The Business Development Company (“BDC”) that we review in this article focuses on making primarily debt investments to pre-IPO growth companies (focused largely on technology and life sciences markets). It also offers a compelling 10.0% dividend yield (with potential for additional “special dividends”). Specifically, this article reviews the business, the company’s investment portfolio, the dividend and the risks. We conclude with our opinion on investing.

TPVG share price

Overview: TriplePoint Venture Growth (TPVG)

TriplePoint Venture Growth (TPVG) is a business development company that was incorporated in 2013 and IPO’d in 2014. The primary motivation for the company’s formation was to expand TriplePoint Capital (TPC)’s investment focus to include pre-IPO stage, venture growth businesses. TPVG is externally managed by TriplePoint Advisors. It has a portfolio amounting to $662M invested across 69 companies as of December 2020. TPVG primarily invests in U.S. middle-market companies with over $20M in revenue that are backed by TriplePoint Capital (TPC) or third-party venture capital firms.

The company primarily makes debt investments (93%) followed by direct equity and related investments (4%) and to a lesser extent, warrants (3%). TPVG’s average investment ticket size is between $5M to $50M in debt financing and $100,000 to $5M in direct equity. From an industry perspective, the company’s key investments are in several growth sectors including business application software (11.8% of portfolio), e-commerce clothing and accessories (8.6% of portfolio) and healthcare technology systems (6.6% of portfolio) as on Dec 31, 2020.

What Is A Business Development Company (BDC)?

A business development company is a closed end investment company that invests in privately owned, typically middle market companies, providing them capital to grow or recapitalize.

What Are the Advantages of Investing via a BDC?

High dividend yield as BDCs are required to distribute 90% of their profits to shareholders as per the governing law.

Being a regulated investment company, a BDC is not required to pay corporate income tax on profits.

They offer diversification as the portfolio consists of companies belonging to varied industries or sub-industries.

Experienced Investment management teams.

Fair amount of liquidity and transparency as BDCs are traded on public exchanges, unlike venture capital funds which are privately placed.

As they are traded on stock exchanges, periods of volatility can lead to shares of BDCs trading at attractive discounts to NAVs.

Advantageous sponsor relationship with adept management

TriplePoint Venture Growth BDC Corp. (TPVG) is managed externally by its affiliate TriplePoint Advisers LLC. TriplePoint Capital (TPC), the sponsor, is a leading global financing firm that invests in companies operating in technology and life sciences. Since inception, the TriplePoint platform has committed more than $7.5 billion to more than 650 companies globally including Facebook (FB), YouTube (GOOGL) and Workday (WDAY), to name a few. The fact that TPC provides financing to companies at earlier stages assists TPVG in generating valuable origination leads as some of the early stage companies reach the growth stage.

Source: TPVG Q4 2020 Investor’s Presentation

Moreover, TPVG has a strong management team with TPC’s co-founders, Jim Labe and Sajal Srivastava sharing 21 years of investment history. Both of them have a strong track record of lending to more than 1,800 companies and deploying in excess of $9 billion of capital. TPC’s venture lending effort is supported by a team of more than 40 professionals with an average 14 years of experience in the venture capital industry and 6 years with the TriplePoint platform. Below are the profiles of the company’s top-executives.

Source: TPVG Q4 2020 Investor’s Presentation

Diversified across sub-sectors of secular growth industries with sufficient asset coverage

TriplePoint venture growth has invested broadly across technology, life sciences, and other high growth industries. Despite investing in high growth industries, we believe that the company’s strategy to diversify its portfolio across different sub-sectors of growth industries has proved pivotal in mitigating credit risk. Additionally, the majority of TPVG’s investments consist of debt that is secured.

Source: TPVG Q4 2020 Investor’s Presentation

For perspective, here is a look at the company’s top 5 debt investments as a percentage of net asset value (“NAV”).

Source: 10-K, company websites

Superior and consistent return profile

Since 2015, TPVG’s total return based on Net Asset Value (NAV) per share plus dividends and special distributions has averaged 9%, and the stock has returned close to 12% annually. The company has consistently generated Net Investment Income (“NII”) in excess of its distributions for the fourth year in a row and has paid out three special distributions since going public. A controlled payout ratio not only provides TPVG with essential liquidity to fund its growth, but also reduces risks for any major dividend cuts.

TPVG recorded a weighted average portfolio yield on debt investments of 13.8% for FY 2020 compared to 15% the prior year. The decrease of 120 basis points was primarily driven by higher prepayments from borrowers as well as a decrease in prime rates due to the pandemic. Having said that, the portfolio yield is still on the upper end compared to its peers.

Controlled leverage and enough dry powder for opportunistic investments will drive future dividends

TPVG reported a Debt-to-NAV ratio of 0.67x in Q4 2020 which is significantly lower than its BDC peers, implying plenty of firepower that the company can use in the future to fund growth opportunities.

Source: Company 10-Ks

The company has close to $252 million of total liquidity as of December 2020 consisting of $45 million in cash, and $207 million in revolving credit facility which is almost double the company’s unfunded commitments. We believe the liquidity levels equip TPVG with significant dry powder to make new investments. The late-stage venture capital market segment in which the company operates saw more than $100 billion invested last year across an estimated 3,400 deals.

Attractive dividend yield despite recent economic downturn

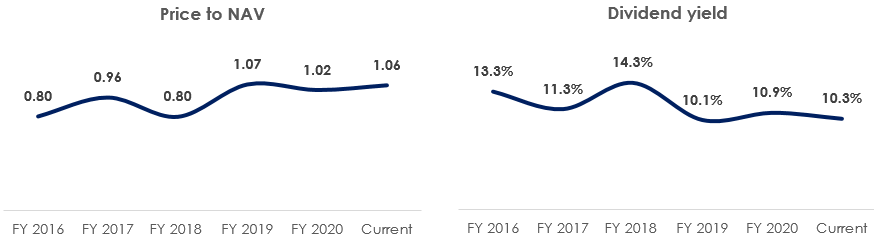

TPVG has significantly recovered from the lows in March last year. It is currently trading at a price to NAV of 1.06x which is only slightly above its historical averages and is less than its closest peers. Moreover, the company has been providing its investors with stable income in the form of dividends with a yield of more than 10% which is significantly higher than the average dividend yield of 8.22% in the BDC ecosystem. Finally, TPVG also offers a higher dividend yield than the other two prominent venture lenders namely Hercules (HTGC) and Horizon (HRZN).

Source: Yahoo finance, bdcinvestor.com, Peers 10-K

Risks

Credit quality: The company’s internal credit rating on its debt investments has mildly deteriorated from last year. In Q4 2020, the company recorded a weighted average investment ranking of its debt investment portfolio at 2.13 which is higher than the Q4 2019 ranking of 1.94 (a rating of 1 refers to investment in safe assets and a rating of 5 refers to investment in extremely risky assets). Having said that, TriplePoint Venture growth BDC Corp. has received an investment grade (BBB) credit rating from DBRS Morningstar and has successfully managed ups and downs of the economy in the past.

Source: TPVG Q4 2020 Investor’s Presentation

Macroeconomic headwinds: The pandemic has impacted global business sentiment and capital expenditure plans in almost all industry verticals. Given the company’s focus on small, middle market businesses, its portfolio companies may be more impacted by macro headwinds. Having said that, majority of the company’s debt investments are invested in secured tranches. Additionally, a rigorous investment due diligence process, and tech/life sciences specific tailwinds provide us comfort in the company’s ability to navigate through a difficult business climate.

Conclusion

TPVG presents a compelling BDC opportunity for investors seeking above average income. Its portfolio is attractive and Its relationship with TriplePoint Capital provides financial support and attractive deal flow. Further, the 10.0% dividend yield is particularly attractive as compared to peers. If you are looking for an opportunity to add some high income to your prudently diversified income-focused portfolio, these shares are worth considering. We currently own shares of TPVG.