When investing in closed-end funds (CEFs), we look for a variety of things, including a big distribution payment, an attractively-discounted price (versus NAV), reasonable leverage, and attractive management team, and a strategy that can succeed (especially in current market conditions). The following two CEFs meet all of these requirements, and they are particularly interesting and worth considering for investment right now.

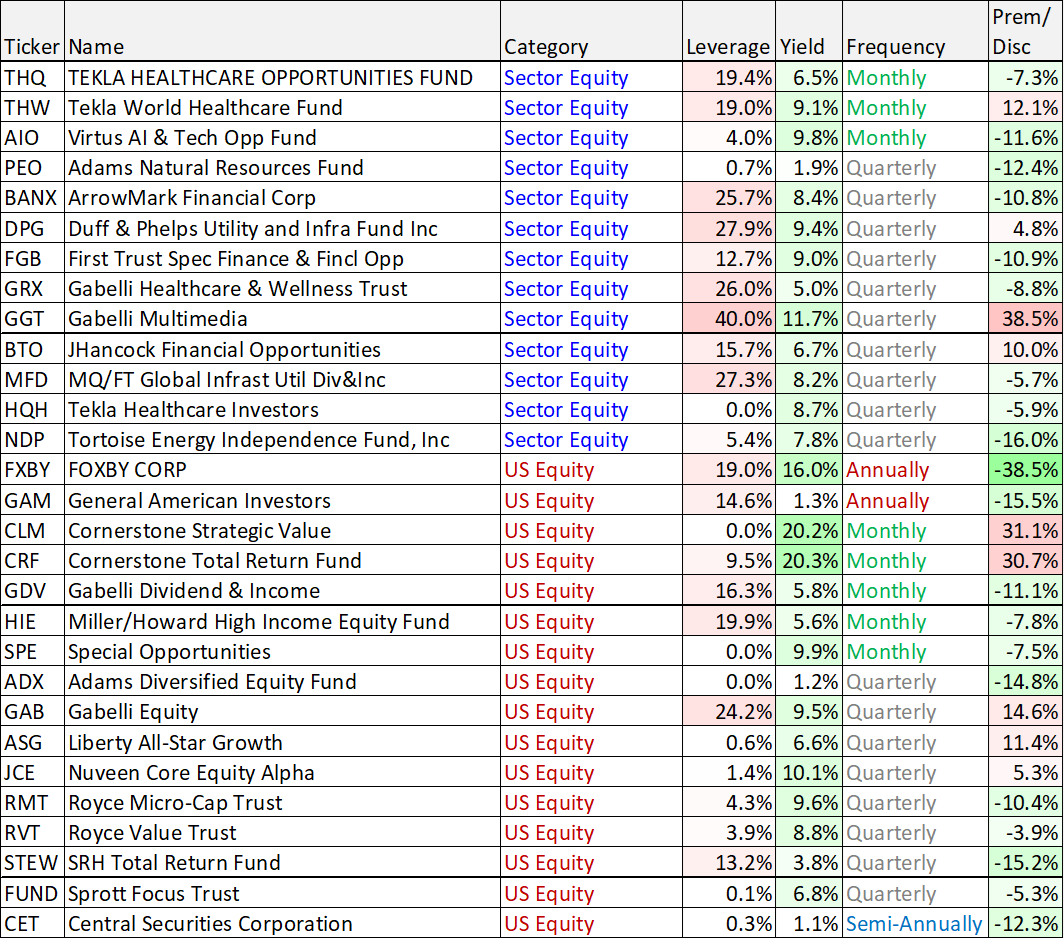

Virtus AI & Tech Opps Fund (AIO), Yield: 9.8%

If you are looking for a high-income opportunity, in a non-tradition income industry, consider the Virtus Artificial Intelligence & Technology Opportunities Fund. This is an industry that has fallen sharply out of favor, but could have significant capital appreciation opportunities in the months, quarters and years ahead. The fund's objective is to generate a stable income stream and growth of capital by focusing on one of the most significant long-term secular growth opportunities in markets today. It currently trades at a large discount to NAV, it uses a very conservative amount of leverage and it offers a distribution yield of near 10%. You can read all the detail on AIO here at CEFconnect or here on the funds own website. This is one that could experience a sharp rally in the months and quarters ahead (while it keeps paying you big steady distribution income (paid monthly).

BlackRock Science & Technology (BSTZ), Yield: 10.1%

This is another attractive industry-focused CEF that could experience a strong rebound while paying you big steady monthly distribution payments. The fund invests in science and technology indsustries and may also employ a covered-call strategy (to generate additional income). Here is how BlackRock describes the fund.

BlackRock Science and Technology Trust II (BSTZ), is a limited-term closed-end equity fund. BSTZ commenced operations in June 2019 with the investment objectives of providing total return and income through a combination of current income, current gains and long-term capital appreciation. Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology. As part of its investment strategy, the Trust intends to employ a strategy of writing (selling) covered call options on a portion of the common stocks in its portfolio.

We like the fund because of the big yield, discounted price, strong management team, relatively low fee, conservative use of leverage and the potential for this particular sector-industry to rebound hard as the overall market seems to be beginning to recover from inflation (i.e. the latest inflation numbers are down—a good thing!).

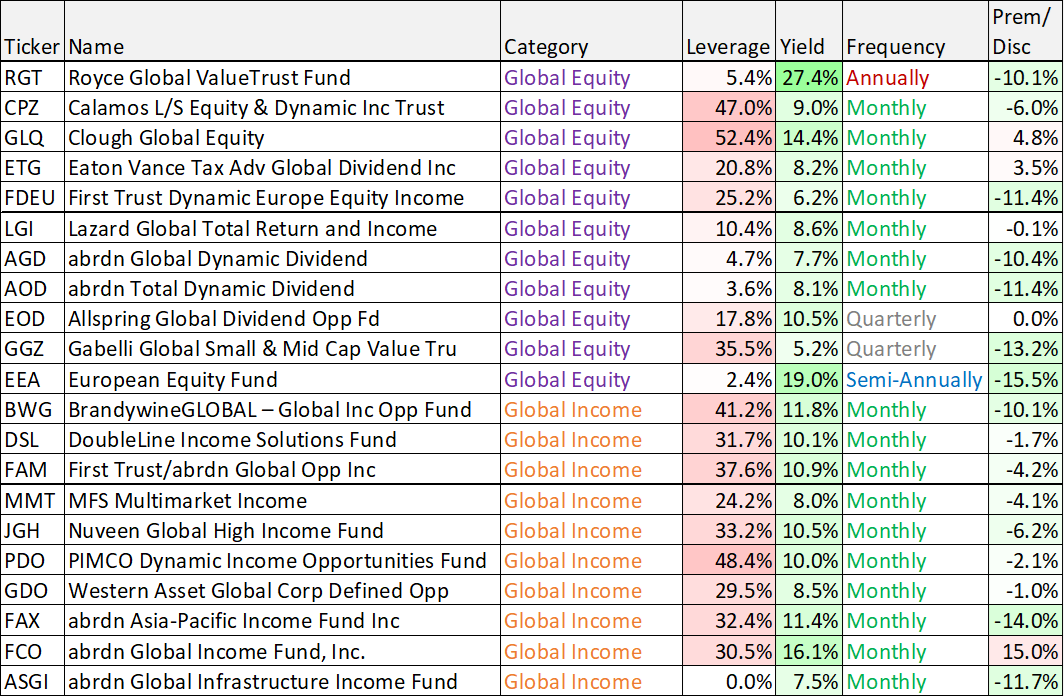

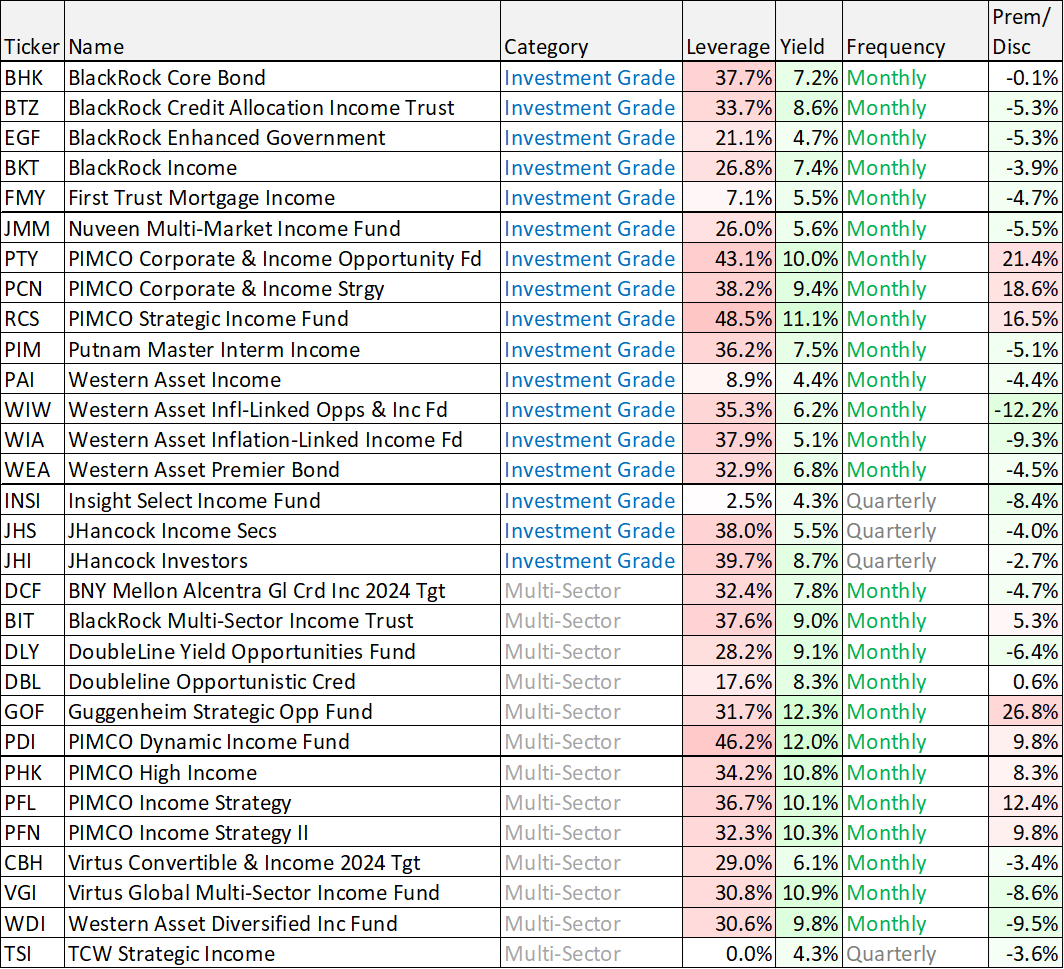

For your consideration, here is additional data on 100 big-distribution CEFs, including the two described above.