In the face of intense pressure to direct more cash to renewables, this blue chip energy stock has remained steadfast in its commitment to oil and gas. And this Friday’s earnings announcement will likely prove once again this strategy pays dividends (big, healthy, growing dividends). In this report, we review the company’s business strategy (and how it differs from peers), strong cash flows, dividend safety, valuation and big risks, including a special focus on social and political risks (i.e. the “woke mob”). We conclude with our strong opinion on who might want to own the shares and who might want to stay away.

Exxon Mobil (XOM), Business Strategy:

Exxon Mobil is an integrated oil and gas company. More specifically, it’s one of the world’s largest publicly traded energy providers and chemical manufacturers. It divides its business into three segments, including:

Upstream: this includes exploration, development, production, natural gas marketing, and research activities.

Downstream: this includes refining, marketing and selling of different petroleum products, including gasoline, jet fuel, heating oil, diesel, and propane.

Chemical: this business supplies petrochemicals (compounds derived from oil and gas) that are used to make packaging, plastics, tires, batteries, household detergents, motor oils, adhesives, and synthetic fibers, to name a few.

Exxon Mobil is unique as compared to many of its peers because it has remained steadfast in its commitment to oil and gas, instead of bowing harder to calls for increased investment in renewables. That’s not to say Exxon Mobil has turned its back on renewables altogether (it hasn’t) it’s just been less distracted by unrealistic calls to end fossil fuel immediately. In our opinion, Exxon Mobil continues to be a better steward of shareholder capital than peers, as we will explain in this report.

For example, during the depths of the pandemic (when demand and oil prices were plummeting ), Exxon Mobil continued to push forward with its growth plans, and is now benefiting from higher oil prices and industry supply that is not keeping up with demand. Specifically, as per CEO Darren Woods, on the second quarter earnings call:

“While the market has clearly been a factor, our results reflect our focus on the fundamentals as well as plans and investments we put in motion several years ago and stuck with through the depths of the pandemic.”

For perspective, Exxon Mobil leads all of its peers in oil and gas investment, as you can see in the following graphic.

Strong Cash Flows

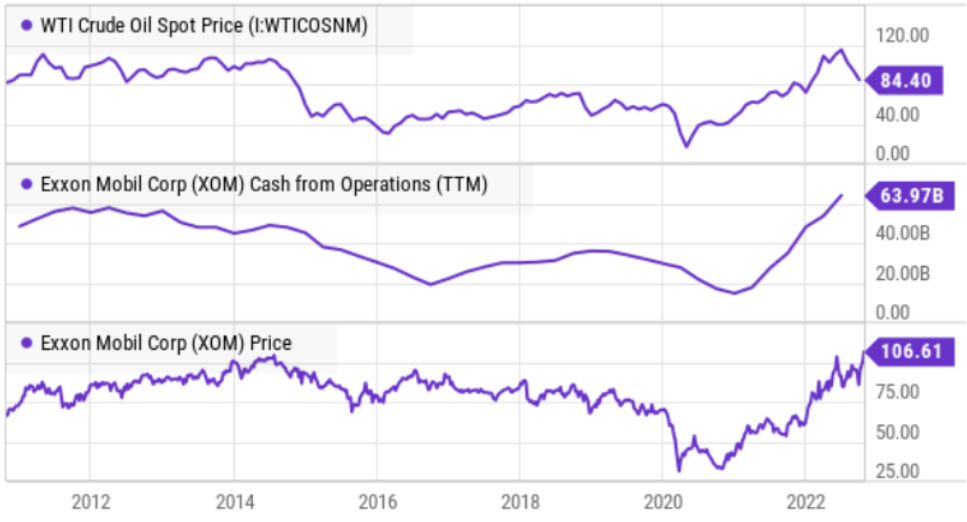

Exxon Mobil is a capital intensive business (i.e. it requires large amounts of investment), and it has continued to deliver very strong cash flow this year, especially as the price of oil has gained. For example, in the following chart you can see Exxon Mobil has delivered its highest cash flow from operations in over a decade.

And as you can also see in the chart above, Exxon Mobil’s cash flows from operations closely follow the price of oil. And its stock price does too. This year’s gain in the price of oil has been a windfall for Exxon Mobil.

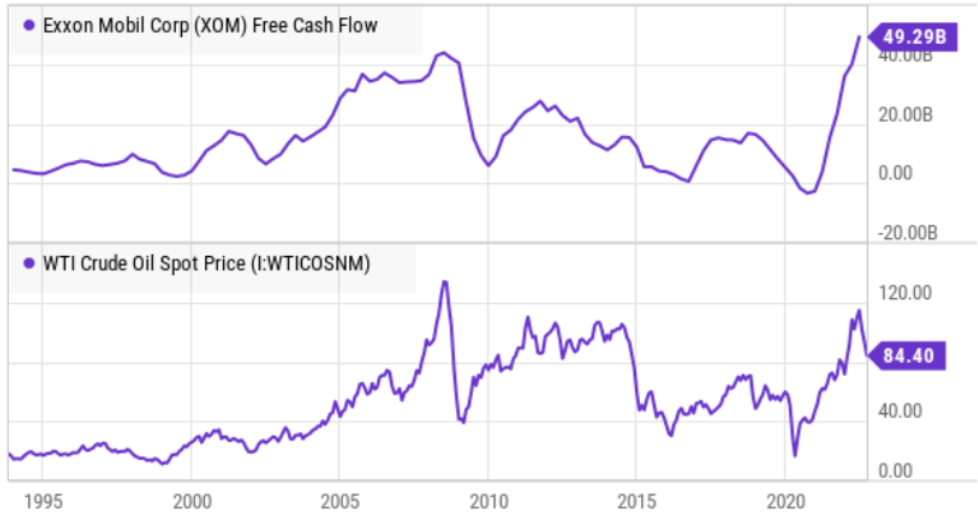

Free Cash Flow (or basically cash flow from operations minus capital expenditures) is an important non-GAAP metric for Exxon Mobil investors to follow because it is an indication of how much cash flow the company has left over to make new investments, pay down debt, buy back shares and pay dividends. Here is a look at Exxon Mobil’s recent free cash flow (as compared to the price of oil), and as you can see free cash flow has spiked (a very good thing).

For perspective, Exxon Mobil pays out about $3.52 per share each year in dividends versus $11.53 per share in free cash flow (i.e. the dividend is very well covered), plus it’s recently been buying back shares, and it has plenty of free cash flow left over to continue financing growth for its capital intensive business.

Dividend Safety:

The steady growing dividend is the main reason a lot of investors own Exxon Mobil. For example, the shares currently yields 3.3% (decent by historical standards), and the dividend payment has been increased every year for the last 19 years.

What’s more, the dividend has grown at an average annual rate of 6.0% over the last 39 years. Further, as we saw earlier, Exxon Mobil’s dividend is extremely well covered by free cash flow, with lots of free cash flow left over to buyback shares and fund growth.

As a side note, Exxon Mobil currently offers three ways for shareholders to receive dividends (direct deposit, check or dividend reinvestment). Considering the healthy dividend, dividend reinvestment has been very powerful for Exxon Mobil over the decades.

Valuation

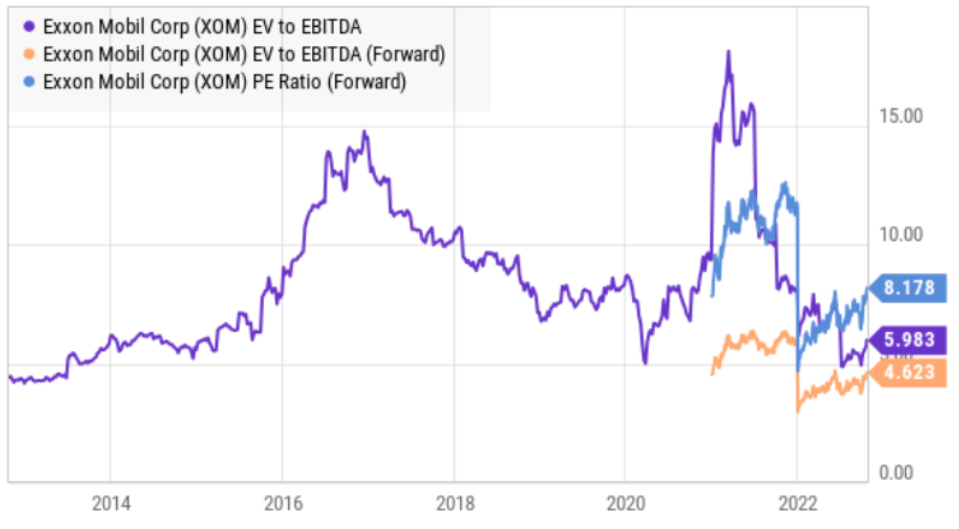

Exxon Mobil currently trades at around 4.6 times enterprise value to forward EBITDA. This is extremely cheap for a business with such financial strength and powerful cash flows.

It also trades at just over 8 times forward earnings. Or said differently, it offers an incredible 12.2% forward earnings yield (the inverse of P/E ratio).

Considering the financial strength and valuation, Exxon Mobil would still be attractive if oil fell dramatically lower. And if the price of oil keeps rising—Exxon Mobil will likely be an incredible winner.

Risk Factors:

Volatile Oil and Gas Prices: are a significant risk factor for Exxon Mobil considering its cash flow and profits depend so heavily on it. However, the good news is that the company is financially very strong (it has an AA- credit rating from S&P), and can weather volatility better than other energy companies. We will have more to say about the future demand and price of oil in a later section of this report.

Capital Intensive Business: As mentioned, Exxon Mobil’s business is capital intensive, meaning they need a lot of cash flow to fund growth (i.e. property, plant and equipment are required and very expensive). However, as mentioned, Exxon Mobil is in a strong financial position with a ton of cash flows. The company was able to keep investing during the covid slowdown (when others backed off), and this has allowed Exxon to be a profit leader now that prices and demand have recovered.

Political, Government and Social Factors: are a major risk for Exxon Mobil. For example, the company can be negatively affected by increases in taxes, changes in environmental regulations, actions by policymakers, litigation and potential greenhouse gas restrictions. Exxon Mobil announced earlier this year that it aspires to be “net zero” or be greenhouse gas emission neutral for its operations by 2025, however this doesn’t account for the emissions produced when its fuels, for example, are used by customers.

Despite The Woke Mob:

To the chagrin of those that would like to see fossil fuel production ended immediately, the US EIA projects production will increase for the next three decades, as you can see in the following oil and gas forecast.

This increase is a good thing for energy producers (such as Exxon Mobil), especially if the price of energy increases, as it has recently, and as you can see in the following high-price and low-price scenarios for oil.

Certainly reducing pollution and protecting the environment are good things, but fossil fuel remains a vital component of the economy, powering our lives and providing jobs (and the alternatives are still much more costly).

And despite the importance of fossil fuels, there are extremely vocal social and political factions (i.e. the “woke mob”) that continue to villainize it, in some cases as an immediate existential threat to the human race. Here are a few recent examples:

Climate activists throw mashed potatoes on Monet painting to protest fossil fuel extraction

Penn Student Protesters Disrupt Football Game to Demand Fossil Fuel Divestment

These pressures are absolutely a risk for Exxon Mobil. Nonetheless, Exxon Mobil has remained steadfast in its commitment, as Morningstar sector strategist, Allen Good, recent wrote:

“While many of its peers have announced intentions to divert investment to renewables to achieve long-term carbon intensity reduction targets, ExxonMobil remains committed to oil and gas… It is also investing in low-carbon technologies, but each of these efforts is measured and keeps oil and gas production at the core. While this strategy is unlikely to win praise from environmentally oriented investors, we think it’s likely to prove more successful and probably holds less risk.”

Conclusion:

Just two years ago, no one wanted oil. The price fell below zero, and Exxon Mobil got dumped from the Dow Jones Industrial Average (after 92 years!). Yet if you were an astute enough contrarian, you recognized social pressures would not eradicate longer-term demand and the shares were a steal (as we wrote about here).

Going forward, Exxon Mobil is in a position of extreme financial strength (thanks to rising demand and rising oil prices). And if you can get passed the risk factors (and don’t mind the factions of social opposition), Exxon Mobil pays an incredible growing dividend and still trades at a very attractive valuation. We are currently long shares of Exxon Mobil in our prudently concentrated Income Equity Portfolio, and we have no intention of selling.