This attractive CEF has been paying big dividends for over 80 years! And its big annual Q4 dividend is currently on sale, as the shares trade at a very attractive discount to net asset value. Additionally, the fund is well managed, it charges very low fees for a CEF, it doesn’t use any risky leverage, and it provides very important diversification by giving income-focused investors exposure to market sectors they don’t usually participate in. If you are a long-term, income-focused investor that likes to buy things on sale, this CEF is absolutely worth considering.

Adams Diversified Equity Fund (ADX), Yield 6.0%+

The Adams Diversified Equity Fund (ADX) is an internally managed closed-end fund (CEF) that seeks long-term capital appreciation, and it is committed to an annual distribution rate of at least 6% (and usually more). The fund is celebrating its 90th anniversary, and it has been paying big dividends for over 80 years!

source: ADX website

If you are an income-focused investor, ADX offers a lot of very attractive qualities, as we will describe in the following sections.

On Sale: Attractive Discount Versus NAV:

Unlike mutual funds and exchange traded funds (“ETFs”), there is no immediate mechanism in place to keep the price of a closed-end fund close to the net asset value (“NAV”) of its underlying holdings, and as such CEFs can trade at wide discounts and premiums as compared to NAV. We generally prefer to buy CEFs trading at discounts because it means we are getting exposure to all the underlying dividends and price appreciation at a discounted price. And in the case of ADX, it currently trades at a very attractive discount to NAV (-13.56%) as you can see in the following graphic.

source: CEF Connect

Attractive Diversification Benefits

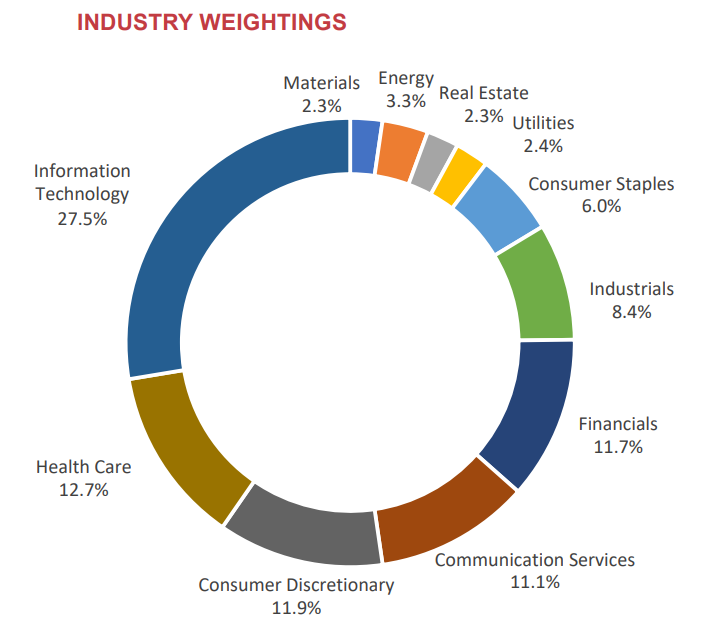

ADX offers attractive diversification benefits that many income-focused investors often to not get. Specifically, many income investors often end up dramatically overweight REITs, BDCs big Pharma and other high income sectors and industries of the market. However, ADX provides important diversification across sectors as you can see in the following sector and holdings graphics.

source: ADX website

As you can see in the graphics above, ADX provides exposure that is uncommon for many income investors, such as information technology and consumer discretionary.

Sources of Income

You may be wondering how ADX can generate at least a 6% dividend every year (and usually more) by investing in sectors that are not traditionally big-dividend sectors. The answer is an attractive combination of dividends and capital gains as you can see in the following chart.

source: ADX website

Aside from an annual distribution rate that is usually well above 6%, you’ll notice that ADX generates these distribution payments from a combination of dividends and capital gains. Historically, the overwhelming majority of the capital gains portion in long-term—a good thing from a tax standpoint. And before anyone starts asking if this is one of those funds that constantly declines in value because it pays out too much in distributions—it’s not. You can see the ADX share price in our earlier “price vs NAV” chart, and you can also see the powerful returns if you reinvest the dividends in the chart below.

source: ADX website

Big Q4 Distribution

ADX pays three smaller quarterly dividends each year, followed by a significantly larger fourth quarter dividend. A lot of people don’t realize how large the ADX annual dividend really is because many data reporting websites list the dividend as much lower than 6% because they’re not accounting for the big Q4 dividend.

There is still time to purchase ADX shares now and capture the big Q4 dividend (ADX won’t go ex-dividend until November). And now is a compelling time to buy because of the big discount to NAV, and because the NAV returns have been strong this year (a good indication that the Q4 dividend will bring the annual rate well above 6% this year.

Expense Ratio

The expense ratio on ADX is highly competitive (reasonably low) for a CEF. Specifically, the ADX expense ratio was only 0.61% for 2020 versus an industry average of 1.16%, according to the ADX website. And you can see the composition of this expense ratio (e.g. management fees, operating expenses) in the following table.

source: ADX 2020 Annual Report

In our view, the ADX expense ratio is very reasonable and increases the attractiveness of investing.

Addressing the ADX Naysayers:

One of the biggest complaints about ADX is that it is simply an overpriced S&P 500 index fund. We disagree (ADX is actually attractively priced), as we will explain.

For starters, here is a look at the recent sector weights of ADX versus an S&P 500 Index fund (SPY). Interestingly, the weights are very similar (which generally leads to very similar performance), however the ADX expense ratio is 0.61% and the SPY expense ratio is only 0.09%. The naysayers ask, why invest in ADX when you can basically get the same total returns from SPY. The answer lies in the discounted price (versus NAV) for ADX, as well as the discipline of ADX management in distributing that big 6%+ yield every year.

source: SSGA and ADX websites

Firstly, to add some context to the value of the ADX price discount versus NAV (currently 13.56%), it basically means ADX only has to perform about 86.44% as well as the S&P 500 to match its returns (86.44% = 100% minus the 13.56% discount). And if we adjust for the 0.61% ADX expense (which is a guaranteed detractor to performance every year), then ADX still only has to perform about 91.7% as well as the S&P 500 each year to match its performance (and more than 91.7% as well as the S&P 500 each year to beat the performance of the S&P 500). For example, hypothetically speaking, if the S&P 500 gains 10% and ADX gains 9.17% on its NAV, the price return is approximately 10% (the same as SPY) after adjusting for the discounted price and the fees (all else equal).

And technically, ADX has been beating the S&P 500 in recent years, as you can see in the following chart.

Secondly, the discipline of the ADX management team in managing the fund for long-term capital gains (instead of higher tax rate short-term gains) adds value for shareholders who likely wouldn’t have the discipline to manage the buys and sells as efficiently on their own to generate the annual income of at least 6.0%.

The Bottom Line

If you like big steady income, ADX is attractive and on sale. This CEF is scheduled to pay its big Q4 dividend next quarter, and the shares are currently trading at an attractively discounted price (versus NAV). The fund also has other compelling characteristics, including important diversification, low expenses and an incredible 80+ year track record of paying healthy dividends. We currently own shares of ADX in our Blue Harbinger Income Equity Portfolio. You can view all of our current holdings here.