Microsoft announced earnings Tuesday after the close, and the shares are reacting negatively. The company beat earnings expectations and topped revenue estimates, but provided weak guidance. Is this a sign of bigger fundamental problems for Microsoft or just a temporary blip on the long-term radar?

To get specific, Microsoft provided weak guidance for the December quarter across all three of its operating segments. More specifically, revenue guidance for the December quarter came in at between $52.4 billion and $53.4 billion, below the Wall Street consensus of $56.1 billion. Also worth noting, revenues from Microsoft’s fasted growing segment, cloud (Azure), came is slightly below expectations. Overall, the company is still growing at an impressive double-digit rate, just not quite as fast as Wall Street was expecting.

Temporary or Permanent Slowdown?

The economy is growing slower as pandemic stimulus fades and interest rates rise (making it more expensive for the economy to grow). Microsoft is feeling this pressure from customers, but it doesn’t mean the long-term secular advantages are over. Cloud is still growing rapidly and Microsoft is a leader with a lot more room for gains as the opportunities are huge and very long-term. The rest of Microsoft’s business is extraordinarily profitable, and will stay that way for years as no one seems able to dethrone this highly-profitable wide-moat juggernaut.

Valuation

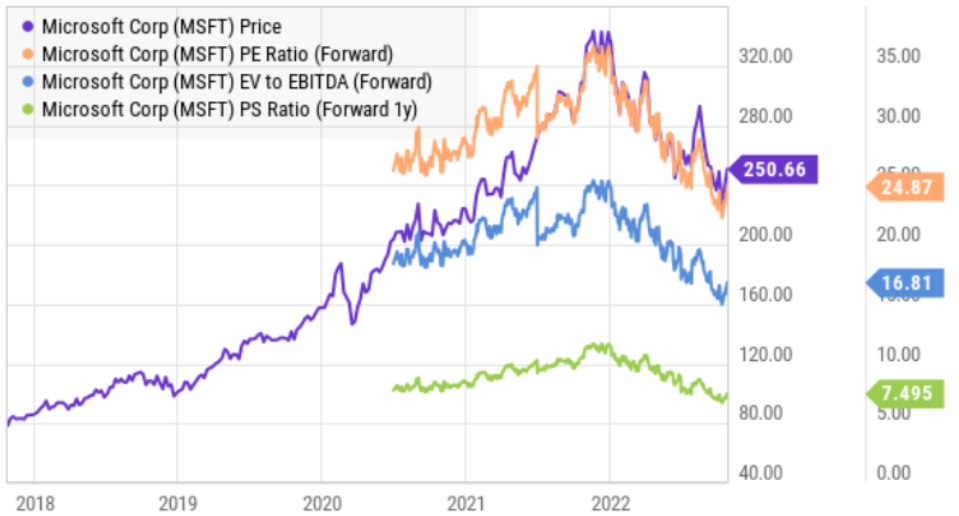

Here is a look at a few valuation metrics (note these are as of Tuesday’s close, so it does not yet reflect the afterhours/pre-market price decline).

Microsoft shares trade at 24.8x forward earnings. This is a very reasonable valuation multiple for a high-growth, high-profit business. What’s more, the company has plenty of cash to keep raising the dividend and buying back shares. For example, Microsoft said it bought back $4.6 billion of stock in the quarter.

The Bottom Line

Microsoft, like the rest of the economy, will face challenges in the near term as the economy slows down (potentially entering a recession). However, this does not change the enormous profitability of this growing, wide-moat, company. It trades at a very reasonable valuation (especially for a double-digit growth company), and pays an extremely healthy growing dividend. Microsoft remains an attractive “buy” and long-term holding.