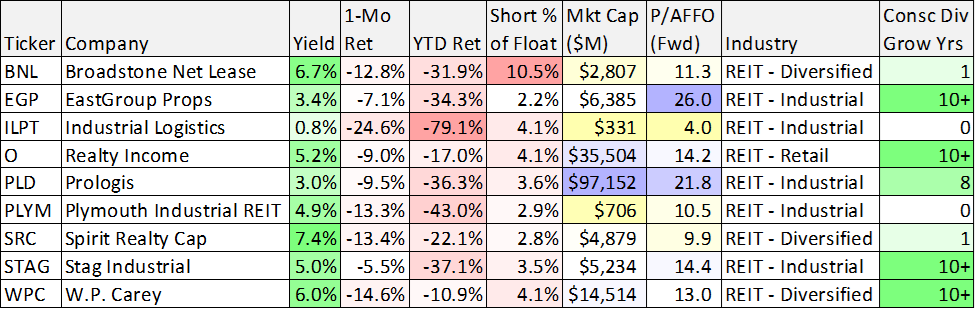

Shares of the commercial REIT we review in this report have declined sharply this year (and the dividend yield has mathematically risen to 6.7%) as investors have shifted from optimistic to pessimistic. However, there are reasons to believe the sell off has gone too far. In this report, we review the risks (including single-tenant properties, economically sensitive property types, and high short interest), and the opportunities. We conclude with our strong opinion on investing.

Overview: Broadstone Net Lease (BNL)

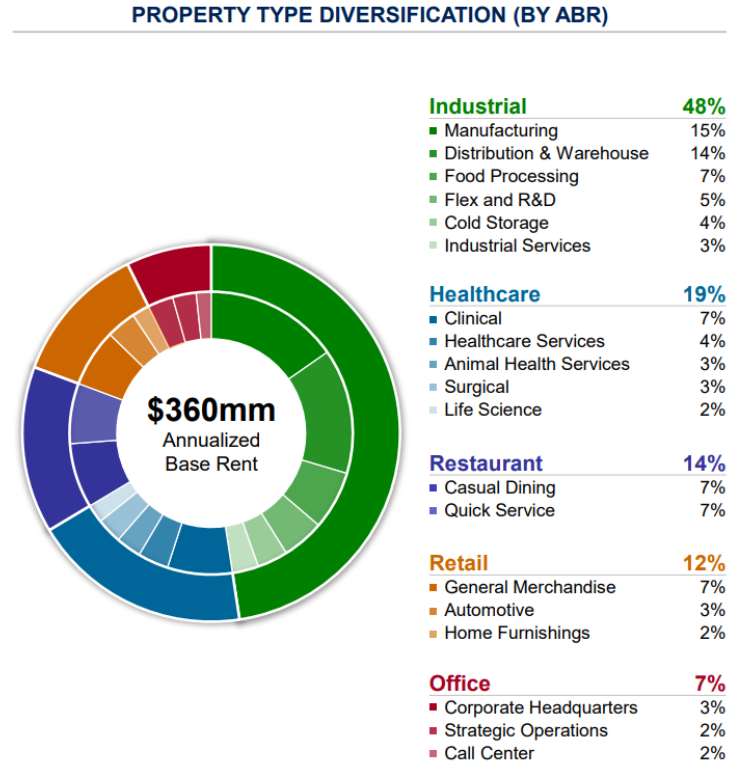

Established in 2007, Broadstone is a net lease property REIT that began trading publicly in 2020 through an initial public offering. Broadstone’s business is to acquire, own, and manage primarily single-tenant commercial real estate across several core property types, including industrial, healthcare, restaurants, retail, and office. The company focuses on establishing long-standing relationships with creditworthy tenants who occupy properties with strong fundamentals.

Attractive Broadstone Qualities:

Before getting into Broadstone’s big risks, let’s first review the strong positives:

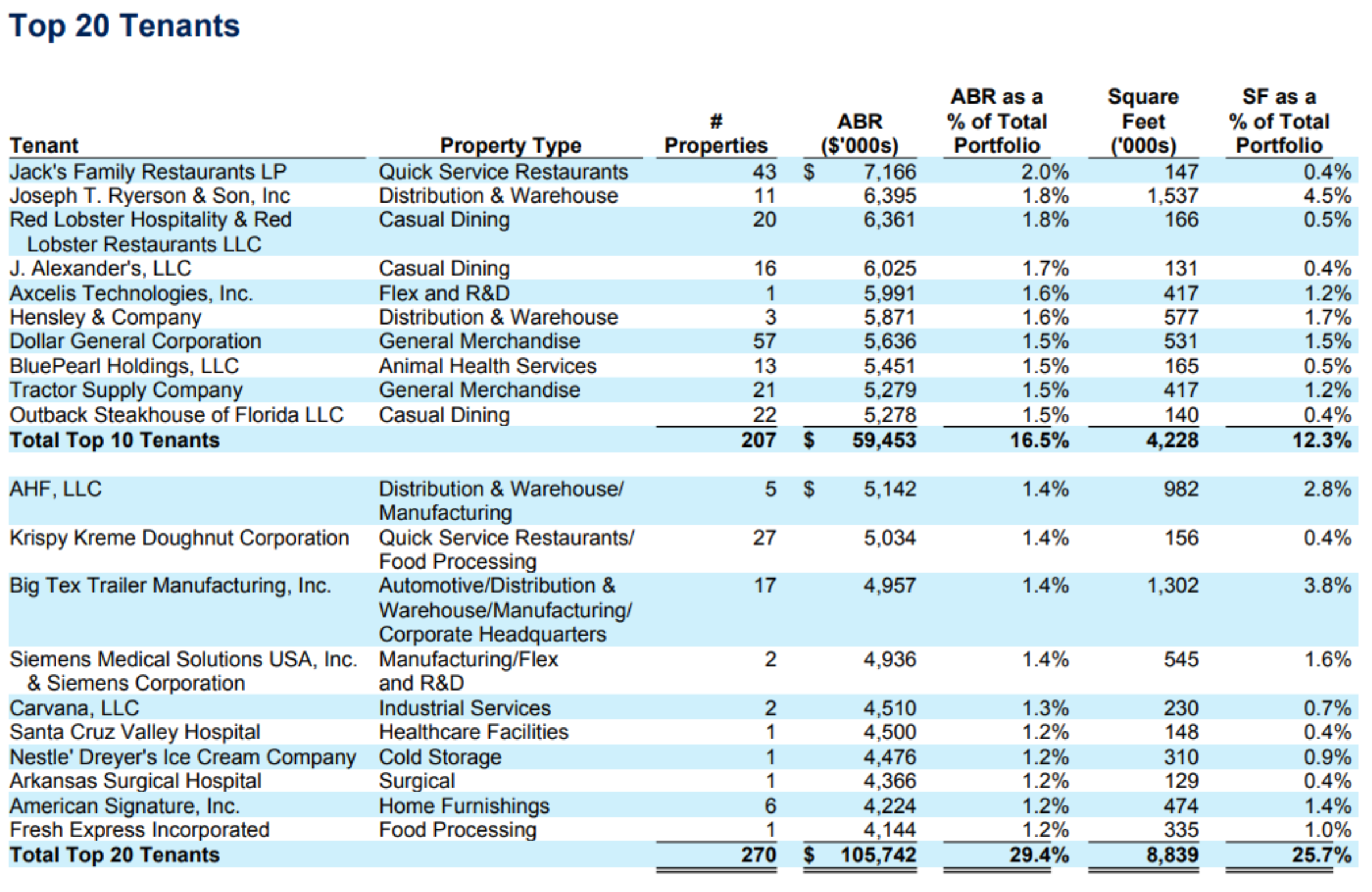

Low Tenant Concentration: For starters, Broadstone is well-diversified across tenants. For example, you can see in the following “Top 20 Tenants” table, the largest tenant is only 2% of annual base rent. This is a very low concentration risk (especially as compared to other REITs that may have only a small number of tenants that comprise the majority of the ABR). Also worth noting, in the most recent quarter, Broadstone collected 100% of the rent (i.e. no troubled operators).

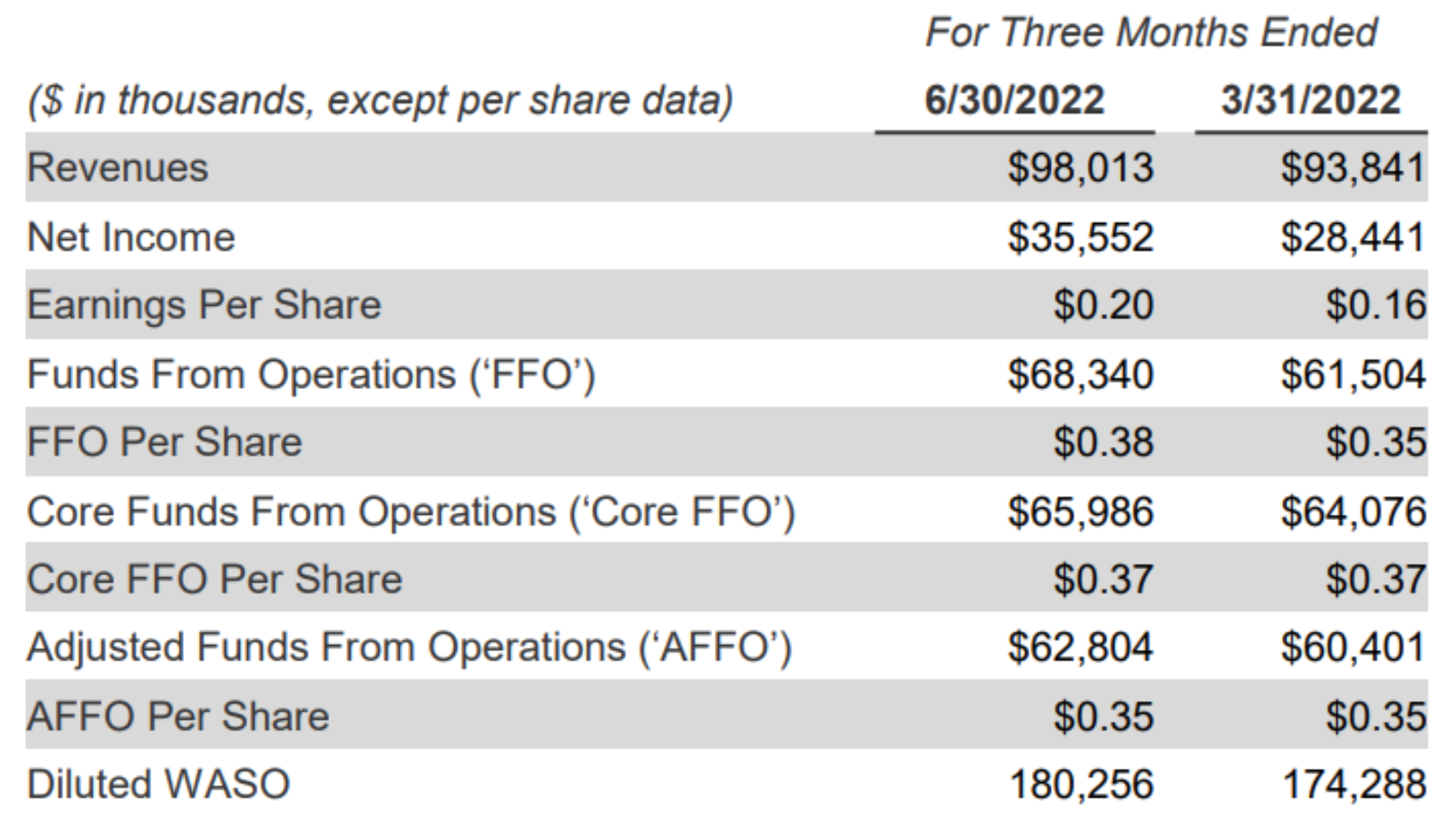

Well-Covered Dividend: Broadstone’s dividend is well covered by its funds from operations (“FFO”). For example, the quarterly dividend payment is $0.27, and this amount is significantly less than FFO (and Adjusted FFO) per share, as you can see in this next table.

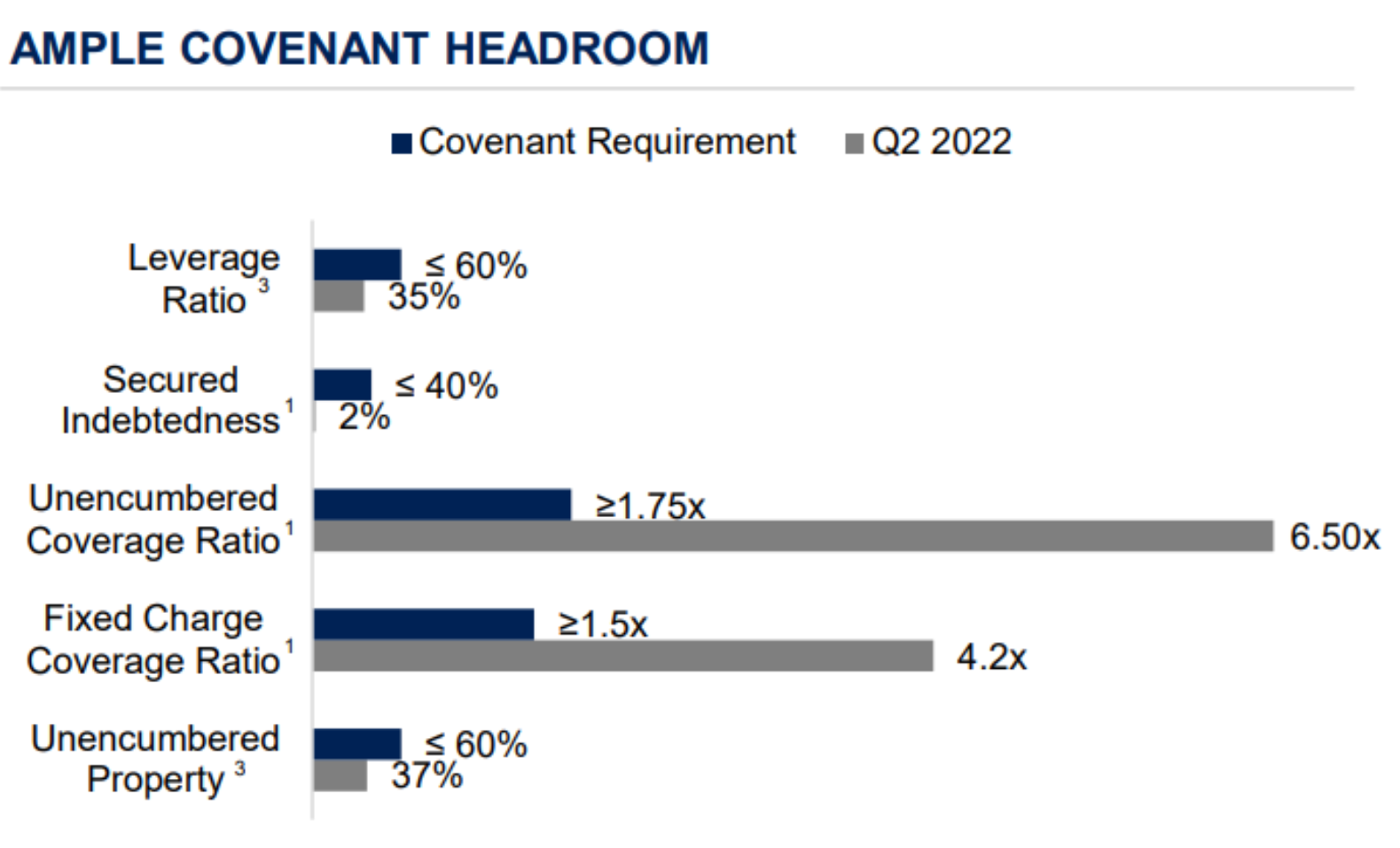

Strong Financial Position: Broadstone has plenty of healthy financial wherewithal, including an investment grade balance sheet (BBB / Baa2 issuer ratings) and lots of liquidity. For example, Broadstone has a lot of cushion relative to its debt covenants (an indication of dry powder and strength).

Also worth noting, Broadstone receives an “A” grade for financial health from Morningstar, as we recently noted in this report.

Attractive Valuation: Shares of Broadstone have fallen sharply this year (they’re down more than 30%) as the overall market is down, especially REITs (as we will cover in the next section on risk). However, Broadstone now trades at only ~11.3x forward AFFO.

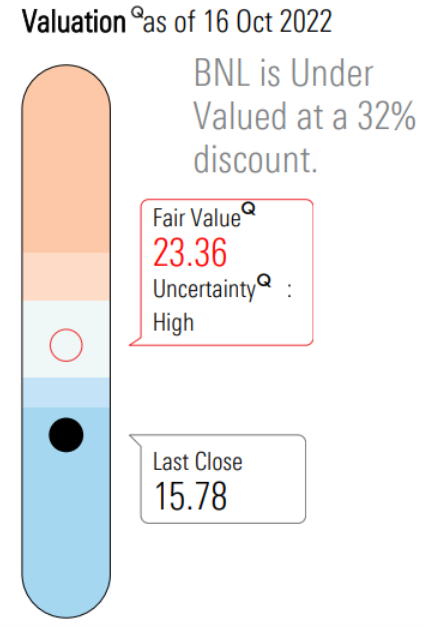

This is a very compelling multiple as compared other REITs, especially given Broadstone’s healthy business. Interestingly, Morningstar’s quantitative rating system also views the shares as significantly undervalued.

In the next section, we’ll get into some of the risk factors (and their credibility) with regards to what is keeping Broadstone’s valuation multiple so low.

Risk Factors:

Shares of Broadstone have sold off hard this year, as the overall market is down. There is a lot of talk of a big ugly recession on the horizon, and this will negatively impact virtually all companies. That is a big part of the reason the shares are down over 30% this year, but let’s consider more of the Broadstone specific risk factors:

Property Type Risks: Broadstone is diversified across various property types, as you can see in our earlier graphic. However, the largest exposure is Industrial real estate, and that is a sector that has been hit particularly hard this year. Industrial REITs did very well right after the pandemic as new supply chain challenges and lock downs created new demand for industrial properties. However, as those challenges are largely being worked out, the pandemic bump to industrial REITs has now slowed, and Industrial REITs in general are down significantly this year. Arguably, a very good time for contrarians to “buy low” as the economy and the markets will eventually get better (and the long-term demand for industrial real estate is not going away—it is only going to strengthen over time).

Single-Tenant Properties: Most of Broadstone’s properties are occupied by a single tenant, and the conventional wisdom is that this creates more risk, Afterall, if a single tenant goes under, the entire property collects no rent. And this perceived risk is part of the reason the shares have sold off so hard this year (especially as recession threats loom). However, in reality, Broadstone is so well diversified across so many tenants spread across so many geographies (744 properties across 44 US states and 4 Canadian provinces) that even if a few tenants go bankrupt, that won’t ruin the business. Also, again, Broadstone collected 100% of its rents from tenants last quarter.

Rising Interest Rates: In case you’ve been living under a rock, interest rates have been rising sharply this year. And this creates big challenges for a lot of businesses that have been accustomed to operating in a near-zero interest rate environment (all of a sudden it is becoming a lot more expensive to finance the business). Not to mention, rising rates slow the rate of new business in general (it’s harder to grow and expand business when rates go up). CEO Chris Czarnecki noted this risk on the latest quarterly call, explaining:

“Clearly, the long-term cost of debt for all net lease REITs is considerably higher today when compared to year-end. In addition, the cost of equity has changed year-to-date for all net lease REITs, but more specifically those focused on non-investment-grade tenants.”

However, Broadstone’s very strong financial position (as described earlier) helps the company more easily navigate the environment, and they are still (selectively) investing in attractive new opportunities. For example, Czarnecki also noted during the call:

“During the second quarter, we invested $182 million in 15 properties at a weighted average initial cash cap rate of 6.4%. The leases include a strong weighted average lease term of approximately 20 years, and solid 2.1% annual rent escalations, translated into robust weighted average GAAP cap rate of 8%.”

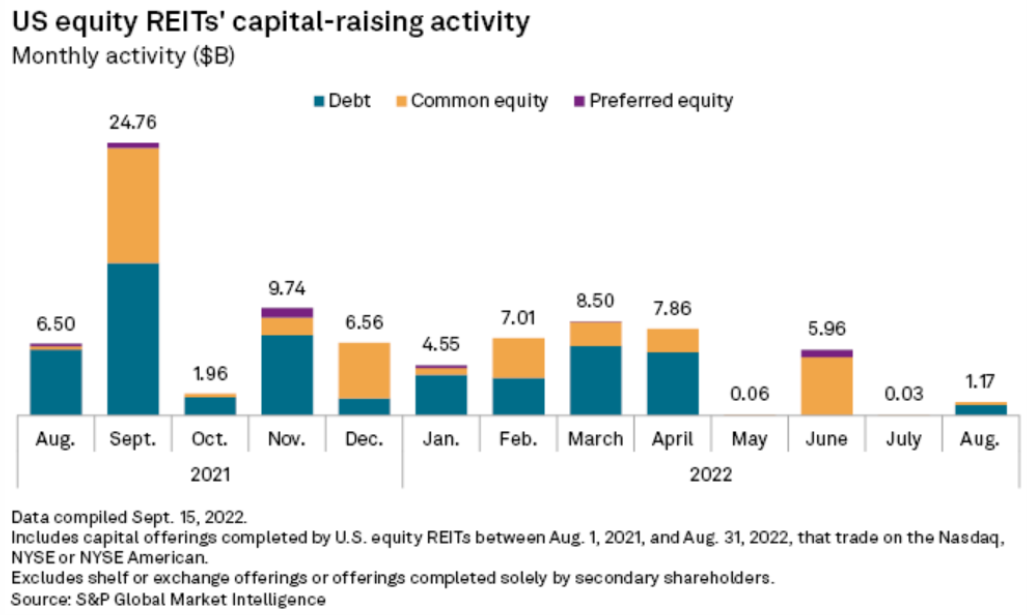

Challenging Capital Market Conditions: To provide color on the increasingly challenged industry environment, here is a look at the dramatically slowed new share and debt issuances this year versus last year as conditions have changed dramatically (i.e. it has become more expensive to raise capital to fund growth).

Worth noting, Broadstone IPO’d in September of 2020 (shortly after the pandemic hit) when rates were lower and demand for industrial REITs was growing very rapidly. Also, again, Broadstone is able to use its strong financial position to navigate the current rising rate environment.

High Short-Interest: Also worth noting, Broadstone shares have roughly 10% of the shares sold short, which means a lot of investors are betting against the shares relative to the rest of the market. In our view, this bet is based more on indiscriminate bias against Broadstone’s single tenant, smaller market cap and industrial REIT characteristics (which have been selling off hard), and not an appropriate take on the company’s actual company-specific fundamentals. In fact, it has created an attractive long-term buying opportunity for contrarians, in our view.

Conclusion:

Broadstone has the financial wherewithal and the secular tailwind strength (i.e. industrial REIT demand will eventually keep growing faster than other sub-industries) to survive current market challenges and thrive in the long-term. The share price decline has been driven by indiscriminate short-termism, and the low valuation has created an attractive buying opportunity. Broadstone is a relatively new, smaller and lesser known REIT, and we suspect the valuation multiple will continue to expand (i.e. the share price will go up) as the market becomes more familiar and comfortable with the company. We don’t currently own Broadstone, but it is high on our watchlist. The shares look attractive for income-focused investors that also like long-term share price appreciation.