This unique 7.2% dividend yield triple-net healthcare REIT comes with its own unique risks and advantages. Its dividend is well covered and has been increased for 17 consecutive years, and the company fared better than other healthcare REITs during the pandemic. In this article, we review the business model, dividend safety, valuation and risks. We conclude with our opinion on investing.

Overview:

Omega Healthcare Investors (OHI) is a triple-net REIT focused on providing financing and capital to Skilled Nursing Facility (SNF) and Assisted Living Facility (ALF) operators. The triple net lease structure means the operator, rather than the landlord, is responsible for paying all property expenses. This reduces operating expenses for Omega allowing it to keep more of its rental income, which can then be returned to shareholders through dividend payments

Omega’s investment portfolio is well diversified across 945 healthcare facilities, located in 40 states and the UK, operated by 69 third-party operators. OHI’s total investments stood at ~$9.7 billion at the end of FY20, with ~83% of investments tied to skilled-nursing facilities.

(source: Company Data)

The company is also well diversified across operators. The firm's largest tenant, Ciena, accounts for 10% of annual rent. No other tenant represents over 10% of revenue, and Omega's top 10 customers make up ~60% of total rent, as you can see in the following graphic.

(source: Company Data)

In addition to favorable portfolio diversification, Omega benefits from long-term leases with minimal near-term expirations. For example, the average lease term is 9.2 years, with 95% of portfolio expirations scheduled for after 2023. This create strong near-term revenue visibility for the company.

However, Omega does rely on Medicare (~37% of revenue) and Medicaid (~52% of revenue) programs which tend to get political (and could impact profitability). Some investors are turned off by Omega’s reliance on government programs, however it has actually proven to be quite advantageous recently. For example. while other organizations struggled during the pandemic, Omega benefited from steady support from the government. Specifically, Omega’s rent collections remained very strong at nearly 99% for 2020. And the company’s adjusted FFO increased from $3.07 in 2019 to $3.23 in 2020. (FFO is funds from operations).

During the recent Q420 earnings call, management alluded to the positive role of government during the pandemic and also noted further funding for SNFs and ALFs.

“We believe at least $23 billion of CARES Act funding under the Provider Relief Fund remains unallocated. We are hopeful that new legislation will add to Provider Relief Funding and hopefully will support the industry through its 2021 recovery.”

Demographic Tailwinds to Drive Occupancy Going Forward

We believe that favorable longer term demographics will drive increasing demand for needs-based skilled nursing care. The company expects a 44% increase in 65+ age population in the next 20 years.

(source: Company Data)

This trend is likely to increase occupancy rates for SNFs, given that there is a significant increase in SNF utilization by those over the age of 75. This utilization further increases through their late 80s.

(source: Company Data)

Skilled Nursing Facility demand is likely to outstrip supply by 2030, which should drive occupancy beyond capacity in the next decade (2030-2040). These demographics suggests the industry is likely near the beginning of a 20 year secular tailwind (a good thing for Omega). For example, here is a look at SNF demand—which is expected to outstrip supply by 2030:

(source: Company Data)

Dividend: Safe and Growing

Omega has increased its dividend for 17 consecutive years, and at the current annualized rate of $2.68 per share, the yield is an attractive 7.3%. The company’s payout ratio was ~82.8% in Q420 which is quite healthy in our view (especially as compared to other REITs, many of which struggled mightily due to the pandemic because of their lack of government support, unlike Omega). Omega’s adjusted FFO has grown at a CAGR of 18% from 2009-2020 and is likely to continue on a similar growth path in 2021.

(source: Company Data)

Additionally, Omega has plenty of liquidity and no near-term debt maturities. For example, as of Q420 Omega had $163 million of cash on hand and $1.1 billion of availability under its revolving credit facilities. And there are no debt maturities until August 2023, leaving OHI with ample financial flexibility. The leverage at the end of Q420 was 5.0x, in line with its target range of 4.0-5.0x. These provide additional levers to support dividend payment as well continue to aggressively pursue growth opportunities

(source: Company Data)

Ample Growth Opportunities

Omega expects to double its market share in the next 10 years. The company is the currently the largest owner of Skilled Nursing Facilities, but still only owns 5% of this highly fragmented market (there is a general lack of competition from other well capitalized companies).

And the pandemic has created more M&A opportunities for Omega, as well. For example, in January 2021, Omega acquired 24 senior living facilities from Healthpeak Properties, which has been struggling and looking to exit the senior housing space. The portfolio primarily consists of assisted living, independent living and memory care facilities with a total of 2,552 units located across 11 states. The facilities will generate approximately $43.5 million in contractual 2021 cash rent with annual escalators of 2.4%.

Valuation:

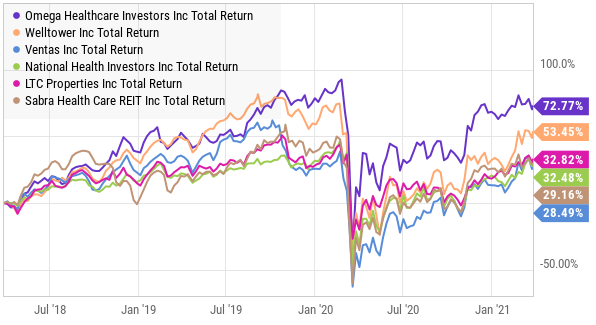

On a Price to Funds from Operations basis (“FFO”) basis, OHI trades at ~11.4x TTM Adjusted FFO, which represents a discount versus peers. The discount exists largely due to Omega’s focus on Skilled Nursing Facilities, which rely on Medicaid and Medicare payments, thereby leaving Omega vulnerable to ongoing draconian political pressures to reduce costs. However, government funding can also be an advantage, as we saw during the pandemic whereby steady government support created clear advantages for Omega versus peers.

source: quarterly supplement

(source: Yahoo Finance)

Risks:

Interest rate risk: Even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Also, higher interest rates put downward pressure on earnings as interest costs rise.

Regulatory risk: We note that the company is reliant on payments from Medicare and Medicaid, which are vulnerable to political interference. Any unfavorable regulation could adversely impact the business.

COVID-19 risk: The company noted that COVID-19 related challenges continue to persist although they are beginning to reduce as vaccinations roll out. However, any slowdown in vaccination could derail the recovery and adversely impact results.

Conclusion:

Omega is an attractive high-dividend REIT, focused primarily on Skilled Nursing Facilities. And while its high reliance on government funding (through Medicare and Medicaid) puts pressure on growth, it also provides a safety net during challenging times (such as a pandemic). Further, long-term demographic shifts suggest demand for Omega’s SNF properties will grow. Also, the company has opportunities for further growth through industry consolidation (M&A). Omega is the industry’s largest player, but still only has 5% market share, thereby leaving more room for growth through acquisitions. And importantly, the dividend is big, well-covered (the payout ratio is healthy), and it has grown for 17 years in a row. If you are willing to accept the unique risks of Omega, this 7.2% dividend yield healthcare REIT is worth considering for a spot in your prudently diversified portfolio.