With the markets down significantly this year, there are attractive babies being thrown out with the bathwater, and this report reviews one such opportunity. Specifically, we review a highly profitable, rapidly expanding, common sense software application company that pays a healthy growing dividend and has a large total addressable market to keep growing the business for years to come. If you have the psychological wherewithal—this one is worth considering.

Overview: Intuit Inc (INTU)

Intuit provides application software, such as TurboTax, QuickBooks, Credit Karma, MailChimp and other small business and consumer solutions. The company has 14,200 employees, they serve more than 100 million customers worldwide, and the aggregate business generated $9.6 billion in revenue in 2021.

Business Segments:

Intuit was founded in 1983 and is headquartered in Mountain View, California. The company operates through four segments:

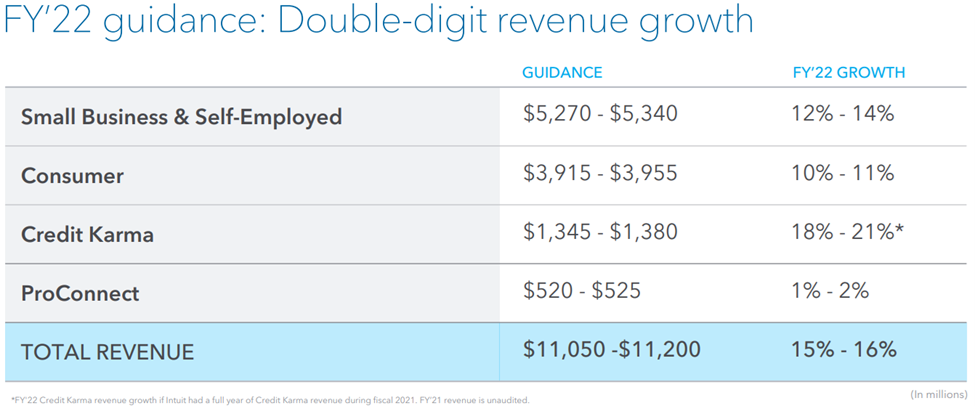

Small Business & Self-Employed: The Small Business & Self-Employed segment provides QuickBooks online services and desktop software solutions.

Consumer: The Consumer segment provides TurboTax income tax preparation products and services; and personal finance.

Credit Karma: The Credit Karma segment offers consumers with a personal finance platform that provides personalized recommendations of home, auto, and personal loans, as well as credit cards and insurance products.

ProConnect: The ProConnect segment provides Lacerte, ProSeries, and ProFile desktop tax-preparation software products; and ProConnect Tax Online tax products, electronic tax filing service, and bank products and related services.

For reference, you can see the relative size (and expected growth) for each of these segments in the table below.

Also important to note, Intuit acquired Mailchip in 2021 (Mailchimp provides digital marketing tools to help small and mid-sized businesses attract and retain customers), and this adds to the businesses already large and attractive total addressable market opportunity (i.e. there is a lot of room for Intuit to keep growing).

Attractive Business:

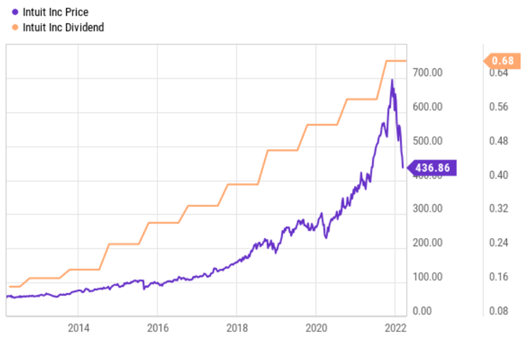

Despite the attractiveness of the business, shares of Intuit have continued to sell off indiscriminately with the shares of other high growth stocks (such as the ARKK ETF). However, unlike many other high growth stocks, Intuit is already very profitable and it has a long and proven track record of disruptive and innovative success. Further, the strategy going forward is focused on capturing the large market opportunities that are available by innovating and by recognizing synergies between its business across the ecosystem.

Specifically, Intuit seeks to expand its core business by offering more and better tax services to consumers and SMB (small and mid-sized businesses), it plans to connect the growing ecosystem and to expand globally, as shown in the following graphic.

Yet despite the attractive business, the shares have recently sold off hard (as the market has been indiscriminately dumping anything with high growth—even though Intuit is already highly profitable—unlike many of its high growth peers).

Valuation:

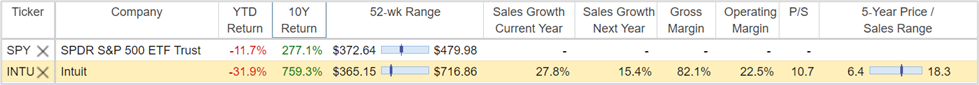

Intuit currently trades at 10.7 times sales, which is not cheap, but still attractive considering the high growth rate (higher that it has been historically, thanks to the compelling TAM), healthy margins and large total addressable market opportunity.

What’s more, Intuit has some serious competitive advantages over its peers, namely the high switching costs for individuals and small businesses (it’s not easy to leave behind your tax software or your marketing/CRM tools). Furthermore, Intuit does benefit from the network effects of its ecosystem of products (and the Mailchimp acquisition will help with this). Further still, Intuit’s high revenue growth rate will continue to outpace certain operating expenses thereby improving profit margins further through economies of scale.

Dividend Growth:

Also noteworthy is Intuit’s track record of dividend growth. As you can see in our earlier chart, Intuit has a growing track record of dividend increases. Investors should not be turned off by Intuit’s small dividend yield (currently ~0.60%). The dividend yield would be higher if the long-term returns hadn’t been so strong (see 10-year total return in the table above). For long-term investors, we expect the “yield on cost” of the dividend will continue to improve in the years ahead.

Also important, Intuit’s dividend payout ratio remains in the low-30% range (a lot of cushion), and the company also has a history of returning significant cash to investors through share repurchases. Intuit is a healthy, growing business in a a strong cash generation position.

Risks:

Rising interest rates pose a risk to Intuit on two fronts. First, the company does carry some debt on its balance sheet (approximately $6.7 billion, compared to its roughly $3 billion in free cash flow, and compared to its $131 billion in total market cap). Rising interest rates could increase the debt servicing costs as loans matures. However, the bigger interest rate risk is simply that future earnings are assigned lower valuation multiples as interest rates rise, and this could add further compression to Intuit’s value and share price, considering the expected growth rate is so high. However, important to note, a lot of the pain of rising rates is already baked into the share price—which has recently fallen hard.

Other risks include competition (for example if a large SMB provider enters the fray), or simply if the government were to create its own free tax filing software (something that continue to be discussed). Nonetheless, the high switching costs of Intuits ecosystem makes it hard for customers to switch.

Management:

It’s also important to mention that Intuit’s founder, Scott Cook, remains associated with the company as the chair of Intuit’s executive committee (this is a good thing). And current CEO, Sasan Goodarzi, has a long 15+ year history with the company (also a good thing) and has provided outstanding leadership balancing sound capital allocation while growing the business and capitalizing on opportunities.

Conclusion:

The market has been rough this year, and that has plenty of investors scared. However, rather than focusing on short-term market gyrations, it can make a lot more sense to focus on long-term opportunities. As such, Intuit remains an attractive long-term business (thanks to business growth and dividend growth) and the valuation is increasingly attractive as the market has been selling high-growth stocks indiscriminately. A couple overused (because they are so good) quotes for you to consider:

Be greedy when others are fearful

The market is a voting machine in the short run and a weighing machine in the long run.

Buy when there is blood in the streets.

Buy Low.

At the end of the day, disciplined, long-term, goal-focused investing is a winning strategy, and as long as profitable long-term growth fits with your goals, Intuit is worth considering for a spot in your prudently diversified portfolio.