Despite ugly performance for REITs this year, select names remain attractive. For example, shares of the specialty REIT we review in this report are down, but the fundamentals continue to strengthen (and the long-term outlook is compelling). In this report, we review the REIT’s highly-attractive business strategy (which positions it well for growth and income), fundamental strength, valuation and risks, and then conclude with our opinion on investing.

Overview: Crown Castle International (CCI)

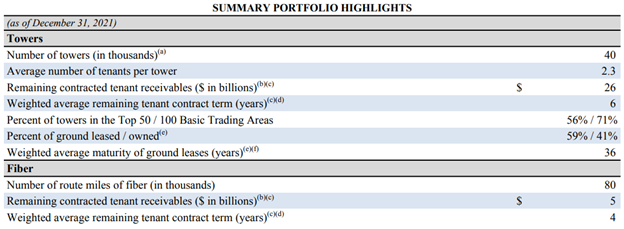

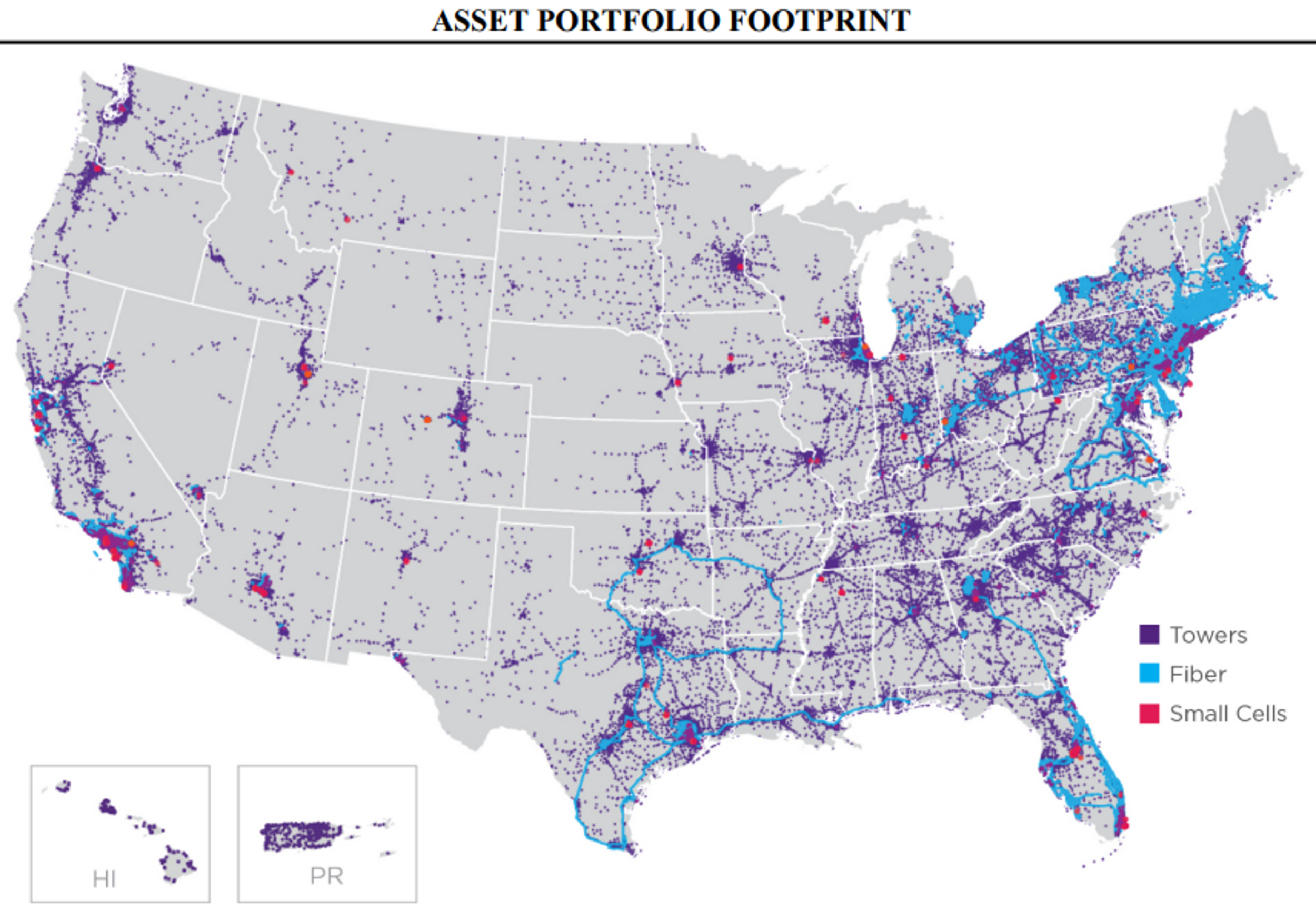

Crown Castle is the nation's largest provider of communications infrastructure (that includes cell towers, small cells and fiber) that connects people and businesses to data and technology. Specifically, the company owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including more than 40,000 towers and other structures, such as rooftops (collectively, "towers"), and more than 80,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions.

The company’s towers have a significant presence in each of the top 100 basic trading areas, and the majority of its small cells and fiber are located in major metropolitan areas, including a presence within every major U.S. market.

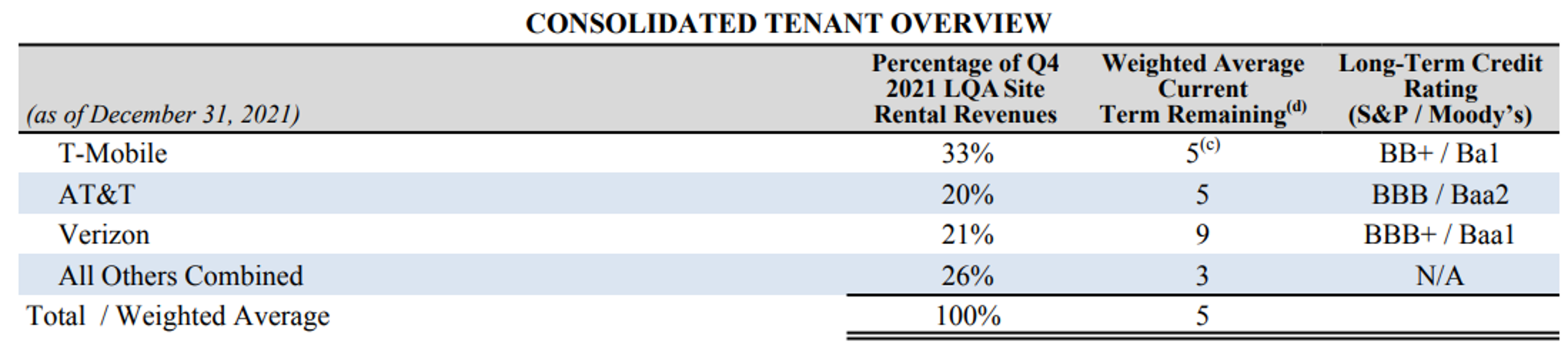

And as one might expect, the company’s top tenants include T-Mobile (TMUS), AT&T (T) and Verizon (VZ), the major carriers.

Crown Castle seeks to increase its site rental revenues by adding more tenants on its shared communications infrastructure, which it also expects to result in significant incremental cash flows due to its low incremental operating costs. The company operates as a Real Estate Investment Trust ("REIT") for U.S. federal income tax purposes.

Strategy:

CCI’s strategy is to create long-term stockholder value through a combination of:

Growing cash flows from existing communications infrastructure. CCI is focused on maximizing the recurring site rental cash flows generated from providing tenants with long-term access to its shared infrastructure assets, which the company believes is the core driver of value for its stockholders. Tenant additions or modifications of existing tenant equipment (collectively, "tenant additions") enable its tenants to expand coverage and capacity in order to meet increasing demand for data, while generating high incremental returns for the business. CCI believes its product offerings of towers and small cells provide a comprehensive solution to its wireless tenants' growing network needs through its shared communications infrastructure model, which is an efficient and cost-effective way to serve tenants. Additionally, CCI believes its ability to share fiber assets across multiple tenants to deploy both small cells and offer fiber solutions allows it to generate cash flows and increase stockholder return.

Returning cash generated by operating activities to common stockholders in the form of dividends. Crown Castle believes that distributing a meaningful portion of cash generated by operating activities appropriately provides common stockholders with increased certainty for a portion of expected long-term stockholder value while still allowing the company to retain sufficient flexibility to invest in the business and deliver growth. Crown Castle believes this decision reflects the translation of the high-quality, long-term contractual cash flows of the business into stable capital returns to common stockholders.

Investing capital efficiently to grow cash flows and long-term dividends per share. In addition to adding tenants to existing communications infrastructure, CCI seeks to invest its available capital, including the net cash generated by operating activities and external financing sources, in a manner that will increase long-term stockholder value on a risk-adjusted basis. These investments include constructing and acquiring new communications infrastructure that it expects will generate future cash flow growth and attractive long-term returns by adding tenants to those assets over time. Crown Castle’s historical investments have included the following (in no particular order): construction of towers, fiber and small cells; acquisitions of towers, fiber and small cells; acquisitions of land interests (which primarily relate to land assets under towers); improvements and structural enhancements to existing communications infrastructure; purchases of shares of its common stock from time to time; and purchases, repayments or redemptions of debt.

The company’s strategy to create long-term stockholder value is based on its belief that there will be considerable future demand for its communications infrastructure based on the location of its assets and the rapid growth in the demand for data. The company believes that such demand for its communications infrastructure will continue, will result in growth of cash flows due to tenant additions on existing communications infrastructure, and will create other growth opportunities, such as demand for newly constructed or acquired communications infrastructure, as described above. Further, the company seeks to augment the long-term value creation associated with growing its recurring site rental cash flows by offering certain ancillary site development and installation services within its Towers segment.

Recent Price Performance:

REITs are among the worst performing market sectors this year, and performance is even worse for REITs with a strategy similar to Crown Castle’s, as you can see in the table below.

However, despite the sell off, Crown Castle’s fundamentals continue to strengthen.

Key Fundamentals:

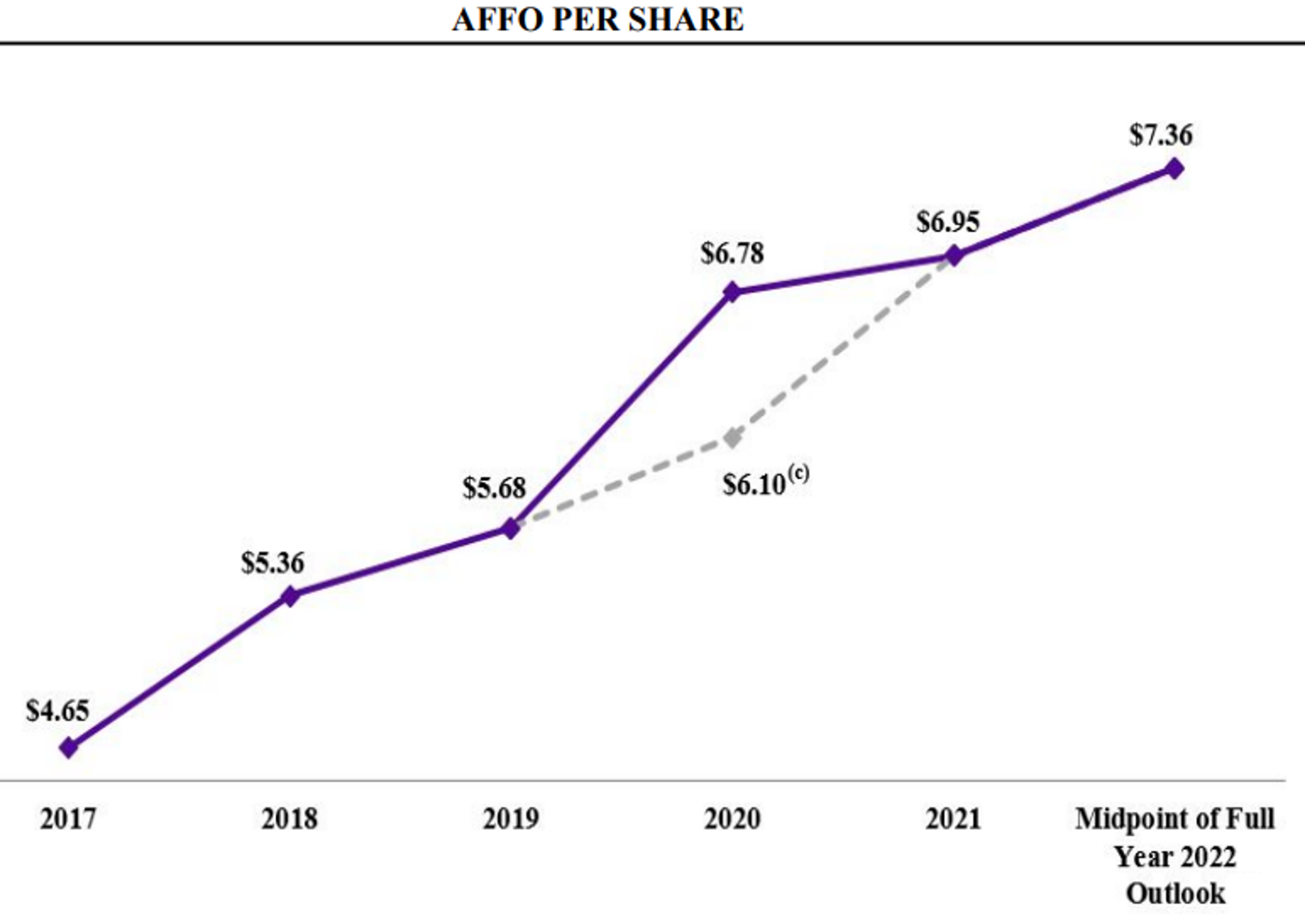

Per the company’s most recent earnings report at the end of January, Crown Castle beat expectations for FFO (funds from operations), it exceeded revenue expectations, and it raised its full year 2022 guidance (all good things). And its adjusted FFO numbers continue to impress.

Further, the company maintains an investment grade credit rating, and has an attractive debt maturity schedule (especially with mostly fixed rates in a rising interest rate environment). For example, credit ratings include:

Fitch - Long Term Issuer Default Rating BBB+

Moody’s - Long Term Corporate Family Rating Baa3

Standard & Poor’s - Long Term Local Issuer Credit Rating BBB-

Valuation:

With a share price of around $173, Crown Castle currently trades around 23.5x its 2022 AFFO estimate of $7.36, not at all unreasonable considering the company’s continuing high-growth numbers in an industry that is transitioning towards smaller cells that will be required with 5G networks. According to a recent Morningstar report:

“Carriers will have to continue investing heavily in their networks as mobile data usage continues increase by more than 30% each year in the U.S., and Internet of Things and video trends make that pace likely to continue.”

Furthermore, Crown Castle’s long-term leases (6 years, on average, see our earlier table), provide visibility into future growth considering its leases have built-in rent escalators.

Crown Castle currently trades at around 28.3x EV/EBITDA (as shown in our earlier table), again not unreasonable.

Risks:

From a risk standpoint, Crown Castle’s strategy is a bit risky because it is based largely on its belief that the industry will continue to transition to small cells. The company has been investing in small cells and fiber, which appears unorthodox considering its tower business is more established and financially established. However, if the industry moves as CCI expects, then the small cell direction could prove extremely valuable.

Another risk is simply that CCI leases a large portion of its land (rather than owning) and this adds uncertainty risk. However the leases are generally long-term and in some cases they have an option to purchase the equipment on the land, thereby potentially decreasing risk further.

Conclusion:

Crown Castle is attractive. It has sold off recently as other REITs have sold off, but its business is uniquely positioned to continue growing rapidly (whereas other REITs are struggling to find growth). Specifically, the secular trend towards 5G and the “Internet of Things” positions CCI well to continue its high growth trajectory. Further still, the company’s strategy to purse small cell opportunities seems unorthodox to some (considering the strength of it tower business) but the move could prove extremely lucrative in the years ahead. We also appreciate the company’s strategy of returning a healthy amount of cash to investors through dividends (this helps with maintaining a stable investor base (and share price), in theory), but also spending an ample amount of capital to capitalize on industry growth opportunities. If you are a long-term income-focused investor (that also likes growth), Crown Castle is worth considering for a spot in your portfolio. We do not currently own shares, but it is high on our watchlist.