As 2022 winds down (it’s been an ugly year so far), things can still get worse in 2023. In this report, we review overall market valuations, macro risks (e.g. monetary policy and recession) and the growing risks related to specific investment styes (e.g. growth versus value, small versus large cap, and various sector opportunities). We also share a handful of specific investment opportunities and then conclude with a few critical takeaways for investors.

S&P 500 Performance and Valuation

For starters, here is a look at the S&P 500 Price Index since 1996. In retrospect, the tech bubble (at the turn of the century) and the Great ‘08-’09 Financial Crisis don’t look so dramatic as compared to the incredible rally we’ve had since then (even after considering the 2020 Covid sell off and the 2022 declines).

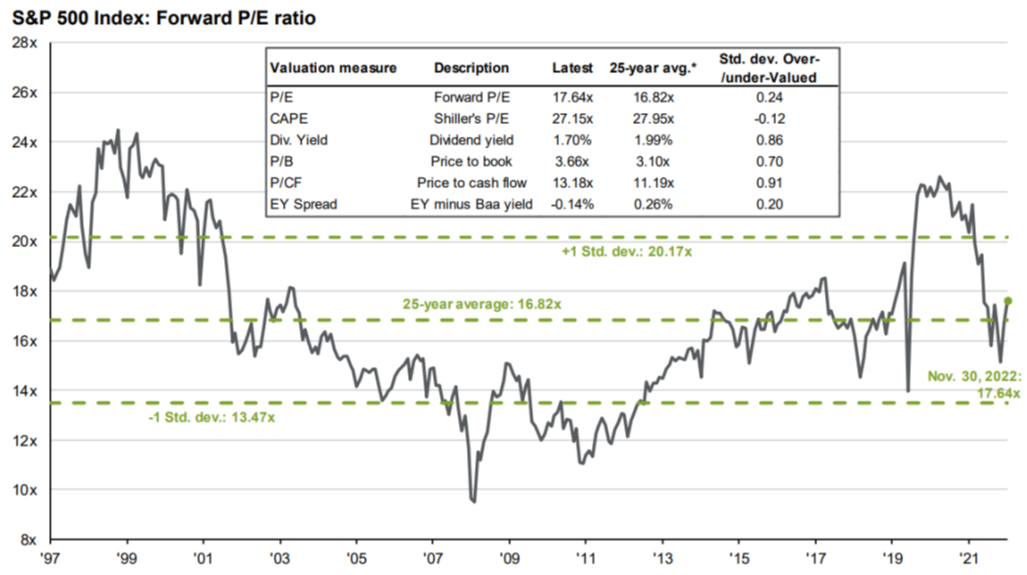

As you can see in the chart above, the index S&P 500 had a forward price-to-earnings ratio of around 17.6x at the end of November (which is expensive by historical standards, but not too expensive). For example, here is a look at the S&P 500 Forward P/E ratio over the last 25 years.

As you can see in the chart above, the overall S&P 500 valuation is still a little high versus its 25-year average (and that is even after this year’s price declines so far). Basically, things can still get worse, especially considering we could be headed into an ugly recession is 2023.

Things Can Still Get Much Worse

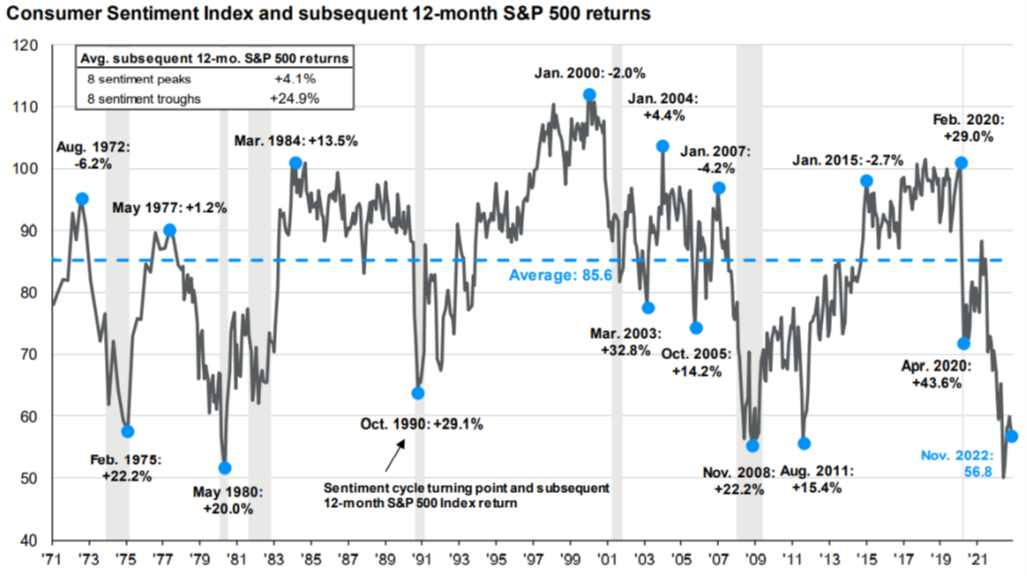

Consumers are currently very negative about the economy. For example, here is a look at consumer sentiment, which currently sits near a 25-year low.

And while some contrarians are quick to suggest this is a great time to buy low, things can still get worse. For example, the Fed is still aggressively increasing interest rates in an effort to fight sky-high inflation, but this also dramatically constrains economic growth (it makes it much more expense to borrow money to fund growth). And the Fed still has years to go in unwinding its balance sheet (it bought a bunch of assets to speed up the economy during the pandemic and the ‘08-’09 Financial Crisis, but now it intends to sell those balance sheet assets which will slow the economy).

Further still, now that interest rates are significantly higher than 0.0% (the fed kept them artificially low during the pandemic) investors could shift money to bonds thereby adding more selling pressure to stocks (the yield on a 1-year US treasury is currently around 4.7%!).

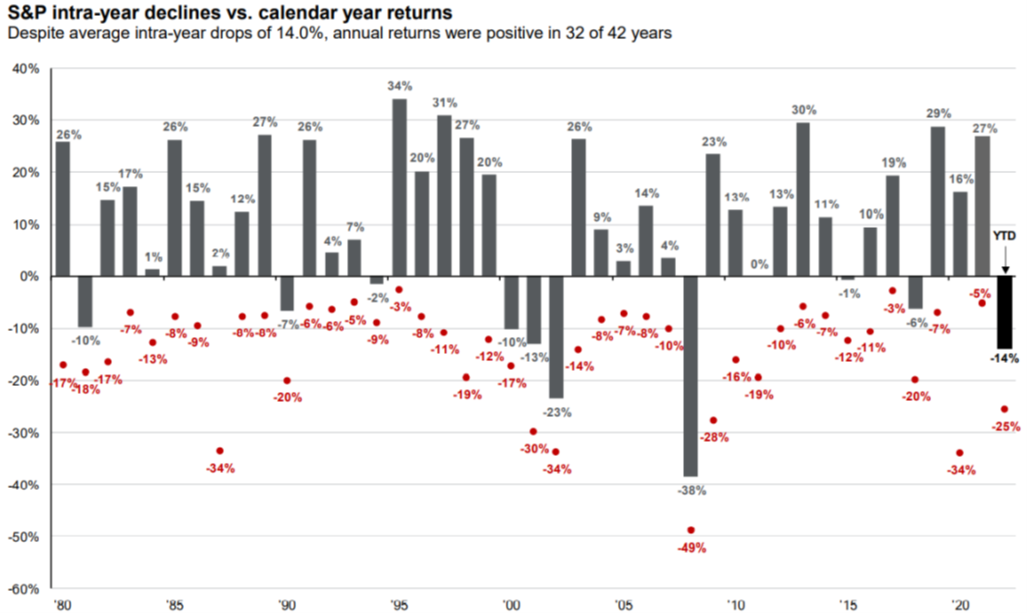

So even though “buying low” can be a smart long-term move (see chart below), things can still get worse before they get better.

Where Should You Invest Your Money

Where you invest your money should depend entirely on your own individual goals and tolerance for volatility (as well as your need for cash flow). For example, if you’re 25 years old and saving for retirement—now is still a great time to buy growth stocks (remember, the price for top long-term performance, is often high short- and mid-term volatility—like this year). But if you are retired (or nearing retirement) your goals are probably very different. Here is some perspective and a few specific ideas about current market risks and opportunities.

Growth Stocks Versus Value Stocks

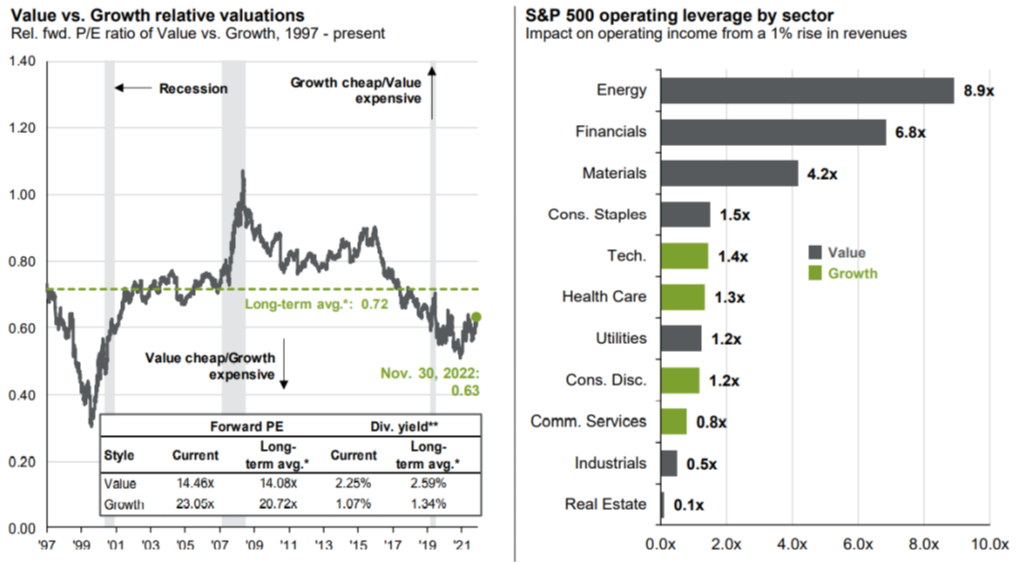

Growth stocks led the market higher as the pandemic bubble inflated in 2020 and 2021. Specifically, growth stocks benefits from the Fed’s artificially low interest rates (which were implemented to stimulate the economy) and from the dramatically increased size of the Fed’s balance sheet (the Fed was buying bonds, also to help stimulate the economy).

However, growth stocks have led the market lower this year as rates have risen and as the Fed is expected to unwind its balance sheet at an accelerated pace (as you can see in this next chart).

However, despite this year’s growth stock sell off, growth stocks are still expensive as compared to value stocks, an indication that there could be more growth stock pain to come. On the other hand, if you are looking to add a little quick value stock exposure to your portfolio, the Vanguard Value ETF (VTV) is a quick cost-efficient way to do it.

Further still, value sectors of the economy, such as Financials, stand to benefit significantly. For example, big banks benefit from higher interest rates because it improves the spread on net interest margins (the rate they lend at versus the rate they borrow at), and operating income (as you can see in the chart above) is set to increase dramatically. For example, here is a look at the relatively low current valuation of Financial Sector stocks versus expected EPS growth (see chart below).

We like big banks going forward (such as JP Morgan (JPM)), as well as select finance companies, including business development companies, including Main Street Capital (MAIN), Owl Rock (ORCC) and Ares Capital (ARCC). These all happen to pay significant dividend income too.

Small Cap versus Large Cap

Another interesting market dynamic is the current valuation of small cap stocks versus large cap stocks. As you can see in the following chart, small cap valuations are currently near historical lows (arguably a strong indication of value and opportunity in small caps).

From a risk management standpoint, investors can top off their small cap allocation with a passive small cap ETF, such as (IWM), or with small cap funds. For example, we like the Royce Microcap CEF (RMT) and the Royce Small Value CET (RVT), both of which offer very large distribution yields for income-focused investors.

Bottom Line Takeaways

No one knows where the market will be next week, next month or even next year (and if anyone tells you they do—they are absolutely full of it). However, risk factors are tilted in favor of value stocks and value sectors (such as financial sector stocks) and increasingly in favor of small cap stocks. None of this means value, financial and small cap will be the market leaders in 2023, just that they are increasingly attractive from a long-term investment standpoint in our view.

As year end approaches, a lot of investors will be rebalancing their portfolios to make room for IRA contributions, required minimum distributions, tax loss harvesting and simply to take advantage of attractive opportunities. As you consider rebalancing your investment portfolio, we like value stocks, financial stocks and small cap stocks, and we have been adding small tilts to these opportunities in our own investment portfolio. However, at the end of the day, you need to do what is right for you.