The investment news media is more interested in generating advertising dollars than it is in actually helping anyone with investments. Their goal is to tell the most ridiculous sensationalized investment stories they can get away with in order to garner more readers, listeners, clicks and ultimately advertising dollars. One of the most common ploys they use to implement their unscrupulous agenda is the false narrative. They’re basically dishonest, uncaring and greedy. In this report, we share 3 highly attractive investment ideas that are hiding in plain sight thanks to the media’s totally disingenuous false narratives.

Before getting into the 3, it’s worth reviewing a few of the most common false narratives being pushed by the media. The first two are the most basic: fear and greed.

Fear and Greed: When the pandemic hit in 2020, the news media pushed out so much fear that a lot of long-term investor sold everything right after the crash, and then ended up missing out on the tremendous rebound as stocks posted exceptional gains in the months that followed. And the other side of this narrative is the one the media started pushing around the start of 2021 whereby there was a growth stock frenzy (based on greed) as investors chased after the best performing “pandemic stocks” (such as anything that supported cloud-based social distancing) only for those high flying stocks to come crashing lower since mid-February. Again, the media generated a ton of advertising dollars (through clicks page views, downloads, etc.), but gave no actual helpful service to investors.

More False Narratives: Other common false narratives include the ever-growing chorus of get-rich-quick people pushing absurd allocations to things like Bitcoin, GameStop and whatever other Robinhood non-sense they can get away with. Further still, some narratives are more nuanced, such as “you already missed the rebound,” “bigger dividends are always better” and “growth stocks are dead” (all of which we’ll talk more about later in this report).

However, if you actually want to be a successful investor for an extremely long period of time, just know that disciplined, goal-focused, long-term investing has been a winning strategy throughout history, and it will continue to be so in the future. If you want entertainment, get a library card. But if you want to build and protect your next egg, ignore the media’s ]false narratives.

3 Stocks Worth Considering, Hidden in Plain Sight

Without further ado, we get into our 3 attractive stocks that are currently hidden in plain sight thanks to the media’s false narratives and the unfortunate inaccurate preconceived notions they have put into the minds of many stubborn (and sometimes quite gullible) investors.

1. Ares Capital Corp (ARCC), Yield 8.3%

Many smaller business got hit particularly hard by the pandemic due to the government imposed lockdowns and social distancing. And this phenomenon revealed itself in the Business Development Company (“BDC”) space, considering these companies specialize in providing financing (mainly loans) to middle market companies (i.e. small businesses as compared to the Google and Microsoft’s of the world). Ares Capital is one example of a BDC that got hit hard by the pandemic.

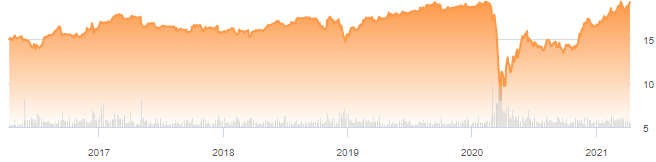

ARCC Share Price:

However, the false narrative that says “it is now too late to invest in BDCs because they have already (finally) recovered from the initial precipitous pandemic sell off” is wrong. Not only is it wrong, but it is one of the most common false narratives that cause investors to make mistakes. Yes, the share price of ARCC has recovered significantly since the pandemic lows, but it is not too late to buy. This is a stock that has continued to pay a steady to rising dividend many many quarters in a row, and based on its continuing financial strength, we expect it to continue paying high income in the years ahead. And if you are an income-focused investor, you’d be remiss to not consider investing in a big strong 8.3% dividend yield just because the price has risen. For our detailed analysis of ARCC you can access our recent full report here:

2. TriplePoint Venture Growth, Yield: 9,4%

Another false narrative among investors is that income-focused investors should not invest in growth businesses. This narrative is wrong for multiple reasons, and it seems to get promulgated by the industry’s fascination with style boxes. According to the style boxes, you need to be a growth investor or a value investor. A small cap investors or a large cap investor. Or a dividend investor or not. This is a dangerous way to think about investing because it not only causes you to overlook attractive opportunities (that may fall outside your style box), but it can also cause you to miss out on valuable diversification benefits.

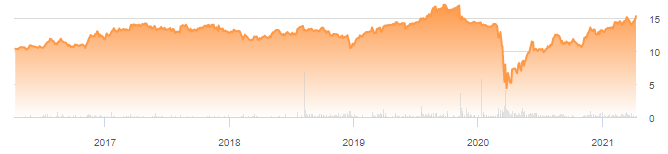

TPVG Share Price:

TriplePoint Venture Growth is a rule breaker stock because it invests in growth businesses in growth industries, but it also offers a big attractive dividend yield. Specifically, TPVG is a BDC that invests in e-commerce, entertainment, technology and life sciences (traditional growth sectors), and we consider it to be a very attractive investment opportunity. You can read our recent full report on TPVG here:

3. Veeva Systems (VEEV)

There are many false narratives about growth stocks, and our next investment idea touches on several of them. First, if you are looking for powerful long-term growth potential, Veeva is worth considering (because it is growing rapidly and has a lot of runway to keep growing). Second, if you are an income-focused investor, it’s okay to own a few growth stocks too (they can provide plenty of spending cash through gains). Third, it’s wrong to associate all growth stocks with a dying pandemic trade (Veeva is different, and it can grow long beyond the pandemic). And fourth, it’s ridiculous to think you can’t buy a growth stock right after a sell off (Veeva shares have recently pulled back).

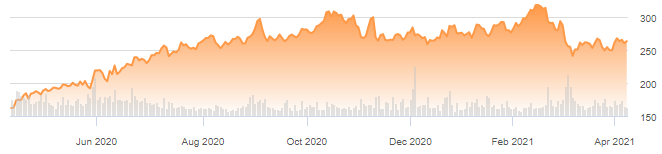

VEEV Share Price:

Successful long-term investing is about identifying attractive business, and if you can purchase them at a better price (i.e. like right after a sell off) then more power to you. You can access our previous full report on Veeva here:

The Bottom Line:

One of the most important rules of investing is simply to understand that the media is not there to help you. The media exists to make money for itself (through advertising dollars), and they don’t care about you or your investments. Unfortunately, one of the most powerful ways the media makes money is by putting out “false narratives,” or stories that garner a lot of attention but are not exactly true. And even more unfortunately, many unsuspecting investors are influenced by the media’s non-sense and end up making bad decisions (for example, they chase get-rich-quick schemes or they panic and sell everything). The single most important rule of investing is to know your own personal goals, and then stick to a plan that helps you achieve them. Disciplined, long-term, goal focused investing has been, and will continue to be, a winning strategy. Be smart. Know your goals; stick to your plan.