There’s a lot to like about the 9% yielding BDC we review in this report, but before investing you should first understand its uniquenesses and risks. We dig into the details and then conclude with our strong opinion on investing.

Hercules Capital (HTGC), Yield 9.0%

In this report, we focus on Hercules Capital, the largest BDC focused on providing financing (mostly debt) to high-growth venture companies.

What is a BDC?

Just as a quick reminder, Business Development Companies (“BDCs”) were created by Congress in the 1980s as a way to help small businesses (middle-market sized) get access to capital. BDCs invest in businesses by providing them debt and sometimes taking an equity position. BDCs can generally avoid paying corporate taxes by paying out most of their income as dividends (you generally still have to pay taxes on the dividends you receive from BDCs—if you own them in a taxable account).

BDCs are subject to a variety of other stipulations. For example, they are regulated by the SEC under the Investment Company Act of 1940, their leverage is limited to approximately 2:1 debt/equity (unless an SEC exemptive order exists to exclude SBA debt) and investments are required to be carried at fair value. The majority of the board of directors must be independent, they offer managerial assistance to portfolio companies and they are subject to comprehensive disclosure requirements under the 1934 Act.

And of course, BDCs are often an income-investor favorite because of the big steady dividend payments they can offer.

Lots to Like about Hercules

Differentiated Strategy

One of the main reasons Hercules is an interesting BDC is its differentiated strategy versus most BDCs. Hercules calls itself the largest BDC focused on financing for high-growth venture (for reference, its market cap is around $2 billion, which makes it a decent-sized BDC, but not the largest).

Since its inception in 2003, Hercules has provided over $14.6 billion in total net debt commitments to over 590 companies (they currently invest in 103 companies through debt and warrants). It has offices in California, Massachusetts, New York, Washington DC, Connecticut and the United Kingdom.

A few additional key point, according to Hercules, include:

We focus primarily on pre-IPO and M&A, innovative high-growth venture capital backed companies at their expansion (venture growth) and established stages in a broadly diversified variety of technology, life sciences and sustainable and renewable technology industries

We are generally the only lender and 74.3% are "true" first lien senior secured

23.6% of our debt investments are second position senior secured of which 93% Hercules has the right to buy out the first lien holder

The majority of our debt investments include warrants for potential additional total return

And for color, here are a few of Hercules investments that you may have heard of: Palantir (PLTR), DocuSign (DOCU), Enphase (ENPH)—a Blue Harbinger Disciplined Growth Portfolio holding and exceptional performer this year, Fastly (FSLY), Lyft, DoorDash, Power Plug (PLUG) and Postmates.

Internally Managed

A lot of BDCs are NOT internally managed, but Hercules is internally managed. External management teams can be expensive (layers of fees) and create conflicts of interest. From an investor standpoint, we greatly prefer internal management teams, like Hercules.

SBIC License

Hercules currently has one SBIC Small Business License. This is attractive because it provides them with the ability to make high return investments in small businesses without all of the typical risks (because the SBIC provides some backing). This is not a large part of Hercules business, but it is enough to move the needle by a small amount.

Investment Grade Credit Rating

We also like that Hercules has an investment grade credit rating (Fitch: BBB- | Moody’s: Baa3 | DBRS: BBB | KBRA: BBB+). This is not true for all BDCs, and it is mostly certainly not true for most portfolio companies. By assembling a well-diversified base of portfolio companies, combined with its own strong balance sheet, Hercules is able to maintain an attractive strong credit rating for a BDC.

Track Record of Success

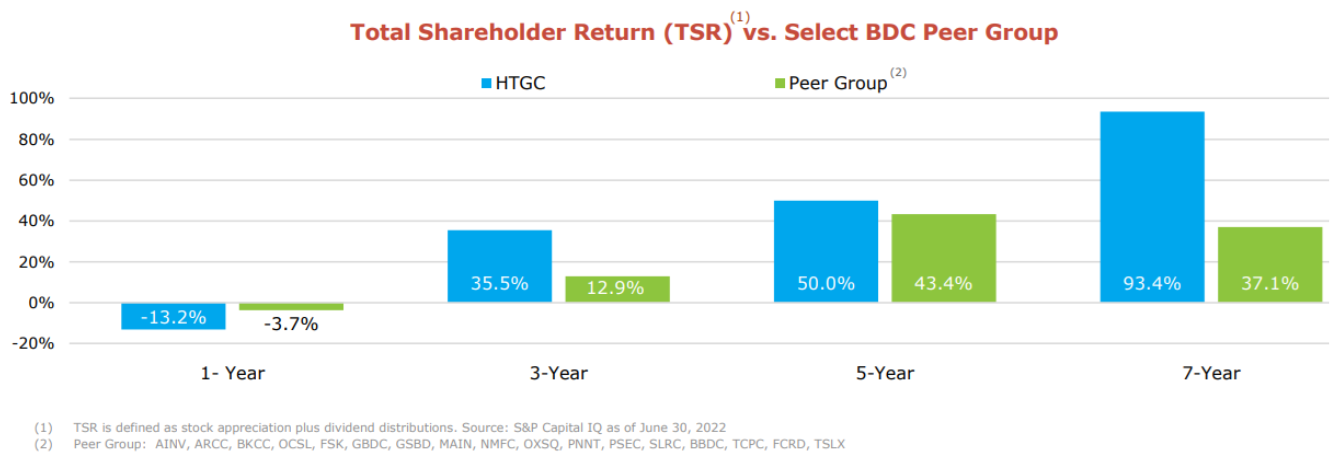

Also encouraging, Hercules has outperformed its peer group historically. Past performance is certainly no guarantee of future performance, but it is encouraging to see strong mid to long-term performance (last 7-years) in the graphic below.

Also worth mentioning here, Hercules investment portfolio consists largely of different sector investments versus other BDCs. In particular, Hercules has higher allocations to growth sectors, which have performed better in recent years, but not as well this year (this helps explain the performance in the graphic above).

Interest Rate Sensitivity

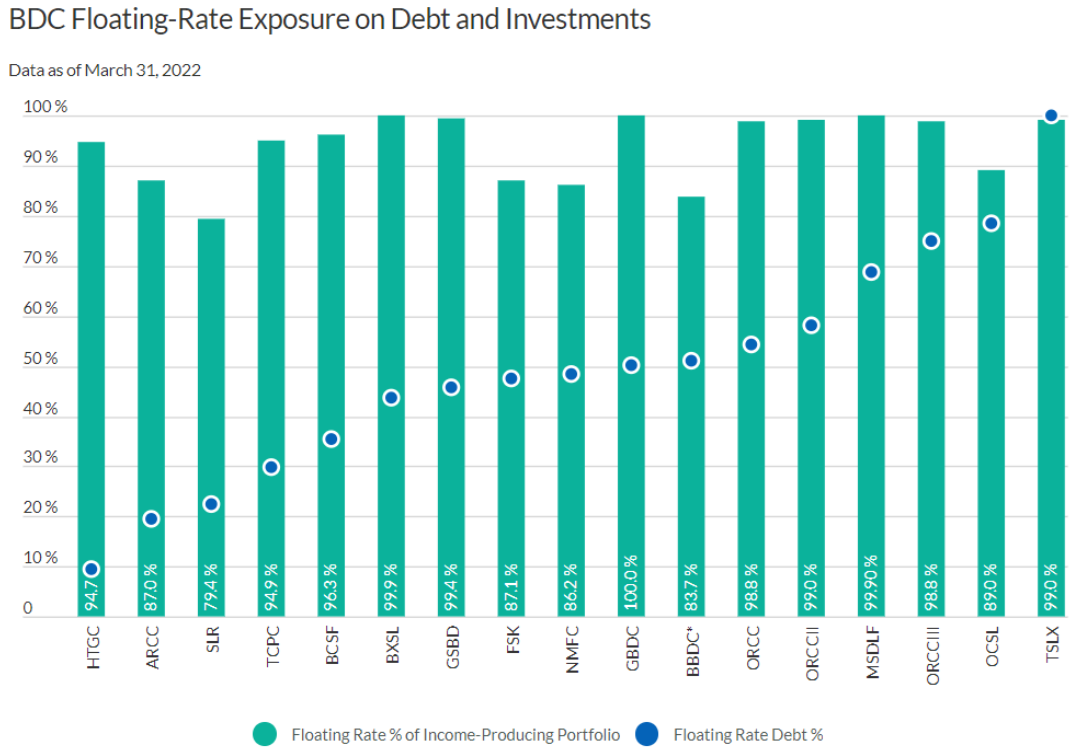

Unlike many companies, Hercules benefits if interest rates rise. Specifically, 94.9% of the companies investment portfolio is floating rate loans—which means Hercules makes more money when interest rates rise. Conversely, Hercules own debt is fixed rate (so they don’t get hurt immediately when rates rise).

Low Unrealized Losses Currently

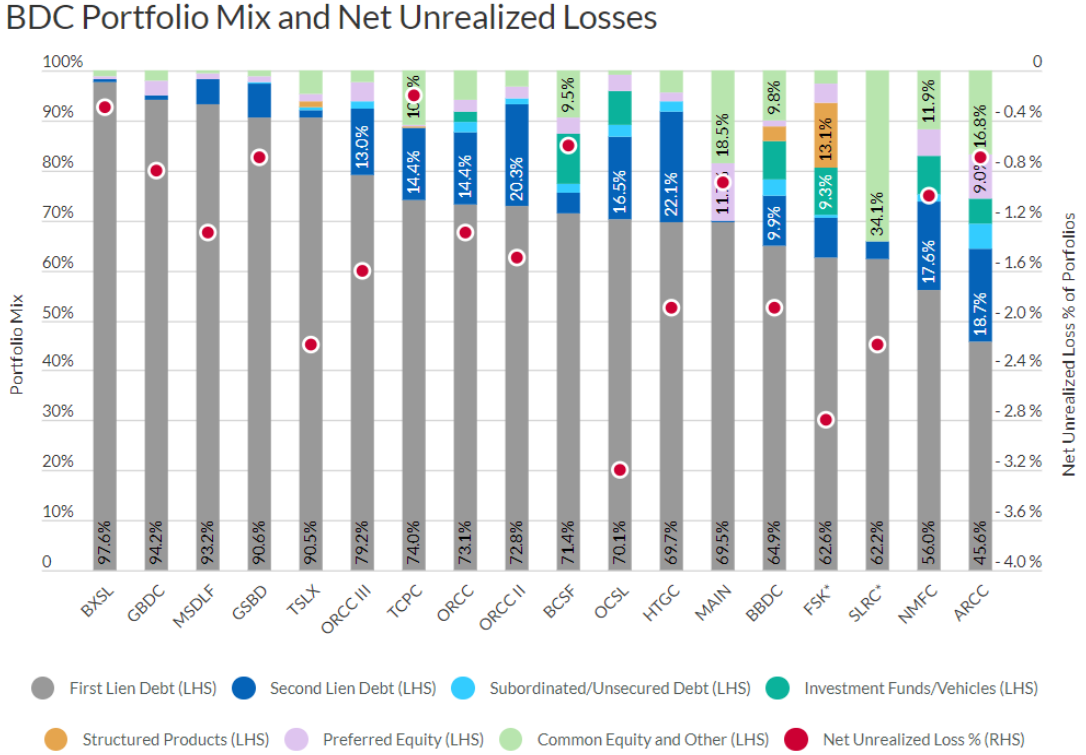

Another encouraging metric to consider is that Hercules currently has low unrealized losses (as of 6/30/22) versus other BDCs, as you can see in the chart below.

More specifically, Hercules has a lot of first lien debt (as described earlier) and the net unrealized losses are fairly low (a good thing).

Healthy Asset Coverage Cushion

Further, HTGC has a healthy asset coverage cushion, as you can see in this next graphic.

Specifically, Hercules’ asset coverage cushion is higher than most other BDCs, while its debt-to-equity ratio is well below 2.0 (the limit, as described earlier).

Baby Bonds

Another interesting consideration for investors is that Hercules also offers some interesting high-yield baby bonds which trade on the NYSE under the ticker HCXY (HCXY). Traditional bonds often have a face value of $1,000, but these bonds have a face value of $25 thereby making them more accessible to smaller investors. They also currently trade down since the start of this year, and they are attractive in our view considering they offer a 6.1% yield backed by a healthy business, investment grade balance sheet and have priority over common shares and common share dividends.

Risks

Of course there are risks to investing in Hercules…

Uncertainty, Volatility

For starters, venture investments are often considered riskier than well-established blue-chip businesses, but in theory they also offer higher long-term returns (just with potentially more volatility). Thus far, the volatility in Hercules’ stock price has created some interesting entry points and been somewhat easier to tolerate considering the big steady dividend it has historically paid (it IPO’d in 2005 and the company was founded in 2003). Also worth mentioning, it can be beneficial to add diversification to your income-focused investment portfolio, and Hercules can often accomplish this because most bigger-dividend yield corners of the market are not invested in venture stage opportunities (like Hercules).

Interest Rate Risk

As mentioned, Hercules pays nearly 100% fixed rates on its own borrowing, but its portfolio companies pay Hercules floating rates on their loans/debt. For this reason, Hercules is increasingly attractive as interest rates have risen this year (and are expected to keep rising). However, if rates don’t rise as much as expected, or even fall, Hercules share price could be a little bit ahead of itself.

Valuation

Price-to-book value is one of the most common ways to value BDCs (and to value financial stocks in general) and Hercules traditionally trades at a premium to its book value. According to the company, it traded at 1.43x as of July 26, 2022, and has historically traded in a range of 1.1x to 1.7x. As of today, the price-to-book value is around. 1.46x, which is near the higher half of the historical range and expensive versus peers. However, Hercules does offer unique venture stage growth opportunities. Venture and high growth assets have sold off hard this year (and so has Hercules). Depending on your view of the economy going forward—this could be an attractive time to buy. However, in the long-term we believe Hercules business is strong and will thrive.

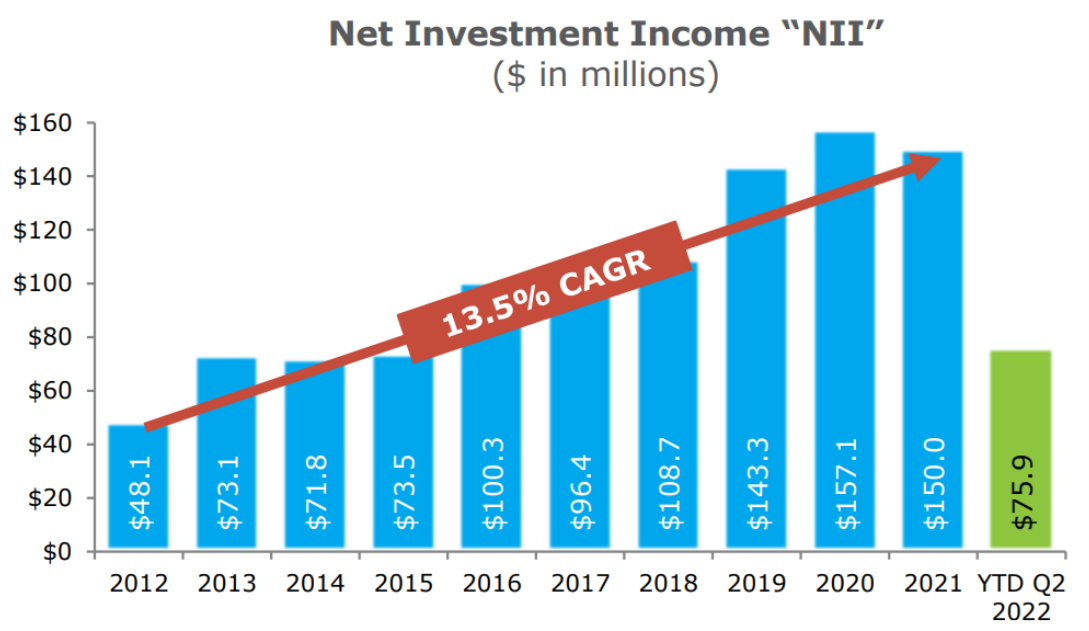

Also, Hercules continues to generate strong Net Investment Income, a key consideration for a BDC.

You can also get a feel for the magnitude of sell off that can occur during times of tumult, such as the beginning of the pandemic in 2020, in the chart below.

Keep in mind also that Hercules big dividend payments can help investors stomach the share price volatility that can occur. Just know that the dividend also has some volatility to it. For example, you can see Hercules dividend history in the following chart.

Some investors despise dividend volatility (particularly to the downside). However in our view the reality is that increasing and decreasing the dividend (based on market and business conditions) is prudent and it actually makes the business stronger and healthier in the long-term (not to mention, sometimes it’s just the nature of a BDC). The reality is some businesses will hurt their business over the long-term because they are so focused on maintaining the dividend over the short term. We are comfortable with the historical mild ups and downs to Hercules’ dividend, and we actually believe this makes management more attractive.

Share Dilution

Another thing to keep in mind (if you are going to own HTGC) is that your ownership of the company will be diluted if you take the dividends as cash (not necessarily a bad thing, just something to keep in mind). Specifically, the company issues new shares (almost always at a premium) to pay the dividend (as more shares) through its DRP Program. You can opt to receive the dividend as cash instead, but many investors prefer to simply receive more shares.

Conclusion:

Overall, we view Hercules as an attractive long-term high-income investment. It can get many investors access to market sectors they don’t normally invest in (prudent diversification can be a very good thing). Further, growth and venture have sold off this year (including Hercules) thereby making for a lower entry point to purchase shares. Further still, if rates keep rising—Hercules is in good shape (double good if the market recovers). The valuation (price-to-book) is not cheap by historical standards (and there are other risk factors, as described above), but Hercules is a well run internally managed opportunity. We do not currently own Hercules, but we like the business, and the shares are high on our watchlist for our Income Equity Portfolio. If you are a long-term income-focused investor, we believe Hercules is absolutely worth considering for a spot in your prudently-diversified portfolio.