Traditional valuation metrics (such as price-to-forward-earnings, and even gross margins) are better suited for evaluating mature blue-chip businesses. On the other hand, such valuation metrics leave a lot to be desired when evaluating nascent innovators—especially those with appropriately shifting business strategies and backed by massive secular trends. If you are looking for a steady-eddy dividend stock, this article is not for you. However, if you are looking for an increasingly attractive opportunity that is trading at a large discount to its compelling long-term potential, then this stock is worth considering, especially after the recent share price decline. In this report, we review the business strategy, the market opportunity, the valuation and the risks, and then conclude with our opinion on investing.

Overview: Stem Inc (STEM)

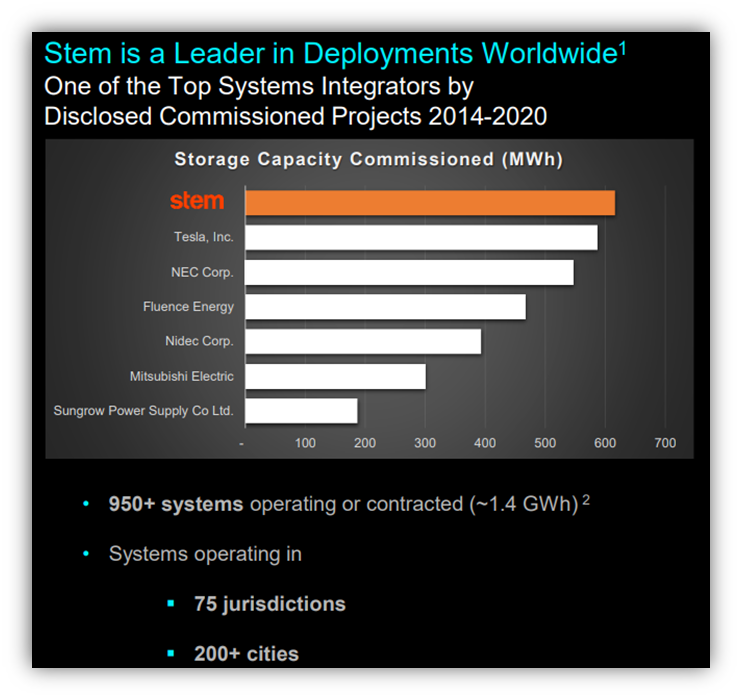

Stem delivers and operates smart battery storage solutions. These solutions maximize renewable energy generation and help build a cleaner, more resilient grid.

Customers include Fortune 500 corporate energy users, project developers and installers, and utilities and independent power producers.

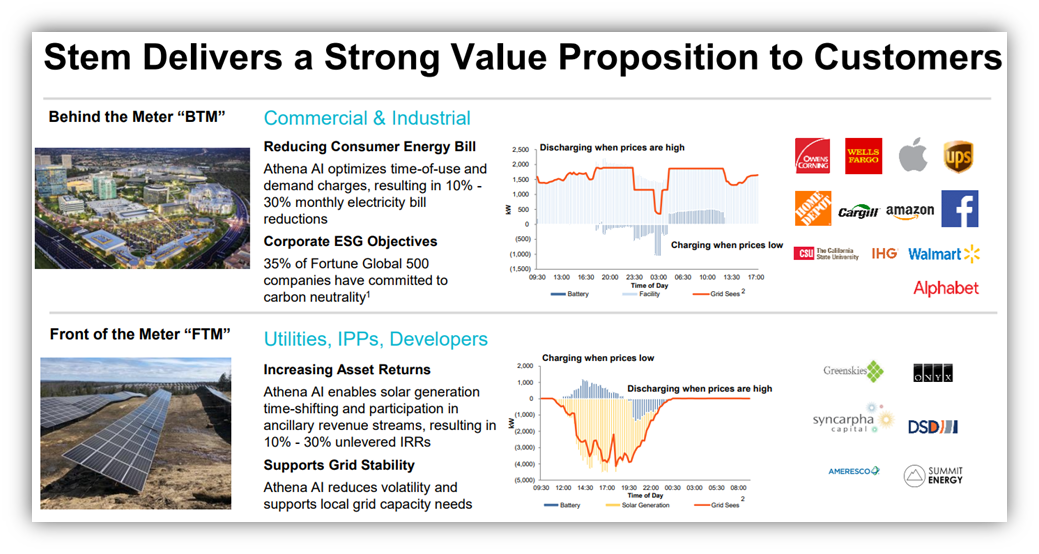

Stem’s market-leading Athena software uses artificial intelligence (“AI”) and machine learning to automatically switch between battery power, onsite generation and grid power. Athena helps lower energy costs, stabilize the grid, reduce carbon emissions, and solve renewable intermittency across the world’s largest network of distributed energy storage systems.

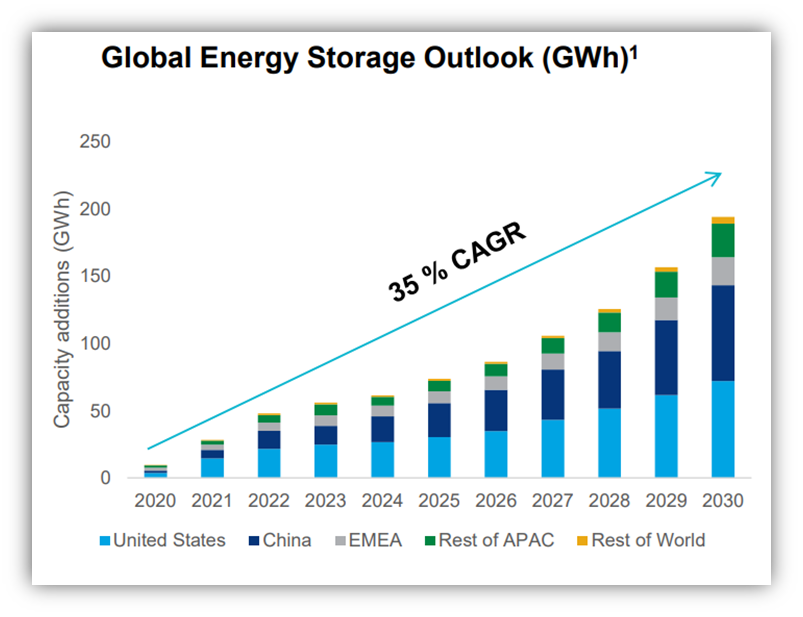

Stem is the first pure play smart energy storage company to go public in the US (April 2021), it is the largest smart storage network in the world with best-in-class technology, it has strong and highly visible growth through long-term software contracts, and it has a massive total addressable market growing 35x to $1.2 trillion by 2050.

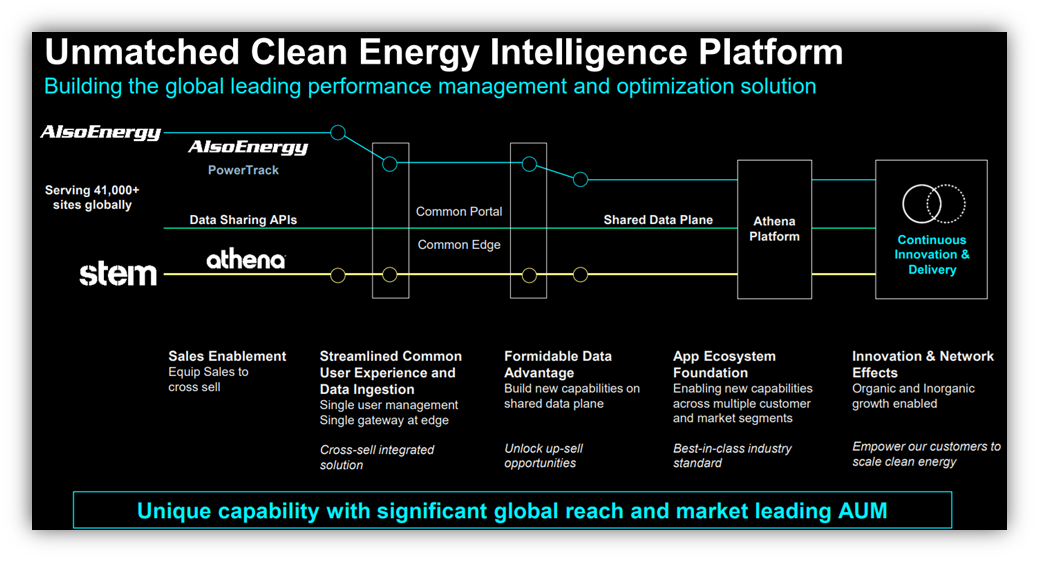

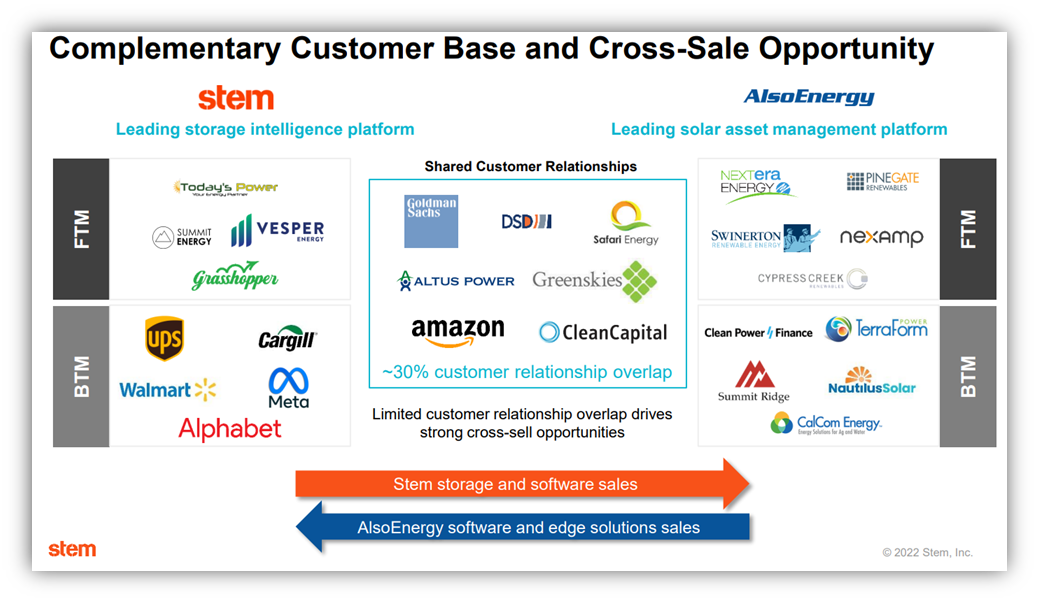

Also worth noting, Stem closed on its $695 million acquisition of AlsoEnergy (solar asset performance monitoring and control software) in February (for 75% cash and 25% stock).

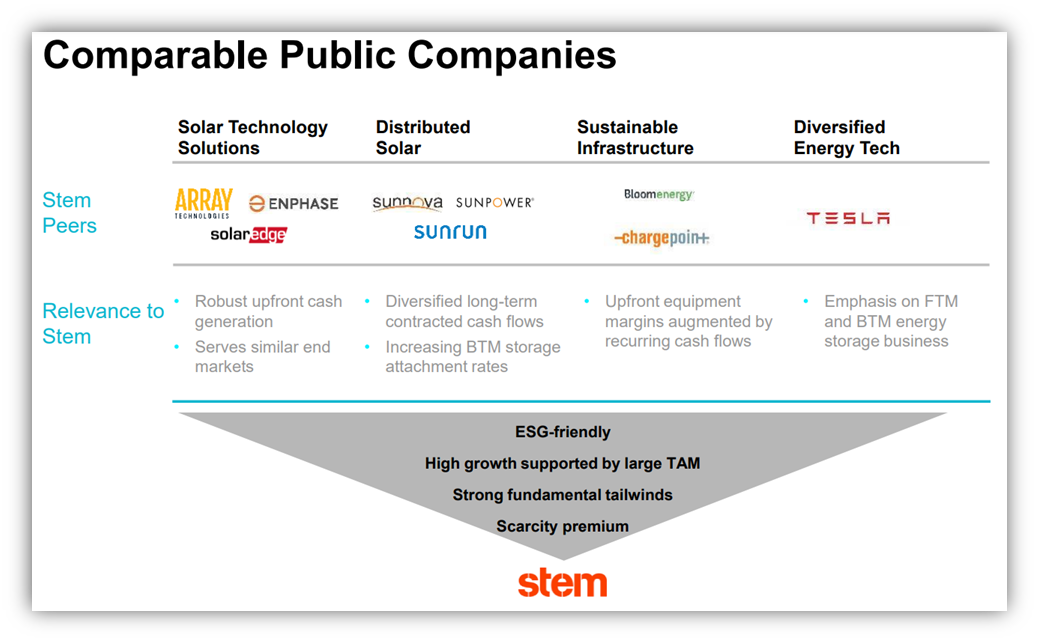

Additionally, Stem was recently awarded a project from Available Power with a value that is expected to exceed $500 million across the portfolio project. Stem also continues to add Athena verticals, including EV, Co-Ops, and GHG co-optimization, to name a few. Comparable public companies include Enphase Energy (ENPH), Tesla (TSLA) and others, as you can see in the following graphic.

Business Strategy: Shifting to SaaS

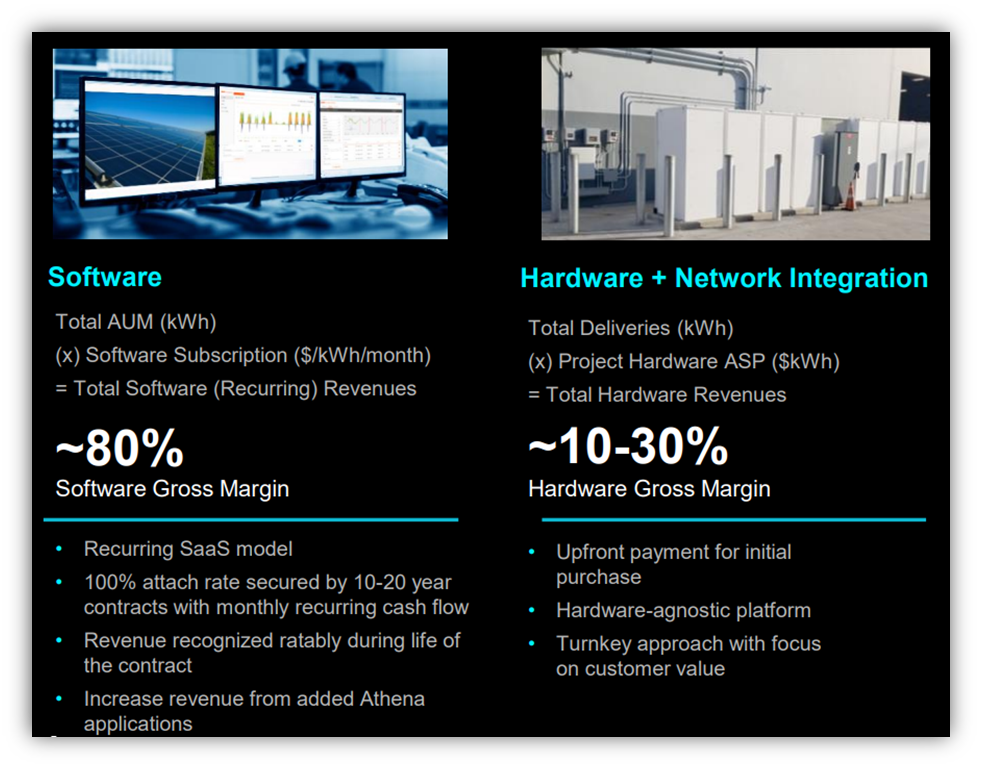

“Software as a Service” (“SaaS”) businesses can be quite compelling as long-term investments because of their recurring revenues (Stem has a very low churn rate) and their high scalability (software can scale much quicker and with less costs than non-software businesses), and they can be particularly compelling when they are supported by a large (and long-term) secular growth trend (such as the large and growing demand for alternative energy sources that will continue to drive Stem).

As per Stem’s most recent quarterly earnings call, the plan and trajectory are to shift from a hardware business to a software business over time, and this will strengthen margins (Athena software margins are 80%+, whereas traditional hardware margins have recently been closer to 10%).

Importantly, the recurring revenue SaaS model is much more scalable than the hardware business thereby allowing Stem to potentially capture much more of the massive secular clean energy trend that lies ahead. And this trend will be furthered by the rapidly declining battery production costs (as seen in our earlier graphic).

Valuation:

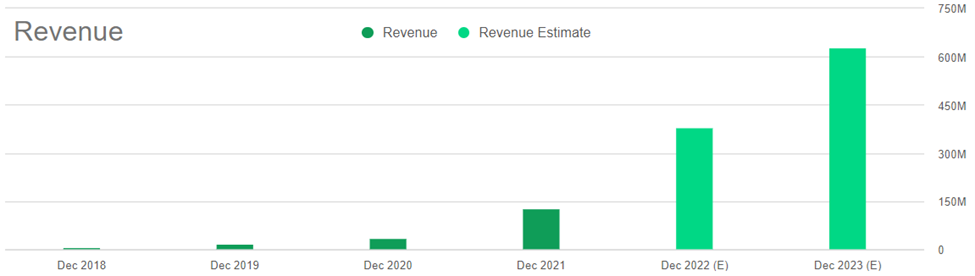

Stem’s share price has come down dramatically (especially relative to its long-term value) following the steep gains after going public through a SPAC deal in April 2021 (as you can see in the chart below).

The above chart also shows the cash on hand at the end of 2021 (which helped cover the acquisition of AlsoEnergy in February) as well as improving EBITDA. Important to note, the company expects significant revenue growth in the years ahead, and currently trades at only around 2.9x 2023 revenue estimates, and attractive level in our view.

Also important to note, quantitative valuation models might get stuck on the current low gross margins (driven by the lower-margin hardware business) instead of picking up on the shifting strategy and high-growth trajectory of the high-margin software business (as described earlier). And even though a large part of Stem’s forward growth expectations are driven by inorganic acquisitions (and some revenue expected in 2021 being pushed out to 2022) the massive secular trend and large market opportunity should not be overlooked as it will provide a powerful tailwind for continuing long-term growth. For a company with as much growth potential as Stem, the shares could reasonably trade at significantly higher valuation multiples.

Risks:

Stem faces a variety of risks that should not be overlooked. For example, bears are quick to point out that the company is not profitable. However, this is not uncommon for nascent disruptive growth stocks, and it is a big contributor to the big long-term price appreciation potential for this high growth company supported by large secular clean-energy tailwinds.

Another risk is growth through acquisitions. Typically, organic growth can be more attractive than inorganic growth. However, given the disruptive nature of this high growth industry, it can make sense to get ahead of the competition in order to win more future businesses by being known as the industry leader.

Another risk is the high short interest of these shares. Recently above 10%, short interest is not entirely due to the business, but rather the indiscriminate short selling of high-growth/no-profit stocks as the unwinding of the pandemic trade was accelerated by the Fed’s increasingly hawkish posture.

Debt and increasing interest rates is another risk faced by Stem because it can make the cost of growth more expensive. However, Stem came public with a strong balance sheet and the expectation that it would be acquiring businesses. Further, the strong political support for this industry can make future capital raising less of an issue as venture capitalists and others may be quick to support this long-term financial opportunity and social cause.

A shifting business strategy (from hardware to an increasing focus on software) presents another risk. In particular, it can be a red flag when a company shifts its strategy. However, given the still small size of this business (it’s a small cap stock) and the large secular tailwind opportunity, the shift towards SaaS seems prudent and compelling.

Conclusion:

With oil and gas prices near all-time highs, alternative energy solutions are increasingly front-and-center. And the demand for such solutions is increased by social demand (environmental concerns) and complemented by improving economics related to SaaS economies of scale and decreasing battery costs (not to mention the fact that Stem can reduce energy costs for end users and reduce stress on the grid). In addition to these benefits, the share price economics of Stem are increasingly compelling. Without question, these shares will continue to be volatile and the target of naysayers. However, the long-term growth potential could end up outweighing these risks by a very wide margin as the secular clean-energy industry tailwinds make Stem’s leading position increasingly compelling.