With inflation screaming higher, the energy sector (and many commodity industries) have posted strong positive returns this year, while the rest of the market has languished. However recently, the financials sector (which is generally boosted by rising interest rates) is also starting to come on strong. And as the market continues to adjust to our starkly different macro environment (i.e., the Fed has shifted focus to battling inflation, which means increasing interest rates), what sector might be next in line for an upswing? Real Estate is worth considering, especially if you like a healthy dose of high dividend income to go along with the potential for compelling price appreciation. In this report, we share data on over 25 big-dividend REITs, including the ones we currently own.

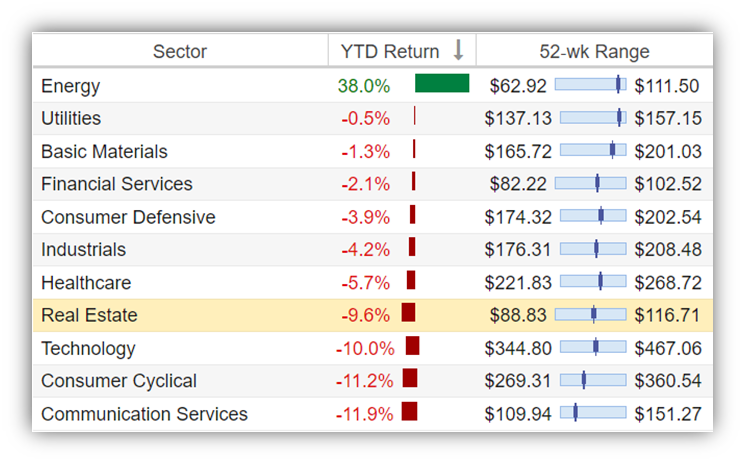

Sector Performance, Year-to-Date:

For starters, here is a look at sector performance, and as you can see—energy sits atop the list year-to-date. Inflation (caused by the easy money following the pandemic, combined with recent geopolitics) has skyrocketed energy assets (and other commodities in general).

And interestingly, the financials sector has made a bit of a run lately, making up some ground it lost earlier in the year as the Fed embarks on its aggressive interest rate increase schedule (financials generally benefit from high interest rates because it can improve their net interest margins). However, REITs may soon come into focus as they generally own physical assets (real estate) which can benefit from inflation (as a reminder, the most recent inflation reading (“CPI”) was 7.9% year-over-year—the highest level in over 40 years!)

Short-Term Versus Long-Term Investing

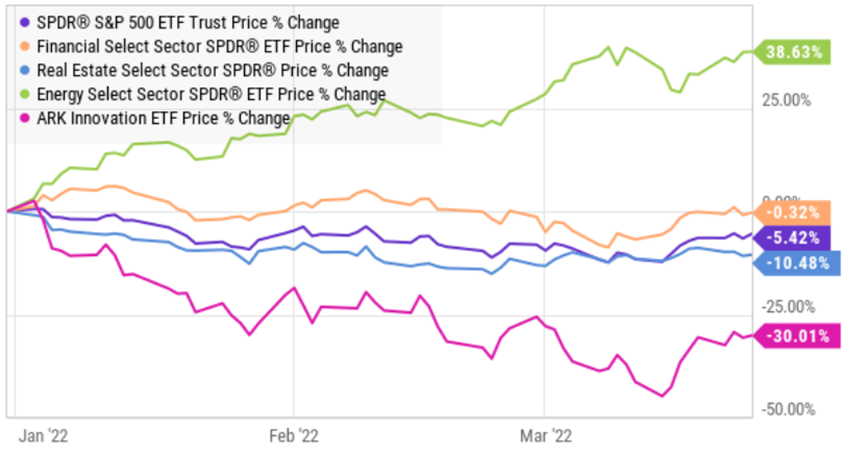

Most readers have likely heard the saying from Warren Buffett’s mentor, Benjamin Graham, that the market is a voting machine in the short-term and a weighing machine in the long-term. Undoubtedly, short-term voters pulled technology stocks dramatically higher following the initial onset of the pandemic (as their fundamental valuation metrics reached extreme levels). However, Fundamentals have regained steam as many “pandemic darlings” now trade dramatically lower (and more in line with long-term valuation levels).

But as the short-term media narrative moves from the “fear of missing out” (that drew so many investors to purchase shares of Cathy Wood’s now infamous ARK Innovation ETF (ARKK)) to panicking about inflation, certain inflation-favored assets classes could benefit. And that narrative trajectory could be exacerbated by the Fed’s now aggressive policy change (from post-pandemic stimulus, to now aggressively battling inflation).

For example, according to one highly-respected twitter handle (with more than half a million followers, @JonahLupton) that was frequently spot on with his interest in specific stocks during the pandemic, REITs are getting interesting. Specifically, in response to the dangers of inflation, Lupton recently tweeted, “I started buying REITs yesterday because they outperform equities during periods of stagflation.”

Fundamentals aside (for just a moment) if the high-speed Twitterverse latches on to the narrative that REITs are the inflation antidote, then look out above!

REIT Fundamentals

The notion that in the long term the market is a weighing machine is widely interpreted to mean fundamentals carry a lot more weight in determining stock prices over the long term (than they do in the short term), and from a fundamentals standpoint, REITs arguably have some very compelling qualities right now. Specifically, valuations have come down, select REIT businesses are particularly attractive at this point in the cycle, REITs spit off lots of cash (dividends) which can be particularly compelling as a bond alternative (because rising interest rates could drive bond prices down, while REIT prices could rise based on business strength and due to increasing property valuations due to inflation). We’ll get into more detail on a few specific REIT examples in a moment, but first let’s take a 50,000-foot view of the real estate sector in general.

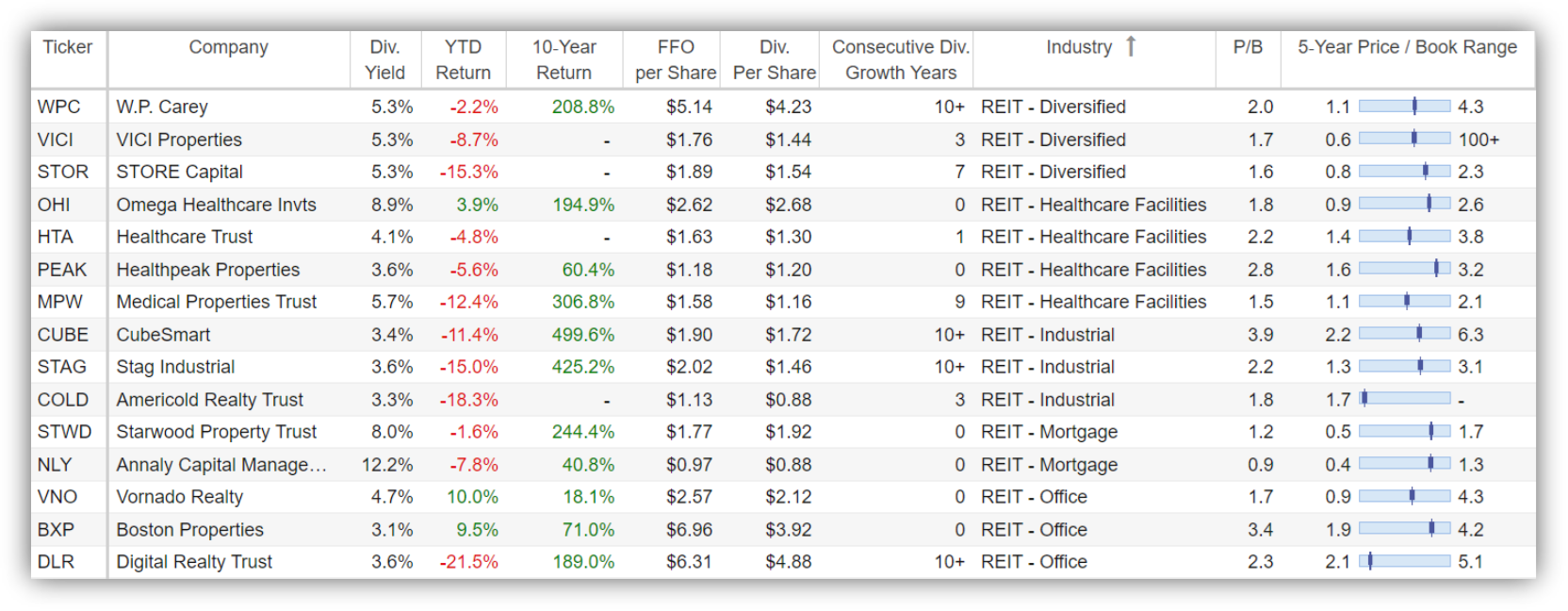

25 Big-Dividend REITs

Here is a look at a variety of metrics on over 25 big-dividend REITs, sorted by REIT industry (and including funds from operations (“FFO”), dividend per share and price-to-book value, among others).

As you can see in the above table, performance has mostly been negative this year (with a few exceptions), such as Iron Mountain (IRM) still attempting to make the transition further into data centers, a couple office REITs that have performed well as pandemic restrictions abate, and Omega Healthcare (OHI) which had already been beaten down badly (as it struggles with struggling operators).

We Own These REITs

Within our Income Equity portfolio, we currently own a variety of big-dividend REITs from the above list, including 12.2% yield mortgage REIT Annaly Capital (NLY), increasingly inexpensive data center REIT Digital Realty (DLR), Perennial favorite monthly-pay retail favorite Realty Income (O) (and Simon Property Group (SPG)), and diversified REIT (but increasingly industrial focused) W.P. Carey REIT (WPC). In our view, the group as a whole is due for some rebound (and increased favorability as the market narrative shifts). Also, not currently owned, but increasingly attractive, industrial REIT Stag Industrial (STAG) is hard to ignore after its market price declines this year, and Crown Castle (CCI) is also compelling as we recently wrote about in a members-only report.

Also, not included in the table (because their yields are relatively lower), industrial REIT Prologis (PLD) and Office REIT Kilroy Properties (KRC) are interesting (and we own them both) as one benefits from growing GDP and the continuing shift to online shopping (i.e. WPC) and the other is an office REIT with attractive properties and benefiting from the continued “post-pandemic” re-openings.

Conclusion:

REIT share prices are down, but select businesses remain attractive, especially as they could be the next sector set to benefit from increasing inflation. Obviously, not all REITs are created equally, and they can vary dramatically from one industry to the next. Regardless, many REITs continue to generate healthy and growing FFO that exceeds their healthy and growing dividend payments. And further still, REITs can be a highly important “basic food group” for your portfolio, especially if you are an income-focused investor.