Unlike the S&P 500, the Blue Harbinger Income Equity Portfolio has posted a positive return so far this year. There are a lot of factors that have contributed to the outperformance, and one has been the noticeable omission of small cap stocks. However, there is growing evidence to believe now is an attractive time to add an allocation to small cap stocks within your portfolio. In this report, we review two very attractive ways to do that (particularly if you are an income-focused investor) with two highly-compelling closed-end funds (CEFs) that offer big double-digit yields. We review all the details in this report.

As a brief introduction, the two CEFs we will cover in more detail (later and throughout this report) are:

1. Royce Value Trust (RVT), Yield: 11.6%

This is the first small-cap closed-end fund, managed since its inception in 1986 by the same portfolio manager (Chuck Royce). Royce Investment Group is a recognized pioneer of small-cap investing. The fund uses a core approach that combines multiple investment themes and offers wide exposure to small-cap stocks by investing in companies with high returns on invested capital or those with strong fundamentals and/or prospects trading at what Royce believes are attractive valuations. The fund has outperformed its benchmark, the Russell 2000 Index, for the 1-, 3-, 5-, 10-, 20-, 25-, 30-, 35-year, and since inception (11/26/86) periods ended 6/30/22.

2. Royce Microcap Trust (RMT), Yield: 10.1%

This is one of the only closed-end funds dedicated to investing in micro-cap stocks (micro-cap stocks' market caps are less than the largest stock in the Russell Microcap Index, currently around $500 million). The strategy uses a core approach that combines multiple investment themes and offers wide exposure to micro-cap stocks by investing in companies with strong fundamentals and/or prospects selling at prices that Royce believes do not fully reflect these attributes. The fund has outperformed its benchmark, the Russell 2000 Index, for the 3-, 5-, 10-, 15-, 20-, 25-year, and since inception (12/14/93) periods ended 6/30/22.

But before getting into too much detail on these funds, it’s worth stepping back for a moment…

Small Cap Overview:

For starters, small cap stocks are publicly-traded business (stocks) with small market caps (typically below $2-$3 billion). This is in contrast to the S&P 500, which is basically a large cap index, and owns the 90% of US stocks with the largest market caps, often ranging as high as $10 billion, $100 billion and even over $1 Trillion dollars (e.g. the Apple’s (AAPL) and Microsoft’s (MSFT) of the world.

Why Small Caps Now?

For starters, here is a look at the 10-year performance (total returns: dividends plus price appreciation) of large cap stocks as measured by the S&P 500 (SPY) and small cap stocks, as measured by the Russell 2000 (IWM). As you can see, small caps have been underperforming in recent years.

And not only is it often worthwhile to consider underperforming stocks as an attractive contrarian investment opportunity, but in this case there is compelling data-driven evidence to suggest now is a really good time to consider investing in small caps.

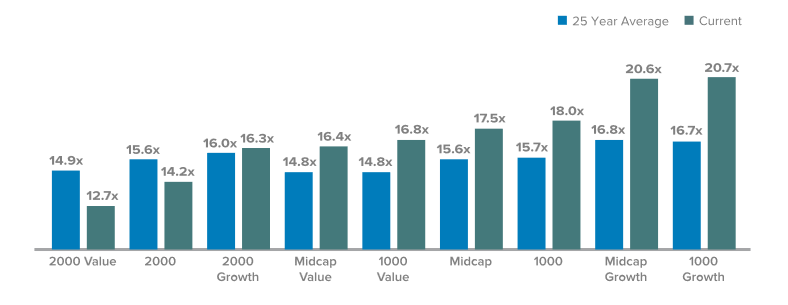

For example, here is a look at the 25-year performance of various market cap and style strategies, and as you can see—only small-cap value and small-cap are cheaper than their historical average.

data as of 6/30/22

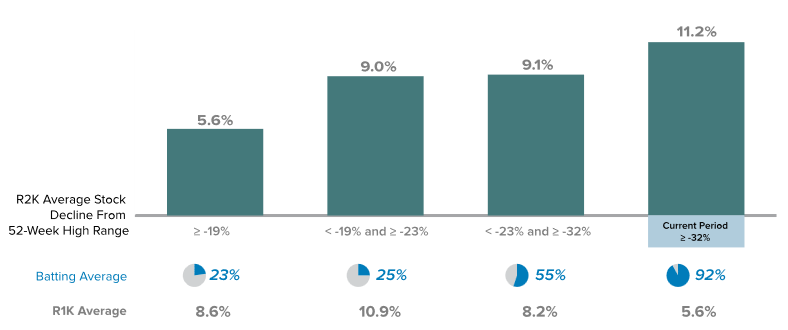

However, there is more. Here is a look at the “Subsequent Average Annual Three-Year Return for the Russell 2000 (Small Caps) Based on Average Stock Decline From 52-Week High Range.” Basically, when small caps are down a lot, they tend to rebound more than other market caps, and we are currently in a period where small caps are down a lot versus large caps (as measured by the Russell 1000 index in the graphic below).

And as you can see with the “Batting Average” metric in the graphic above, this phenomenon tends to exist most of the time (i.e. 92%). Said differently, now is a very good time to consider investing in small cap stocks.

How to Invest in Small Caps Stocks

There are lots of ways to invest in small cap stocks (such as picking and choosing individual small cap stocks or investing in a passive small cap ETF such as ticker IWM (which basically owns all of the small cap stocks). However, one particularly attractive way to invest right now is via the high-income closed-end funds (“CEFs”) offered and managed by Royce Investment Partners, such as Royce Value Trust (RVT) and Royce Micro-Cap Trust (RMT). In fact, we will review these 2 funds in subsequent sections of this report, but first it makes sense to review what a closed-end fund actually is.

What is a Closed-End Fund?

Closed-end funds, or CEFs, are basically a basket of stocks (often hundreds) that trade through a single vehicle—the CEF. However, there are a variety of unique characteristics about CEFs that investors should be aware of—before they invest (as we will review in the following paragraphs).

Discounts and Premiums to NAV

Perhaps the most important characteristic of a closed-end fund is that they are closed-end, which generally means they cannot create or eliminate new and existing shares. This is different than most mutual funds or ETFs, and it is important because it results in CEFs trading based on supply and demand instead of based on the underlying value of the things they hold (i.e. they’re NAV). This means, unlike most mutual funds and ETFs, CEFs often trade at wide premiums or discounts to their NAVs, and this creates unique risks and opportunities for investors.

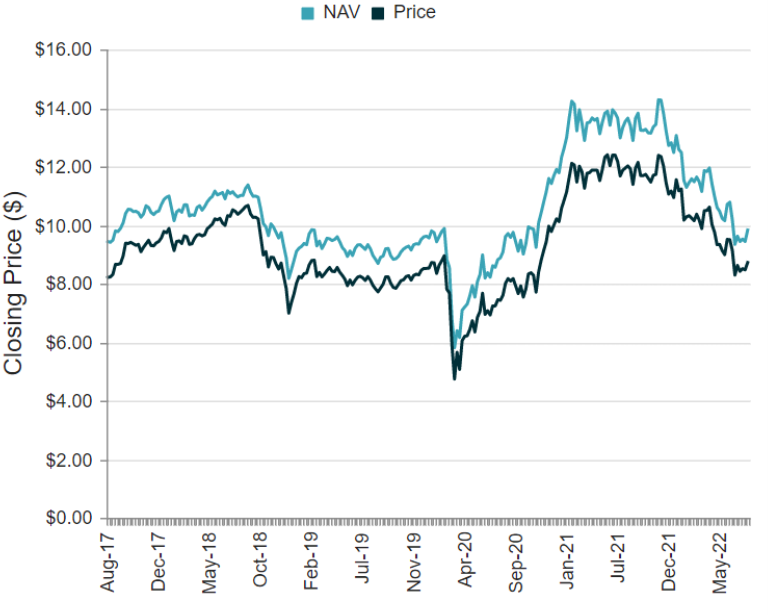

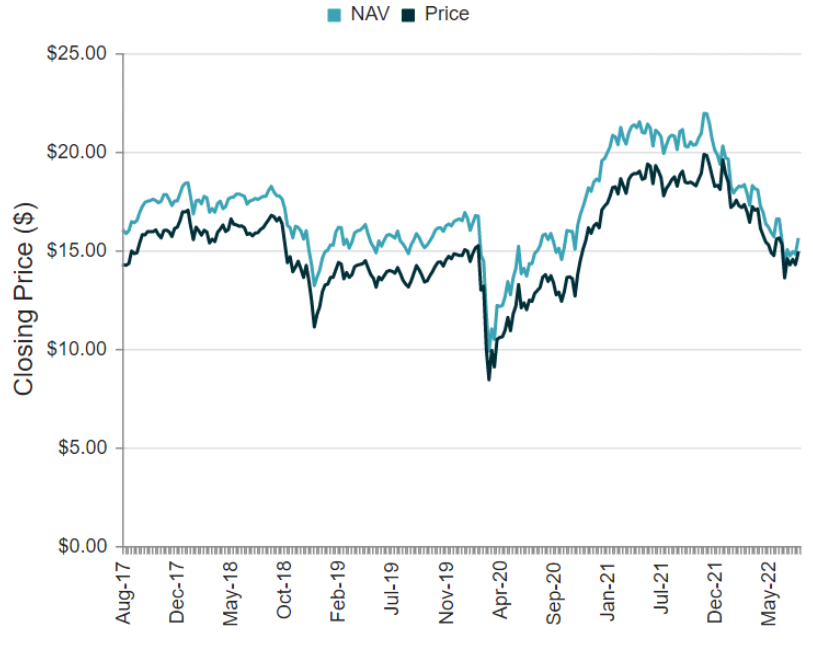

Generally speaking, we greatly prefer to buy CEFs at a discount to NAV because it means we are gaining access to the underlying holdings at a discounted price. It’s like buying something on sale—and as long as what you are buying is quality—that can be a very good thing. For example, the two CEFs we will review in this report (RMT and RVT) both trade at attractive discounts to their current NAVs, as you can see in the following charts (a 10.8% discount for RMT and a 4.2% discount for RVT).

above: RMT

above: RVT

High Distribution Yields

The next important thing to understand about CEFs is that they often offer very high yields, but these yields aren’t based totally on the dividends (or income payments) of the underlying holdings. Rather, CEFs often pay out some of their capital gains as distributions, and this allows them to keep their yields high.

Paying out capital gains (in additions to dividends) as part of a CEF distribution can be a very good thing (because it provides steady income for income-focused investors), but it needs to be monitored. For example, the distribution can consistent of dividends, long-term capital gains, short-term capital gains and return of capital. All may have different tax consequences (which will be conveniently reported to you (at least annually) in form 19-a. The one thing to pay attention to is “return of capital” because this is when a CEF is returning your own initial investment dollars as part of the distribution, and this can act to reduce your cost basis so you will have a bigger (potentially unexpected) taxable capital gain when you do sell your shares. Also, it’s good to see a fund paying distributions from its excess gains instead of just returning your own capital. In the case of RMT and RMT—they both use a prudent mix of distribution sources and have done so successfully for the better part of 3 decades).

Leverage (Borrowed Money)

Leverage (or borrowed money) is another thing you have to watch for with CEFs. Prudent leverage can be acceptable, but just know if can increase returns in the good times but also increase losses in the bad times. In the case of the Royce CEFs (RVT and RMT) they both tend to use very little leverage (currently ~3.9% for RVT and 4.4% for RMT). For reference, equity CEFs generally don’t go much above 30% leverage for regulatory reasons and bond CEFs are generally limited to 50% leverage. Royce makes very prudent use of conservative leverage (to offset relatively small operating expenses while keeping the strategies invested prudently and consistently).

Expenses and Fees

It is important to note, unlike an individual stock or bond, CEFs charge management fees and other expenses. At Blue Harbinger, we avoid investments that charge high fees, and we believe the Royce Fund fees can be acceptable as long as the particular investment strategy (e.g. RVT or RMT) fits with your own personal investment portfolio goals.

The expense ratio for RVT was recently 0.63% which is acceptable for a small cap strategy.

However, its also important and interesting to note that a portion of RVT’s management fee is performance based. Per the fund’s fact sheet, here is what Royce has to say about expenses:

Low Operating Expenses—Annualized operating expenses, including advisory fee, were 0.73% of average net assets applicable to common stockholders for the 12-months ended 6/30/22.

Performance Fee Structure—A portion of the adviser's fee is "at risk" and is determined by the Fund's performance relative to its benchmark, the S&P SmallCap 600 Index. In general, if the Fund outperforms the benchmark over the measurement period (a rolling 60 months), the fee is increased. If the Fund underperforms, the fee is decreased. This performance based structure can increase or decrease the adviser's base fee of 1.00% by up to 0.50%.

Negative Performance Penalty—No fee will be taken for any month in which the Fund's performance (rounded to the nearest whole number) over the trailing 36-month period is negative. This total fee forfeiture for negative performance is unique among closed-end funds.

And the expense ratio for RMT was recently 1.06% (acceptable for a microcap strategy). And here is what RMT’s fact sheet has to say about performance fees:

Performance Fee Structure—A portion of the adviser's fee is “at risk” and is determined by the Fund's performance relative to its benchmark, the Russell 2000 Index. In general, if the Fund outperforms the benchmark over the measurement period (a rolling 36 months), the fee is increased. If the Fund underperforms, the fee is decreased. This performance-based structure can increase or decrease the adviser's base fee of 1.00% by up to 0.50%.

Important to note, when considering expense ratios, the cost of leverage is often included in the total expense ratio, and this can increase the expense ratio significantly depending on how much leverage a strategy uses. For example, some highly-levered PIMCO bond fund strategies often have expense ratios in the 3% to 4% range (or more), but that also includes the cost of borrowing.

Overall, we view the expense ratios on RMT and RVT to be reasonable and acceptable.

More About RVT and RMT

We are currently attracted to both RVT and RMT for a variety of reasons, including their large distribution yields, discounted prices versus NAV, solid management teams (here is an interesting video by founder Chuck Royce—who happens to be about 100 years old, is supported by a strong team, and will eventually be carried out of the office in a pine box), relatively low fees, and prudent use of leverage. We also like these funds for their prudently diversified approach (they invest across sectors, have around 486 and 285 individual holdings each (for RVT and RMT, respectively), and have high “active shares” versus the index—meaning they are not “closet index funds”). We have a lot of faith in these investment strategies, the investments team and long-term small cap investing (particularly considering the attractive valuations for small cap stocks right now).

Conclusion

In our view, both of these strategies are particularly attractive right now as small cap stocks have fallen out of favor (and that tends to be the best time to buy, according to the data). We also like the current market price discounts on both funds versus their underlying net asset values (even though the discounts are not currently at their historical widest, they remain attractive now, particularly when combined with the attractiveness of small caps in general).

We have owned both RVT and RMT in our Income Equity Portfolio in the past, but currently do not own either one. However, they are high on our watchlist for now considering the Income Equity Portfolio has no current exposure to small caps (which has been a good thing so far this year, but that may be about to change). If you are looking for an attractive, well-managed, high-income opportunity, both RVT an RMT are worth considering. We expect their strong long-term track records to continue based on the team, the process and the attractive small cap asset class.