Closed-End Funds (or CEFs) are often an income-investor favorite because they can pay large distribution yields. However, CEFs come in many different shapes and sizes. One very popular CEF, The Reaves Utility Income Fund (UTG), has performed very well this year, but in this article we argue that it’s time to stop adding money to UTG because there are currently better CEF opportunities available. We will review two specific attractive CEFs (that we currently prefer over UTG) in this report.

Reaves Utility Income Fund (UTG), Yield: 6.9%

The Reaves Utility Income Fund is a very popular CEF for several reasons , including:

Big Monthly Dividend: UTG pays a big monthly dividend. The current yield is 6.9% and the actual payment has steadily increased over the years.

Utilities Sector: UTG invests in mostly utility sector securities (common and preferred stock and debt). This sector is known for being steady (less risky, less volatile), and steadiness is exactly what many income-focused investors are looking for.

Tax-Advantaged Income: The fund focuses on tax-advantaged income (qualified dividends, which can reduce your tax bill if you hold UTG in a taxable account).

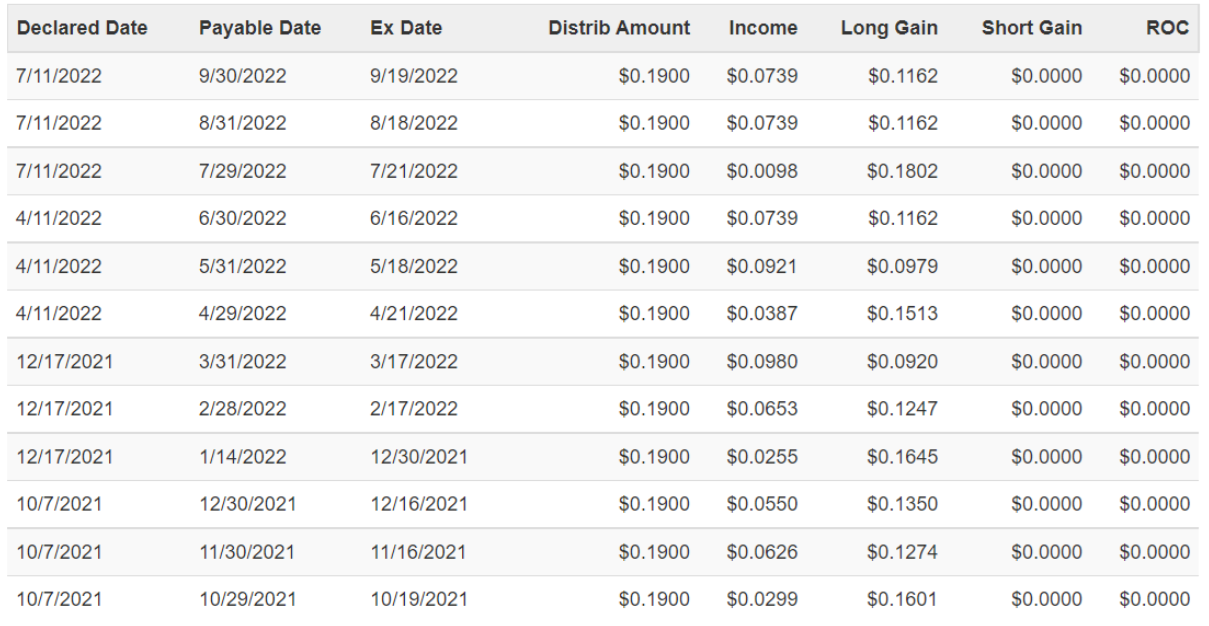

Distribution Sources: Monthly distributions paid by UTG generally consist of investment income and long-term gains (not short-term gains or return of capital). It’s good to avoid short-term gains (because they can be taxed at a higher rate) and to avoid ROC (return of capital) because it can reduce the cost basis on your investment so you get hit with a bigger capital gains tax when you do sell your shares. You can see UTG’s recent breakdown in the table below.

Leverage: UTG uses a little bit of leverage (or borrowed money) to help magnify income and potential long-term price appreciation (currently leverage is ~16.6%).

Concentrated: The fund is concentrated. Unlike other CEFs that can hold hundreds (or even over 1,000) individual securities, UTG currently holds ~44 securities. This allows the fund to pursue strong performance by putting more weight into top ideas.

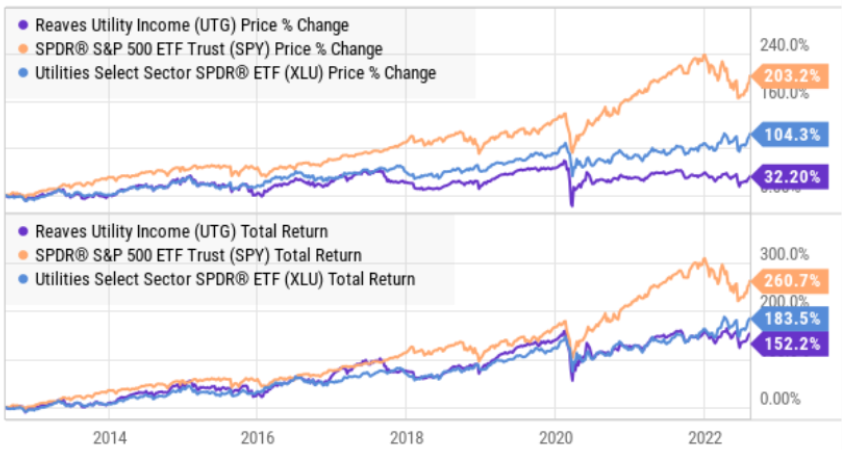

The fund has the potential to deliver price appreciation (in addition to steady dividend payments), and it has successfully accomplished this over the last 10 years, as you can see in the following chart (total return is dividends plus price appreciation).

And even though UTG’s long-term returns have lagged the market (SPY) and the utilities sector (XLU) over the last 10 years (see chart above) some investors don’t mind as long as UTG keeps paying those big steady increasing monthly distribution payments.

Reasons to Skip UTG Now:

However, there are also a few things about UTG that are a bit of a turn off for some investors right now, such as those described below.

Sector Rotation: The Utilities sector is currently less attractive. Two powerful investor themes are “buy and hold” and “buy low, sell high.” If you are a pure “buy and hold” investor, and you are happy with UTG, then that is your prerogative (everyone needs to do what is right for their own situation). However, if you are into “buy low, sell high,” you might want to avoid the Utility sector now (or at least not add any new money to it) because it has performed relatively very well this year (as it is a “flight to quality” sector where investors often park money when the market is selling off (like the first half of this year). However, the market has started to perk up in recent weeks and it likely has a lot more upside ahead considering inflation is starting to come down, the fed may ease up on rate hikes, and this will cause investors to increasingly sell safe utilities stocks and buy other sectors that do particularly well in a healthier market (we will cover this more in a later section of this report about specific CEFs we like more than UTG right now). As you can see in the chart below, the utilities sector and UTG have outperformed the S&P 500, but that may be about to switch as the market rebounds and other sectors (more sensitive to the market cycle) will likely play catch-up.

Premium Price: UTG’s price (relative to its net asset value (“NAV”)) is less attractive currently. One of the unique characteristics about CEFs is that they can trade at wide premiums or discounts to NAV (something other mutual funds and ETF generally cannot do because they strike a daily NAV). We greatly prefer to buy CEFs at a discount, and UTG currently trades at a slight premium (which is somewhat unusual for UTG, as you can see in the chart below).

Management Fees: UTG charges management fees that are somewhat reasonable, but still unattractive. And the management fees plus the total CEF expense ratio detracts from your returns. We’d be more okay with UTG’s annual total expense ratio of around 1.23% (consisting of roughly 0.70% management fees, 0.19% interest expense (for borrowed money) plus other operating expenses) if it traded at a wide discount to NAV, but considering the current premium, we view the management fee as unattractive. You can see the fund’s historical premium-discount versus NAV in the earlier chart.

In a nutshell, if you are happy with the steady long-term gains and income UTG pays monthly, you might want to keep your shares. But if you are more sensitive to your total returns (dividends plus price appreciation) now may be a good time to invest new money in CEFs other than UTG, such as the two we describe below.

2 Better Big-Dividend CEFs

If you are looking to diversify your income investments somewhere other than UTG, here are a couple big-dividend CEFs that are currently attractive and worth considering. Keep in mind, CEFs come in a wide variety of flavors, and the two listed below are similar (they’re both CEFs) but quite different (very different strategies and holdings).

BlackRock Credit Income Trust (BTZ), Yield: 8.6%

BTZ is an attractive investment-grade bond CEF that offers a compelling yield (currently 8.6%) paid monthly, and it currently trades at a nice discount to NAV (~5.3%). We have owned this fund in the past, and appreciate the strong management team and resources of BlackRock (not to mention the very reasonable management fees as compared to some other bond CEFs). Furthermore, we really like this fund now because as inflation slows, the fed will likely reduce its interest rate hike trajectory, and as interest rate expectations fall, bond prices (e.g. BTZ) will rise. Bond funds often use more leverage than stock funds (by way of regulation, bond funds are typically allowed up to 50% leverage) and BTZ clocks in with 33.7% leverage—a healthy dose that will likely magnify income payments and price appreciation over time (knock on wood). We are currently considering re-adding BTZ to our Income Equity Portfolio (we sold it earlier this year to avoid some losses).

Adams Diversified Equity Fund (ADX), Yield: 6.0%+

The Adams Diversified Equity Fund has been paying dividends to investors for over 80 years! And we currently like it for a variety of reasons including its wide price discount to NAV. ADX currently trades at a 14.7% discount, which makes its 0.58% expense ratio (which is very low to begin with) even easier to accept. The fund invests in equities across sectors, but currently (and typically) has larger allocations to some growthier sectors (such as technology and consumer discretionary). Because of the sector allocations, the fund is down this year (much like the rest of the market), but is also poised for a strong rebound as inflation eventually falls and the market recovers. Furthermore ADX is a great way to get exposure to sectors that typically aren’t know for paying high dividends (such as technology and discretionary) as ADX generates its income from a combination of dividends and long-term capital gains (no recent returns of capital, although the fund has had some short-term gains recently as management repositions the fund for market conditions). The fund typically uses zero leverage (a good thing for risk averse people). One caveat with this fund is that it pays three smaller dividends in the first three quarters of the year, followed by a larger fourth quarter dividend (to bring the annual yield to at least 6%—often more), and that fourth quarter dividend is still coming up at the end of this year. Given the big yield, discounted price and well-managed attractive strategy, ADX is absolutely worth considering for a spot in your income-focused portfolio.

Conclusion:

When selecting high-income CEFs, there are many categories to choose from and characteristics to consider. For example, BTZ and ADX stand out as attractive on our new list of 100 big-dividend CEFs because of their discounted prices, reasonable leverage, market-cycle-appropriate strategies and big monthly income payments to investors. And while UTG is less attractive in many of these same categories, we certainly don’t believe it is a terrible investment (we just think there are better places to put new money). However, at the end of the day, you need to choose investments that are appropriate for you. Disciplined, goal-focused, long-term investing is a winning strategy.