As the Fed continues on its path of aggressive interest rate increases (to tame inflation), infamous growth stock investor, Cathie Wood, says “equities and bonds seem to be warning the Fed that its policy measures could cause an economic and/or financial crisis.” Both stock and bond markets are down sharply this year (largely in response to the Fed), but there are reasons to believe things could be about to change (for example, high inflation rates could still prove somewhat transitory thereby making the Fed more receptive to the market’s growing taper tantrum), and now may be an attractive time to consider investing in select high-yield bond CEFs. In this report, we review one in particular that is increasingly attractive.

BlackRock Credit Allocation CEF (BTZ), Yield: 8.7% (Pays Monthly)

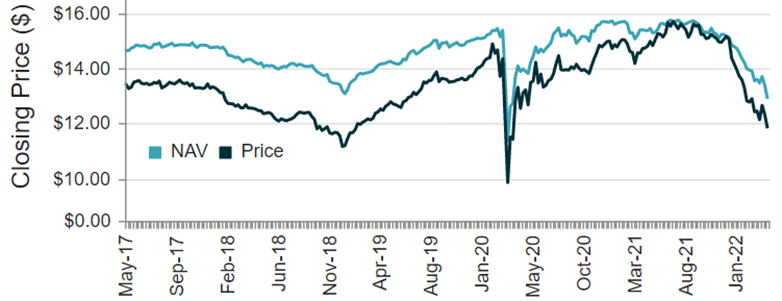

For starters, here is a look (above) at the Credit Allocation Income Trust (ticker BTZ) managed by perennial powerhouse, BlackRock (some investors consider BlackRock second tier relative to PIMCO, but they’re both head-and-shoulders above the rest in terms of resources and capabilities). Not only does this fund offer a strong 8.7% yield (paid monthly), but it trades at a significant discount to net asset value (“NAV”), and that alone should be enough to get a lot of investors’ attention.

Why is the Price Down?

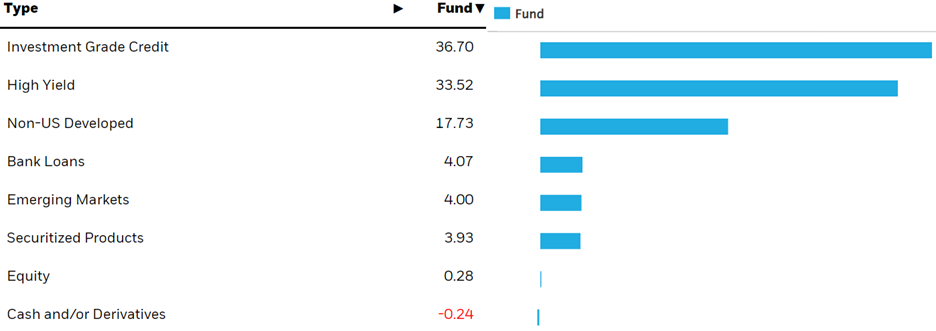

As interest rates rise, bond prices fall. That’s how it works. And with the fed on its aggressive interest rate increase trajectory this year (in response to high inflation numbers) that has put pressure on bonds across the board. If you have been holding bonds, you’re probably down. If you haven’t been holding bonds, the yields are now higher than they were, and the prices are down (contrarians generally like to buy when the price is down). For perspective, here is a look at the current holdings of BTZ by type (they’re basically all bonds).

Why the Discount to NAV?

Unlike open-ended funds (such as exchange traded funds and most mutual funds), closed-end funds (such as BTZ) don’t have an immediate mechanism to ensure the price stays very close to the underlying holdings, or NAV. In the case of BTZ (and anything else trading at a discount to NAV for that matter) if you added up the value of all the bonds it currently holds (it holds around 1,200 of them!) they are worth more than the price at which BTZ trades. That’s a potential “buy low” sign in many investors minds. And in the case of BTZ, the reason it trades below NAV is because frightened investors have been selling bonds so frantically (they fear the fed) that the price of this CEF has fallen more than it should have (again the NAV is higher than the price). This can’t happen for open-end funds, mainly just closed-end funds, such as BTZ.

Also worth mentioning, if you look at the price history of BTZ (in our earlier chart), it has traded at a discount frequently as investors often shun BlackRock CEFs (more likely to trade at a discount to NAV) in favor of PIMCO CEFs (more likely to trade at a premium), and this has resulted in a very attractive long-term return stream for many BlackRock CEFs.

Also very important to note here, bond prices (i.e. the stuff BTZ holds) don’t trade based on the Fed’s current interest rate, they trade based on the market’s expectation for future interest rates. So just because the Fed is expected to keep raising rates in the near future, bond prices already reflect those future expectations (this is why bond prices are down so much); and if the Fed doesn’t raise rates as much as the currently fearful market is already pricing in, then BTZ is even more undervalued, and will enjoy a price increase if/when the Fed doesn’t raise rates as dramatically as the fearful market currently expects. The combination of market fear (over rising interest rate expectations, thereby driving NAV lower) and market fear (selling pressures have driven BTZ’s price below NAV), have made the current price of BTZ particularly low and interesting.

So when will the price of BTZ rise?

You should run away (don’t walk) from anyone that tells you they have a working crystal ball that accurately predicts future interest rates. But with history as a guide (for example, the significant price declines for BTZ in our earlier chart at the end of 2018 when the Fed was last previously expected to keep hiking rates aggressively, but didn’t actually follow through), the bond markets could be due for a rebound. Also, extreme panic at the onset of the Pandemic in 2020 also made for an extremely attractive buying opportunity in the bond market (again, see our earlier price chart).

Taper Tantrum

During the 2008-2009 financial crisis, the Fed became the main show as their aggressive interest rate cuts and other creative stimulative activities (for example, quantitative easing through massive bond buying in the open markets) had the ability to turn the market on a dime (at least in the short term). Every time the market got overly “fed up” with the Fed’s action (or lack-there-of) the Fed would step in and ease the market’s fear with aggressive short-term policy shifts. And a lot of signals (including warnings from investors such as Cathie Wood, as mentioned earlier in this article) indicate that we could be increasingly “due” for the Fed to respond to the market’s most recent taper tantrum (the market has been selling off hard due to the Fed’s aggressively hawkish policy activities) with less “interest-rate-hawkish” policies, which could send the market (stock and bond prices) higher. Especially considering the Fed’s very hawkish activities are due to their fears about high inflation (which could still prove to be somewhat transitory and relatively short-term considering high inflation is (in large part) just an obvious result of absurdly dovish monetary and fiscal policy (easy money) to address the pandemic, which we are over (at least for now, as lock downs have largely ended, supply chain challenges are starting to clear up, and people have by-and-large gone back to work).

At the very least, BTZ shares are cheap from a contrarian standpoint (buy low) and the yield is high (attractive if you are focused on income).

Other Attractive Things about BTZ

As mentioned, we like BTZ because of the discounted price and high yield, and because of the massive resources and capabilities of BlackRock in general (this significantly reduces idiosyncratic risks as compared to other smaller CEF providers). We also like that BTZ has much more reasonable management fees as compared to others (such as PIMCO). BTZ’s management fee is around 0.87%, which isn’t bad considering BlackRock is giving you access to a portfolio of attractive bonds that you simply couldn’t get access to on your own because you don’t have the scale. The fund also uses around 33% leverage (or borrowed money), which is common and acceptable for bond funds such as this (and it is lower than the 40% leverage used by comparable funds managed by PIMCO).

Also noteworthy, some investors don’t like that the distribution payments (income yield) paid by this fund has some variability to it, and has occasionally included a small amount of ROC (return of capital, which can impact your capital gains tax if/when you sell, if you hold in a taxable account), but we are okay with these things because it works out from a total returns standpoint (income plus price appreciation) and because it is also an indication that this fund isn’t playing games with its yield like other funds do (some funds refuse to even slightly reduce the distribution when they should because they think it hurts investors’ confidence—which it shouldn’t—it’s usually the exact opposite).

The Bottom Line

BTZ is increasingly attractive from a high-income standpoint and from a contrarian price standpoint (it’s due for a rebound). No one knows where the market is going in the short-term, and the price of BTZ could still go lower. However, in the quarters ahead, we expect the most likely outcome is that the market gets better, interest rates don’t actually increase as much as everyone seems to fear, and the discounted price (versus NAV) of BTZ dissipates thereby boosting your price return—and that is in addition to the big 8.7% yield that BTZ pays monthly. We are currently long shares of BTZ.