The market is selling off hard—especially top growth stocks. It’s likely just a short-term breather—especially for the most attractive companies. Nonetheless, when fear increases (like it just has), volatility also increases—and that means more upfront premium income available in the options market. In this report, we review an attractive upfront income-generating options trade on a powerful long-term growth stock in the connected TV space. We believe the trade is attractive to place today—and potentially over the next few trading days—as long as the market doesn’t move too dramatically before then.

FuboTV (FUBO)

The underlying company (stock) for this trade is FuboTV (FUBO). FUBO is a “sports first” streaming platform with a very high growth trajectory and a large total addressable market (i.e. lots of room to run). Specifically, it is benefiting from the the secular decline in traditional TV, the shift to connected TV advertising, and the potential growth in online sports wagering. We recently completed a detailed full report on FUBO, and you can access that report here.

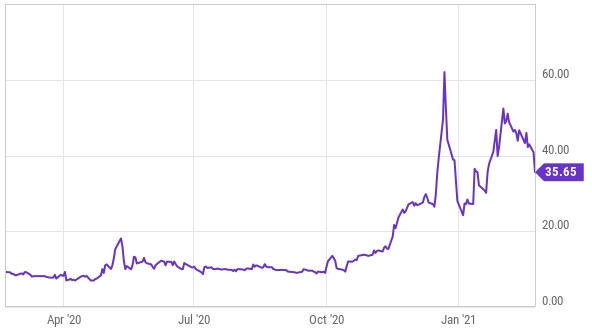

FUBO Share Price:

The Trade:

Sell Put Options on FUBO with a strike price of $25 (~28.8% out of the money, it currently trades at ~$35.11), and an expiration date of March 19, 2021, and for a premium of at least $1.00 (or $100 because options contracts trade in lots of 100). This comes out to approximately 4.0% of extra income less than one month—which may not sound like a big return—but it is huge for such a short time frame (it’s approximately 48% of extra income on an annualized basis, calculated as ($1.00/$25) x 12 months). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a dramatically lower price ($25—the strike price) if the market price falls below $25 and the shares get put to us before this option contract expires in about 24 days. And we get to keep the upfront premium income no matter what.

Important to note, your broker will require you to keep $2,500 of cash in your account ($25 strike x 100 shares) to secure the trade (assuming you don’t want to use margin).

Also important to note, you can adjust the strike price of this trade (for example to $30) depending on how badly (and at what price) you want the shares put to you, and to generate a different amount upfront income as shown in the table above).

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of FUBO doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our overall thesis is simply that FUBO is a very attractive businesses, and we’d love to own shares (as a long-term investment) if they fell to a purchase (strike) price of $25. But if these shares do not get put to us, then we’re also happy to simply keep the very high upfront premium income that is generated by this trade.

Very briefly, from a valuation standpoint, FUBO trades at approximately 12.7 times sales, which is actually reasonable for a company with such a high revenue growth rate. As you can see in the following table, FUBO’s revenue is expected to grow at an extremely high rate this year and next year (for a little perspective, a growth rate over 20% is generally very good).

source: StockRover

For a little more color on these shares (in addition to our previous full report on FUBO linked earlier), here is a look at the the aggregate price target and rating per the 8 Wall Street analysts covering the shares and reporting to Factset.

All of the analysts currently rate the shares a buy, and they have an aggregate price target of $45.50. Not only is that price target above the current price, but it is dramatically above the strike price on our trade. FUBO is a volatile stock to begin with, and the uptick in market wide volatility only makes the shares even more volatile. Rather than trying to catch a potentially falling knife, we like the trade in this report because it puts attractive upfront income in our pocket (that we get to keep no matter what) and it gives us a shot at owning shares of FUBO at an even lower price (if the shares fall even further than they already recently have).

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. In FUBO’s case only earnings is a concern (because it doesn’t pay a dividend). Regarding earnings, FUBO is expected to “announce” after the market close on March 2nd, and this adds significant uncertainty and potential volatility to our trade. However, this is why we have selected a strike price that is so far out-of-the money, and (in our view) the very high upfront premium income available on this trade more than adequately compensates us for the risk.

Conclusion:

FUBO is an attractive business. It has a very high growth rate, a large market opportunity and the shares are reasonable priced. However, the shares are volatile, and current maketwide volatility only adds uncertainty to the near-term share price. For these reasons, we believe the trade described in this report is extremely attractive. Specifically, it puts a high amount of upfront income in your pocket right away (that you get to keep no matter what) and it also gives you a chance to pick up shares of this attractive business at a significantly lower price if they fall below the strike price and get put to you before the options contract expires.