The prices of big-yield MLP CEFs have been rising, but not as fast as their NAVs, thereby creating some interesting opportunities, such as those offered by ClearBridge (including tickers: EMO, CEM and CTR). We share the data (including yields, premium/discounts and leverage) for 60 CEFs in this report, including multi-sector bonds, real estate and US Equities.

To get right to it, here is the data.

A few interesting things stand out…

MLP CEFs

Master Limited Partnership CEFs have been on the rise (not surprisingly) as the entire energy sector has been the one sector bright spot this year. In particular, CEF prices have been rising, but not as fast as net asset values (“NAVs”) and that means discounts have been on the rise (some investors greatly prefer to purchase CEFs at attractive discounts. The three ClearBridge MLP CEFs in the table about are an example. ClearBridge is sponsored by Franklin Templeton.

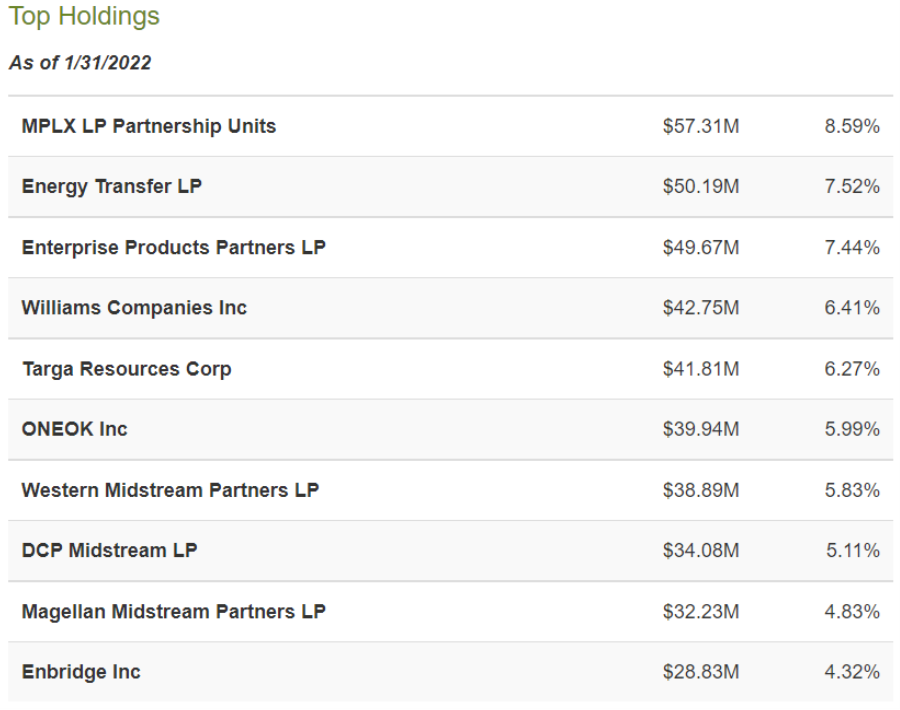

For some color, here is a look at the top 10 holdings of “ClearBridge MLP and Midstream” (CEM).

PIMCO Bond Funds

PIMCO’s multi-sector bond funds are a perennial favorite. However, their once massive premiums to NAV have significantly dissipated as they now face headwinds from rising interest rates.

For example, PDI offers a highly tempting 11.7% yield (disclosure: we are long PDI) following its recent merger with two other PIMCO funds, thereby strengthening the distribution, in theory. It pays monthly, and if the Fed’s interest rate expectations shift to less hawkish, the shares have upside and the large premium could return.

Also noteworthy, PIMCO recently launched a new fund on January 31st, (PIMCO Access Income (PAXS)) currently yielding 7.7% and trading at a 5.6% discount to NAV.

Adams Diversified Equity Fund (ADX)

This fund has been paying distributions for over 80 years, and it currently trades at a slightly wider discount to NAV than usual. The fund is a bit “tech heavy” at 26% (Microsoft and Apple are its two largest holdings). We are currently long shares of ADX and have no intention of selling. Be advised, this one pays three smaller quarterly dividends each year, followed by a big one in Q4, and the fund guarantees at least a 6% aggregate distribution each year (with many investors simply reinvesting, considering they always get to buy more shares at a discount).

The Bottom Line:

If you are an income-focused investor, CEFs can offer the income you like. And lately, many of them have seen more price weakness than NAV weakness (a good thing if you like to buy things at relatively better prices). We are long PDI, ADX, BIT, DLY, RMT, RVT and RQI from the list.