The market has been volatile this year, and it’s left a lot of investors feeling very uncomfortable. Contributing factors have ranged from a surge in oil prices, to upward moves in interest rates, the unwinding of many “pandemic trades,” bitcoin narratives, market fear mongers, and of course the ever present chorus of nonsensical get-rich-quick people. We have some very strong advice for anyone feeling unsettled about the market. If you’ve been following Blue Harbinger long enough then you’ve likely heard it many times before. It’s worth repeating now…

Know Your Long-Term Goals, Stick to Your Plan

The number one thing you can do as an investor is to know your long-term goals and then stick to your plan. Every time the market gets volatile, people make unfortunate and costly mistakes. One of the most common mistakes is when people hit the panic button and sell all of their investments out of fear. The reality is that no one can time short-term market moves. And if you try to, you’re likely to get burned. For example, I can’t begin to tell you how many times I have seen highly experienced investors sell a big chunk of their investments out of fear, only to watch the market almost immediately rebound whereby said “experienced investor” missed out almost entirely on the rebound.

Similarly, some investors believe they should dump everything they’ve got into risky assets at the first sign of a market sell off, only to see the market sell off further thereby leaving them stuck holding a bunch of volatile stocks that simply don’t meet their long-term goals.

Disciplined, goal-focused, long-term investing has been a winning strategy over and over again throughout history, and it will this time too. For example, if you are a long-term growth investor, many of your stocks are likely down in recent weeks, but that doesn’t mean you should sell everything you own and stick the cash under your mattress. Short-term volatility is often the price you pay for the powerful long-term returns.

Volatility is not risk. A permanent loss of capital is a risk, but many of the top growth stocks that have sold off recently aren’t going out of business. In reality, many of these businesses remain incredibly strong and will continue to grow revenues and profits at a rapid pace for many years to come.

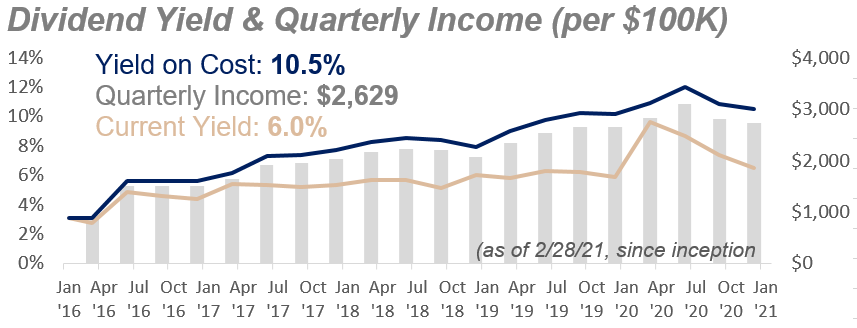

Similarly, if you are an income focused investor, don’t go dumping a big portion of your nest egg into Bitcoin because you think it’ll make you rich. For a little more perspective on income-focused investing, here is a chart of the performance of our Income Equity portfolio. Only this chart is focused on income (because that is what the strategy is focused on). And as you can see, the income (the gray bars) has been fairly steady (certainly much more steady than overall stock market prices), and the income also continues to trend higher in the long-term.

Income Equity Portfolio Data

For example, you can see that during the violent pandemic sell off around the end of the first quarter of 2020, the strategy continued to offer a high yield and and pay big dividend payments with very little volatility. In fact the dividend payments continue to trend higher over the long-term, and the “yield on cost” continues to grow (an important metric many short-sighted investors overlook).

Macro Factors

Regarding recent macroeconomic factor moves, don’t worry about them too much. Instead, buy really good stocks that meet your long-term goals and then hang on for the long-term.

Regarding interest rates, yes they have ticked higher this year, but they are still extraordinarily low compared to the long-term and they’ll very likely remain extraordinarily low for year to come, despite any ridiculous policies that come out of Washington DC.

Regarding energy prices, yes they’ve ticked significantly higher and been volatile, but you shouldn’t have 100% of your investments in the energy sector anyway. Last year energy was terrible, and we were due for a big of a rebound, especially with the vaccines, re-opening, and people starting to drive to work and other places more. And don’t forget energy isn’t just about gas prices, the sector encompasses a lot more including natural gas and byproducts used in plastic making, for example. And as wonderful as the concepts of zero-emission electric vehicles is, gas powered cars won’t disappear over night.

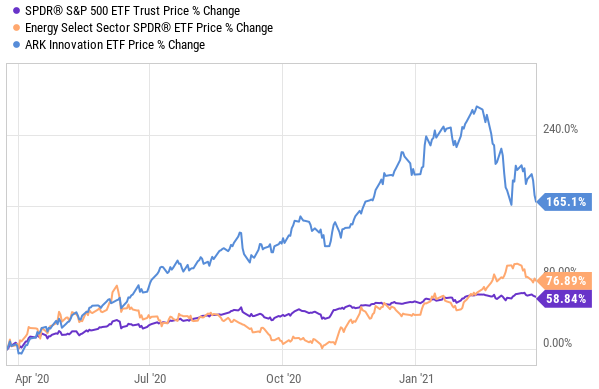

The ARK Innovation ETF (ARKK) was/is a popular “Pandemic Trade.”

Regarding the pandemic trade, you shouldn’t have been piled into 100% pandemic stocks in the first place, and shouldn’t be piled into 100% non-pandemic stocks now. Conducting a prudently diversified and prudently concentrated portfolio, consisting of attractive investments from across market sectors and styles is always a smart strategy. We are strongly opposed to being a “closet indexer,” but for goodness sake don’t go putting all your eggs in one basket!

The Bottom Line:

Don’t let short-term market volatility and non-stop sensationalized media fear mongering distract you from your investment goals. There have been plenty of much bigger and longer bouts of high volatility and momentum shifts throughout the history of markets, and the one thing that has remained the same is that the market has always eventually gone higher (much higher), and it will this time too. Rather than trying to time short-term market moves (which absolutely no one can actually do—sorry folks, crystal balls aren’t real), it’s a far better strategy (and far more profitable) to know your long-term goals and then stick to your plan. Because it’s when you try to get cute or clever that big costly mistakes happen. Be smart. Know your goals—stick to your plan.