“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” - John D. Rockefeller

That quote takes on special meaning for income-focused investors today as many of the world’s most popular stocks don’t even pay dividends (and many don’t even have positive net income). On the flip side, big steady dividend income is hard to find, but very special—especially when those big dividends are paid monthly (MOPAY). In this report, we share data on 50+ big-dividend MOPAY stocks, and then highlight three in particular that are uniquely attractive and worth considering.

For starters, here (below) is the first (of two) tables on big-dividend MOPAY opportunities. This one includes mostly REITs and BDCs (two popular categories for income-focused investors). Not only does this table list companies, tickers and yields, but it shows recent performance data, consecutive years of dividend growth, recent dividend changes (percent increases or decreases over the last 1 year and 3 year periods) and more.

Table 1: Big-Dividend MOPAY Stocks

image source: StockRover

Generally speaking, there is a tendency to look for big dividend yields that have been increasing (or at least not decreasing), as well as no short-interest red flags and share price performance that hasn’t been moving too dramatically. We’ll dig deeper into the fundamentals of a couple names on this list later in this report, but you may already see a few of your favorites that made the list.

Table 2: Big-Yield MOPAY CEFs

Our second table of big-dividend MOPAY stocks includes closed-end funds (“CEFs”), and you have to take this table with a grain of salt because CEFs are funds not stocks (although many of them can hold stocks), and because CEFs pay distributions not dividends. However, with that in mind, CEFs can also offer extremely attractive opportunities to collect big monthly income payments (which is really what a lot of income-focused investors are looking for anyway), plus CEFs can have a few distinct advantages over stocks too (such as instant diversification, attractive pricing versus net asset values and sometimes the use of prudent leverage).

As you’ll notice in the table above, the CEFs all offer big monthly income payments to investors, and the table is sorted by strategy (depending on the strategy, CEFs can hold a variety of stocks, bonds, REITs and others).

You’ll also notice that we have included whether each fund is trading at a discount or premium (and how much) to its net asset value (“NAV”). Unlike mutual funds and exchange traded funds, there is no immediate mechanism in place for CEFs to ensure the share price trades close to the NAV, and as such (depending on supply and demand) CEFs can trade at significant discounts or premiums to their NAV. We greatly prefer to buy at a discount (because it means you’re getting access to the dividend and income payments of all the CEFs underlying holdings at a discounted price). However, there is a lot more to CEF investing than simply discounts and premiums, and in some cases many investors don’t mind paying a large premium (this is common for many PIMCO bond funds (such as (PCI), (PDI), (PDO) and (PKO) in the table above).

3 Attractive Big-Dividend “MOPAY Stocks”

We always dig deeper into the fundamentals, and we’d never invest in anything based on preliminary data alone (such as the data in our tables above). Therefore in this section of the report, we dig deeper to highlight 3 uniquely attractive opportunities from the tables of MOPAY opportunities listed above.

1. Stag Industrial (STAG), Yield: 3.4%

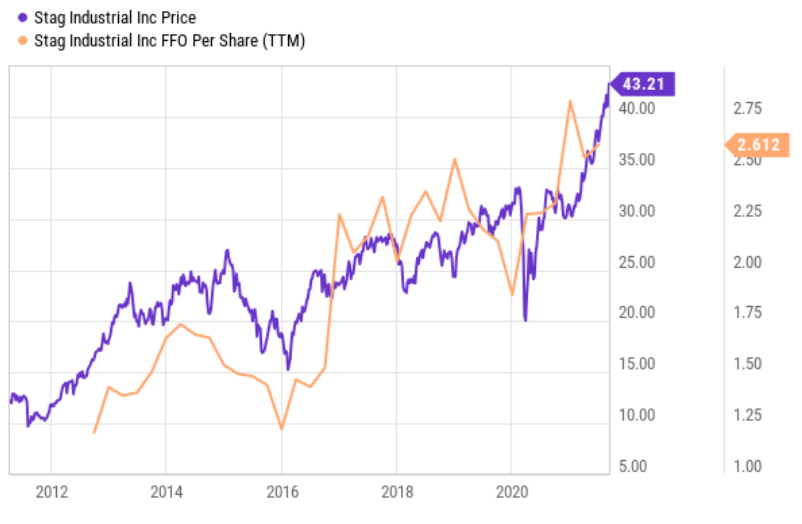

Stag is an attractive MOPAY industrial REIT. It has experienced strong price returns this year (+37.6%), but don’t let that fool you into thinking the shares are overvalued. Because as the share price has risen, so too has “funds from operations” (“FFO”), as well as estimates for increasing future FFO.

source: Seeking Alpha

STAG FFO (source: YCharts)

Despite the challenges created by the pandemic for other REIT industries (such as office and retail), industrial real estate has continued to thrive, in large part because it was less impacted by social distancing restrictions. Further, industrial REITs continue to benefit from growing online businesses as industrial properties are an important part of the supply chain infrastructure. Here is a look at Stag’s top 10 tenants.

source: Stag website

Importantly, Stag has a lower price-to-forward AFFO ratio (23.3x) than other industrial REITs (for example Prologis (PLD) at 38.4x and EastGroup Properties (EGP) at 40.4x) because of the perceived higher risk of its often secondary-market and single-tenant properties. However, we believe the company is actually quite attractive for moving into these opportunities, and because it has built an impressively diversified portfolio of properties.

We previously pounded the table about Stag’s attractiveness at the end of 2020 in this article, and the shares have since gained over 37% (plus the REIT’s attractive monthly dividend payments). Yet we believe the shares continue to present an attractive investment opportunity based on its high quality business strategy and properties, combined with its attractively low valuation. If you are an income-focused investor, Stag is worth considering for investment.

2. EPR Properties (EPR), Yield: 6.0%

You may be looking at horrific dividend track record of EPR Properties and wondering how could anyone highlight it as an attractive investment opportunity. Specifically, this experiential property REIT cut its dividend to zero during the pandemic, and only just recently reinstituted any dividend payments as all.

However, the key here is to realize that as painful as it was at the time (for those invested in EPR), EPR’s decision to temporarily halt the dividend put the company is a much better financial position going forward.

The reality of covid is not over by any stretch of the imagination, but the world will eventually move on (in many cases, it is already), and EPR’s experiential properties (e.g. Top Golf, AMC theaters, lodging, fitness and education) are extremely attractive contrarian plays (anecdotally speaking, the waiting list for Top Golf near this author’s home is very long—the place is always packed).

From a valuation standpoint, EPR trades at forward P/AFFO ratio of 17.2x (versus a 21.6x sector median), which is attractive in our view given the reinstated (and growing) monthly dividend, combined with ongoing (and eventual) economic re-openings. If you are an income-focused investor, EPR’s monthly dividend is absolutely worth considering.

3. DoubleLine Yield Opportunities (DLY), Yield: 7.3%

The DoubleLine Yield Opportunities CEF is particularly attractive for income-focused investors because of its high distribution yield (paid monthly), its discounted price (versus NAV), its strong management team (DoubleLine—led by portfolio manager Jeffrey Gundlach) and its prudent use of leverage to name a few.

source: CEF Connect

The fund pursues its objective (high total return with an emphasis on current income) by investing across the global fixed income universe, including a mix of mortgage backed securities, corporate bonds, emerging markets and others (as you can see in the table below).

(source: DoubleLine)

We wrote in detail about this fund back at the end of last year, and the performance has been strong since then, but there is still room for attractive gains ahead (in addition to high distribution income payments to investors).

This fund does sit lower on the credit strength spectrum (see table above), but the portfolio is diversified across many opportunities, and we believe DLY can make an attractive contribution to a prudently-diversified income-focused portfolio.

We especially like this fund because it trades at a discount to NAV (see earlier table), which means investors get access to the income streams of the underlying securities at a discounted price. We also like the prudent use of leverage (~21.9%—which can help magnify returns and income) and the fact that it is relatively newer (the inception date is 2/25/20). We believe the discount to NAV will continue to evaporate over a time (a good thing for investors) as more investors recognized the relative attractiveness of the fund. We currently own shares of DLY within our 39-stock Income Equity portfolio.

Conclusion:

In a world where the news is often dominated by zero-dividend growth stocks, many investors take comfort (and generate spending cash) from healthy dividend paying stocks, especially those that pay monthly. We shared data on over 50 examples in this article, and then reviewed three in particular that are attractive and worth considering. However, and most importantly, know your own goals as an investor, and then stick to investments that meet your own personal needs. Disciplined, goal-focused, long-term investing is a winning strategy.

*You can view all of our current portfolio holdings here (we currently own 3 monthly-pay stocks and 3 monthly-pay CEFs from the lists in this report).