If you are into wide-moat, blue-chip, dividend-growth stocks, you might want to consider the impressive industrial stock in this report. It’s not a high-flying growth stock, nor does it offer a massive dividend yield, but it does have a healthy growing dividend (2.0% yield), ongoing share repurchases, strong operating margins and a business that is virtually impossible for competitors to replicate. It’s also a high book value business (which can be valuable in times of inflation). We will review this attractive business in detail in this report (including valuation and risks), and then conclude with our opinion on investing (we currently own shares in our income portfolio).

Overview: Union Pacific (UNP)

Union Pacific is a massive class I railroad company (its market cap is approximately $147 billion). It operates in 23 western US states, and connects its customers and communities to the global economy. It also offers strategic access to key west coast ports that connect the US to Asian freight. Railroads are one of the most fuel-efficient means of transporting freight by land (much more efficient than trucking for long distances).

The Business:

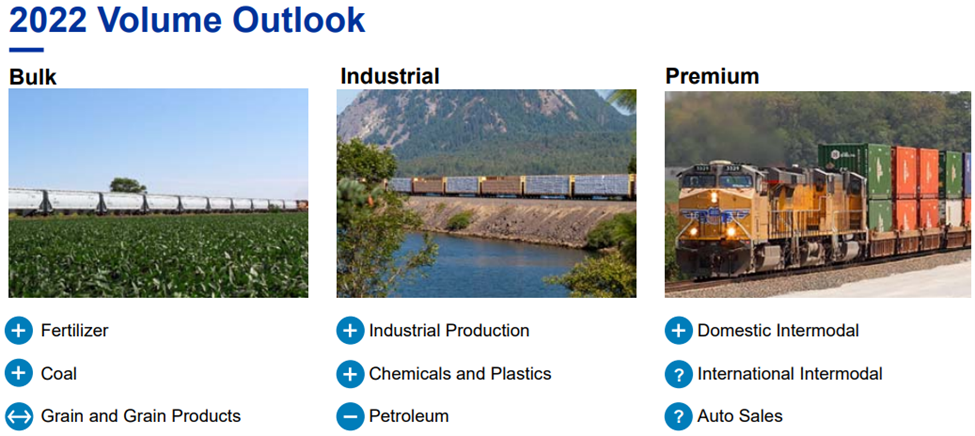

In its most recent quarterly earnings presentation (released on April 21st), Union Pacific provided the following 2022 volume outlook for its three main operating segments (you can see the segments (and sub-segment goods shipped) in the following graphic).

Notably, the Bulk segment includes commodities (the types of goods being especially impacted by high inflation), industrial and finally Premium (including the automobile segment that has been down due to chip shortage supply chain issues).

In that recent late-April earnings release, the company exceeded expectations for revenue growth and earnings, and forecasted solid ongoing growth in 2022.

The Moat:

An important consideration for UNP investors is to recognize that it is a wide moat business. The company gains practically insurmountable advantages over the competition because it has a massive network of railroad capabilities that would simply be impossible for competitors to recreate. Additionally, the company’s large size affords it scale efficiencies and operating cost advantages. Further still, there is significant long-term pricing power to UNP’s business which allows it to pass through (eventually) rising costs due to inflation, which is a particularly attractive advantage.

The Current Environment

For a relatively “boring” industry, there is a lot happening for UNP. For starters, supply chain disruptions and covid have shifted its business segments levels, ranging from auto manufacturer chip shortages to spiking prices for many of the commodities it transports. Further, spiking diesel fuel costs make railroad increasingly attractive versus trucking. Related, UNP boasts that “if just 10% of freight moved by America’s largest trucks was instead transported by rail, then the nation would save 1.5 billion gallons of fuel a year—the equivalent of taking 3.2 million cars off the nations highways. Further still, the company has been struggling lately to attract enough staff to handle all of its business. Also, as a company with a high book value (it is an asset-based and capital-intensive business with a lot of “property, plant & equipment), UNP ultimately can do well in a higher inflation environment.

The Dividend and Share Repurchases:

Two great ways for a company to return cash to its shareholders are through dividends and share repurchases. UNP offers a healthy 2.0% dividend yield, and has increased its dividend for the last 16 years straight. And during the recent quarterly call, UNP affirmed its target dividend payout of 45% of earnings (healthy and attractive). Further, the company returns cash to shareholders by consistently buying back significant amounts of its own shares (this results in a higher percent of earnings going to those that hold on to their shares). For example, in Q1 UNP repurchased approximately 11 million shares, which equals an approximately 5% reduction in shares outstanding (and the company expects a similar level of repurchases going forward).

The Valuation:

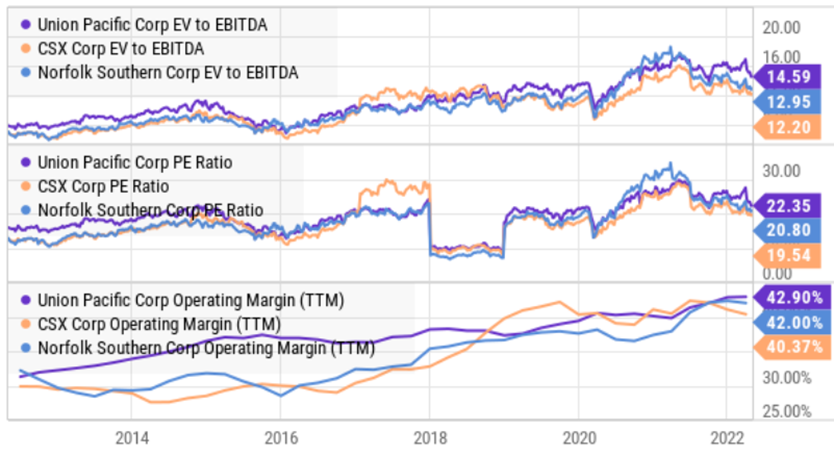

For long-term investors, UNP’s valuation remains attractive. While the EV to Forward EBITDA ratio of 13.8x may seem slightly expensive relative to other class I railroads (such as Norfolk Southern and CSX Corp), it’s quite reasonable for UNP considering its strong and improving operating ratio that has strengthened from 60.1% in Q1 2021 to 59.4% in Q1 2022 and forward guidance of 55% for 2022.

Of the 30 Wall Street analysts actively following the shares, they have an aggregate buy rating.

Risks:

There are some risks to UNPs current valuation. For example, the company continues to face significant challenges in terms of attracting and retaining enough labor. The after impacts of covid and wage inflation has put the company behind in this regard. UNP is working aggressively to hire staff, but attracting and training new staff takes time.

Another challenge is simply the challenges of supply chain disruption (particularly in automotive, for example) as well as long-term downward pressure on coal (a major commodity transported by UNP).

Further still, while the current valuation is not particularly unattractive (and the price has just dipped a bit in recent weeks), some investors prefer to wait for an even better (lower) price to purchase. In our view, the dividend helps make it easier to hold the shares, and UNP shares are going higher in the long-run.

To some extent, regulation remains a risk for the industry too. Particularly, the Surface Transport Board is a federal agency that regulates prices, and any stringent policy change could have negative impacts on UNP (although draconian disruption seems unlikely).

Conclusion:

UNP is an attractive wide-moat business and an attractive stock to own. Its strong cash flows, operational efficiency, growing dividend (and share repurchases) and pricing power are all highly compelling qualities. It does face near-term challenges with regards to staffing and supply chain disruption. However long-term, this business isn’t going away (because barriers to entry are unsurmountable and railroads are more cost efficient and friendlier to the environment than trucking). Long-term investors that own this stock, will wake up one morning to see these shares eventually trading at a much higher price. We are currently long UNP.