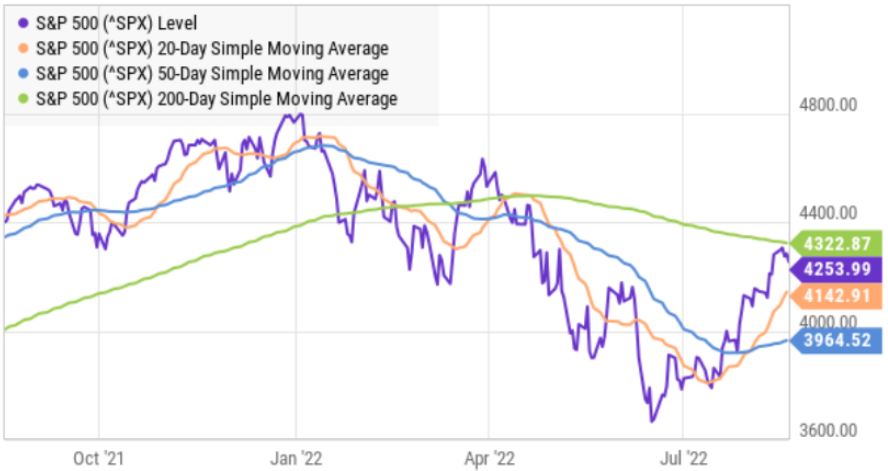

Here is a look at the S&P 500 (including its 20-, 50- and 200-day moving averages). As you can see, it’s still down significantly this year, but has rebounded hard since June. The question some investors are wondering is if they should take some chips off the table before the downtrend resumes. Afterall, inflation is still sky high, the fed is still raising rates aggressively and your account balance is likely a lot higher than it was 2-months ago. We share a few data points and our opinion in this note.

As you can see, the S&P 500 has broken through its 20-day and 50-day simple moving averages (to the upside) and many technical analysts believe this is a good sign. The next major resistance level to the upside appears to be around 4,400 and then 4,600 (suggesting more room for the market to run). However, resistance at the 200-day moving average (green line) is concerning to some.

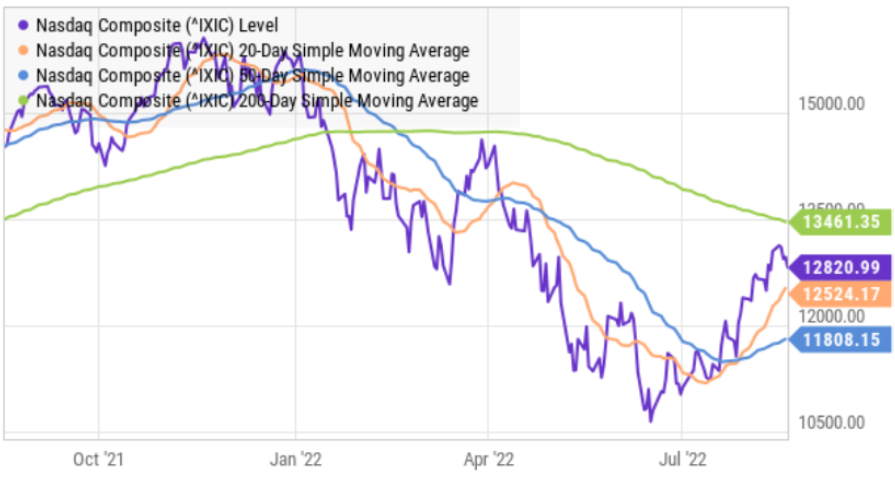

And similar data points for the tech-heavy Nasdaq Index are similarly encouraging (perhaps even more so) as you can see in this next chart.

As long-term investors, we put some credence in technical analysis, but not much. Especially since, as long-term investors, short-term market moves amount to mostly just noise over time.

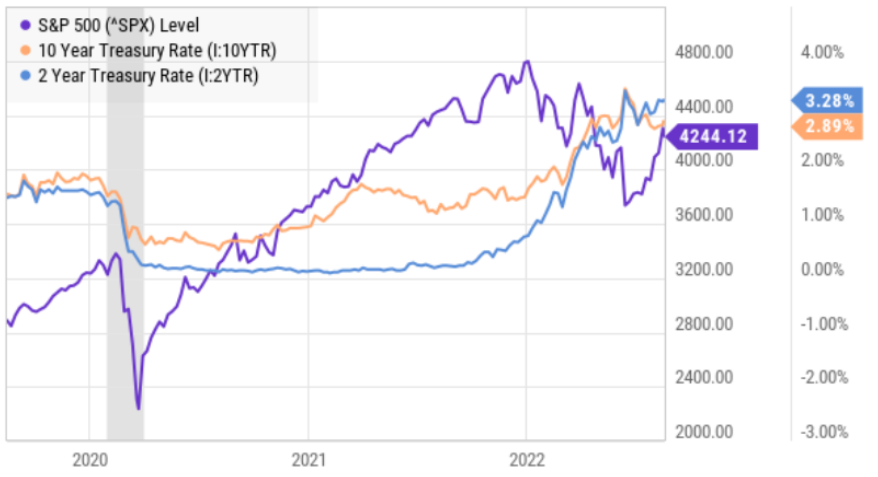

However, we do put more credence in interest rates because as the fed increases rates, it slows the economy. The Fed’s interest rate monetary policies manifest themselves in treasury rates, and as you can see in this next chart, interest rates have risen sharply this year and markets (the S&P 500) have fallen.

And of particular concern to some, the 2-year treasury rate is still HIGHER than the 10-year rate—a historically-strong indicator of recession. An inverted yield curve is not a good sign for the economy.

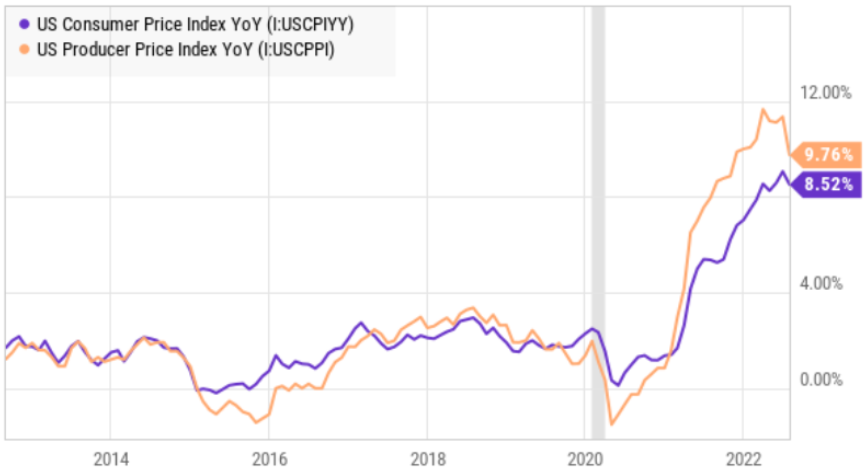

The Fed is raising rates aggressively to fight inflation. And as you can see in this next chart, inflation has ticked lower recently, but is still very high by historical standards.

The cause of high inflation is absolutely government policies following the onset of the pandemic (that clogged up supply chains with lockdowns and pumped massive easy money (inflationary) into the economy), but that’s essentially irrelevant to the Fed’s monetary policy. It is encouraging that inflation has ticked lower in the latest monthly reading (that could encourage the Fed to be slightly less hawkish). But the problem is the Fed’s interest rate decisions generally don’t impact the actual economy for around 10 to 18 months. The market may move on the news, but the economy does not.

Our Bottom Line

We are still under the impression that the rate of inflation growth will slow, but prices aren’t going back to their previously low levels. Higher prices are here to stay (let’s just hope they don’t dramatically higher in the short-term).

Further, pandemic-induced supply-chain challenges will eventually work themselves out, and this will slow inflation.

Moreover, the Fed’s aggressive interest rate hikes (of 2022) will eventually slow inflation (perhaps in 2023 or even 2024), and the economy will get healthier again.

Trying to time the exact date-and-time the market will “return to normal” is impossible. But believing the market will eventually get healthier is a quite reasonable viewpoint. Further, the market is forward looking, and will get a lot stronger long before the economy (arguably in recession) improves.

Said differently, if you are a long-term investor, now IS an attractive time to buy/own stocks. Prices (and valuations) are still significantly lower than they were, and over the long term the market is going much higher. You can review our most recent growth stock idea reports here and our most recent income-investment idea reports here. Further, we remain fully invested in our portfolios (we’re not trying to “hide” in cash).

Disciplined long-term investing will continue to be a winning strategy.