I don’t trade often (because I believe in long-term investing), but recent market dislocation has created some very attractive buying opportunities. Year-to-date, the Blue Harbinger Income Equity Portfolio has significantly outperformed the S&P 500 (this has been due to its large overweight to very high-income securities, in particular). However, going forward, the strategy is now focused more heavily on steady dividend/income growth—through compelling blue-chip capital appreciation opportunities. This report has all the details.

Many New Buys

To get right to it, here is a link to the updated Income Equity Portfolio. The new purchases are highlighted in green.

Before getting into the details of the new positions, you may want to notice a few things:

Sector Weights: You can see the sector and aggregate sector weights for each position and the aggregate portfolio. Monitoring the portfolio’s aggregate sector weights can be a very important risk management technique. And while you will notice that some sectors are more heavily weighted than others, these sector weights are not dramatically different from the aggregate sector weights of the overall market (for example, technology is the biggest sector in the overall stock market (e.g. S&P 500)).

Portfolio Objective: You’ll note in the sheet that the portfolio’s objective is:

“Steady income and long-term capital appreciation by investing in blue-chip companies with earnings growth potential, attractive valuations (multiple expansion opportunity) and prudent capital allocation (including reinvesting in the business, dividends, share repurchase and strong balance sheet management).”

Dividend Growth: You’ll notice two dividend information columns in yellow. The first one is the current dividend yield, and the second one is the number of consecutive years the company has raised its dividend. While big current dividend yields are nice, a lot of times dividend growth is better because as the share price grows higher over the years, the dividend yield stays relatively moderate even though the actual dividend payments continue to grow larger and larger—year after year.

Market Caps: From a risk management standpoint, it can make sense to monitor your portfolio’s aggregate market cap exposures. We’ve broken this down into Microcap, Small Cap, Mid Cap, Large Cap and Mega Cap. And as you can see in the data, the Income Equity Portfolio consists mainly of mid, large and mega cap stocks.

Buy Under Prices: the buy under prices for each stock have been adjusted. As a reminder, we select the buy under price based on a variety of objective and subjective factors (such as valuation multiples, analyst price targets and our own opinion about the stock). The recommendations (such as “Buy” “Strong Buy” “Top Buy” and “Hold”) are updated in real time based on our buy under price and the current share price in the market.

Performance: You can view the performance of the Income Equity Portfolio (since the strategy’s inception) near the bottom of the page. Bear in mind, the actual Income Equity Portfolio is managed in a non-taxable retirement account, so if you are buying and selling in a taxable account—you’ll want to be sensitive tax consequences (e.g. capital gains). And if you are rebalancing in a taxable account, now can be a good time to do so considering the market has been down this year (although the Income Equity Portfolio is outperforming the market).

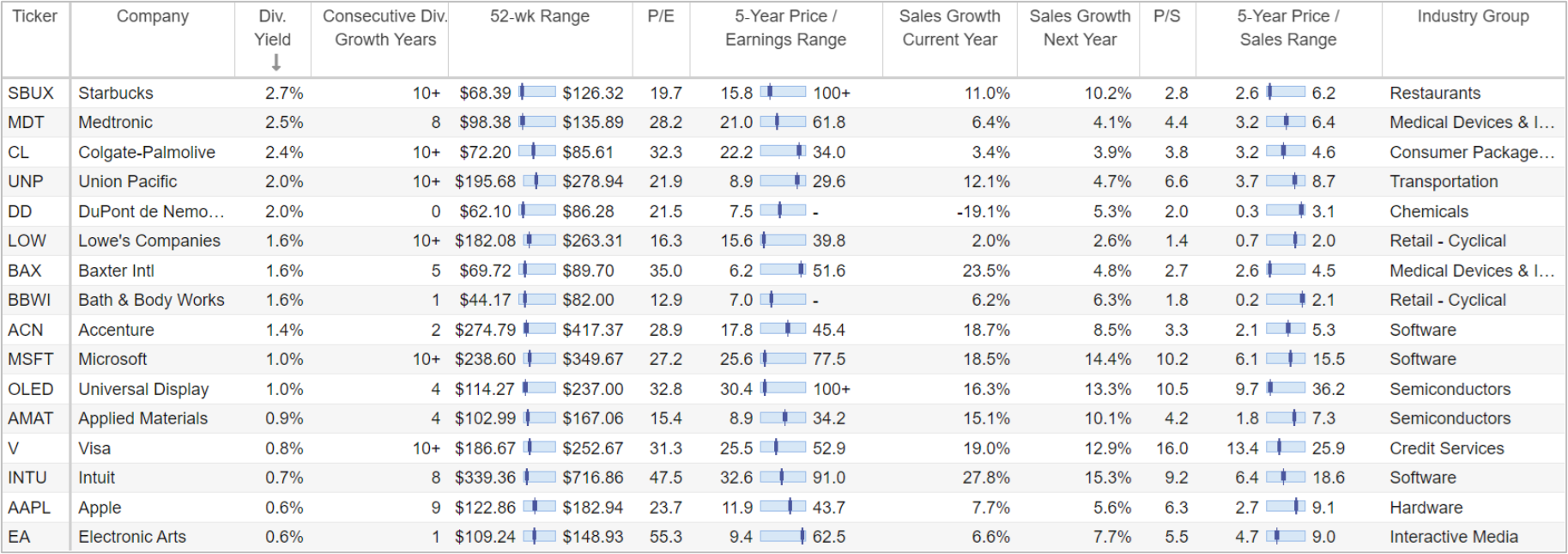

More info on individual positions: We’ll have more to say about the individual new buys in the portfolio in the future, but wanted to first share the new buys right away. For your reference, here is some additional data on each position that you may find helpful.

The Bottom Line:

We believe the Income Equity Portfolio is very well positioned for strong income growth and share price appreciation in the quarters and years ahead. The strategy has been working well this year (relative to the extremely ugly performance of the overall market) and we have taken this opportunity (created by market volatility) to reposition the portfolio for continuing success in the quarters and years ahead. We expect disciplined, prudently-diversified, goal-focused, long-term investing to continue to be a winning strategy.