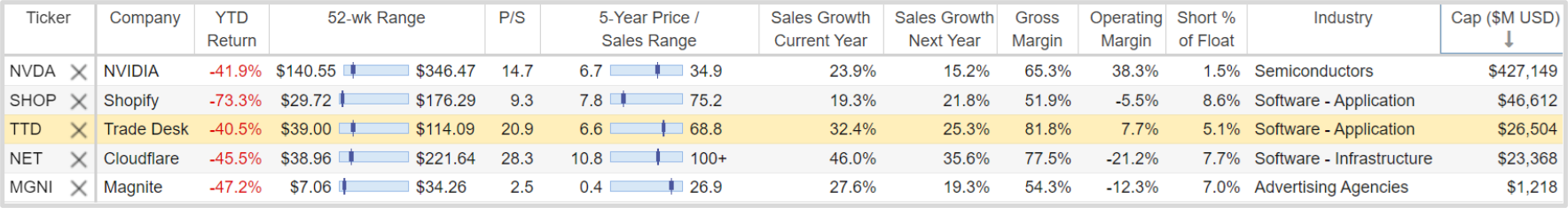

That’s what long-term investing is: at least 10 years. If you cannot handle the volatility of high-growth stocks, then high-growth stocks are probably not right for you. And to get specific, here are four more top growth stocks (five if you count The Trade Desk) that may crash again soon, considering current market conditions (i.e. recession), the recent dead cat bounce (since mid June), continuing high valuations (by historical standards) and the fact that the Fed could now be emboldened to raise rates even more dramatically to fight inflation.

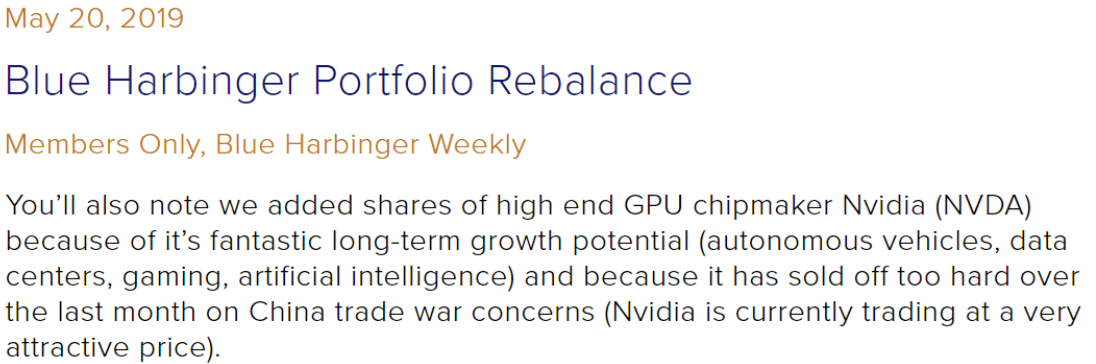

Nvidia (NVDA)

Nvidia is one of the most beloved retail investor stocks around. The growth rate is very high, the total addressable market is huge, and leader Jensen Huang is proven and likeable. We recently wrote up a lot more about Nvidia in this report.

Sadly, a lot of investors just don’t understand that being a great long-term business (like Nvidia is) does NOT protect you from massive short-term price declines. For example, Nvidia is now down 41.9% this year, and things can still get much worse (its 14.7x price-to-sales multiple is still high considering the current market environment we’re in—even if Nvidia’s growth rate remains healthy (see table above).

However, another important point is that being a long-term investor (i.e. expecting to hold something for at least 10 years when you buy it) doesn’t mean you can’t do a little trading around the edges when valuations get particularly egregious. For example, we bought Nvidia in May of 2019 for around $39 per share—split adjusted (see screen shot below), and then later sold it for many times that amount. Here is a look at our initial buy reasoning:

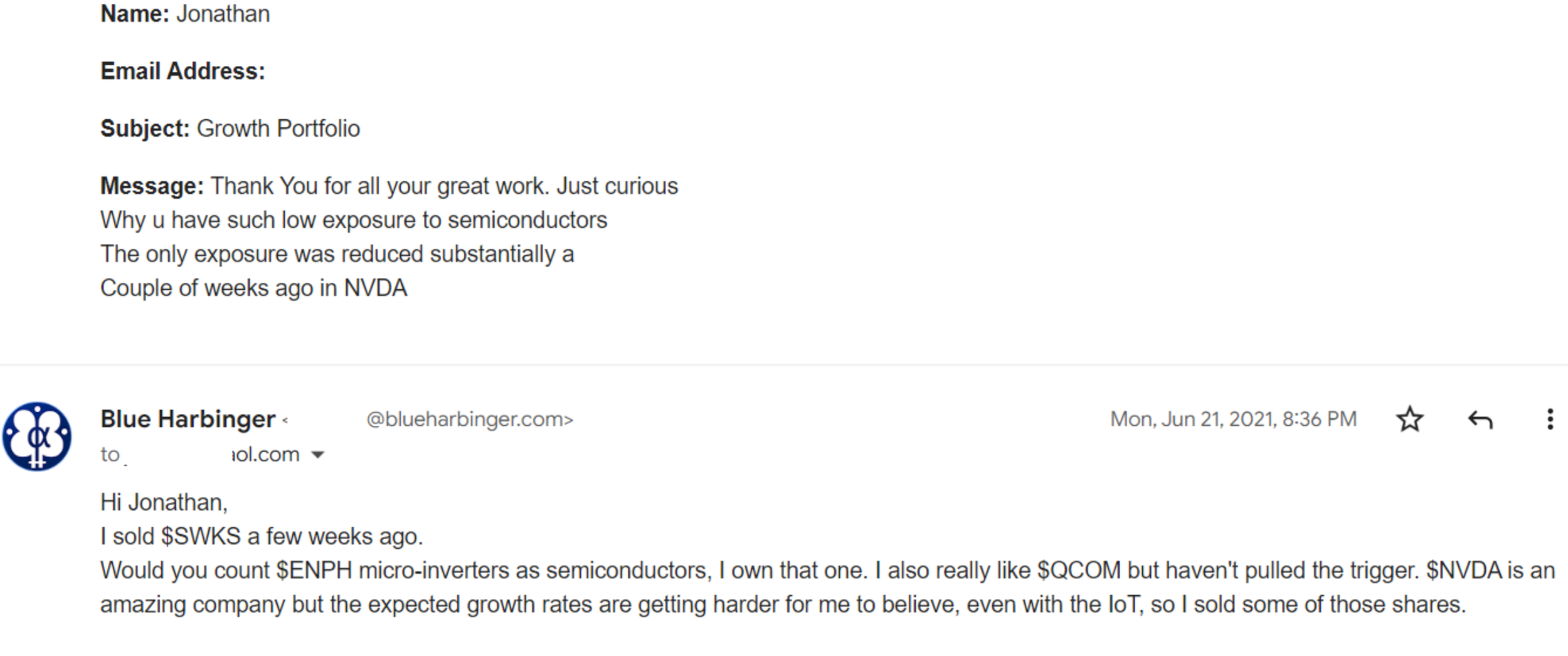

However, valuations got so egregiously high in 2021, that we sold half of our Nvidia shares (in our Disciplined Growth Portfolio) in June 2021 (for around $180 per share) and the other half in December (for around $318 per share), only to buy them back this year at $170 per share. And both times we sold, readers questioned the move. For example, here are a couple emails from readers.

But in retrospect, our sales helped us avoid some losses. And even though the shares can still decline dramatically more in the short-term, the business remains very attractive over the next 10 years (as per our earlier Nvidia report, linked above).

Magnite (MGNI):

Magnite is another top-growth stock (in the connected TV and digital advertising space) that can easily fall another 50% from here. We bought shares of Magnite for under $10 in 2020, only to watch them get caught up in the egregious pandemic bubble and soar dramatically higher. We sold more than half our shares at around $30, and then another half of what was left at almost $60. We’re glad to have taken profits as the shares fell back below $10—our original purchase price.

Magnite announced light earnings after the close on Tuesday, and the shares can still easily fall another 50% from here. However, over the long-term the business remains interesting and has upside (we still have a very small position in our Disciplined Growth Portfolio).

Cloudflare (NET):

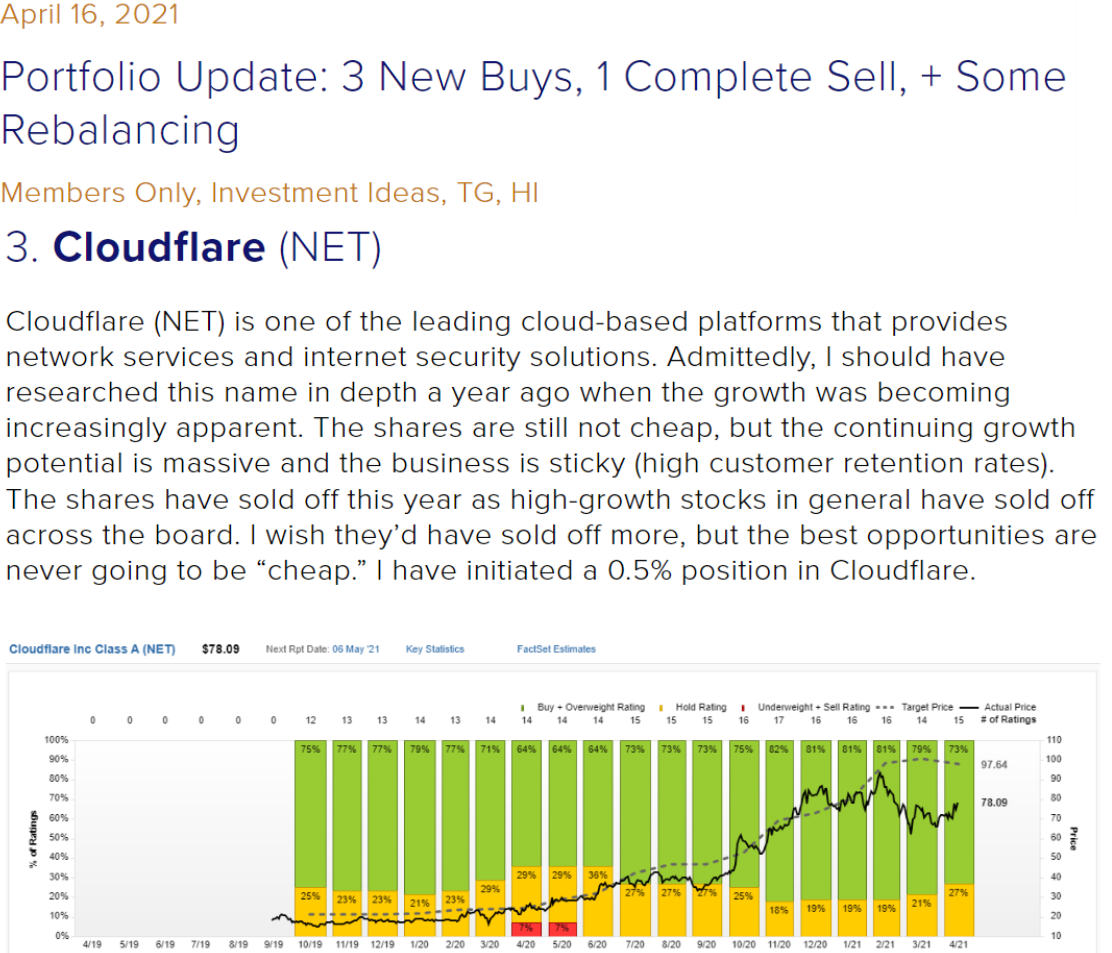

And as you can see in the earlier email screenshot above, we also avoided some losses this year by selling high-growth stock Cloudflare (for around $150 per share) in December of 2021 based on its very high valuation. And now that Cloudflare is down so much this year (it currently trades around $71) it’s starting to look very attractive again based on its continuing high growth rate, high gross margins and now significantly lower valuation (as per our earlier table). We first purchased these shares in April 2021 (for around $72 per share), took big gains in December 2021 (we sold at around $160), and are considering re-entering the position again (it’s on our watchlist for now).

Shopify (SHOP):

Shopify has been ugly this year. In fact, its share price has been so ugly that it’s starting to get interesting again. We first purchased shares of Shopify in August of 2018 for around $14 per share (split adjusted)—they currently trade at over $36. That may sound like a quick 4 years to more than double your money, but it’s not so attractive when you realize the shares are still down more than 70% this year. That’s the nature of long-term high-growth investing. We intend to continue holding our shares (despite the risk of more serious short-term declines) because the current valuation is attractive relative to the long-term value of the business.

Conclusion:

The most important takeaway from this report (aside from the fact that The Trade Desk is an attractive long-term investment) is that if you cannot handle a 50% decline in your investment, then you deserve the mediocre long-term returns you will get. Long-term investing means at least 10 years; and anything less than that is mostly just noise.

That’s not to say you can’t do some buying and selling around the edges of your portfolio when things get egregiously over or under-valued (like we did with Nvidia, Magnite, Cloudflare and Shopify). Additionally, it’s perfectly fine to avoid high-growth stocks altogether and in favor of lower volatility income-securities (such as the ones in this report), if that is consistent with your own personal situation. But to put it all in perspective, we’ll leave you with a quote from our recent report “70 Top Growth Stocks Down Big.”

In 2021, a new growth investor was born every minute and poured more money into what had been working best, despite the ugly sky-high valuations. And now that valuations have come crashing down, they believe they’re wise to avoid growth stocks like the plague. In reality, every investor is different, and each should focus on what works best for their own personal situation. Disciplined goal-focused long-term investing has been a winning strategy throughout history, and we believe it will be this time too.