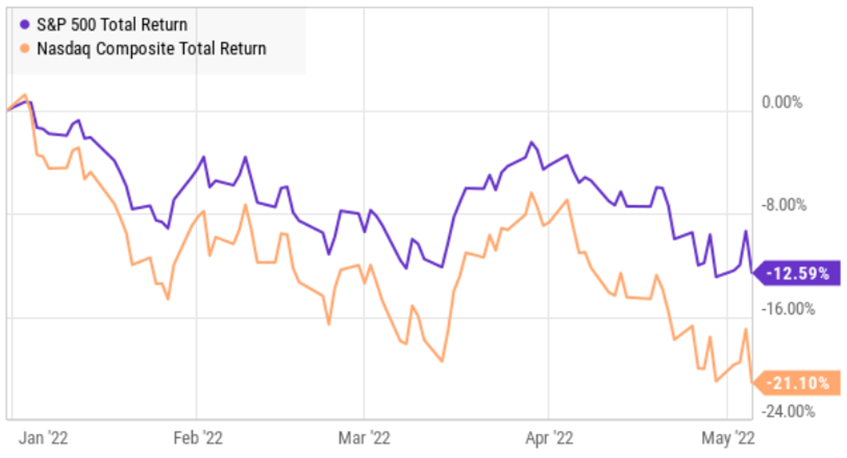

The markets are down this year. A lot. The S&P 500 has declined 12.6% and the Nasdaq is down 21.1%. And we just had our sixth consecutive down week for the Dow.

What’s Happening?

It’s a combination of things, but in short: The chickens have come home to roost. Easy money and stimulus from the US Federal Reserve (and from various fiscal policies) have made inflation intolerable (sky high inflation numbers are the delayed result of easy money).

To be completely honest, it’s not just easy money following the onset of the pandemic in 2020, but it’s also the lingering impacts of easy money (low interest rates and government spending) since the 2008-2009 financial crisis.

A New Market Paradigm

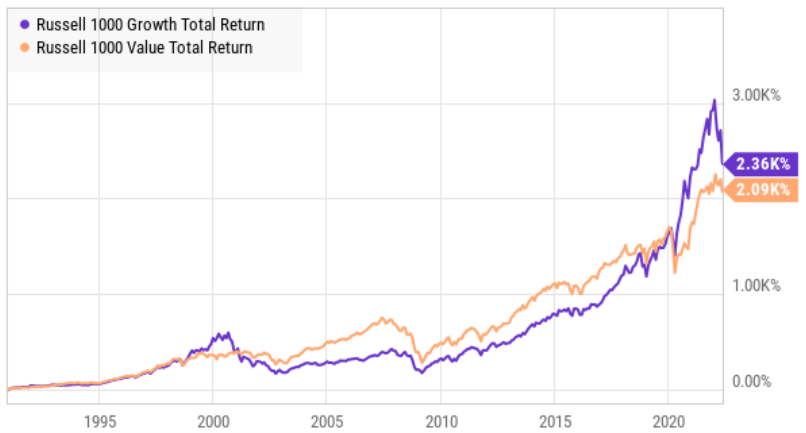

Growth stocks had been outperforming value stocks for the last 5+ years. Until this year. Year after year, value investors had been screaming that growth investors are fools for paying such high valuation multiples for their stocks.

Similar but different than the tech bubble that crashed two decades ago, the growth stocks of this mega cycle have powerful revenue growth, and in some cases actual earnings, but the valuation multiples (such as price-to-revenue and price-to-earnings) has elevated to very high levels in recent years. Again, the chickens may finally be coming home to roost.

How Bad Can it Get?

Things can still get worse. To paraphrase Benjamin Graham, the market is a voting machine in the short-term and a weighing machine in the long-term. For years, the market has been voting for growth stocks (perhaps courtesy of the massive tribes and wolf packs that have formed on Twitter and Reddit). But if the narrative is finally shifting (and why wouldn’t it be if rates really are going to be raised as much as the market expects), then growth stocks can continue to get pummeled as the narrative pendulum could swing in the other direction. And as the existential stagflation (low growth and high inflation) threat looms, things really could get ugly.

What Should you Do?

Most arguments between market participants stem from those with differing investment time horizons. For example, if you thought you had saved just enough to retire this year, but now the market is down big-time, you are feeling an entirely different set of pressures than the 28-year-old just starting to stuff money away in his 401K.

Some Perspective

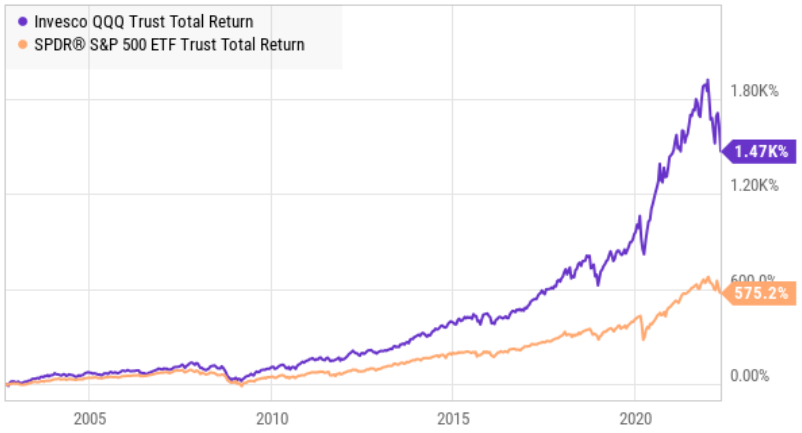

Here is a look at how bad things got when the Tech Bubble burst (the Nasdaq was down around 80%).

But if you had just held on, the Nasdaq did extremely well in the years that followed.

Of course, if we step back in history a couple decades further, the yield on a 10-year treasury bonds was over 15% in the early 1980’s following the ugly stagflation of the 1970’s (it’s only around 3% now). That’s a big difference, and it has a very big impact on investment style valuations.

The partial truth of “Market Beta”

Market beta is a measure of how an individual asset (such as a stock) moves (on average) when the overall stock market increases or decreases. For example, when the market is up a lot, a high beta stock is up even more; and when the market is down a lot, a high beta stock is down even more. A lot of growth stocks today have high betas, and as the market has sold off hard this year, they have sold off even harder.

One big problem with beta is that it is backward looking (it’s based on past data and individual company fundamentals may have changed). Another problem is more psychological; specifically a lot of investors say they can handle the volatility when everything is going up, but then they panic and head for the hills when the market is down. 2022 has been particularly challenging for high-growth investors that have seen their portfolio values in sharp decline.

The Bottom Line

Investing comes down to knowing your long-term goals and then sticking to your strategy. That doesn’t mean being stubborn (market conditions do change), but it does mean avoiding psychological mistakes. My bet is that if the pitch of market declines gets much louder, the Fed will be forced to bow to political pressure, stagflation so be it. As Charlie Munger recently explained, his assumption is that in the long-term the US dollar is going to zero:

“Inflation is a very serious subject… You can argue it’s the way democracies die… The safe assumption for investors is that over the next 100 years, the [fiat] currency is going to zero... that's my working hypothesis."

The dollar is unlikely to go to zero this year, this decade or even over the next 5 decades (although no one knows for sure). If you have a 10-year investment horizon, now is a much better time to buy stocks than 5 months ago; and 10-years down the road you’ll likely be in dramatically better financial shape than you are now—that is assuming you can avoid the psychological urge to panic, sell all your stocks and run for the hills. Disciplined, goal-focused, long-term investing has proven to be a winning strategy over and over again throughout history, and the same will likely hold dramatically true this time again.