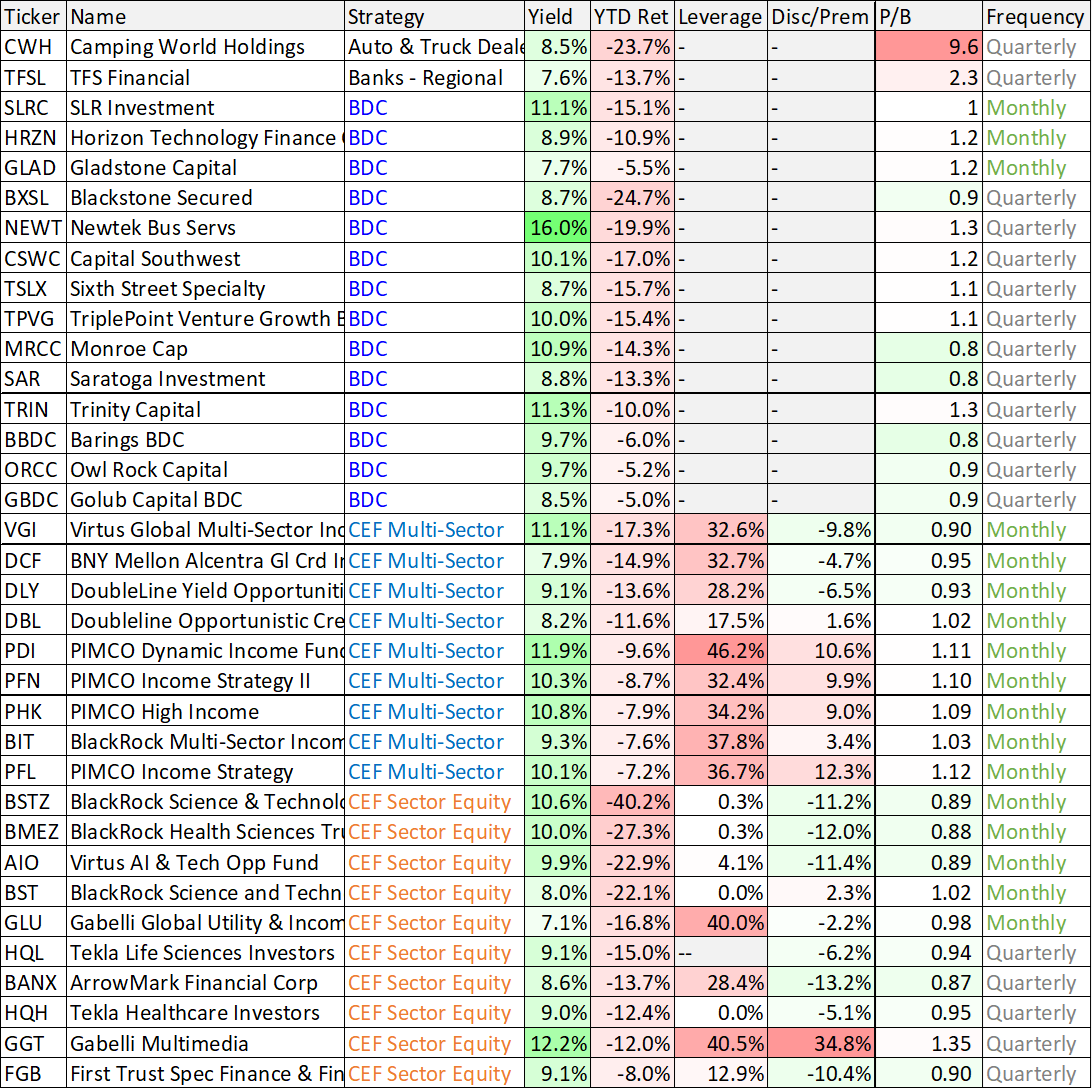

With the market posting strong gains over the last month (particularly high growth stocks) it can make sense to focus on areas receiving less attention. And in this report, that includes big-dividend investment opportunities that are still down big year-to-date. More specifically, we share data on 70 investments that currently yield over 7% and have experienced significant share price declines so far this year. The list includes REITs, BDCs, CEFs and more.

Of course chasing after the highest yields can be a mistake, considering high-yield is often an indication of high risk. However, occasionally attractive big-dividend opportunities go on sale. For example, consider our recent detailed report on Medical Properties Trust, a healthcare REIT that has increased its dividend for the last nine years in a row and currently offers a yield of over 7%. And our report on these 2 high-income equity CEFs.