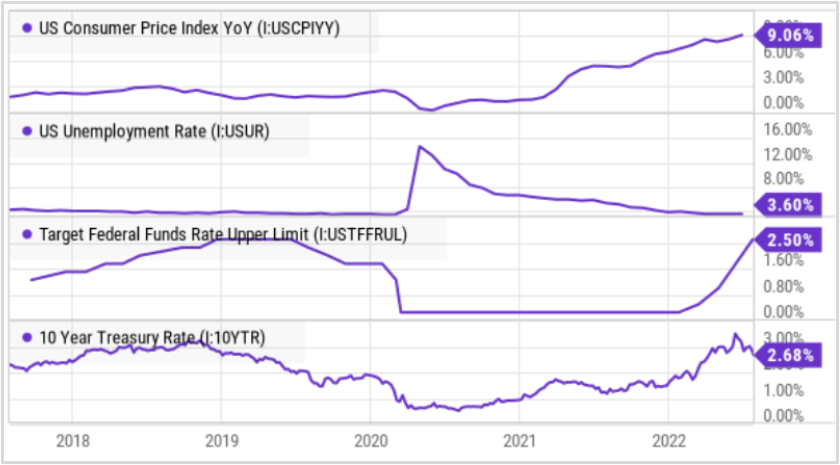

Stocks have posted strong gains over the last 3-weeks, but a lot of investors remain fearful that this year’s painful downtrend will resume. After all, inflation is sky high (9.1% CPI), the fed is expected to hike rates another 50pbs (possibly 75bps) at its next meeting (which will slow economic growth), and the 10-year treasury yield (2.68%) has dipped (over the last 3-weeks) and remains inverted versus the 2.85% 2-year treasury yield (a strong recession indicator).

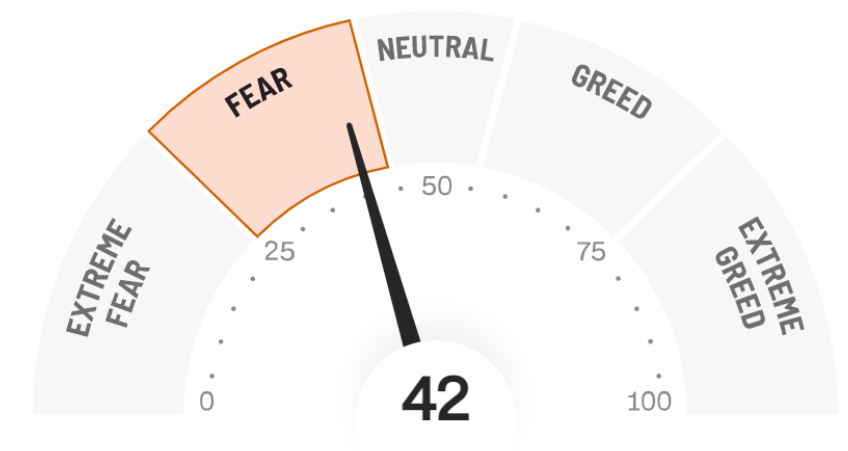

As you can see in the graphic above, and despite recent S&P 500 gains, the market currently remains emotionally driven by fear.

Climbing the Wall of Worry

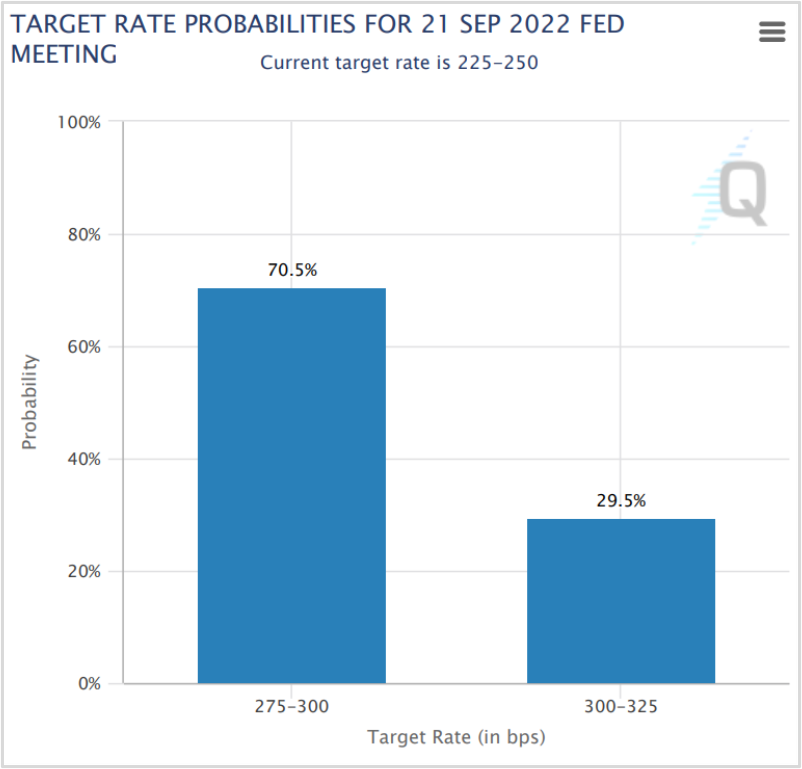

Despite ongoing fear, there are reasons to believe the market has actually turned to corner. For starters, even though the fed is expected to raise rates 50bps at its next meeting (in September)…

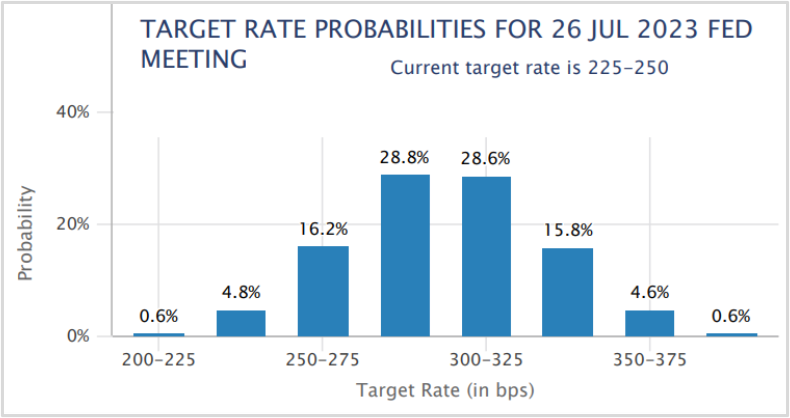

…that may be the end of the interest rate hikes that have been designed to fight inflation, but also have the side effect of slowing the economy and the market. For example, here is the expected fed funds rate in July of 2023…

…and as you can see, rates are not expected to rise much higher following the next big hike from the fed (which is largely already priced into the market).

If you don’t know, the fed’s dual mandate is to keep unemployment low (which it already is, as you can see in the chart below) and to keep inflation fairly low (which it is not, but will likely tame soon as the pandemic inflation bump will likely subside—especially considering the slowing economy).

Furthermore, the 10-year and 2-year treasury rates are already trending lower in anticipation that the fed cannot raise rates much higher (the fed funds rate is already 2.25% to 2.50%). And as a reminder, it’s the sharp increases in rates that have been slowing the economy (and the stock market) and it is a good sign that indictors are suggesting the hikes are almost over (and the fed may even need to eventually bring rates down again to offset the negative economic impacts on the economy of the fed’s latest inflation fight). Said differently, there are reasons to be more positive about the market, despite the high current levels of fear.

The Bottom Line

Despite the persistent high levels of fear, there are reasons to believe the market has turned the corner. Although no one can accurately predict the short-term market moves, and things can still get much worse in the short-term. The long-term outlook has improved. Stock prices are down, and now is a better time to invest than the start of this year.

However, rather than trying reactively predict short-term market moves, it’s better to invest for the long-term based on a strategy that is right for you. For example, our Blue Harbinger Disciplined Growth portfolio has massive long-term upside potential from here—just know the volatility will also remain high. And our Income Equity Portfolio also has significant long-term upside from here—and with less volatility thanks to the steadier more “blue-chip” nature of those companies plus the steady dividends they pay.

At the end of the day, you need to select an investment strategy that is right for you in terms of volatility, income and your own personal psychological disposition (i.e. how much volatility can you handle before you start panicking and making short-term mistake that will hurt your long-term performance).

Disciplined goal-focused long-term investing is a winning strategy.