The business development company (“BDC”) we review in this report is healthy and has advantages over its peers. For example, its large size, seasoned management team and strong balance sheet all give it a leg up (versus peers and versus other high yield investments) as it grows its track record of 46 consecutive quarters to stable or growing dividend payments. In this report, we review the business, balance sheet, liquidity position, dividend strength, valuation and risks. We conclude with our opinion on investing.

Overview: Ares Capital Corp (ARCC), Yield: 8.5%

Ares Capital Corporation (ARCC) is a business development company (BDC) that provides direct loans and other investments to privately-held US middle-market companies (usually with annual EBITDA (earnings before interest taxes depreciation and amortization) between $10 million and $250 million).

ARCC’s investment portfolio consists mainly of first/second lien senior secured loans and subordinated debt, generally ranging between $30 million and $500 million. These first/second lien senior secured loans (including ARCC’s Senior Direct Lending Program (SDLP) investments—a first lien senior secured loans focused JV with American International Group’s lending platform, Varagon) make up 79% of the company’s total portfolio. And the high level of senior secured loans add a level of safety to the portfolio, as defaults are generally very low and recovery levels are very high (in cases where default occurs).

Portfolio by Asset Class:

In addition to senior secured loans, ARCC also makes non-controlling equity investments under $20 million, usually in conjunction with a concurrent debt investment. Additionally, it invests between $10 million and $200 million in project finance/power generation projects.

The company is the largest BDC in the US with ~$16.2 billion of total assets (as of 31 December, 2020), and is externally managed by a subsidiary of the $197 billion alternative investment manager Ares Management Corporation (ARES). It was founded in 2004 and is headquartered in New York.

Highly Diversified Portfolio, Primarily Across Defensive Industries

ARCC’s portfolio includes investments in 350 companies (as of 31 December 2020), and no single company makes up for more than 2% of the total portfolio value (this is good for reducing risk through diversification).

Issuer Concentration:

A large majority of these portfolio companies operate in non-cyclical and less-cyclical industries such as healthcare (~17%), software (~15%), professional services (~8%), consumer services (~7%). Further, ARCC’s exposure to industries most prone to the negative impact of economic cycles such as hospitality, energy, retail, and leisure, to name a few, is limited and is even less than that of high yield bonds and the leveraged loan industry.

These attractive qualities (e.g. less cyclical industries, diversification) helpts protect ARCC’s investments against the downside risks related to various economic cycles and is one of the primary reasons it has remained largely resilient in various downturns, including the current, pandemic related economic downturn.

Portfolio companies have conservative credit metrics and consistently growing profitability

ARCC typically evaluates hundreds of opportunities before selecting a company to invest in. Its historical average new deal selectivity rate has remained as low as ~4% (and not surprisingly, in the pandemic year 2020, its selection rate was even lower at ~3%). ARCC originated $6.7 billion of new investment commitments across 142 transactions in 2020 (despite evaluating more than $500 billion of financing opportunities across over 1,700 companies) which had average EBITDA growth of 53% over 2019.

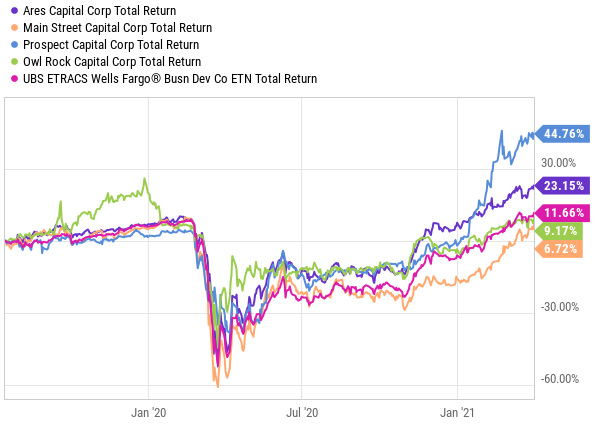

Consequently, ARCC’s portfolio consists of some of the strongest companies that have conservatively managed their credit metrics and have held up well to the various operational challenges posed the pandemic and generated strong EBITDA line profits. For perspective, here is a look at ARCC’s recent price performance versus other popular BDCs leading up to (and through) the pandemic (ARCC has been resilient).

Also worth mentioning, the loan-to-values (LTVs) of ARCC’s portfolio companies is in the ~50%-55% range, which indicates they are moderately leveraged. Their weighted average EBITDA has grown consistently even during the peak pandemic period in 2Q20 and 3Q20 and had reached $156.3 million at the end of 2020, up from $138.9 million at year-end 2019 and just $99.0 million two years ago.

Notably, ARCC’s upper middle-market portfolio companies (with over $100 million in EBITDA) have been experiencing faster EBITDA growth as compared to those below $50 million, underscoring the expanding market opportunity for large direct lending transactions. As a matter of fact, ARCC has recently been strategically focusing on scaling into primarily larger, upper-middle market companies in its direct deal origination and lending (to take advantage of the attractive opportunity).

Despite this, the Private Equity sponsors (who generally have significant financial resources to support businesses) still control a large majority (~84%) of ARCC’s portfolio companies (thereby indicating that these companies will likely have plenty of financial wherewithal to navigate unforeseen circumstances). Moreover, interest coverage ratio of ARCC’s portfolio has remained solid throughout 2020 (sitting as 2.8x for the fourth quarter of 2020—which has substantially grown from comparable periods in the recent years). Overall, these factors have combined to provided cash flow stability to ARCC (even during the downturn).

Source: 4Q20 Debt Investor Presentation

Another important credit metric to consider while evaluating a BDC’s portfolio is the percentage of nonaccrual loans to the total portfolio, which shows the financial health of borrowers by indicating overdue payments. A consistently high percentage of non-accrual loans to the total portfolio can be worrisome.

ARCC’s nonaccrual loans percentage has historically averaged around 1% at fair value, but had increased to 3.2% by the end of the third quarter of 2020 owing to the impact of the pandemic. However, these nonaccruals have declined to 2% as at the end of 4Q20, which we believe is a positive outcome of the improving economy. Going forward, we expect ARCC’s nonaccrual loans percentage to decrease further as the economy benefits from enhanced liquidity (coming from billions of dollars in stimulus spending by the government, and the benefits of vaccine-supported re-openings).

Source: 4Q20 Debt Investor Presentation

Strong Balance Sheet and Ample Amount of Liquidity

ARCC has a very strong well-capitalized balance sheet with a diverse range of financings. Equity and long-dated unsecured loans make up a sizeable portion of total capitalization (supporting ~84% of its assets, as of 4Q20). These unsecured loans are attractive considering their inherent benefits (i.e. they are unencumbered assets, which can be used as collateral for secured debt to amplify liquidity) and their historically low costs recently (i.e. the cost of sourcing unsecured financing for ARCC has recently been around 2%, which is almost equivalent to the secured debt funding costs). Nonetheless, ARCC plans to keep its balance sheet flexible with a healthy mix of varied financing sources, despite the historically low costs of unsecured loans. We view this as a prudent approach, especially considering such an approach has historically worked well for ARCC.

“We're thrilled about that (unsecured debt) cost of capital, but we're trying to maintain a very flexible balance sheet that just allows us to run the company with, again, excess liquidity and the flexibility to stick to our investment approach, which has worked well over a long period of time.” – CEO, Kipp DeVeer on 4Q20 earnings call

Further, the significantly large portion of equity on ARCC’s balance sheet has helped in keeping leverage levels low. Further, ARCC has recently announced a new public offering of its common shares, the proceeds of which will be used to repay certain outstanding indebtedness under its credit facilities. While this new offering will dilute the ownership stake of existing investors to a certain extent, it will reduce the company’s leverage further.

As regards to the upcoming debt maturities, ARCC has well-laddered schedule, with no debt set to mature before 2022. Also worth noting is the fact that only ~20% of its current outstanding debt will be maturing between 2022 and 2023.

Source: 4Q20 Debt Investor Presentation

Adding to liquidity, ARCC has a solid $4.1 billion in uninvested capital (or excess liquidity). This is a significant improvement from $2.6 billion at the end of 1Q20, and is about 2.6x more than its unfunded investment commitments. We think this liquidity depth will help ARCC to not only grow (by pursuing advantageous new investment opportunities) but also to continuously keep supporting its existing borrowers and targeting attractive risk-adjusted returns over the longer term.

“The strength of our balance sheet and the depth of our liquidity has proven to be a significant weapon that we continue to use to support our existing borrowers during these periods of economic uncertainty and recovery.” – CEO, Kipp DeVeer on 4Q20 earnings call

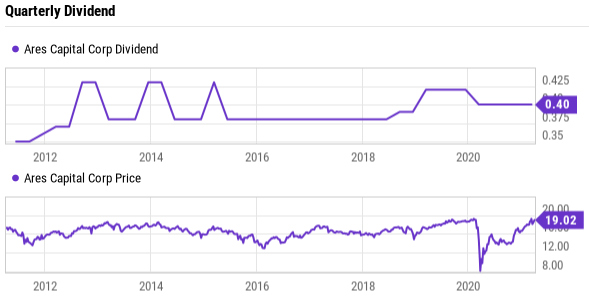

Healthy, Stable Dividends

ARCC has a successful track record of paying healthy dividends to its shareholders (it’s been paying for 46 consecutive quarters), which has occasionally been topped off with special dividends. Most recently ARCC paid out a quarterly dividend of $0.40 for 1Q21, which amounts to an impressive 8.5% dividend yield.

Source: ARCC website

Importantly, ARCC’s dividend has remained well covered as its net investment income (NII) often exceeds the dividend payout. For example, in 2020 ARCC’s NII of $1.87 per share covered its annual dividend of $1.60 per share by 1.17x, which is slight improvement from 1.13x in 2019. Also, ARCC has consistently generated cumulative core earnings and net realized gains in excess of its dividends paid since its IPO (which essentially implies the company is being conservative in dividend payouts and saving for the rainy day).

Consequently, ARCC had $1.07 of taxable income (per share, as of 4Q20) that has accumulated over the years and remains undistributed to shareholders. We believe that this undistributed spillover provides a bit of a safety net for future quarterly dividends. Also, as per ARCC’s CFO, Penni Roll on the 4Q20 earnings call:

“We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend through varying market conditions and sets us apart from many other BDCs that have no such spillover to speak of.”

Strong investments team driving attractive risk-reward balance

Driven by a strong and experienced investments team (over 145 investment professionals averaging average 26 years of experience—and have successfully invested $63 billion across over 1,400 transactions since 2004), ARCC has been able to consistently generate higher returns. For example, on a 5-year basis ARCC’s net return on equity (ROE) has been the highest in the BDC industry and has comprehensively beaten the BDC peer group average net return on equity (“ROE”) by ~465 bps.

Also, ARCC has generated higher annualized returns in terms of dividends and changes in net asset value (NAV) over various time periods as can be seen from the charts below. Importantly, the company has been able to do so with much less volatility than not only its BDC peers but also versus high yield bond and loan indexes.

Source: 4Q20 Debt Investor Presentation

Benefits from Ares Management Corporation

Also very important, ARCC derives significant benefits from its relationship with global alternative investment manager, Ares Management Corporation (ARES). Ares Management Corp. operates integrated businesses across multiple asset classes such as credit, private equity, real estate and strategic initiatives. And as a part of the Ares group, ARCC derives multiple benefits in the form of investment origination leads, flexible access to capital, augmented market reach and also a pool of highly experienced investment professionals that help drive long-term performance.

Valuation

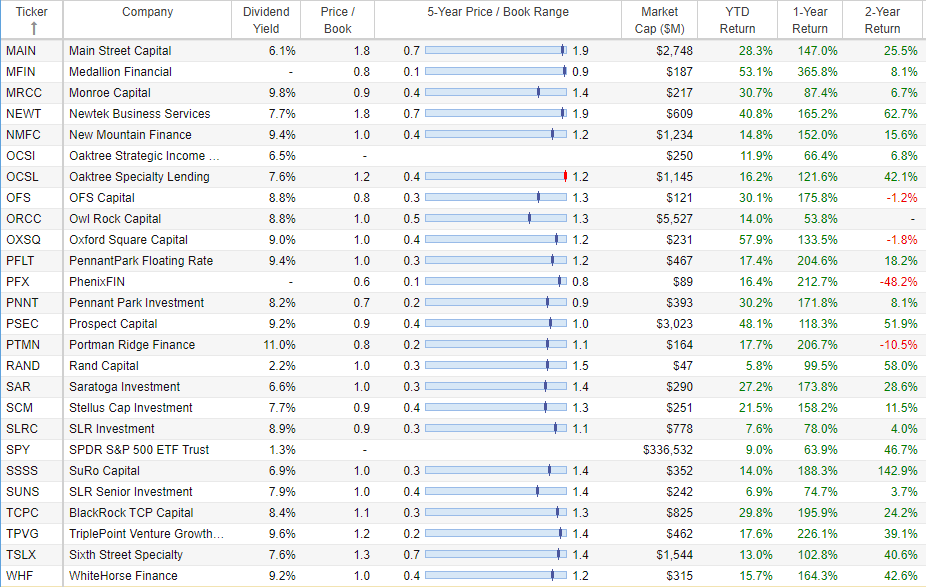

ARCC shares currently trades at a Price to Book Value (P/BV) of 1.12x, which falls at the higher end of its historical P/BV range of 0.47x to 1.16x.

Also, on a comparative basis with other large BDCs (with over $1 billion in market capitalization), ARCC’s P/BV is slightly on the higher side.

Source: Yahoo Finance, BDC Investor.com

However, we believe the valuation is fair and justified as investors typically tend to assign higher valuations to high quality dividend paying companies. Also, one of ARCC’s competitors, Main Street Capital (MAIN), is trading at a significantly higher P/BV, while yielding considerably less in dividends.

For perspective, ARCC’s currently offers an ~8.5% dividend yield, which is on par with the selected large BDC peer group as well as its long-term historic average. We find ARCC’s dividend yield significantly attractive as there is a remains a lack of high quality yields amid the current low interest rate environment.

Source: YCharts

source: StockRover

Risks

Interest Rate Risk: The majority of ARCC’s credit portfolio generates interest income based on floating rates, which means its investment yields are tied to market interest rates, such as LIBOR. However, the company’s liabilities have largely fixed interest rates, which implies that in a declining interest rate scenario, declining investment yields will not necessarily be offset by a commensurate decline in interest payments. This could negatively impact NII. Nonetheless, the majority of ARCC’s floating rate investments have interest rate floors, which limits the downside risk.

Risks Associated with the Investment Portfolio: Most of ARCC’s portfolio investments are in privately held middle-market companies, which generally tend to carry higher risks relative to publicly traded securities. For example, investments in private companies are subject to many legal and other restrictions on resale and as such they are relatively less liquid. Should a need arise to liquidate an investment, ARCC may find it difficult to do so in a timely manner and hence may realize significantly less than the value at which the said investment is recorded on the books.

Conflicts of Interest with Ares Management: Being externally managed, ARCC is inherently exposed to conflicts of interest with its parent, Ares Management. For example, many of ARCC’s officers and members of the investment management team also serve Ares Management. As such, they may have certain obligations that might not be in the best interests of ARCC’s shareholders.

Conclusion

Aside from its big 8.5% dividend yield, Ares Capital Corp (ARCC) has other attractive qualities, including its healthy balance sheet liquidity, strong management team and its large size. And even though there are a variety of company-specific risks associated with ARCC’s many underlying company investments, those risks are reduced through prudent diversification and an experienced investment team (besides, it is this prudent selection of diversified risks that allows ARCC to offer its big attractive yield in the first place).

In our view, ARCC is a highly attractive risk-reward opportunity versus other BDCs and versus other higher yielding investments (such as high yield bonds, for example). And from a valuation standpoint, ARCC may appear slightly expensive (relative to other BDCs), but not when you consider it’s also financially stronger and healthier than many other BDCs. Plus, the big dividend yield (46 consecutive quarters of stable to increasing dividends, plus an occasional special dividend) makes it easier to hang on to the shares for the long-term (as part of your prudently diversified income-focused portfolio). Overall, the business is attractive, and we are currently long shares of ARCC.