There is little doubt that this business is growing rapidly with a massive total addressable market opportunity (i.e. it has a long runway for continued growth). However the company is not profitable, its shares continue to be diluted, and in a fairly short period of time the share price has gone from high-flying pandemic darling to now a poster child for stocks to avoid in a rising interest rate environment. In this report, we review a variety of big headwinds the business currently faces, we consider several critical attractive qualities, and then we conclude with our opinion on whether a contrarian investment currently makes sense.

Overview: Teladoc (TDOC)

As the name suggests, Teladoc is a telehealth company. Specifically, it provides virtual healthcare services on a business-to-business basis, mainly in the United States. The company’s vision is to make virtual care the first step on any healthcare journey (this has multiple benefits, including convenience and cost savings, as we will cover later).

Teladoc covers a widening variety of clinical conditions, including non-critical, episodic care, chronic, and complicated cases like cancer and congestive heart failure, as well as offers telehealth solutions, chronic condition management, expert medical services, behavioral health solutions, guidance and support, and platform and program services.

Teladoc serves health employers, health plans, hospitals, health systems, and insurance and financial services companies. The company offers its products and services under the Teladoc, Livongo, Advance Medical, Best Doctors, BetterHelp, and HealthiestYou brands.

From Love to Hate

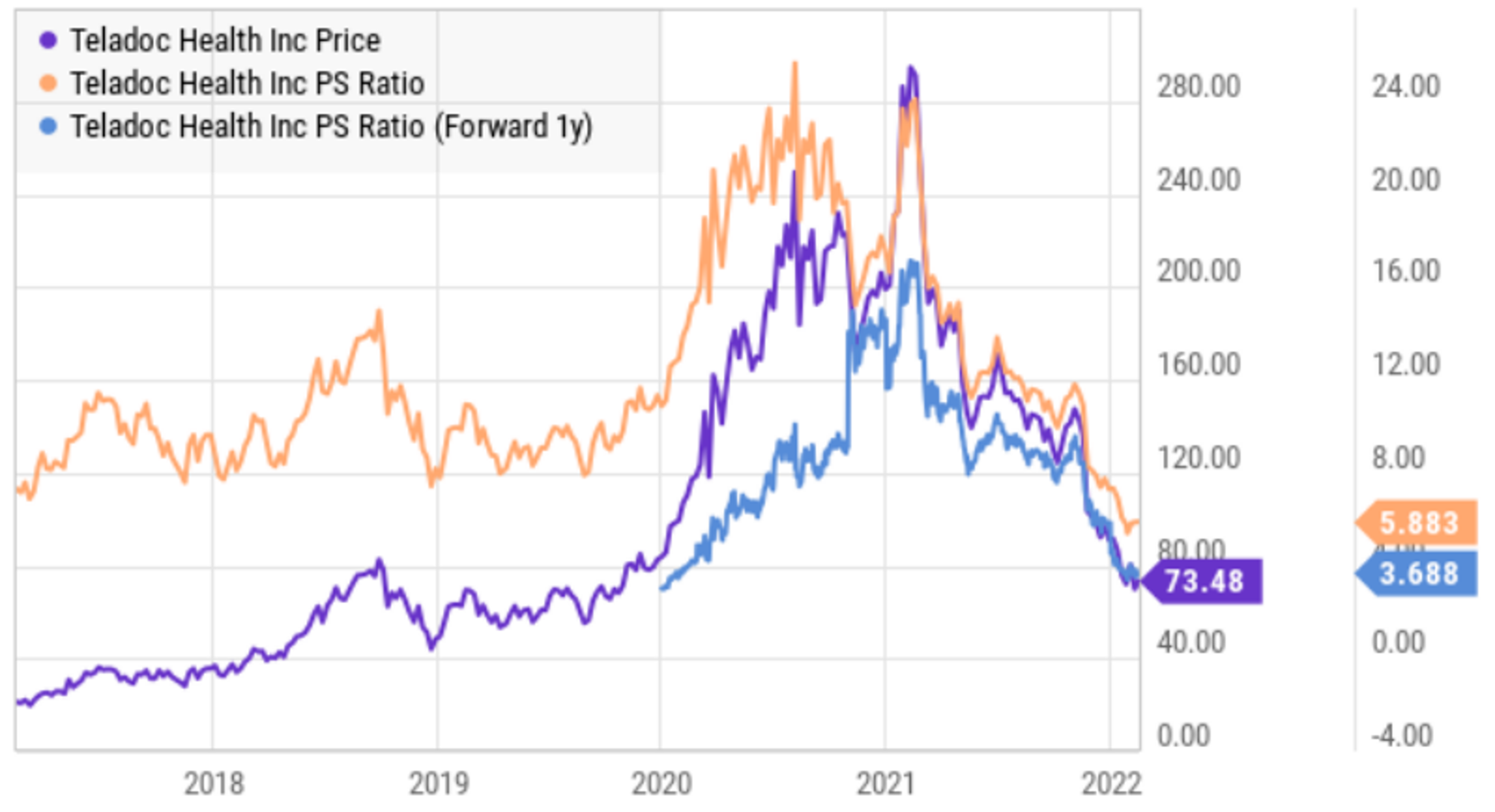

As mentioned, Teladoc shares have gone from high-flying pandemic darling, to now a poster child for stocks to avoid in a rising interest rate environment (see price chart below). More specifically, the idea of telehealth seemed extraordinarily attractive to many investors as the pandemic first started because of the need to social distance, but the shares are now in the doghouse as the pandemic trade unwinds and the market assigns a lower value to stocks being valued on distant future earnings (Teladoc has no current earnings) because those future earnings are worth less as they’re being discounted back to the present value at a higher interest rate.

The Ugly Side of Teladoc

Teladoc shares are easy to hate. Naysayers love to point out that the business in not profitable, it has essentially no moat, competition is creeping in, insiders are selling, shares are being diluted, it was just a pandemic meme stock, and now rising interest rates will put the final nail in the coffin for this glorified video app. While there is some truth to some of that, a lot of those arguments are way off base.

With regards to profitability, it is difficult for many investors to understand, but it can make a lot of sense for high growth stocks like Teladoc to intentionally have no profits in the short run as they focus all of their financial resources on capturing extremely high growth opportunities because this is often a far better approach to maximizing profits in the long run. For example, Teladoc has very high gross margins (revenues minus cost of goods sold), but negative net income (revenues minus total expenses) because they are spending heavily to capture growth. Teladoc could be extremely profitable in the short run simply by turning off the growth spigots, but then this would dramatically decrease the long-term value of the business. Of course the future is unknown, and it may seem counterintuitive, but Teladoc’s current negative net income is highly preferred by those seeking to maximize long-term value.

Regarding the argument that Teladoc has no moat (i.e. it is easy for competitors to copy), this is not entirely true. For starters, Teladoc has already amassed enough scale to offer a breadth of healthcare offerings that are not easily reproduced by competitors. Teladoc is the leader in the industry and is ranked number 1 in consumer satisfaction by J.D. Power. Not to mention Teladoc’s existing customer base provides a significant advantage over smaller competitors and new entrants to the industry.

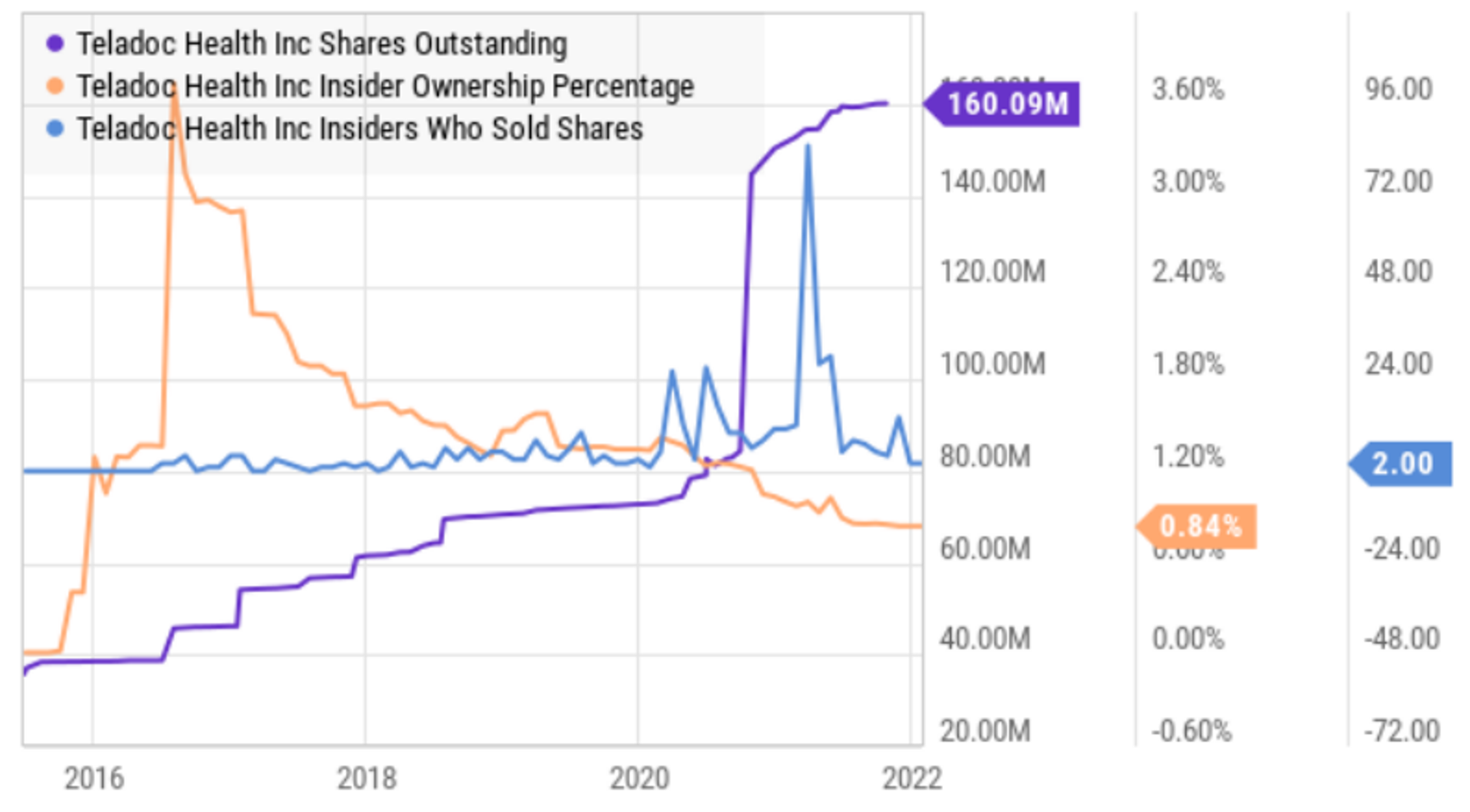

Regarding the claim that insiders are selling and the shares are being diluted, there is truth to this claim, however it is important to keep this in perspective considering this is normal for high growth stocks.

Keep in mind also, it could continue down this road as the company’s convertible notes could eventually be converted to shares. Nonetheless, these are not overly concerning characteristics given the nature of this high growth business. What matter is that the company continues to grow its valuable healthcare business at a pace that creates long-term value for investors.

Some bemoan Teladoc as just another obvious pandemic meme stock (and glorified video app) that will now be crushed by rising interest rates. Without question, Teladoc’s share price was helped by the pandemic (it was a great social distancing tool). However, to suggest that the company is now going to disappear into oblivion as the pandemic seems to fade is just absurd. The share price has already fallen to its pre-pandemic level, but the business has grown significantly, and is on track to continue growing significantly, as we will cover in more detail in the section on valuation. And with regards to rising interest rates, sure this will put pressure on the business (it has significant debt/convertible notes on its balance sheet and a negative tangible book value) but rising interest rates doesn’t mean valuable healthcare is simply going to disappear (Teladoc offers a variety of valuable characteristics, as we will cover in the next section). Furthermore, Teladoc is not just a glorified video app; rather, it offers real benefits to the growing number of large businesses it has large contracts with, as we will cover in the next section.

Why Teladoc is Attractive

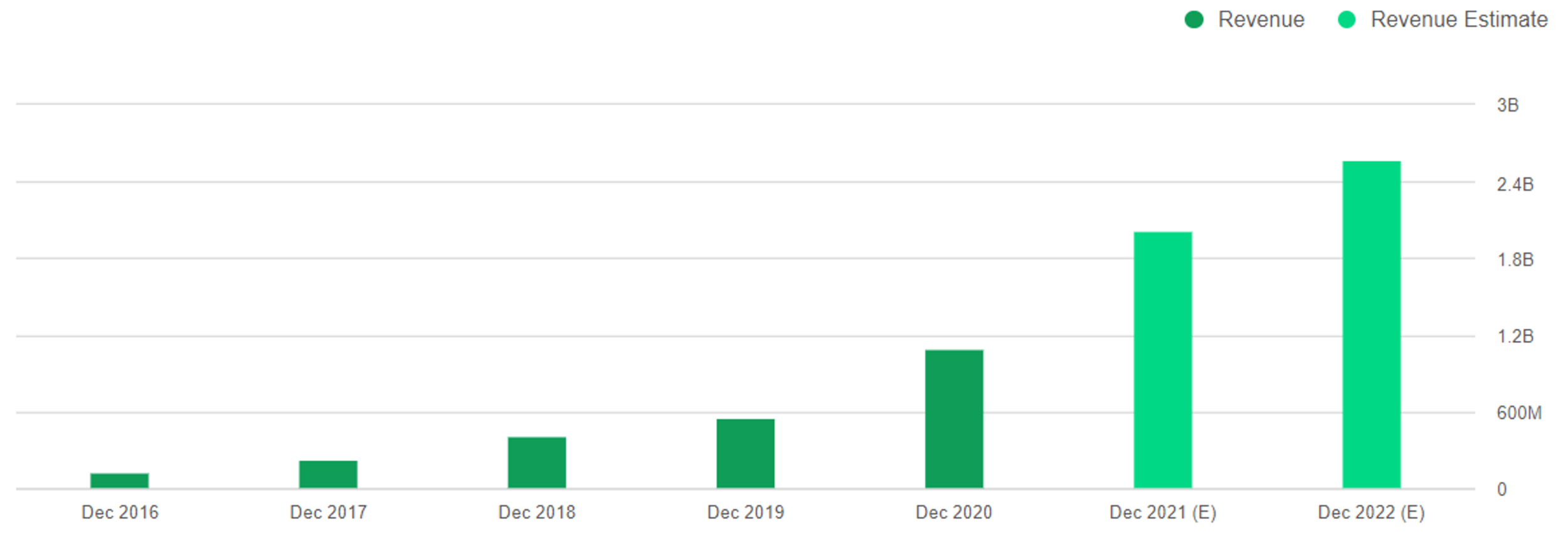

The main reason why Teladoc is attractive as a potential investment is because it provides a helpful service (healthcare) that is growing rapidly, and it has a long runway (large total addressable market) to keep growing rapidly for a long time. To put Teladoc’s growth in perspective, here is a look at its historical growth rate.

And as CEO Jason Gorevic explained during the most recent quarterly earnings call, revenue grew at 81% over the previous year (including 32% organic growth). Furthermore, the company estimates in can continue to grow revenue at 25-30% (CAGR) from 2021-2024.

Regarding the notion that Teladoc provides a helpful service (healthcare), there are certainly arguments on both sides. While some pundits will argue that doctors hate telehealth because it diminishes the in-person doctor-patient relationship, these are largely anecdotal stories. Further, doctors hate a lot of things about healthcare (like insurance expenses, lawsuits, administrative distractions, and a host of other things) so take the negativity with a grain of salt. Also recognize that Teladoc continues to win contracts with businesses (not necessarily individual doctors) as the company operates largely through enterprise relationships. For example, in Q3:

“Total Visits grew 37% y/y, driven by strong growth in direct-to-consumer visits and visits thru our enterprise relationships with health plans and employers.”

“[Teladoc] Announced significant new agreements with CVS Health and Centene to provide Teladoc Health’s Primary360 in order to deliver greater care access and health engagement by reimagining the primary care experience.”

Keep in mind also that Teladoc can help reduce costs for large enterprises as telehealth visits often help avoid more costly (and often unnecessary) specialist visits. Also worth re-mentioning, Teladoc’s vision is to make virtual care the “first step” on any healthcare journey (this has multiple benefits, including convenience and cost savings), and Teladoc also provides an increasingly wide range of value-add services.

As Morningstar analyst, Dylan Finley, explains

“The company’s robust platform efficiently matches patients with providers to avoid costly visits and assists employers and payers with analytics to analyze cost benefits.”

Another reason why Teladoc is attractive is its large 2020 merger with Livongo. Livongo was (and still is—now it’s just part of Teladoc) a leader in virtual diabetes care management. This is differentiated from what pre-merger Teladoc did, and it adds to the breadth (and cross selling opportunities) of Teladoc’s offerings, and gives the company another leg up versus the competition.

Valuation

Teladoc is attractive from a valuation standpoint. However, if you are looking for an old school steady-eddy blue chip company that is growing razor-thin profit margins by 1-2% per year, Teladoc is not for you. Rather, Teladoc is surrounded by high uncertainty, high (and volatile) growth, and an increasingly attractive valuation (for those with the stomach to buy and hang on). Here is a look at Teladoc’s growth rates (25-30% through 2024) and price-to-sales valuation multiples.

We value Teladoc on price-to-sales because net income is still negative (as explained earlier—this is preferred for a high growth business with a compelling long-term offering, such as Teladoc). Also important to note, Teladoc has very high gross margins (revenue minus cost of goods sold, currently in the mid to upper 60’s) and this is another indication that it can be extremely profitable in the future.

And as mentioned earlier, Teladoc estimates it can continue to grow revenues at 25-30% through 2024. This is an extremely high (and attractive) growth rate as compared to the average publicly traded stock, and at 3.7x forward sales (less than 1/4th of what it was just a year ago, and back to its pre-pandemic level) Teladoc offers a compelling value proposition to long-term investors.

Conclusion:

Teladoc is not for everyone, but it you have the intestinal wherewithal to buy and hang on for the long-term, these shares are potentially going much higher. Teladoc has gone from extremely overbought in the short-term (as a result of the pandemic) to extremely oversold (as the pandemic trade unwinds and interest rates are set to rise). But what hasn’t changed is the strength of the business. Teladoc is growing its valuable healthcare business at a rapid pace, and if you are a long-term contrarian investor that likes to buy attractive businesses at a low price when they are out of favor with the market, Teladoc is worth considering for a spot in your portfolio. We are currently long shares of Teladoc.