With the market in disarray this year (stemming from inflation, central bank policy changes and now the threat of an ugly recession) a lot of investors are increasingly looking to dividend stocks for safety. With that trend in mind, we are sharing the 10 most “financially healthy” big dividends (yields of 6% and up). We conclude with our strong opinion on how you should, and should not, be playing this current market environment.

Macroeconomic Backdrop

Before getting into the ranking, let’s first consider the question of “why?” Specifically, why would anyone want to invest in the healthiest big dividends? For starters, big dividends provide comfort when the market is volatile. When the market goes down, it can feel nice to keep receiving steady (growing) big dividend payments. It can help you sleep well at night.

With regards to the question of “healthy,” we are looking for sustainable dividends (not yield traps!). Healthy is critically important in this market environment with interest rates rising and a potentially ugly recession looming. It’s so important to know that the company paying the dividend isn’t going to get crushed by rising debt servicing costs as interest rates rise (do they have the financial wherewithal to keep operating without serious damage). It’s also important to know they’re not paying dividends that are beyond their long-term financial means. If/when that ugly recession ramps up, we need to know these companies are in good shape to not only survive, but also thrive.

Defining Financial Health

For purposes of this article, we are using Morningstar’s Financial Health Grade to define financially healthy. Specifically, we ran a screen for stocks that yield over 5%, and within this group only 10 of them received an “A” grade based on Morningstar’s grading system. More specifically, the Financial Health Grade from Morningstar is based on Financial Leverage (assets/equity) from the most recent quarter's balance sheet, cash on the balance sheet, cash flows, and free cash flows and its trend. Here are the 10 that received an “A” grade, plus a handful more of popular big dividends that are interesting and worth considering.

Broadstone Net Lease (BNL), Yield: 6.8%

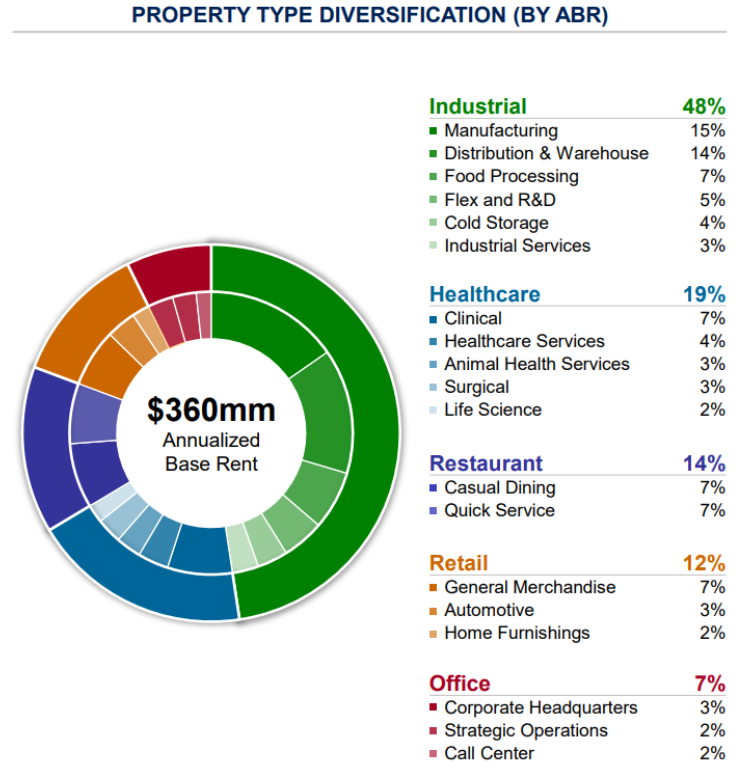

One “A” rated name that stands out on the list is Broadstone Net Lease. This is a real estate investment trust (REIT) focused on single tenant commercial properties.

As you can see in our earlier table, shares of BNL are down 32.5% this year (the most of any stock in our top 10), and it has a high amount of short interest (10.5%). People have been selling shares because its single tenant strategy is viewed as riskier with a potentially ugly recession looming. Also, industrial REITs have sold of this year as the initial pandemic supply chain bump has slowed.

However, we view BNL as interesting because it is well diversified with low tenant concentration. This is important because one big tenant bankruptcy cannot necessarily ruin this REIT (it can for other REITs that are much more concentrated). Further, BNL has an investment grade balance sheet (S&P – BBB, Moody’s – Baa2) which is a good thing. And it gets an A grade from Morningstar on Financial Health.

CEO, Chris Czarnecki, acknowledged the challenging market environment during the previous quarterly call, but remained upbeat as the company continues to use its financial strength to take advantage of market dislocation. According to Czarnecki:

“During the second quarter, we invested $182 million in 15 properties at a weighted average initial cash cap rate of 6.4%. The leases include a strong weighted average lease term of approximately 20 years, and solid 2.1% annual rent escalations, translated into robust weighted average GAAP cap rate of 8%.”

We’ll certainly be taking a closer look at BNL in the days and weeks ahead to get a better idea as to whether this represents an attractive contrarian opportunity. But initial signs point to yes.

Other names from the list

It’s worth noting a few other highlights from the list of financially healthy big-dividend payers.

Mortgage REITs: A lot of big-dividend mortgage REITs have been hit extremely hard this year, however we recommend caution as the decreased book values and mathematically increased leverage ratios create expensive near-term complications, especially with increasing borrowing costs! Lots of mortgage REITs are currently rated “D,” and the recent price declines may not be over. Certainly dividend cuts are coming for some. There may be some attractive short-term trading opportunities, but be cautious!

“B” Rated Opportunities: There are a lot of attractive “B” rated opportunities on this list including business development companies (BDCs) that have strong balance sheets and will benefit form rising interest rates through increased net interest margins. Additionally, there are a lot of attractive property REITs with strong financial health. Two that have been hit particularly hard this year, but that we like as contrarian plays are Stag Industrial (we recently purchased shares) and Digital Realty (it’s simply sold off too hard, and the yield is particularly attractive by historical standards for Digital Realty).

The Bottom Line

This year’s market declines have created some exceptional long-term investment opportunities. And while we believe it is smart to take advantage of market dislocation, don’t over do it to the point that you lose sight of your long-term goals. While choppy markets create opportunities for gain, they also create opportunity for mistakes. Stay focused on your goals. Disciplined, long-term, goal-focused investing is a winning strategy.