Aside from backward looking financial metrics (which are good for this particular REIT), forward guidance is also attractive, and so too is the industry outlook attractive. Further, the balance sheet is strong for this monthly-dividend payer, and the valuation is reasonable (especially after the recent indiscriminate market declines). The dividend is well covered, and the company is getting ahead of the industry-trend towards environmental, social and governance (“ESG”) considerations. In this report, we review the business and conclude with our opinion on who might want to invest.

Purple Line: Share Price, Orange Line: Monthly Dividend Amount

Overview: STAG Industrial (STAG)

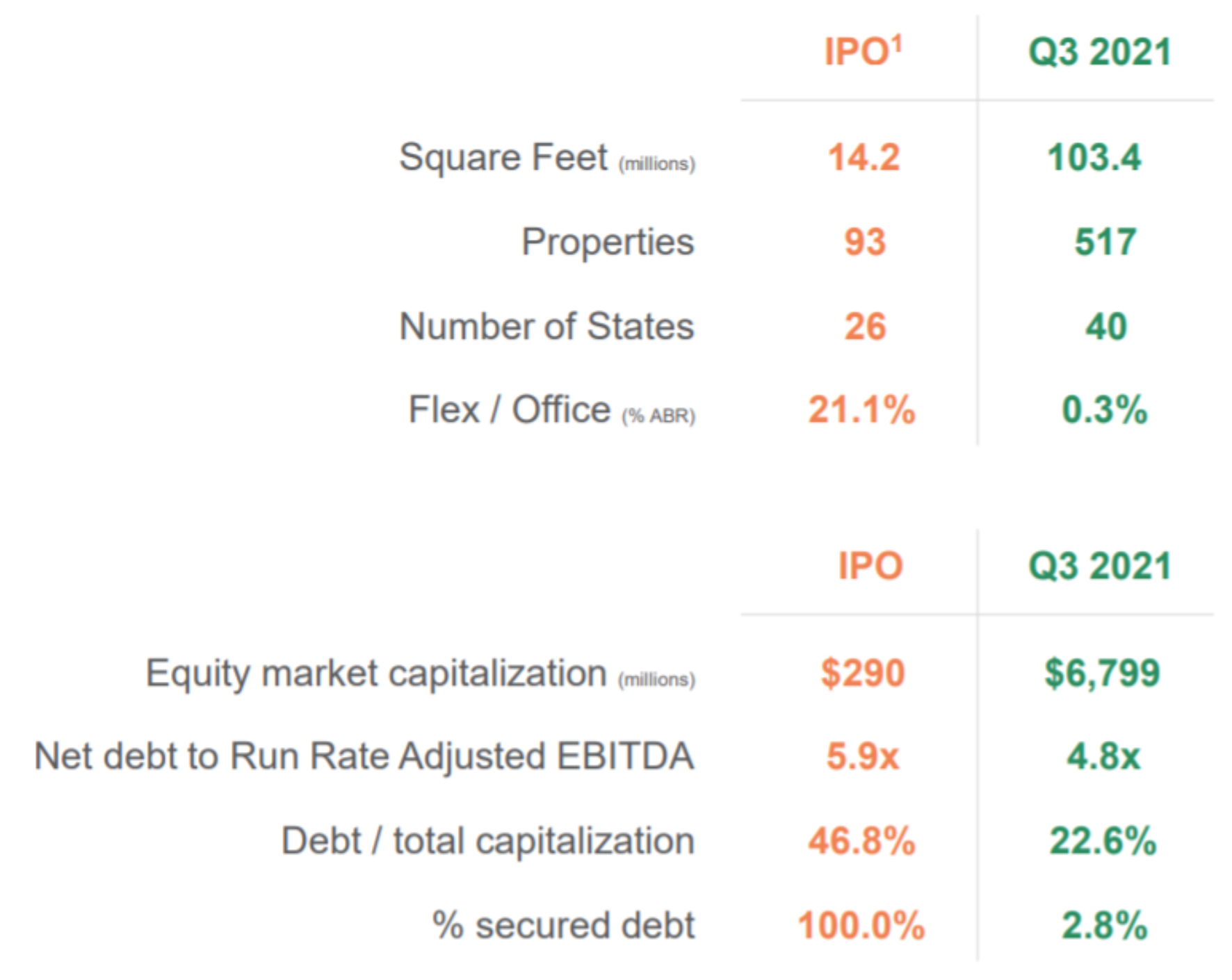

STAG Industrial, Inc. (STAG) is a real estate investment trust (“REIT”) focused on the acquisition and operation of single-tenant, industrial properties throughout the United States. The company’s shares began trading publicly in 2011, and back then it was considered higher risk because of the focus on single-tenant tertiary and secondary market properties.

However, STAG has grown steadily over the years—thereby reducing the concentration risk of its portfolio and increasing value for its shareholders in the process.

As evident in some of the earlier debt metrics, STAG’s financial risk has decreased over the years. And the company maintains a healthy investment grade balance sheet (e.g. Moody’s and Fitch investment grade rating of Baa3 / BBB), with a well laddered debt profile at highly competitive rates.

Business Outlook

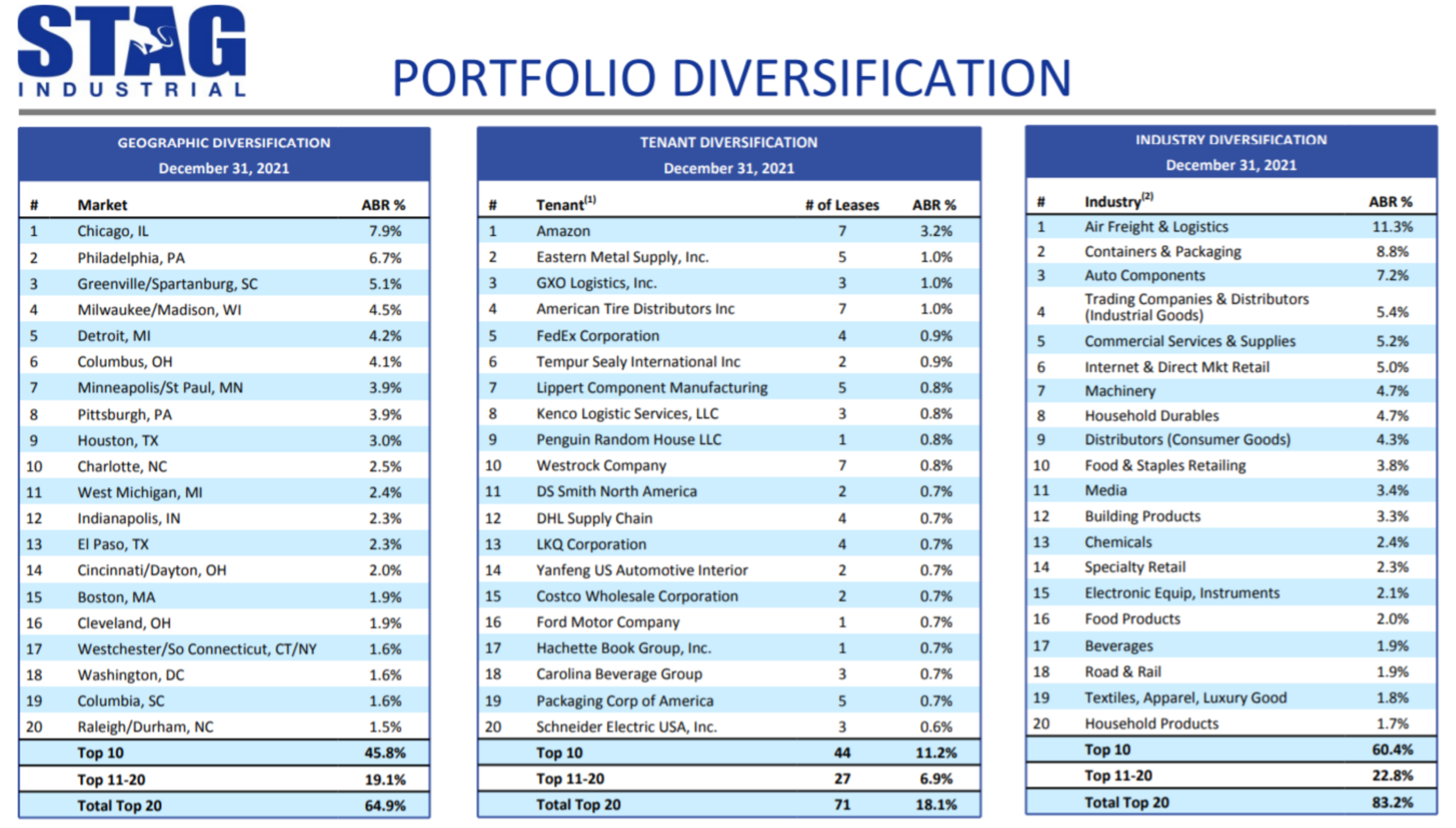

STAG’s business has continued to grow over the years (as shown in the earlier graphic), and the business remains on track for continued growth thanks to a variety of growth drivers, including increasing “same store” growth (driven by rental escalators and shorter downtime), increasing external growth (acquisitions), decreasing “General & Administrative” expense ratios (thanks to growing economies of scale), and better overall capitalization (for example, the amount of leverage continues to come down over the years).

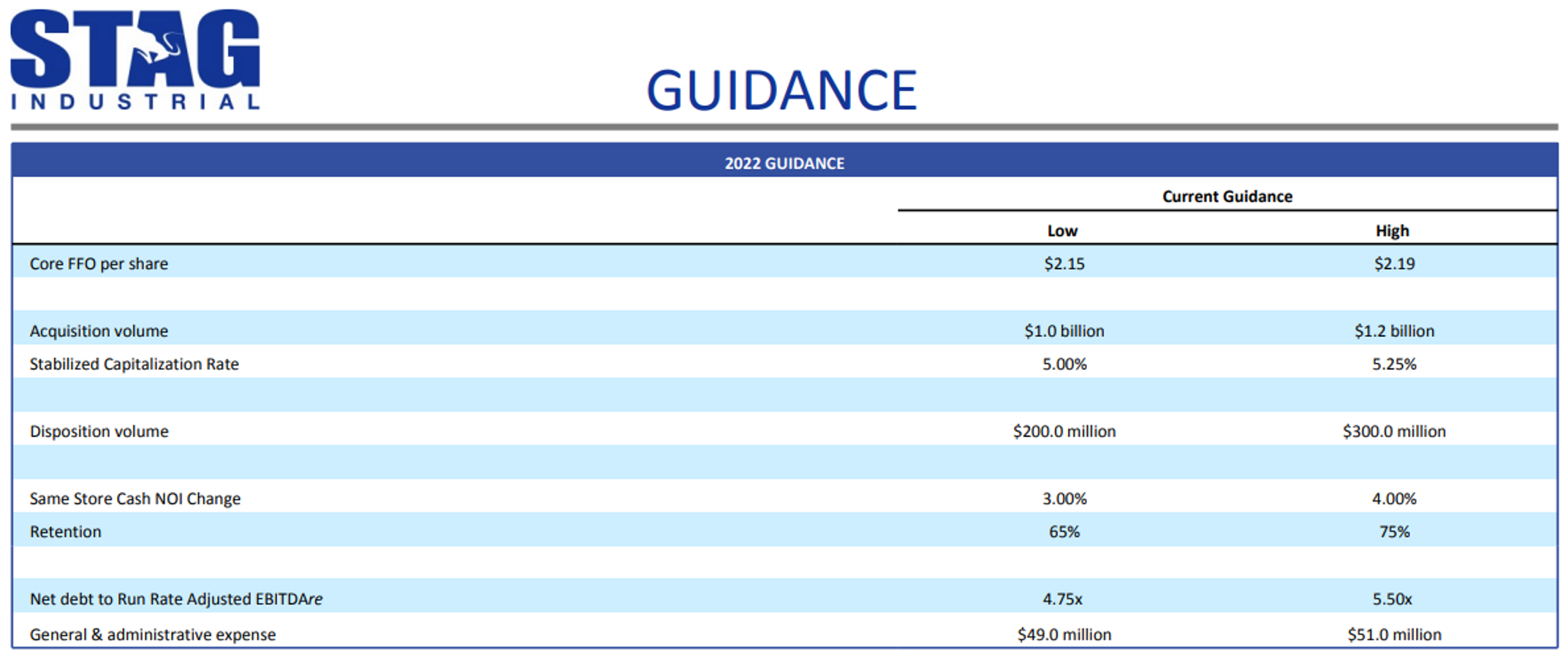

Further, STAG issued strong forward guidance during its recent Q4 earnings call, whereby core Funds From Operations (Core “FFO”) is expected to be $2.17 per share (versus 2.06 in 2021 and $1.89 in 2020), fueled in part by continuing healthy acquisition volume (with an expected cash cap rate range of 5% to 5.25%--a compelling reward versus risk, as we will see in the next section).

Industry Outlook

The industrial REIT industry remains particularly attractive as it remains an increasingly important part of the supply chain, especially as internet commerce continues to grow. For example, according to CBRE’s 2022 real estate outlook, the industry will remain hot in 2022:

“Amid record demand, rent growth and investment activity, industrial real estate will stay hot in 2022. E-commerce’s expansion will fuel the need for more warehouse space, as will the growing economy, population migration and the desire for “safety stock” onshore.”

Further, CBRE’s report shows cap rate compression for industrial REITs, however cap remains remain strong, and particularly strong for STAG as we saw in the previous section.

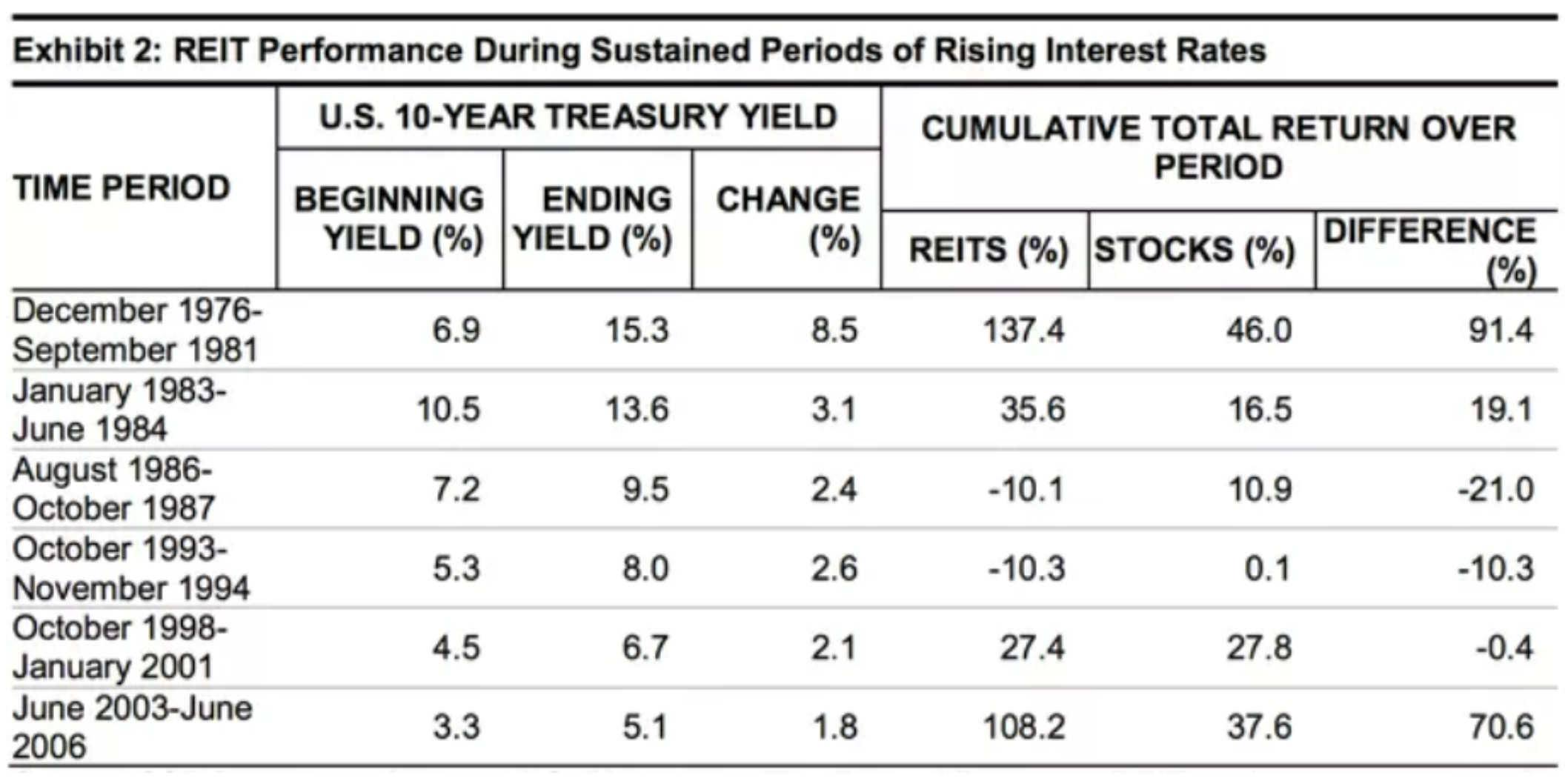

Also worth mentioning, REIT performance has historically been strong in periods of rising interest rates (as rates are expected to rise this year and next) as you can see in the following graphic.

Valuation:

From a valuation standpoint, STAG shares are reasonably priced, especially following the recent share price selloff and considering the business continues to improve. For example, the shares currently trade at approximately 14.5x FFO, and at around 17.8x forward Core FFO, which is not unreasonable, especially considering the continuing strong environment for industrial real estate (and considering STAG’s existing heathy business). In fact, as STAG’s business continues to evolve over time (it is becoming less risky) it warrants a higher valuation than previously.

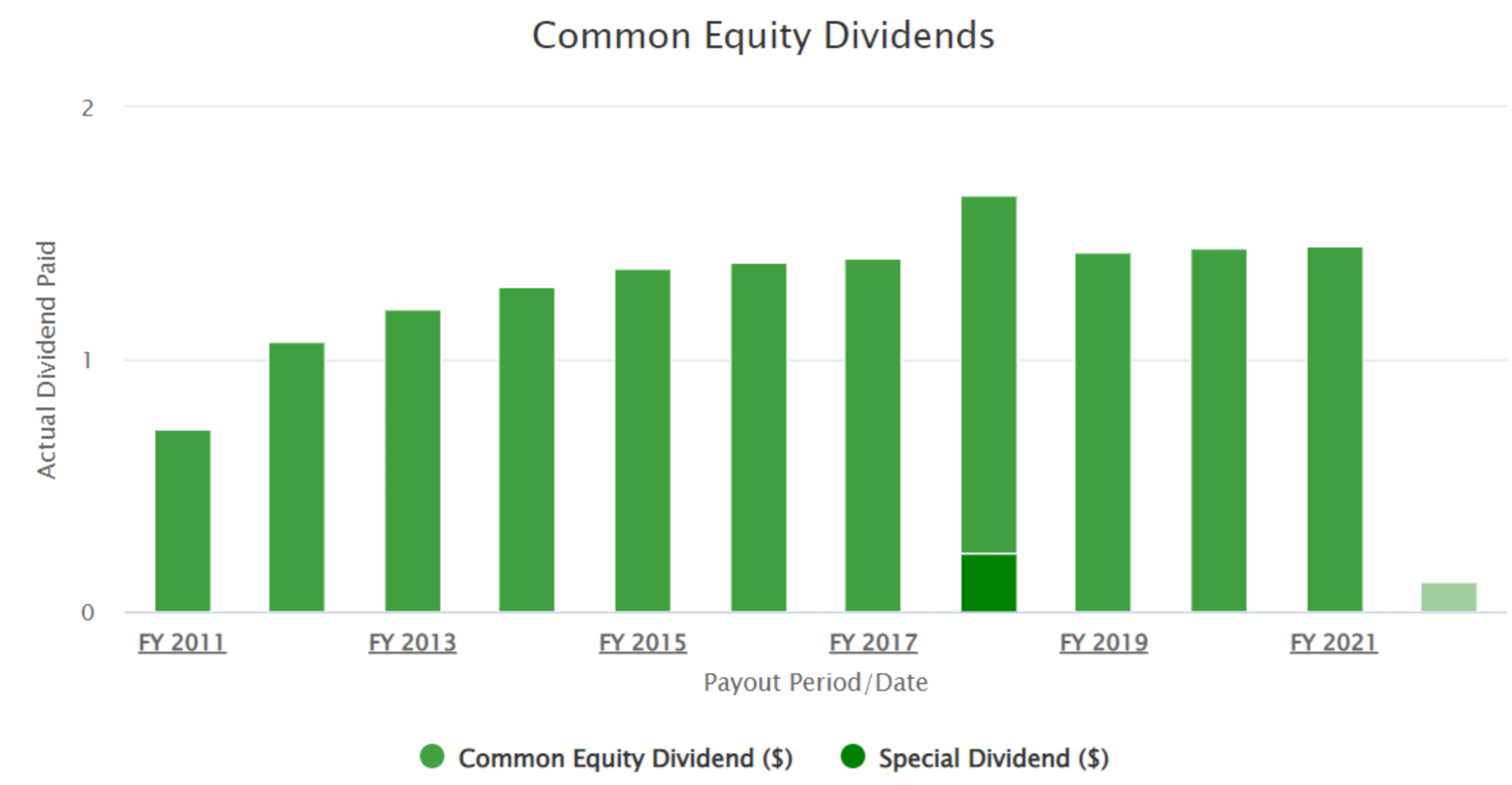

Also, with a monthly dividend of $0.1217 (~$1.46 per year), the dividend is well covered by Core FFO, as mentioned earlier. And STAG has a strong history

Risks

ESG Risks: Another increasingly important consideration for industrial REITs is ESG. Environmental, Social and Governance consideration are increasingly a part of the industry, and STAG is getting ahead of this trend with its inaugural Sustainability Report. The report highlights STAG’s ESG efforts, including:

Environmental: STAG is host to the country’s largest community rooftop solar installation, which was completed recently at our facility in Hampstead, Maryland. In further eorts to continuously modernize and update our properties, STAG has also installed LED lighting across more than 17 million square feet of our buildings since 2015.

Social: In 2020, STAG created the STAG Charitable Action Fund to reflect its increased financial commitment to bettering its community.

Governance: STAG has worked to improve board diversity, and has received industry accolades (such as its General Counsel being named to the Modern Governance 100 list).

Leadership Change: Not overly concerning, but worth mentioning, CEO Ben Butcher will be replaced by President Bill Crooker in July (Butcher will remain on as Executive Chair of the Board of Directors). According to Butcher:

"As we enter this year of management transition, I am heartened by the continued operational excellence we are enjoying… I am truly proud of the team we have built and am confident that the company will be in good hands when I move to Executive Chair.”

Conclusion:

STAG’s business has changed since its IPO in 2011. In aggregate, the changes amount to an increasingly healthy business, with a healthy outlook for the business and the industrial REIT industry. The monthly dividend remains durable and well covered, and the valuation is reasonable. If you are looking to add a strong monthly dividend payer (with long-term price appreciation potential) to your portfolio—shares of STAG are attractive (especially after the indiscriminate market sell off) and worth considering for a spot in your portfolio.