The market has been volatile this week, especially top growth stocks. This report covers an attractive internet infrastructure and security company (i.e. a top growth stock) that has been increasing revenues very rapidly and has a very large total addressable market (for continued high growth in the long-term). And while the shares of top growth stocks are never going to be cheap, this week’s price pullback has created a small margin of safety thereby creating an increasingly tempting entry point for long-term investors. In this report, we consider the business model, competitive strength, financial position, and finally conclude with our opinion on investing.

Share Price (source: YCharts)

Overview: Cloudflare (NET)

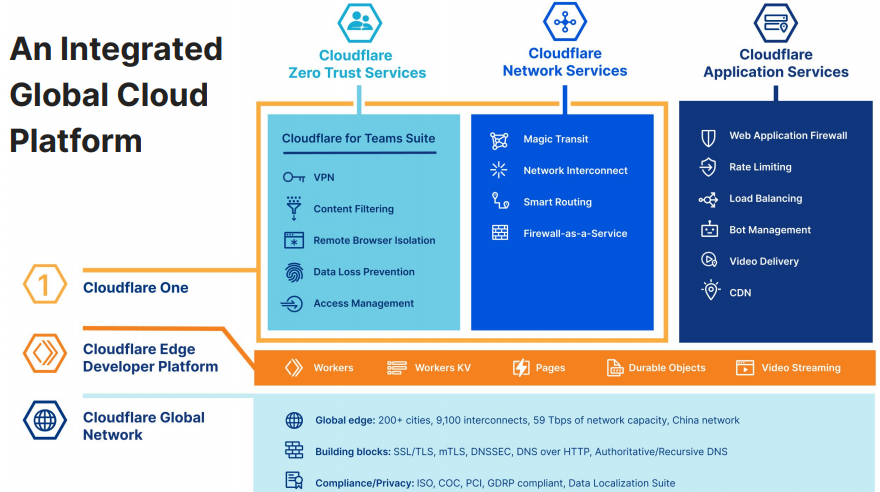

Cloudflare (NET) is one of the leading cloud-based platforms that provides network services and internet security solutions. The company has benefited from strong tailwinds due to increased cloud adoption and digitalization.

Headquartered in San Francisco, California, the company was founded in 2009 by Matthew Prince, Michelle Zatlyn, and Lee Holloway. Matthew Prince (CEO) and Michelle Zatlyn (President & COO) are still with the firm and held 12.4% and 4.8% stake in the company respectively, as of March 2020. Cloudflare went public in September 2019. The company offers a broad suite of solutions that help meet the security and performance needs of businesses.

Below are the company’s key infrastructure offerings:

Security offerings that help secure IoT devices, SaaS applications, on-premises solutions, and cloud including cloud firewall, bot management (block malicious Internet traffic created by bots), Distributed Denial of Services (DDoS), Infrastructure protection, IoT (protects IoT devices), SSL/TLS (manages web traffic), among others.

Performance offerings that help improve end-user experience, conversion, and reduce churn include content delivery (i.e. reduce content delivery time by serving content from Cloudflare’s network locations that are closer to customers’ end-users), intelligent routing (routing end-users through less congested Cloudflare networks), content, image and mobile optimization, and mobile software development kit (network diagnostic tools for developers).

Reliability solutions that help improve the overall operational experience and increase efficiency include load balancing (reduces latency by distributing traffic across servers or routing it closer to end-users), anycast network, virtual backbone, DNS, DNS Resolver, among other solutions.

Besides that, the company offers Cloudflare for Teams which provides seamless access to internet and other applications. Additionally, the company’s serverless applications (Cloudflare Workers, Cloudflare Workers KV) assist back end developers to deploy serverless codes globally without investing in infrastructure. It provides DNS resolver for fast and secure internet and freemium VPN service to individuals.

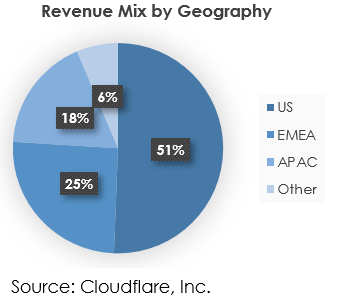

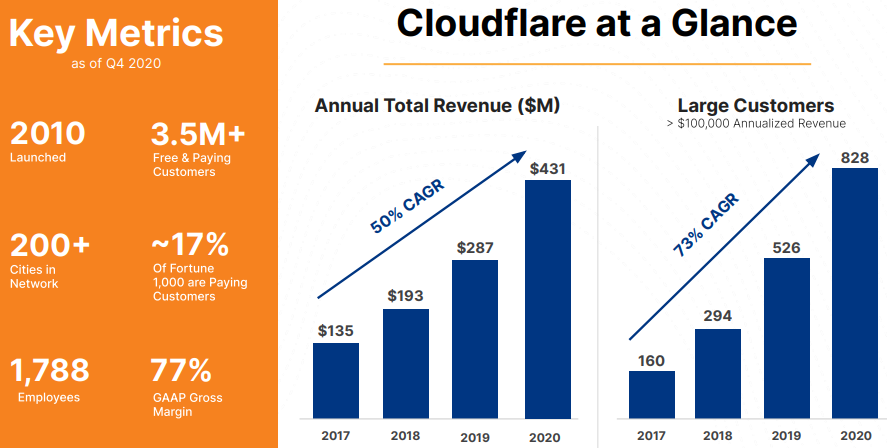

The company has two types of paying customers: pay-as-you-go customers and contracted customers. Pay-as-you-go customers can directly register for Cloudflare’s basic plans as well as customize product plans through Cloudflare’s websites, therefore, they can be onboarded without requiring sales forceinteraction. They pay subscription fees monthly and can terminate service with a short notice period. Contracted/enterprise customers are typically larger customers and get better service and control over solutions. Contracted customers are billed on a monthly basis and the contract duration is typically one to three years. Contracted customers accounted for 83% of revenue in 2020. The company has over 3.5 million customers which include 111,183 paying customers. Nearly 17% of the Fortune 1,000 companies are Cloudflare’s paying customers. It derives nearly 50% of its revenue from the United States while the remaining comes from other regions. The company follows a largely subscription-based business model with less than 5% revenue on usage-basis.

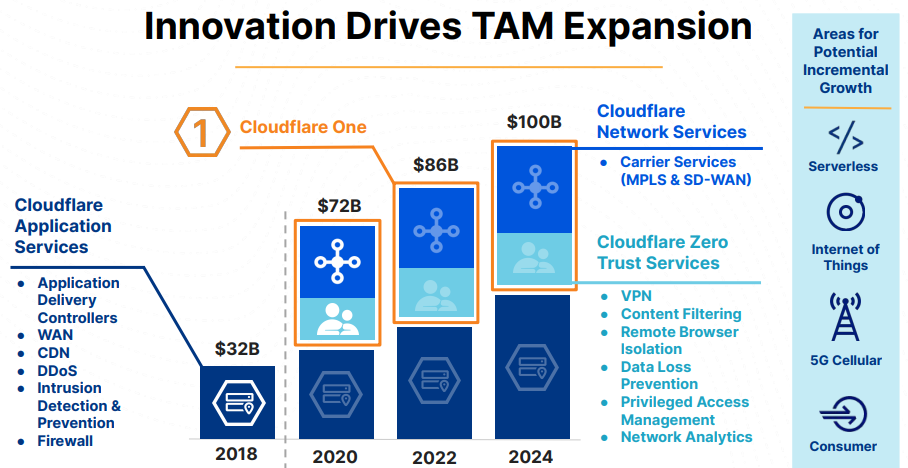

Significantly large and expanding addressable market

The increasing number of IoT devices, use of machine learning & AI, Big data analytics are leading the transition to digitalization and increased adoption of the cloud. COVID-19 has further propelled digital transformation by making more users and businesses turn to the internet to meet their daily needs and continue business operations. High scalability, flexibility and low maintenance of cloud compared to on-premises solutions have led businesses to transition to the cloud. Businesses increasingly require high-performance and security solutions such as load balancing, firewall, traffic optimization, and other network services. Cloudflare’s solutions are built to address these needs for the cloud-native, hybrid as well as the on-premise environment, while traditional hardware products were built only for the on-premise environment and offer lower flexibility and scalability. Moreover, they are expensive to set-up and are complex. On the other hand, the company’s offerings don’t require high installation spend and are highly scalable and easy to use. The increasing workload on the cloud would lead to boosting demand for the company’s solutions.

The company’s total addressable market size stood at $72B in 2020 and is expected to grow at a 4-Year CAGR of 8.6% to reach $100B in 2024 as per 2021 investor day presentation. This TAM represents a market penetration of less than 1%, thus offering immense room for expansion. Please note, company’s TAM has expanded significantly from $32B in 2018 as it has introduced Cloudflare One, a cloud-based network-as-a-service (“NaaS”) solution to provide fast, reliable, and secure network services across organizations which has gained significant relevance with the growing hybrid work environment culture.

Further TAM expansion can be expected as the company continues to innovate and expand its product portfolio by investing in adjacent markets which include computing, storage, and 5G.

Strong market position despite competition

The company competes in a crowded marketplace where it competes with multiple companies across various markets such as CDN, WAN, firewall, web security, threat prevention, VPN, etc. The key competitors include on-premise hardware network providers (Juniper Networks, Cisco Systems, Imperva, etc.), point-cloud solution providers & CDN providers (Fastly, Zscaler, Umbrella, Akamai Technologies, etc.), and large public cloud providers such as AWS, Azure and Google Cloud.

While the competition is fierce, the company’s leading technology, broad product portfolio, and significant presence globally offers it a competitive edge. Cloudflare was named innovation leader by Frost & Sullivan in the Global holistic web protection market for 2020 that includes DDoS, web application firewall (WAF), and bot risk management (BRM) solutions.

It holds a 12% market share in the global holistic web protection market as per Frost & Sullivan and has emerged as a leader in the CDN market with the largest share in SMBs and second-largest share in enterprises (behind AWS) as per Intricately’s data. Increasing adoption of cloud and hybrid work environment would further bolster this position as Cloudflare, along with other cloud-based solution providers would become more indispensable relative to on-premise solutions due to agility, scalability, and flexibility. Besides that, the company has a network spanning 200+ cities across over 100 countries and interconnects with more than 9,100 networks worldwide that include major ISPs and cloud services. Operating on such a scale provides a size advantage to the company relative to smaller competitors in the space.

The company has a strong market-leading position in the Global DDoS and bot protection software market with a market share of 73% as of June 2020 as per Statista. Cloudflare has the largest network capacity in the market that can be leveraged for handling DDoS attacks by enabling the company to mitigate attacks closer to their source. In fact, the company has mitigated two of the largest DDoS attacks globally. Moreover, the product efficiency would improve as the adoption of solutions increases due to machine learning capabilities. The data on cyber attacks against customers can be used to improve offerings for all customers. As per Q4 2020 figures, the company blocked 57B cyber threats per day.

Expanding and highly scalable product suite

Cloudflare offers a broad range of internet-related services for both performance and security enhancement. Expanding the product portfolio leads to improvement in the value proposition for customers. The serverless architecture of the company makes its solutions highly scalable and also enables the company to provide starter or basic plans for free of cost or at low cost to attract customers to the platform while keeping the cost of acquisition low.

The company has been investing over 20% of its revenue in R&D in order to innovate and introduce new product offerings. As we can see below, the company has consistently added new products to its portfolio.

The company recently launched Cloudflare Pages beta version in December 2020 which can be used by developers to build and host JAMstack websites in a fast and secure way for free of cost. This can lead to attracting more developers and customers to the platform who can then be sold more products. The company also introduced a data localization suite to help manage organizational data privacy and compliance via performance and security.

Solid customer base and increasing multi-product adoption

The company’s penetration in fortune 1,000 companies has increased from 10% at the time of S-1 filing (September 2019) to 17% as of YE 2020. Growth in large paying customers with $100,000 in annualized revenue has been stronger than the growth in total paying customers. The company’s customer count with more than $100,000 in revenue has gone up from 160 in 2017 to 828 in 2020 growing at a strong CAGR of 73%. Similarly, the contribution from large customers in revenue has gone up from 21% in 2017 to 46% in 2020.

Strong growth in paying customer base has been driven by customers with free plans transitioning to paid offerings of Cloudflare. The large base of 3.4M+ customers with free plans will help in driving growth in paying customers in the near to medium term. For example, Cloudflare for teams was made free at the start of the pandemic. Later, when it was converted back to a paid offering, there was a strong conversion of free users to paid users. The company’s freemium business model would continue to create brand awareness and help reduce the cost of customer acquisition.

Besides that, multi-product adoption by existing customers is high with 88% of the customers using 4 or more products. This number is significantly up from 70% as per S-1 filing in September 2019. Increasing product adoption by existing clients as a result of successful upselling and cross-selling has resulted in a strong dollar-based net retention rate (“DNR”). DNR has been above 115% in the last 8 quarters. The gross retention rate too remained healthy by staying above 90% throughout 2020. This shows strong customer satisfaction and stickiness to the platform.

Impressive, sustainable top-line growth

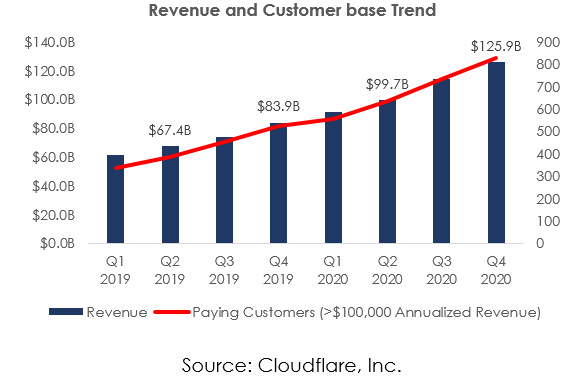

The company has delivered a strong top-line performance with expanding customer base and revenue per customer. It has consistently delivered a strong dollar-based net retention rate which stood at 119% in Q4 2020. The Remaining Performance Obligations (RPO) stood at $384M in Q4, up 75% from the previous year. Revenue equivalent to 75% of the RPO is expected to be realized within the next 12 months.

Cloudflare’s revenue has gone up from $85M in 2016 to $431M in 2020, growing at a 4-Year CAGR of 50%. The growth hasn’t cooled off yet and revenue was up 50% in 2020 despite a higher base. The company is expecting another strong year in FY 2021 with growth of 37%. We believe that the significantly large addressable market coupled with low market penetration and industry-leading solutions ensures above average growth rate over the next few years. Subscription-based business model adds to revenue sustainability and predictability.

Margins lag due to heavy investments but improving as operating leverage kicks in

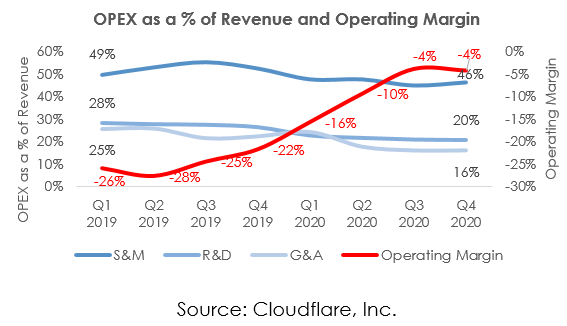

The company has delivered solid gross profit margins in recent years of more than 75% due to low variable cost but the operating costs have risen as well as the company is aggressively investing in product development, sales and marketing. This has resulted in negative margins, however, as revenue is growing steadily, the company is increasingly realizing the benefits of high operating leverage. Non-GAAP operating losses have shrunk significantly from -26% in Q1 2019 to -4% in Q4 2020 as we can see in the chart below.

While we believe aggressively spending in marketing and product innovation to be highly beneficial for the company in the long-run given the very low market penetration, we expect the number to decline notably as a percentage of sales as the company expands. The company expects to reach the operating profit break-even point in Q1 2022 and is targeting an operating margin of 20%+ in the long-run on a non-GAAP basis.

Near-Term Price Pullback, Yet Still Richly Valued

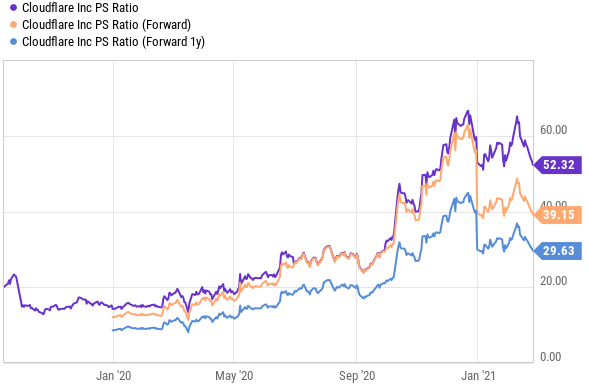

Cloudflare trades at premium valuation multiples with a Price-to-Sales ratio of 53.2 times. This compares to Price-to-Sales ratio of around 10 times at the beginning of 2020.

While the accelerated digital transformation and cloud adoption are facts of life at this point, and the company is indeed well positioned, we believe the current valuation is pricy, albeit slightly less pricy than just a week ago, and increasingly tempting for a small nibble at a few shares at this slightly lower price point. Top growth stocks are never going to be cheap.

Competitive Risks

Cloudflare operates in a fiercely competitive industry with a rapidly changing technological landscape. As such, the company has to consistently innovate and stay ahead of the curve to fend off competition. Investors must note that the company has been investing aggressively in product development and has access to enough growth capital to invest further and grow.

Conclusion

Cloudflare is an impressive business. It has delivered tremendous top-line growth in recent quarters, yet market penetration is still less than 1%, thereby leaving plenty of room for continued high growth. The company has industry-leading solutions (designed for the cloud which is seeing large scale adoption), high multi-product adoption and solid retention rates are also impressive. The shares are richly valued (already factoring in a lot of continued success), yet the price pullback in recent trading sessions has created a somewhat enticing entry point. Shares of top growth stocks are never going to be cheap. We do not currently have a position in Cloudflare, but the shares are tempting (and high on our watchlist) especially considering the recent price pullback and tremendous long-term growth potential.