This report shares data on over 50 big-dividend REITs, sorted by industry, and then highlights our pick for the most financially healthy big-dividend opportunity in each of the following REIT industries: industrial, retail, office, healthcare, specialty, mortgage and diversified.

Overview: Financial Health

Before getting into the details, it is worth noting that we are concentrating on financial health in this report because it is increasingly important in the current market environment. Specifically, it becomes increasingly challenging for businesses that are not financially healthy to fund their operations as interest rates rise (thereby increasing the cost of debt they rely on) and as share prices keep falling, as they have this year (thereby making it more expensive to raise cash through share issuances). And every time interest rates rise, it pushes many unhealthy big-dividend companies closer to the brink.

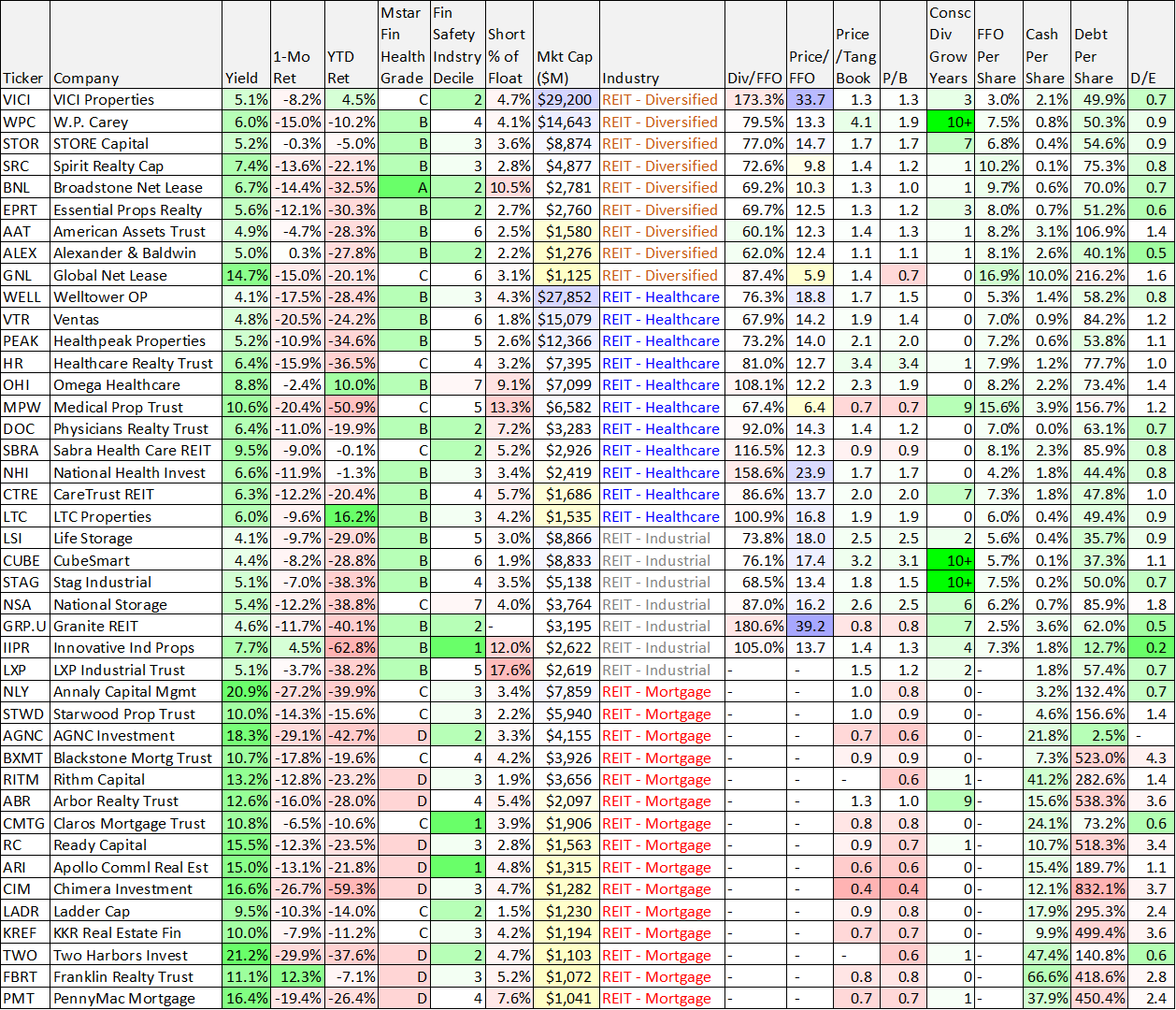

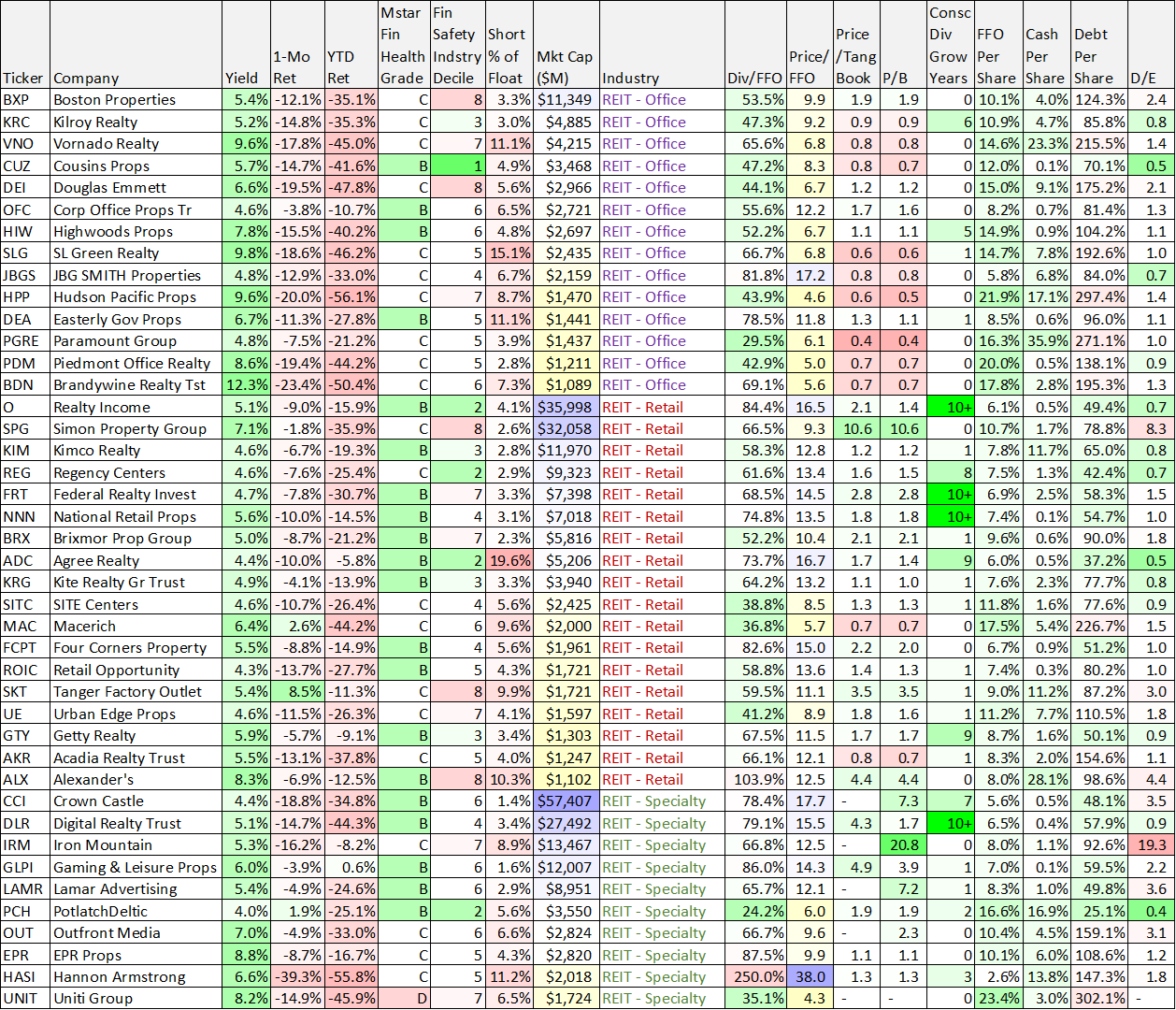

50 Big-Dividend REITs

The following table includes data on over 50 big-dividend REITs, sorted by industry. For example, the table includes data on dividend yield (we required at least a 5% yield to be included), recent share price performance (as you know, this year has been ugly), Funds from Operations (“FFO”) data, and a variety of other “financial health” metrics worth considering.

Before we get into the top 7, here are quick definitions of a couple columns you may not be familiar with.

Morningstar Financial Health Grade (see link) can be used to help eliminate companies that are on shaky financial ground. Specifically, each financial-health grade is based on the strength of each company's balance sheet and cash flows relative to other companies within its sector. Setting the minimum financial-health grade at a C, for example, would eliminate companies in worse-than-average financial shape. To get a high grade in this area, a company should have low financial leverage (assets/equity), high cash-flow coverage (total cash flow/long-term debt), and a high cash position (cash/assets). Also, companies with improving financial health are rewarded, while those with deteriorating health are punished.

Financial Safety Industry Decile: The 1-10 rank of a company's financial safety versus that of its industry peers. Companies with the lowest Financial Leverage and lowest Debt to Equity Ratio will score a 1.

The 7 Healthiest Big-Dividend REITs

With that backdrop in mind, let’s get into the top 7. We have selected one top “healthiest” REIT from each sector, as detailed below.

Retail REITs

1. Realty Income (O), Yield: 5.1%

Realty Income is a well known retail REIT for good reason—it offers an attractive dividend (paid monthly) and the business is actually very financially healthy. And financial health is not necessarily something you would expect in the retail real estate sector. Specifically, between pandemic disruption and the continuing growth of online shopping, brick-and-mortar retail has been facing serious headwinds for years.

However, Realty Income stands out for its financial strength, including low debt-to-equity, a dividend well covered by FFO, and a long history of increasing the dividend payment every year. Furthermore, Realty Income continues to grow (albeit at slightly slower pace than historically) as its large size lends itself to more growth through acquisitions. Realty Income won’t be the fastest growing REIT in the sector, but it is one of the safest, especially considering its property types are concentrated in retail areas that are less susceptible to being overtaken by internet shopping. With a dividend yield that has now mathematically risen to over 5% (as the share price is down this year) Realty Income is a steal if you are looking for a healthy big dividend. For more information, our previous detailed report on Realty Income is available here.

Industrial REITs

2. Stag Industrial (STAG), Yield: 5.1%

In recent years, Stag has steadily evolved from a riskier industrial REIT (focused on single-tenant properties in secondary and tertiary markets) to a sophisticated and operationally efficient, $5 billion market cap, industrial REIT leader. And not only is the debt low and the monthly dividend well-covered, but the shares are particularly low-priced right now as the entire industrial REIT industry has sold of indiscriminately and particularly hard this year as the accelerated growth from the pandemic bump has now slowed. Yet we view the slowed growth as temporary because the long-term secular demand for industrial properties will continue to grow (unlike certain undesirable retail REITs where demand will keep slowing). We like the industrial REIT sector, and we like Stag in particular. If you are looking for a relatively safe big dividend, Stag is absolutely worth considering. For more information, our previous detailed report on Stag is available here.

Diversified REITs

3. Broadstone Net Lease (BNL), Yield: 6.7%

Broadstone falls into the diversified REIT category, but roughly 50% of its business is in the industrial REIT industry—and industry we like (as described above). Further, Broadstone has sold off particularly hard this year as the industry has sold off, but also because it is perceives as riskier because it has a smaller market cap, it is relatively new (it IPO’d in 2020) and it is focused on single tenant properties (which are perceived as risker, but Broadstone is so well diversified that it becomes essentially a non-issue).

Broadstone has the highest Morningstar Financial Health Grade (it’s the only “A” rated opportunity) in our big-dividend table. It’s debt is low, its dividend is well covered by FFO, and we expect its valuation multiple to expand as more people become familiar with the opportunity. For more information, our new detailed report on Broadstone is available here.

*Honorable Mention (Diversified REIT):

W.P. Carey (WPC), Yield: 6.0%

Coming in slightly less healthy (but still healthy) on the “Morningstar Financial Health Grade” is popular big-dividend diversified REIT, W.P. Carey. WPC is one of the largest net REITs, it’s focused on industrial real estate (as well as Office, Retail and Others), and the share price is down roughly 20% over the last months. And despite the fact that this one faces the same macroeconomic and capital market challenges as others, WPC has a very strong financial position, a very attractive portfolio, a healthy dividend and a compelling valuation. We are including it as an honorable mention on this list (we like it), and you can read our new full report on W.P. Carey here.

Mortgage REITs

4. AGNC Investment Corp (AGNC), Yield: 18.3%

To be clear, mortgage REITs are very different than the other REITs in this report. Specifically, they often don’t necessarily own any properties, but rather property-related securities, such as mostly Agency Mortgage Backed Securities (Agency MBS) as is the case for AGNC.

Mortgage REITs can be a particularly volatile industry, depending on market cycle dynamics, because they use significantly more leverage (or borrowed money) than other REITs. Mortgage REITs face significant challenges when interest rates are volatile (like they have been this year) and when Agency MBS spreads widen (like they have this year, based on interest rates and housing market risks).

One of the most basic ways to value mortgage REITs is based on their current market price versus their book value. For example, a low price-to-book value (for instance, below 1.0) can be a signal of great opportunity (i.e. a discounted price) and risk. In the case of AGNC, the price-to-book is unusually low (and interest rate risks and MBS spread risks are heightened).

AGNC recently pre-released its quarterly book value numbers (to help calm investor concerns), and we followed that new information up by writing a very detailed report about AGNC Investment Corp that you can access here.

Office REITs

5. Cousins (CUZ), Yield: 5.7%

Office REITs have faced significant challenges in recent years as work-from-home arrangements have risen sharply thereby decreasing the demand for office space. And what what was spurred by covid lockdowns appears to have long legs for years into the future.

Despite the secular challenges faced by office REITs, Cousins stands out based on its low debt, well-covered dividend, low valuation multiples (P/FFO and P/B) and strong Morningstar Financial Health Grade. Based in Atlanta, and founded in 1958, Cousins primarily invests in Class A office towers located in high-growth Sun Belt markets. Given current market dislocations and this office REIT’s financial strengths, Cousins is hard to ignore.

Healthcare REITs

6. Physicians Realty Trust (DOC), Yield: 6.4%

Physicians Realty Trust isn’t the fastest growing REIT, and it has far less dramatic upside price appreciation potential than increasingly troubled industry peers like Omega Healthcare (OHI) and Medical Properties Trust (MPW) (which both have distressed operators, higher yields and more interesting valuations), but DOC does have much more stability and financial health.

If you don’t know, Physicians Realty Trust owns healthcare properties that are leased to physicians (as well as hospitals and healthcare delivery systems). DOC also offers a well covered dividend, a reasonable valuation, less debt and is in a much stronger financial position than many of its industry peers. If you are looking for a steady dividend yield (along with some price appreciation potential), Physicians Realty Trust is worth considering.

Specialty REITs

7. Digital Realty Trust (DLR), Yield: 5.1%

Digital Realty is a data center REIT, and the shares have sold off way too hard this year as it’s gotten caught up in the tech sell off (tech stocks are down more than the market averages this year). Noteworthy, DLR has low debt, a very reasonable valuation and a dividend (that has been growing every year for 10+ years) that is well covered by FFO. Simply put, if you are looking for a steady big-dividend with some reasonable share price appreciation potential, Digital Realty is a blue chip REIT worth considering.

The Bottom Line

REITs are often an income-investor favorite, but not all REITs are created equally. And the changing capital market conditions this year (e.g. rising rates, lower stock prices) are creating increasing challenges for some REITs in particular. This is why it can be so important to pay attention to the financial health of your investments. Every investor is different and has their own unique goals, but if you are looking for financially healthy big-dividend REITs—many of the names on this list are attractive and worth considering for a spot in your prudently diversified, long-term, income-focused portfolio.