Preferred shares can offer big-yields and less risk than common shares. And given the current market environment, some preferreds are offering particularly compelling opportunities as prices are down, yields are up and underlying businesses remain relatively healthy. This report gives a little more information on preferred shares, and then concludes with three examples that are particularly compelling investments for income-focused investors right now.

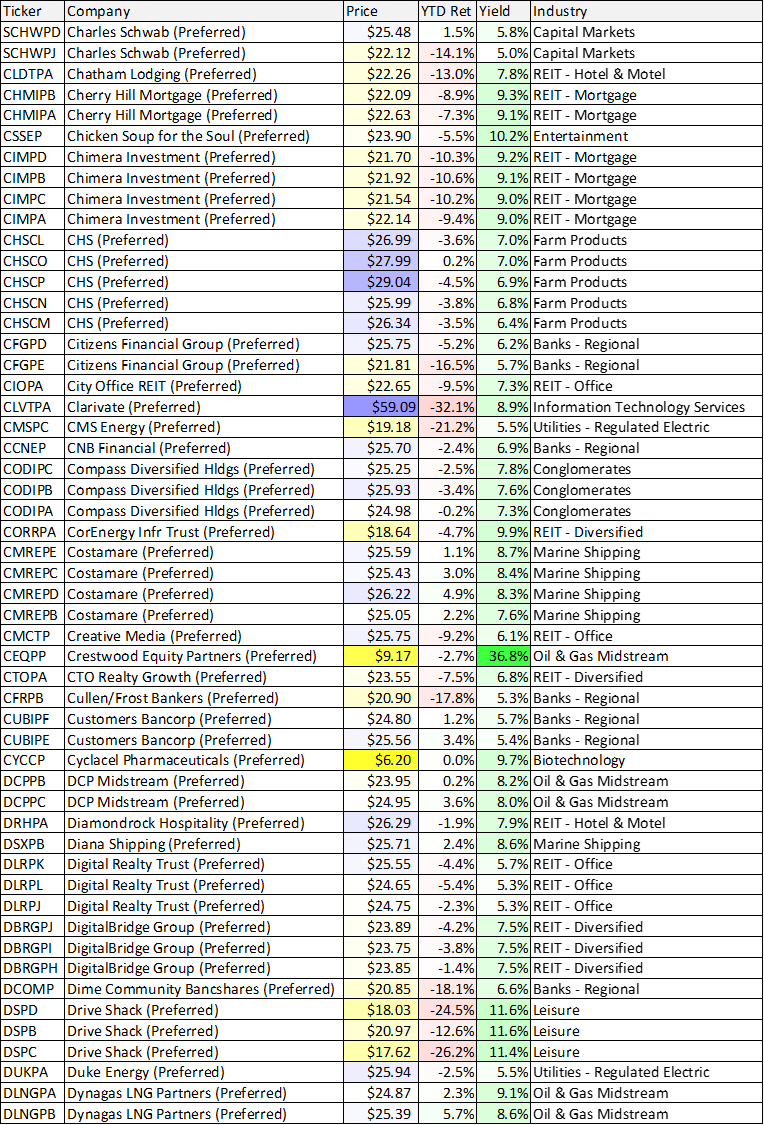

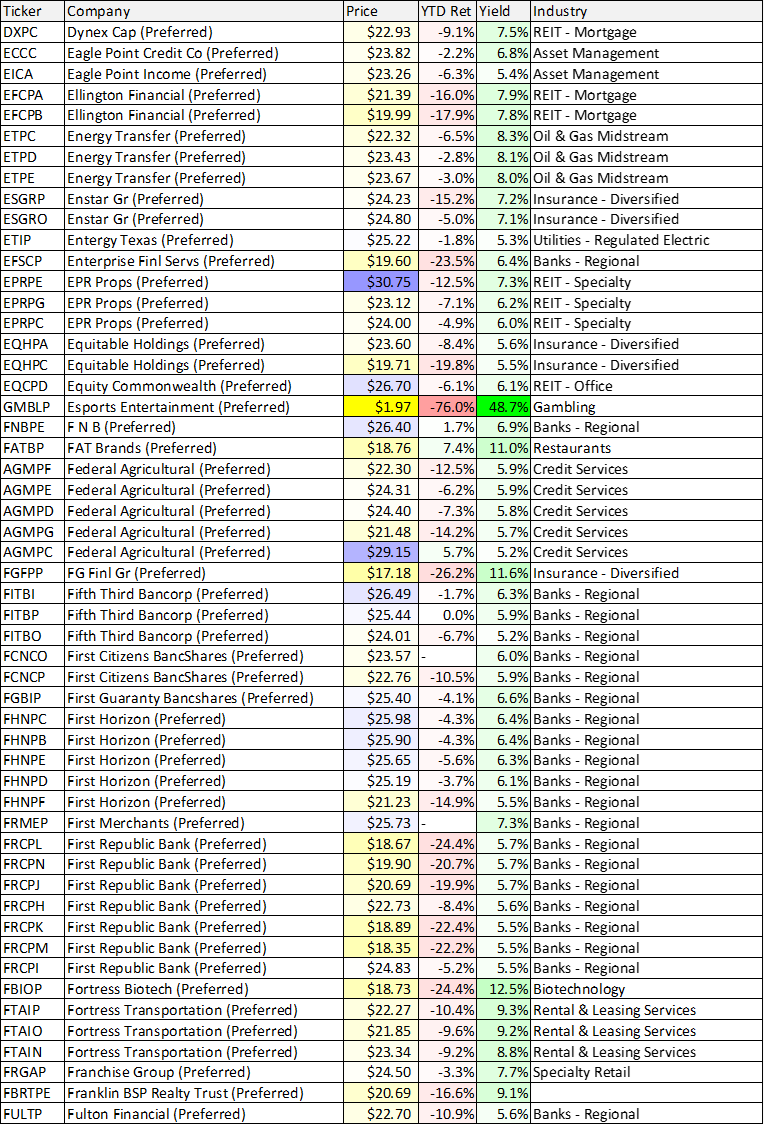

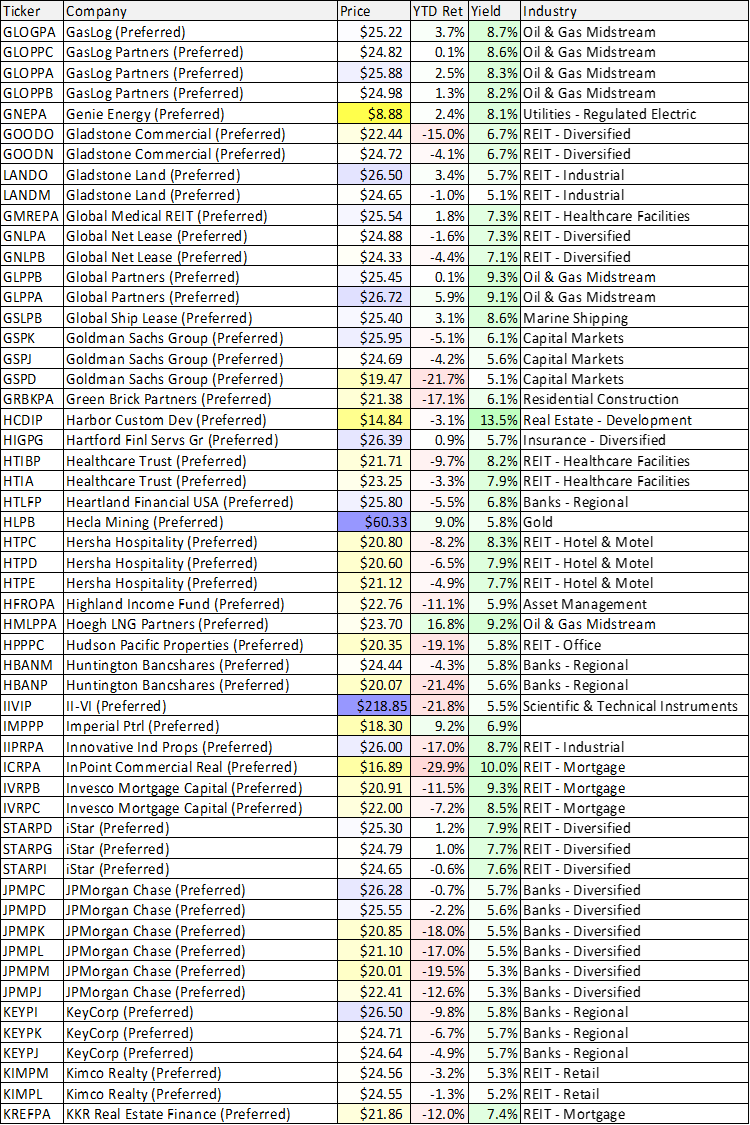

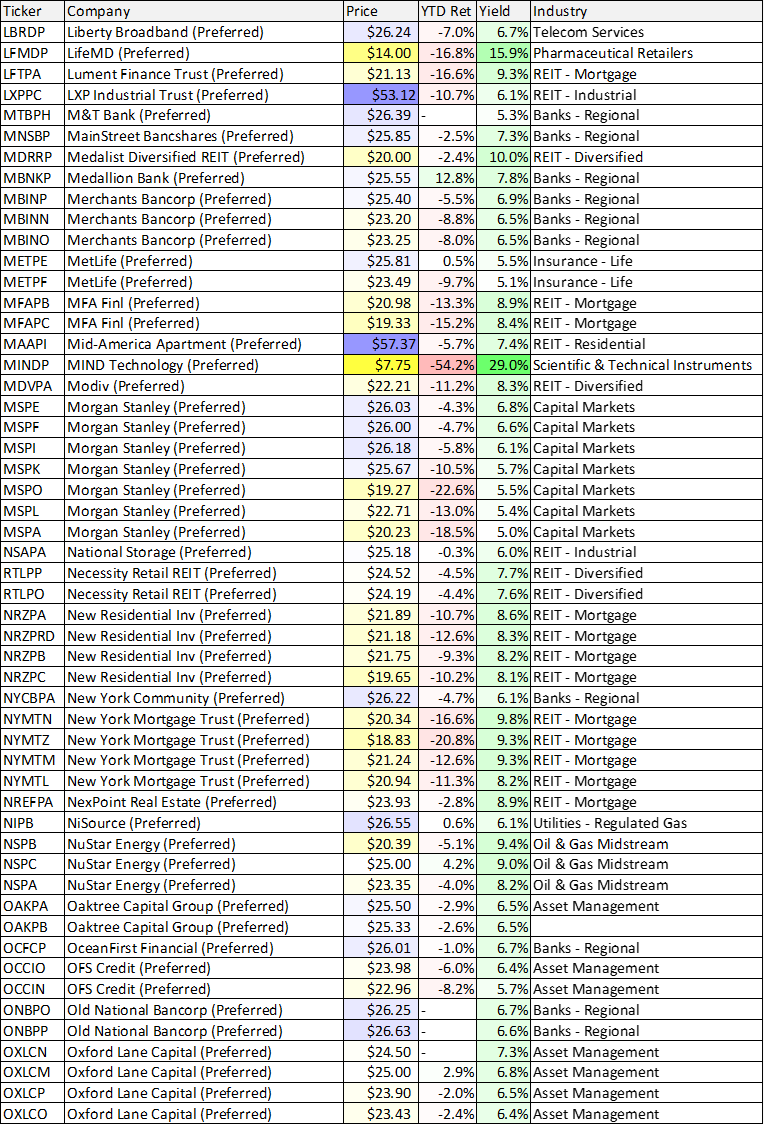

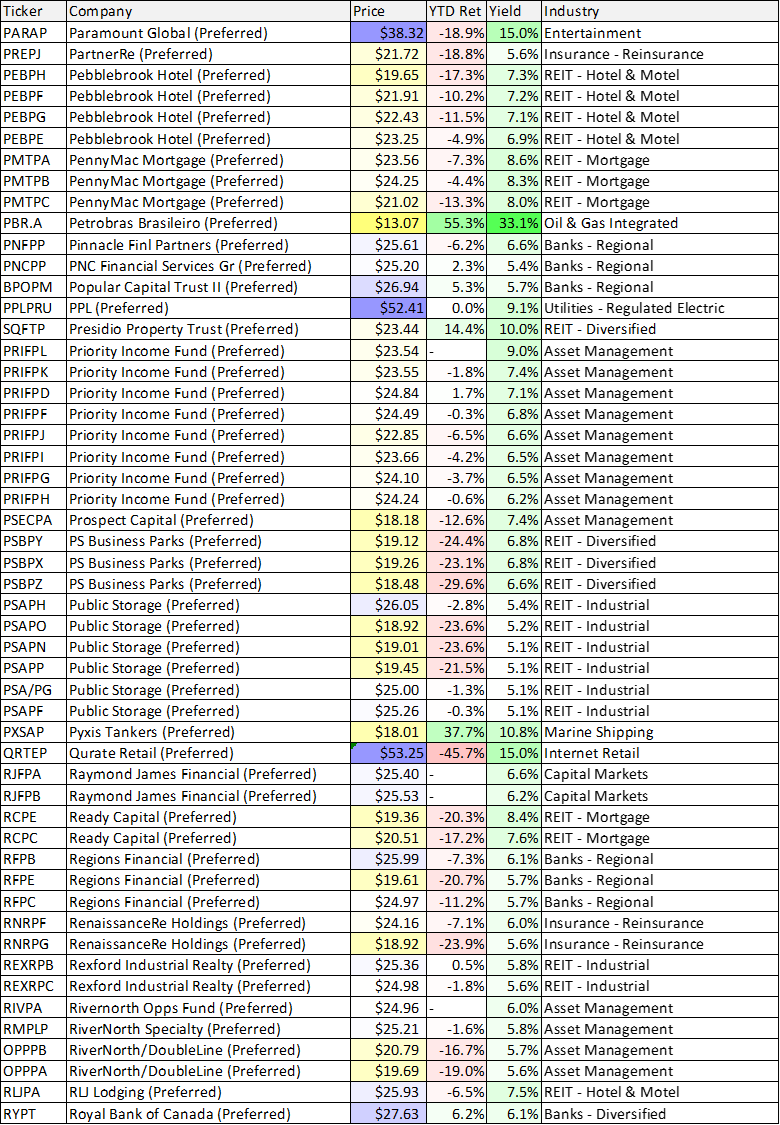

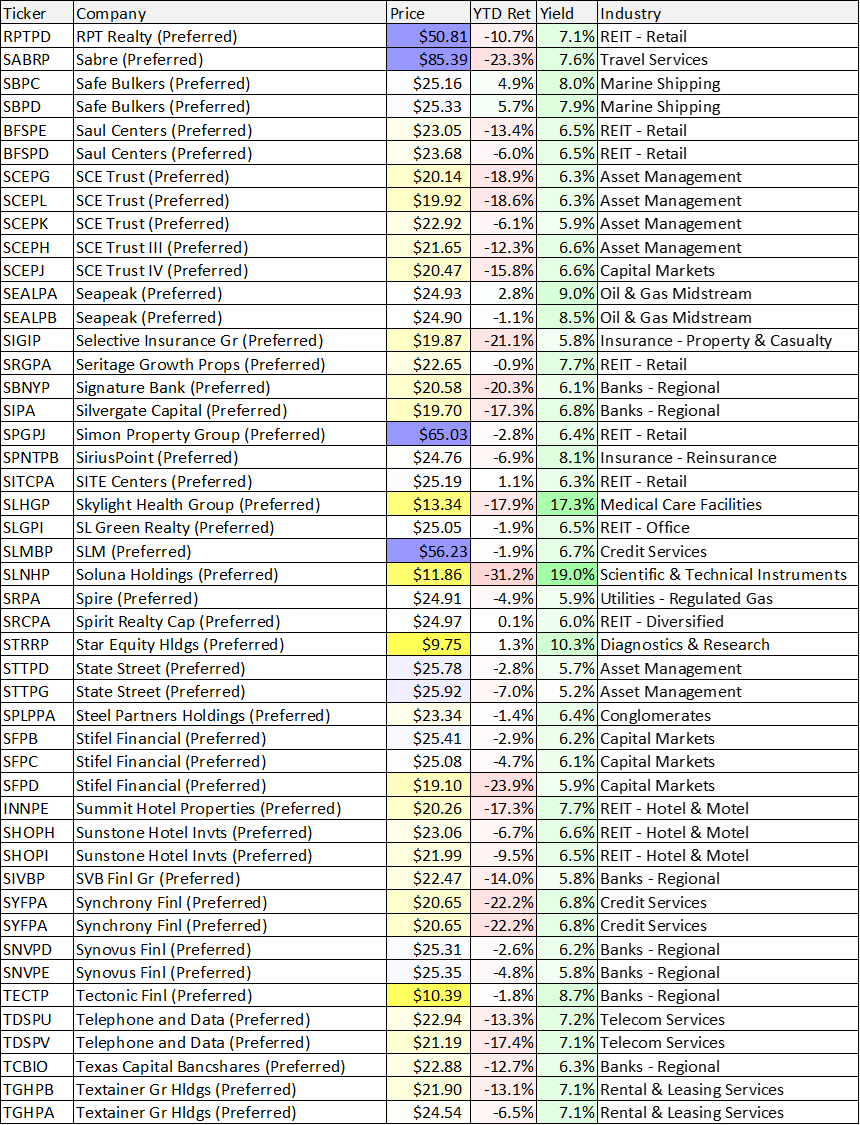

For starters, there are a lot of preferred stocks to choose from. For example, here is data on over 400 as of Friday (the last trading day of July).

How to read the list:

In the price column, the brighter the yellow—the lower the price. And the brighter the indigo, the higher the price.

In the year-to-date return column, the brighter the red—the worse the performance. The brighter the green—the better the performance.

In the yield column—the brighter the green—the higher the yield.

As you review this list, you may see a few names you are familiar with.

How Preferred Stocks Work

Preferred stocks are a hybrid between common equity (which is lower in the capital structure—more risky) and bonds (which are higher in the capital structure—less risky). Preferred stocks often stipulate a potential future redemption price by the company (often $25 per share) whereby they are allowed to buy back the shares. This redemption price keeps the preferred share price from ever rising too high (they don’t have as much upside as common shares), and the redemption price also introduces some interest rate risk (as interest rates rise—like this year—preferred share prices generally fall). Additionally, preferred share prices can fall when the market perceives the risk to be high (for example, the underlying company could go bankrupt and not pay back the preferred shares at all).

3 Big-Divided Preferreds Worth Considering

Generally speaking, we like to invest in preferred stocks that are backed by strong businesses and that trade below $25 so there is some price appreciation (although we don’t mind paying slightly above 25 if the yield and the business is right). We also like to review the specific rules and stipulations of each individual preferred stock at QuantumOnline.com. For example, click on the tickers at this link for the rules on each individual AGNC preferred stock.

1. Triton International (TRTN-D), Yield: 7.0%

Triton is the leader in the leasing of shipping containers, and the preferred shares are attractive. They trade just below $25, and they are supported by a very strong business. We recently wrote up Triton in great detail here, and if you are looking for a high-income opportunity, Triton Series D shares are worth considering.

2. AGNC Investment Corp (AGNC-P), Yield: 7.3%

AGNC in a mortgage REIT (i.e. they own mostly agency-backed mortgage securities), and the preferred shares are compelling. For example, the 6.125% AGNC-P “Fixed-to-Floating” shares are attractive because they offer a high yield, trade at a low price and are backed by a business than can continue to operate. An important stipulation of these shares is as follows:

“From and including 04/15/2025 at a floating rate equal to Three-Month LIBOR plus a spread of 4.697% per annum.”

This can turn into a compelling floating rate dividend on 4/12/2025 or they could get redeemed at $25 before then. We recently wrote up a detailed report on AGNC here. And for these reasons, AGNC preferred shares are attractive in our view.

3. Tsakos Energy Navigation (TNP-E), Yield: 9.5%

Tsakos provides seaborne crude oil and petroleum product transportation services worldwide. We have owned Tsakos preferred share in the past, and they are tempting again now considering the share price has fallen, the yield has risen, and the company continues to have the financial wherewithal to support them. The shipping industry is attractive as the world continues to get better at dealing with the pandemic and as the threats of a global recession are already largely priced into the shares. At the current price, Tsakos preferred shares are attractive.

The Bottom Line

Preferred shares are not for everyone. However, if you like high-income payments and don’t mind giving up some price appreciation potential, preferred shares can be a valuable part of a prudently diversified portfolio. And considering many preferred share prices are down this year (and yields are up), it can be an increasingly compelling time to add a few shares of attractive preferred stocks to your strategy.