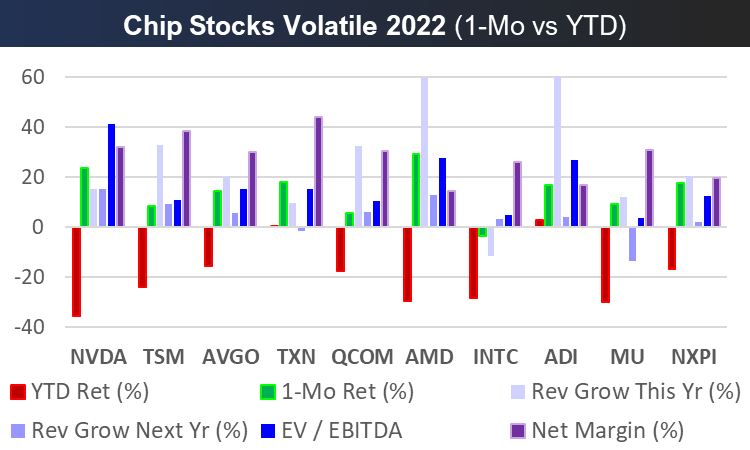

Here is a look at the volatile performance of some of the largest and most popular semiconductor (chip) stocks so far this year. As you can see based on the green bars, performance has been very strong over the last month, but they are still down a lot this year (red bars). Some investors may view these stocks as still too expensive based on the current valuation (EV/EBITDA), but that is not necessarily the case when you compare these stocks to their strong revenue growth rates (this year and next) and their very healthy net margins.

If you are a “medium-term” income-focused investor, these stocks may not be for you because of the high volatility (which will continue) and because most of them pay very little dividends (except for Intel). However, over the long-term—this industry is eventually going much higher. Chip stocks are an integral and growing part of the massive digital revolution and the economy in general. If you have a long-term horizon (and can handle the volatility) now is still a good time to buy attractive chip stocks.

We currently own Nvidia in our Disciplined Growth Portfolio, and we believe the shares have attractive (albeit volatile) long-term price appreciation potential. We also own Intel (for entirely different reasons) in our Income Equity Portfolio (it pays an extremely safe big dividend, and the shares are simply hard to ignore from a value standpoint).

Whatever your long-term goals are, chip stocks remain attractive. We saw during the pandemic-induced supply chain problems just how important chip stocks are (new cars were in short supply and used car prices went through the roof because of the chip shortages).

Choose stocks that meet your personal goals and strategy. Long-term, chip stocks are eventually going much higher.