Income-focused investors often love bond closed-end funds (“CEFs”) for their big monthly distribution payments. However, this year has been challenging as interest rate volatility has created some painful price moves. In this report, we review one bond CEF in particular that has almost zero interest rate risk (its duration is close to zero), but still pays big steady monthly distributions to investors.

BlackRock Multi-Sector Income (BIT), Yield: 10.1%

BIT’s primary investment objective is to seek high current income, with a secondary objective of capital appreciation. BIT seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. The Trust may invest directly in such securities or synthetically through the use of derivatives.

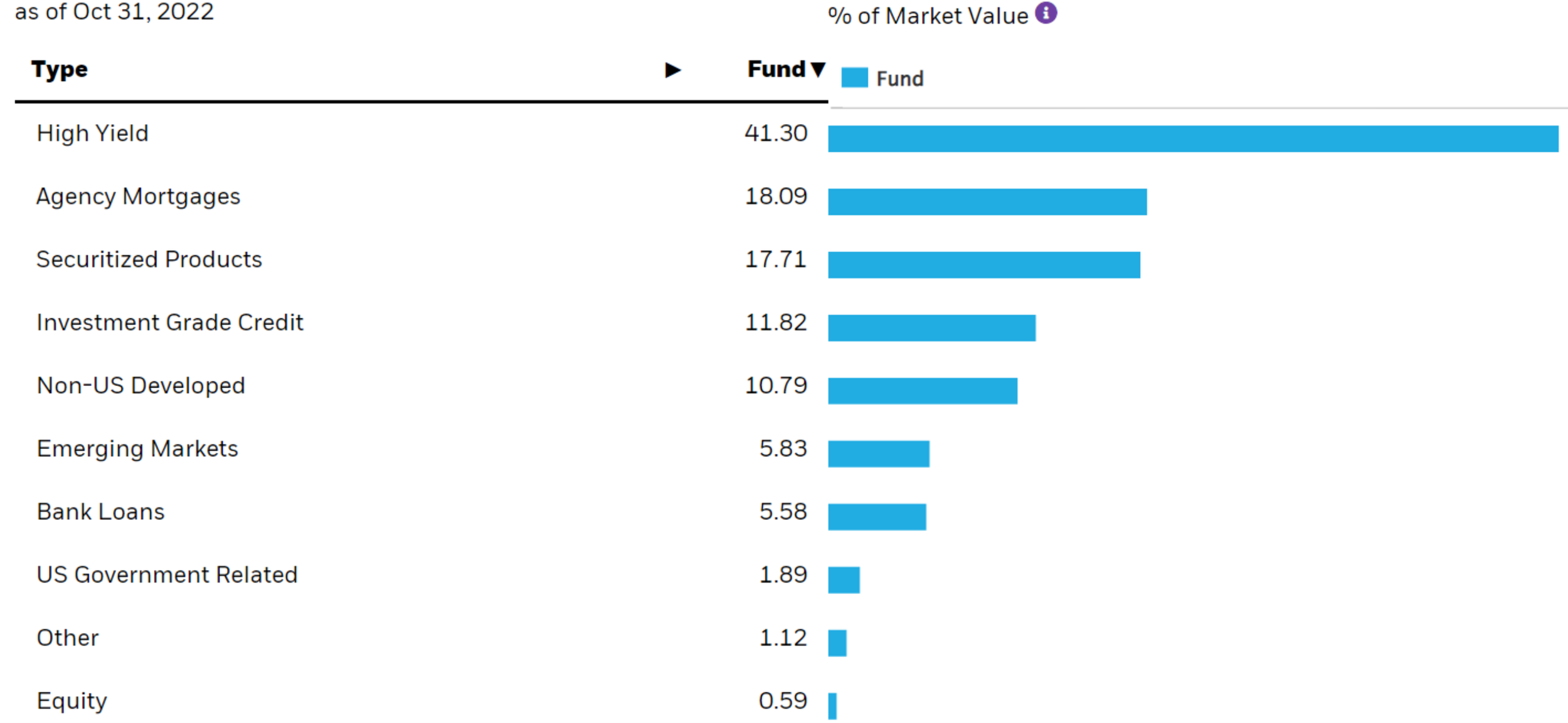

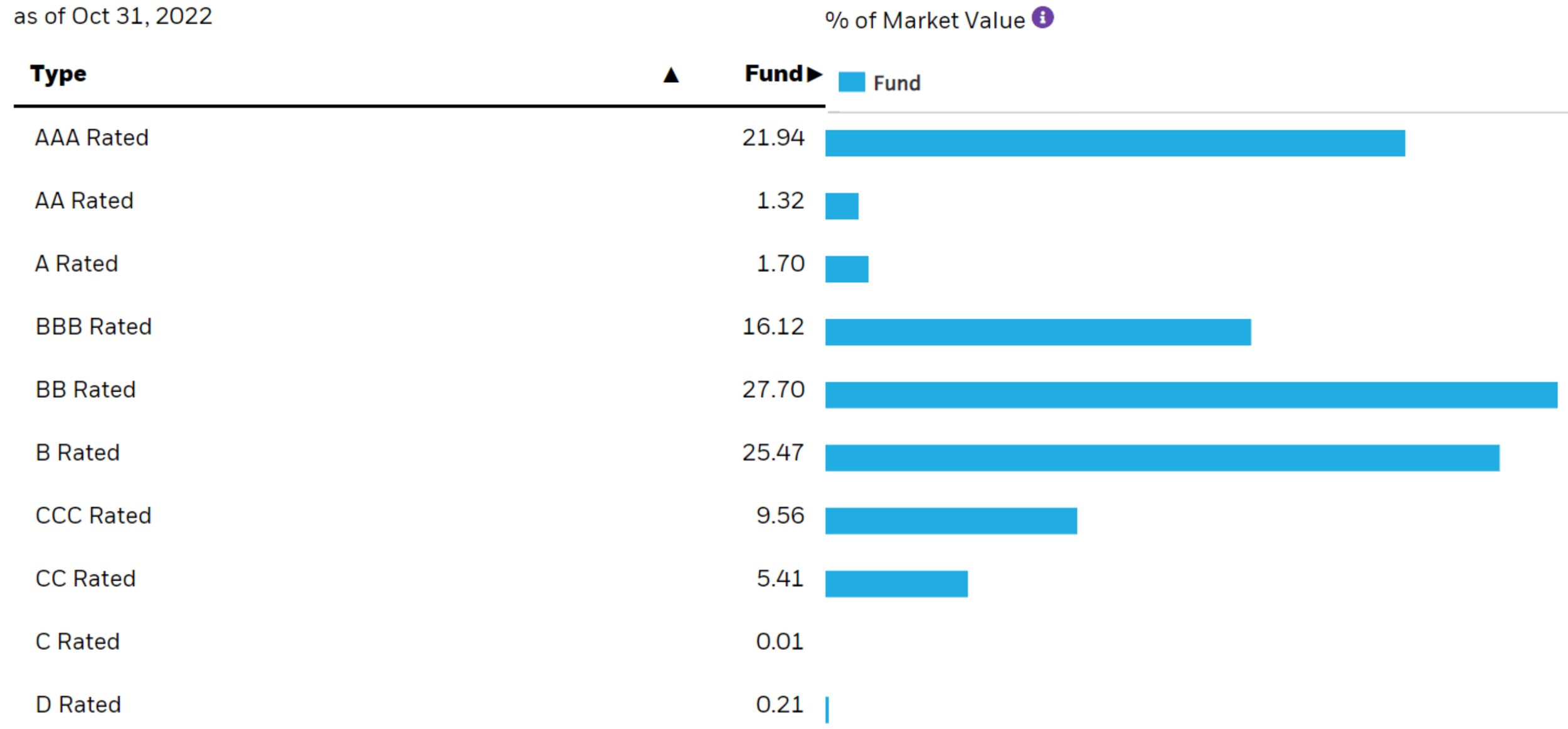

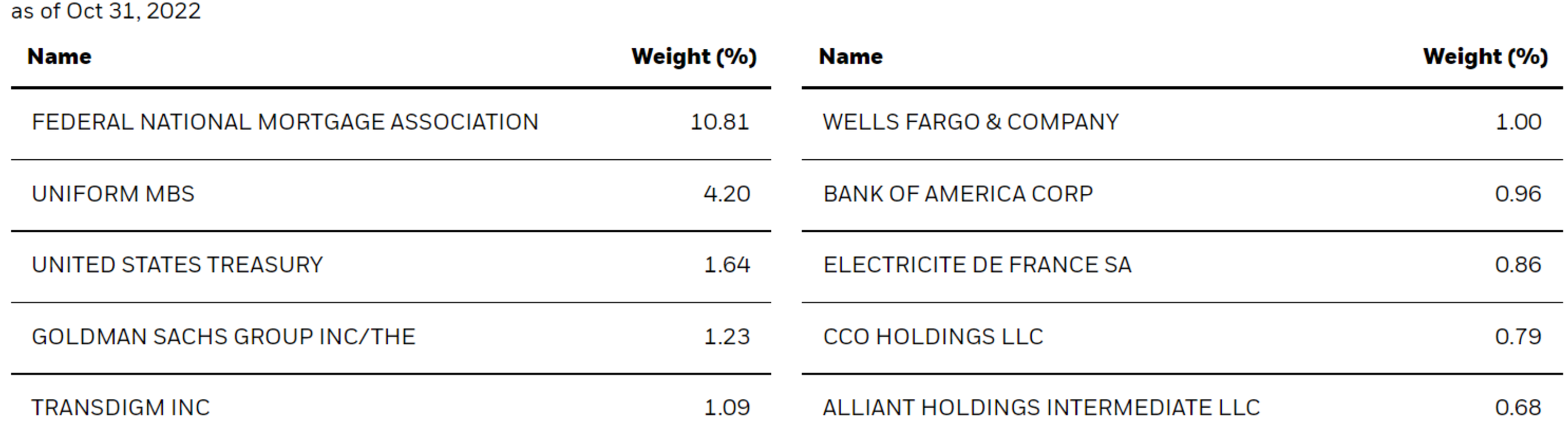

To put that in perspective, BIT currently has over 1,500 individual holdings, and here is a look at some of BIT’s holdings characteristics (and you can view more on the BIT website here).

Top Holdings:

As you can see, the fund is diversified across securities types (e.g. high yield, agency mortgages, bank loans and others) and credit ratings.

CEF Mechanics

Before we go further, it’s important to understand some of the basic “nuts and bolts” on how CEFs work. Similar to other mutual funds and exchange trade funds, CEFs have many underlying holdings (in BIT’s case over 1,500). However, unlike mutual funds and ETFs, there is no immediate mechanism in place to ensure the market price of a CEF stays close to the value of its underlying holdings (i.e. its NAV or net asset value) and as such CEFs can trade at significant premiums and discounts to their NAV, thereby creating risks and opportunities. For example, here is a look at BIT’s historical and current price discount/premium versus its NAV.

We generally prefer to buy CEFs at a discount to NAV (it’s like buying something on sale), and BIT currently trades at a small discount to NAV (as you can see in the chart above).

Leverage

Another important characteristic of CEF is that they can use leverage (or borrowed money). Bond funds are generally limited by regulation to a maximum leverage ratio of 50%, and BIT’s current leverage ratio is around 38.9%. Leverage generally magnifies the interest payments to investors (that’s how BIT and other bond funds keep their yields so high), but it also magnifies price returns in the good times and price declines in the bad times.

We are comfortable with BIT’s leverage ratio. It seems prudent, somewhat conservative (its lower than a lot of popular PIMCO CEFs, such as PDI and PDO) and because BlackRock has the resources and infrastructure in place to monitor and manage leverage appropriately. Not to mention, institutions like BlackRock can generally borrow money more efficiently (and at a lower rate) than you or I, generally speaking.

Interest Rate Risk:

When interest rates rise, bond prices go down. And this has played out in dramatic fashion for most bond CEFs this year as the fed aggressively hikes rates and levered bond fund fall in price significantly (many popular levered bond CEFs are down 15%, 25% and more this year).

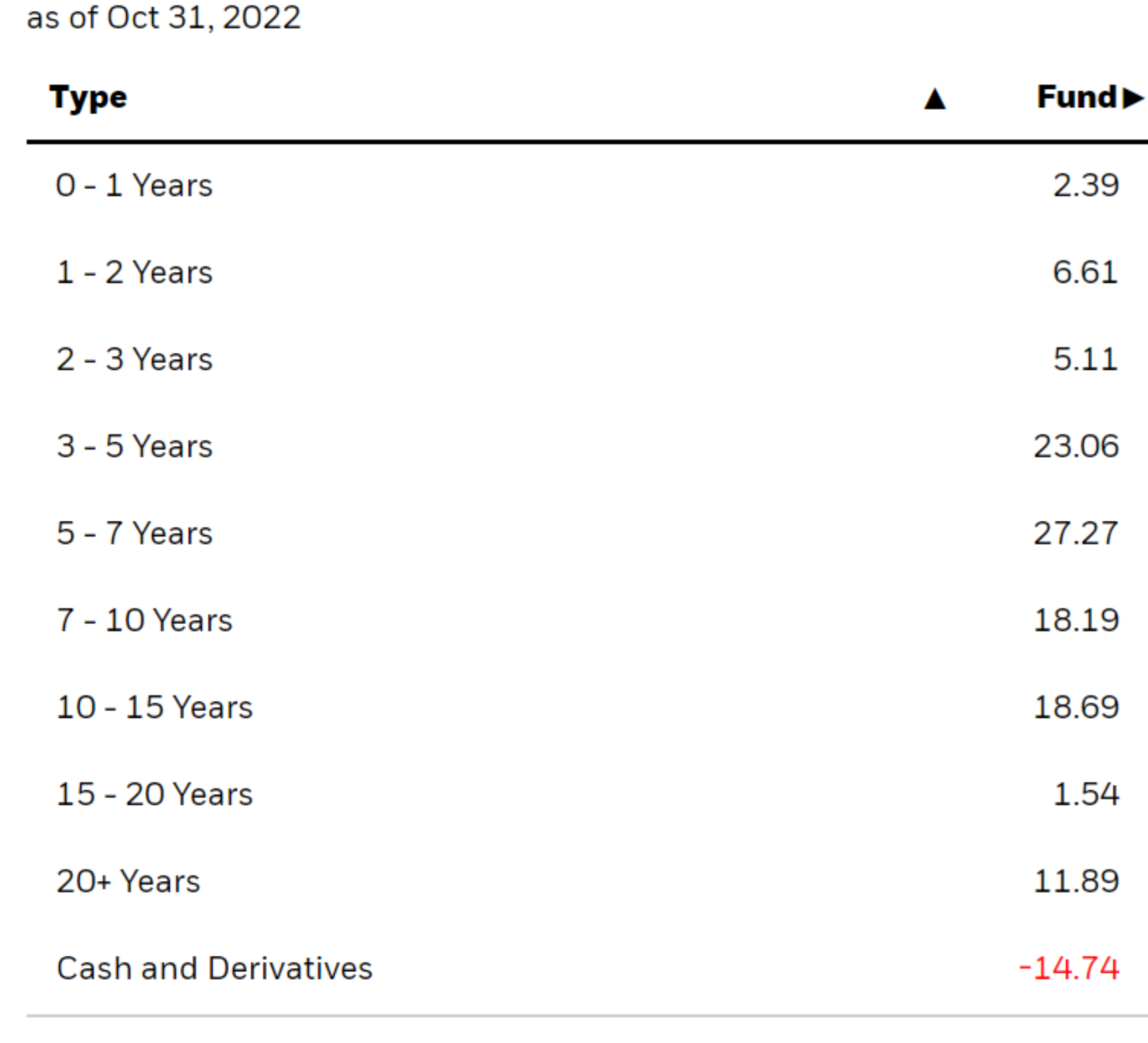

Interestingly, BIT currently has virtually zero interest rate risk. Specifically, interest rate risk is measured by duration, and BIT’s current duration is approximately zero (or 0.12 years) as you can see in the graphic below.

Many bond CEFs have durations in the neighborhood of 4 to 7 years (depending on the strategy), so they are impacted a lot more dramatically by interest rate moves. For reference, duration can be defined as a measure of the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates. Alternatively, duration can measure how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows.

BIT currently keeps its duration near zero through the use of certain financial instruments, including derivatives, used to reduce market exposure and/or risk management. Here is a look at the recent maturity schedule of BIT’s holdings.

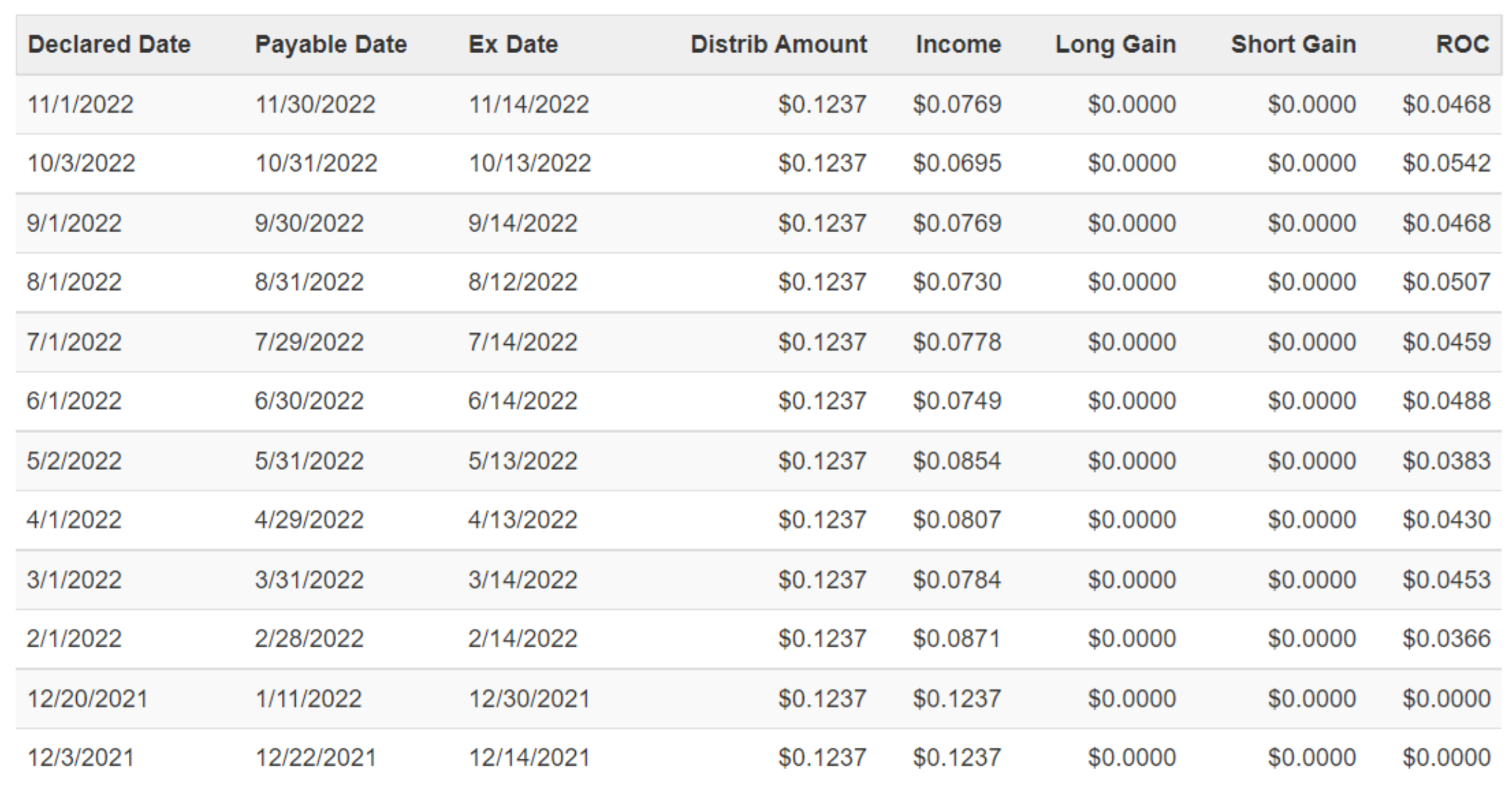

Source of Distribution Payments

A lot of investors love BIT for its big steady monthly distribution payments, which have never been reduced since its inception in 2013 (only increased), and it has also paid an occasional special dividend (a good thing). As mentioned, like most Bond CEFs, BIT is able to magnify the interest payments delivered by its underlying holdings through the use of leverage, but there is more to it than that.

Specifically, bond CEFs can source distributions from income payments from the underlying holdings, short-term capital gains, long-term capital gains, and by simply returning some of your own capital. We generally prefer funds that source income from interest on the underlying holdings. And some ocassional capital gains and return of capital can be acceptable too. However, we generally prefer to avoid funds that source the distribution by returning some of your own capital for an extended period of time because this strategy is not sustainable in the long term and because it can result in some unexpected capital gains taxes if/when you do sell your shares (unless you hold them in a qualified retirement account).

In the case of BIT, the distribution payments have historically been sourced mainly from interest payments on the underlying holdings. However, recently BIT has also been sourcing a smaller portion from return of capital. We view this as acceptable for the time being (considering the dramatic bond market gyrations this year). We believe in the competence and resourcefulness of BlackRock as an organization, and believe the ROC is temporary and will slow/cease soon. Nonetheless, it’s important to monitor.

Management Fees

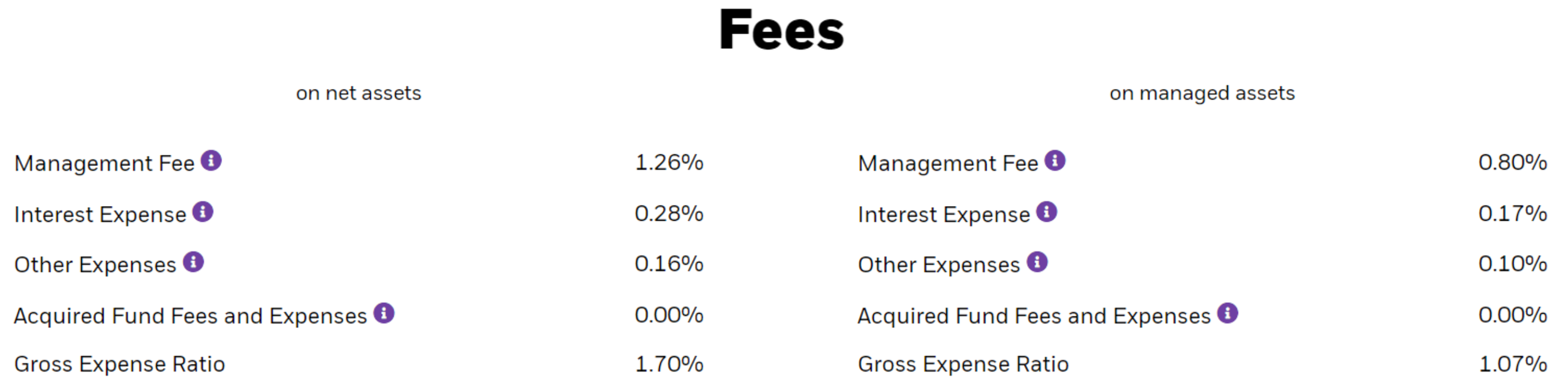

The management fee on BIT is 0.80% annually, which is acceptable for a bond CEF, especially considering BlackRock is able to access bond markets that individual investors cannot, and also considering BlackRock can prudently apply and manage leverage better (and at a lower cost) than most individuals.

However, a few important things to note about fees. First, the 0.80% fee jumps to 1.26% on net assets (the fund uses leverage to buy more). There are also other interest expenses and operational expenses too (see chart above). Overall, we view the fee as quite reasonable based on what you are getting, but at the end of the day these fees still detract from performance.

The Bottom Line

If you are looking for big, steady, monthly income payments, BIT is absolutely worth considering. It is prudently managed by well-respected BlackRock, it uses less leverage than many popular PIMCO funds (such as PDI and PDO) thereby reducing risks in that regard, and BIT has essentially zero interest rate risk, so it is not negatively impacted by rising interest rates to the same extent as most other bond funds. And considering it trades at a discount to NAV, offers over a 10% yield and holds a significant dose of investment grade bonds, we like it. We don’t currently own any shares of BIT, but we have owned it in the past, and it remains high on our watchlist.